So a man walks his wife up to the receptionist’s desk at a surgery center to check her in for a minor invasive procedure. A smiling twenty-something woman in purple scrubs greets them. She chirps a handful of questions to make sure the wife’s file is current. As she scrolls down on her oversized computer monitor to verify the wife’s insurance information, the couple waits for the penny to drop.

And there it is. “But … it says here you’re self-pay,” the receptionist says, her smile gone.

“And we are,” the man says.

“But you need to pay $1,500.”

“And here is our credit card.”

The receptionist reaches for the embossed plastic rectangle the man is sliding across her desk. She holds the card in both hands, contemplating it before running it through her machine. She appears bewildered. Probably she does not realize she just earned her employers easy, and maybe extra, cash.

Receipt in hand, my wife and I walked off to surgery prep, pleased to have paid our provider for health care and not one dime to an insurance company. We belong to a growing minority of American patients who not only lack health insurance—we like lacking it, and we like the health care we buy, too.

The receptionist, however, belongs to the dwindling majority of American health-care professionals, patients, elected officials, and appointed bureaucrats who have been conditioned to conflate health care and health insurance.

Pay Your Way, Change the World

A world, and worldview, of difference separates the two. Many people and governments of the Ideally Insured worldview erroneously consider health insurance the sine qua non of health care—the payment method “without which not” a single red-blooded American can get so much as a blood test, except by incurring obscene expenses for himself, his provider, taxpayers, or all three.

Surely patients who go uninsured, according to this worldview, fall somewhere on the caste system below the Ideally Insured Patient (may he live forever, etc.). Lower rungs of this caste include the uber rich, the indigent, and lawless bandits who don’t know or don’t care President Obama signed the Affordable Care Act into law six years ago.

By contrast, self-pay patients of the Unconcernedly Uninsured worldview know the truth, and the truth is setting them and their health-care providers free. Although self-paying requires a modicum of cash flow and short-term savings, self-pay patients need not be rich. They can be and frequently are poor, or close to it, by federal poverty guidelines. The self-payers we know are aware enough of ACA’s mandates to factor its penalties and exceptions into their cost-benefit analysis.

These self-payers’ analysis weighs the cost of insurance premiums and deductibles—which have increased dramatically in dozens of states since ACA’s implementation—against their unlikely prospect of maxing out their deductible in a given year. Whoever does not max out his deductible may as well be paying cash, because insurers won’t be reimbursing him.

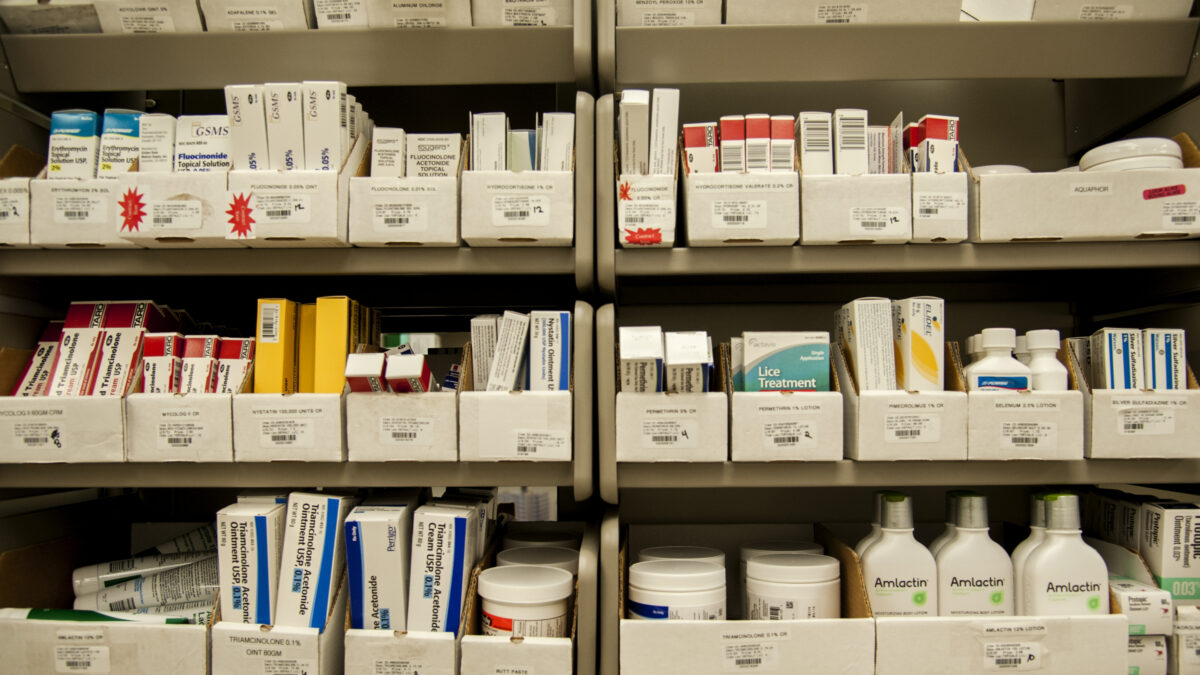

In fact, patients who don’t max out their deductibles would do far better for themselves and their doctors by paying cash straight up. Providers typically charge 20 to 50 percent less when they can get paid immediately and without funneling payment through a third-party health insurer. That’s not charity. That’s savvy.

How to Scoop Up Your Own Gravy

Physicians and surgeons set their prices to cover all costs related to patient care, including the time and labor spent processing insurance claims to make sure insurers pay what patients do not. Sometimes insurers compensate these doctors months after service was rendered. Cutting out the middle-man insurer saves providers so much time and money that more are ditching the insurance model to run cash practices and offer patients direct-pay membership agreements.

Consider the $1,500 the happy couple (my wife and I) paid. This amount was the second of three prices the provider quoted us: $2,250 if billed through insurance, or $1,500 paid the day of service, or $550 paid the day of service plus $1,700 through an indefinite payment plan.

Our bet, in hindsight: The office recovered its costs and maybe a modest profit with the first $550 we paid—the bare minimum payment, presumably for a poor patient unlikely to pay the rest (hence the payment plan with no deadline). The next $950—which we also paid same-day—was gravy for the practice. Had we paid through insurance, the practice would have banked the gravy plus some of an additional $750 after administrative labor costs, possible claim disputes, and haggling. (I love a good fight.)

Looking back, and assuming we’re right about the three quoted charges, our only regret despite getting a $750 discount is failing to claw back even more of that gravy, due to us being fairly green self-payers then. This would have fattened not only our own wallets, but the purse of the health-care sharing ministry (HCSM) that reimbursed us for $1,200 of the $1,500 we paid. Better yet, our HCSM financially incentivizes us to seek documented discounts, so we could have made bank.

That’s not charity, either. That’s just how self-pay patients do business.

Michael T. Hamilton is The Heartland Institute’s research fellow for health care policy, author of the weekly Consumer Power Report, and managing editor of Health Care News, an online and print newspaper read by market-minded health care professionals, policy analysts, and 56 percent of lawmakers.