One week after a flawed premium study tried to make the case that premiums would nearly double over the next three years, another study claims that a “stability” bill in Congress would lower premiums by “more than 40 percent.” Or so claimed Republican Sens. Susan Collins and Lamar Alexander.

As with many things Alexander claims, however, there’s more to this story than meets the eye. In reality, the study itself admits that most of the supposed premium “reduction” for 2019 likely will not materialize — and most if not all of the remainder would be offset by the effects of repealing the individual mandate while keeping Obamacare’s onerous regulatory regime.

The analysis itself, by consultants at Oliver Wyman, said that it “assumed states would use federal pass-through savings under Section 1332 of [Obamacare] to supplement and leverage the $10 billion the considered legislation would authorize and appropriate each year.” In other words, it assumes that states will enact their own reinsurance programs using an Obamacare waiver in addition to the funds provided through the federal reinsurance program — and conditions the 40 percent premium reductions on states doing just that.

However, in the very next paragraph, Oliver Wyman called its own assumptions unrealistic, conceding that most states will not have time to enact their own reinsurance proposals for 2019:

In our modeling, we are presuming that states will take advantage of these pass-through savings in 2019. In reality, states that have not already begun working on a waiver will be challenged to get a 1332 waiver filed and approved under the current regulatory regime in time to impact 2019 premiums.

Oliver Wyman went on to point out that applying for such waivers currently requires states to pass their own laws, undergo a 30-day public comment period at the state level, and then navigate a federal approval process that can last nearly eight months. While Collins and Alexander might argue in reply that one potential element of “stability” legislation could speed the waiver approval process, it remains far from certain that all states 1) even have an interest in this type of reinsurance proposal, 2) have the authority they need to establish such a program, and 3) could get federal approval in time to affect the plan year that starts with open enrollment on November 1 — under eight months from now.

If states don’t request a 1332 reinsurance waiver to supplement the federal insurance dollars, or can’t get one approved in time for the 2019 plan year, a likely scenario for many states — what does Oliver Wyman think would happen? “We estimate that premium [sic] would decline by more than 20 percent” — 10 percent from funding of cost-sharing reductions, and 10 percent coming from reinsurance.

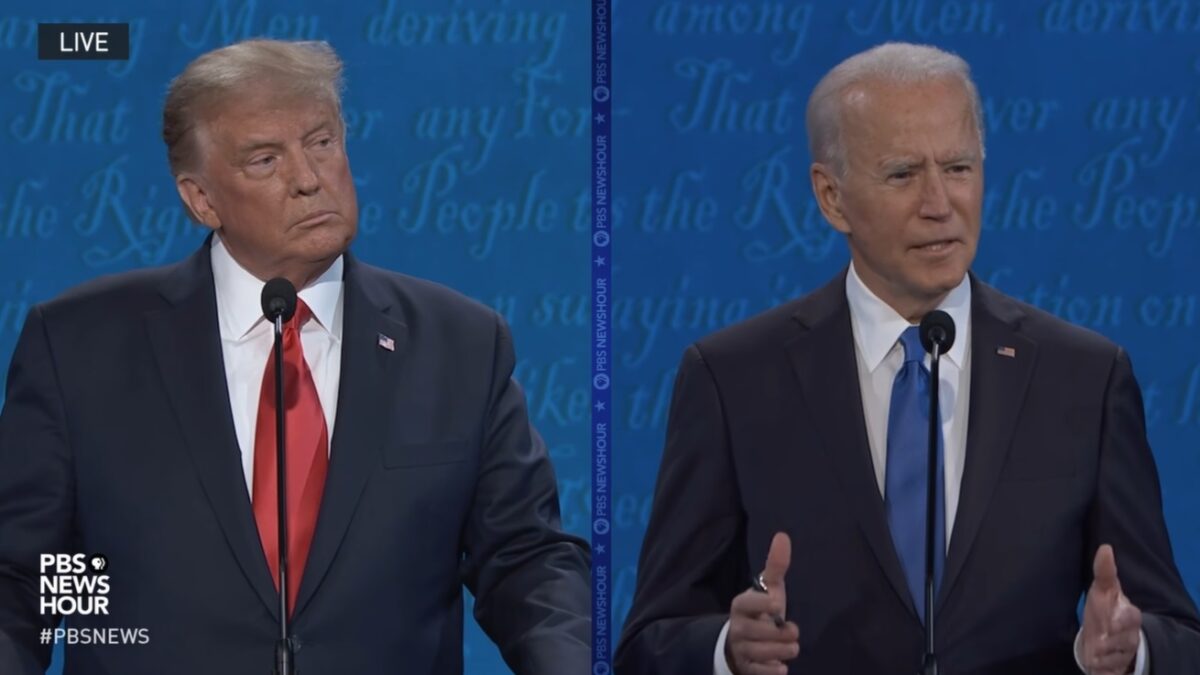

But keep in mind that President Trump cancelled the cost-sharing reductions just last October, and Congress repealed Obamacare’s individual mandate, while keeping its costly regulations — a combination of decisions which, all else equal, will raise premiums. In other words, even after dumping tens of billions into bailouts for insurers, premiums could well end up right about where they were last year — and, after taking medical inflation into account, even increase.

Why would Oliver Wyman, let alone Collins and Alexander, put out such shoddy work? Politico got at the issue Tuesday morning: “Oliver Wyman often does analysis for insurers.” Which might explain why the actuaries there put out a headline premium number that by their own admission relies on unrealistic and fanciful assumptions. The analysts seem to have searched for the largest possible premium reduction number they could find, and then made up assumptions to match.

It also explains the statement by Collins and Alexander. If Oliver Wyman takes money from health insurers on a regular basis, as Politico noted, so too does Alexander. So much so that Alexander — who called reinsurance the “Great Obamacare Heist” not eighteen months ago, and pledged to get taxpayers’ billions back from health insurers — now instead wants to shovel more of your hard-earned dollars to insurers’ corporate welfare payments.