It’s apparently so rare for a millennial to achieve adult milestones that doing so is a news story. I recently posted on Facebook a Time magazine article about Jordan Arnold, an inspiring young man who paid off his $23,375 in college debt (from a private school, no less) in 10 months by living with his parents to save money and working two jobs to earn extra.

I accompanied it with a positive comment, but some of my Facebook friends took his achievements as a negative reflection on themselves, and spent the comments section tearing him down or explaining why people should not expect them to do something similar. Of course, everyone has slightly different circumstances.

My husband and I, for example, were blessed with a series of surprise babies right after college graduation and marriage, and variable healthcare provisions while I was pregnant. So it took us two years instead of 10 months to pay off a slightly larger college debt than Arnold’s. But I’m not complaining. We were elated to do it. Although it took some sacrifice (actually, what felt like a lot of sacrifice to two people used to American-level appetites), it was worth every tightened belt notch.

Most of our peers and thus circle of acquaintance, however, are still underwater and struggling to pay their bills as a consequence. As everyone now knows, this financial crunch is reducing marriage and childbearing rates, with huge implications for my peers’ personal happiness and our nation’s fiscal and cultural survival.

Millennials could blame our parents for being too ashamed of how poorly they’ve handled their own and our nation’s finances to pass down fiscal wisdom, or we could stop the cycle of blame and start repairing the ruins. Dave Ramsey’s “Total Money Makeover” was a life-changer we mercifully discovered early in our marriage and adult lives. In addition, here are some things we have done right or have seen pay off for others.

1. Work Early, Work Often

Arnold displayed prudence and humility by taking on a second job delivering for Pizza Hut to pay down his loans faster. I have heard many millennials disparage choices like this, as if a college degree automatically lifts them from the mundane necessity of, you know, paying the bills. They’re the losers, not Arnold. He now owns his whole paycheck, while people who refused to make similar choices still have to fork over a pile to their lenders every month.

If you’re lucky, you’re reading this before you hit college: A college degree will not save you from the need to work hard, often at jobs you will not love. It may be fun to believe that lie now, and majorities of millennials do, but it will bite you in the butt later. Successful people work hard, and usually succeed because they’re willing to do things other people aren’t. There are no shortcuts to the top (unless you have a famous family, but everyone will disrespect you for not having put in the work to be there—just ask Chelsea Clinton).

If you want to climb high, you should start at the bottom as early as possible. Work in high school and through college. You will never have another time in life where your parents are buffering your finances by paying most of your living expenses, so these years are prime for getting ahead. Be wise: Don’t squander them.

If you want to own your own earnings, you have to be willing to do what it takes to get there. And it takes sacrificing free time and personal comfort. If you’re not willing to do that, fine. But don’t whine about how hard your life is. Your choices put you in this situation, and your choices can get you out.

2. Develop Appropriate Saving and Spending Habits

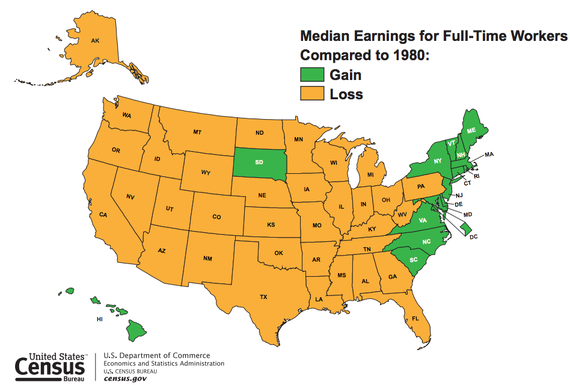

You are not eight years old any more. You can’t spend a significant portion of your money on candy and trinkets. Put down the gum and ice cream—these are easy ways to save on both groceries and dental bills. Neither have you reached middle age and the middle class. You can’t spend money like your parents do, even on things as mundane as groceries. Mom may buy boneless chicken breasts and packaged, pre-washed salads, but those are expensive compared to bone-in pieces of chicken and a head of lettuce you wash yourself. You cannot afford even little luxuries. Your income after graduation is less than your parents’ was when they were your age, and you have way more debt. So act like it.

This doesn’t mean you have to eat like a college student. Say no to ramen. Say yes to rice, fresh vegetables, potatoes, tuna, legumes of all varieties, and eggs. These are all cheap, filling, and healthy. For entertainment, get books and movies from the library rather than buying them new or paying for rentals or (heaven forbid) theater tickets. Plan picnics and in-home wine-tasting with friends rather than nights out (restaurant food and alcohol are luxuries—the price difference between having you prepare food and having someone else prepare food can be as much as 1,000 percent, even at a moderately-priced restaurant). It’s a lot of fun to cook with friends, besides helping you develop important home-keeping skills and keeping expenses down. You can make really delicious, even fancy food for pennies on the restaurant dollar. When mom and dad visit, they can take you out.

It’s the same with housing, which is probably your biggest expense next to taxes. Unless you just graduated from Harvard Law School and have a salary the rest of us only can dream of, you are not a hip young professional who has the money to live in hip young professional parts of town. Get some roommates. Live in a smaller, cheaper apartment in a cheaper (but safe!) neighborhood. Get second-hand furniture and use Pinterest for ideas about how to doll it up.

If you are lucky enough to have little debt or reasonable college loan payments, you may wonder why all this conservation is necessary. Your monthly salary is enough to cover the basics and have a little left over. Sure, give yourself $50 of “blow money” per month (that’s what we call our fun budget) you’re allowed to spend on anything you want, but save any other excess, don’t spend it.

If you ever hope to marry and have children, then are blessed enough to achieve that dream, in those days you will thank yourself for your prudence and foresight. Savings now will allow you to buy a house big enough for kids later, provide a cushion if you or your spouse wants to attend graduate school or make a job change, set up your nursery with enough quality items to last several children, etc. Plus, Social Security will not be there to support you in old age, and you will need a ridiculous amount of money to retire. Enough people have squandered their earnings—or earnings potential—during years of opportunity and regretted it deeply later. By then, though, the money and time for earning it are gone. Don’t be like them. Think ahead.

3. Don’t Automatically Enroll in College

Don’t be snookered by college hawkers’ continual self-promotion: The ratio between college costs and its financial returns may look good on average, but averages hide danger for individuals, who are almost never average. Even if you plan on earning a college degree, it may be financially and personally wise to take at least a gap year. My husband and brother did this, and it worked well for them. You can spend that year earning money to pay for college upfront, which is far cheaper than paying tuition plus years of compound interest. You can also spend that year exploring your options—a gap in academic work will give you a huge mental breather.

This is doubly true if you wish to go on to graduate school. By then, you have probably accumulated undergraduate loans. Stacking graduate loans on top of that will be a financial nightmare you will struggle to wake from for a decade or more. Moreover, the market is becoming glutted with advanced degrees, just as it has been glutted with undergraduate degrees, so this may not set you apart or up for higher earnings or career advancement. And any good college counselor will tell you that you should probably not pursue graduate school if you have to go into debt to do so, i.e. don’t have a strong-enough academic record to get your graduate pursuits funded (law and medicine being the usual exceptions to this generality).

A good college counselor will also make you aware of the burgeoning well-paying career opportunities available through technical training, which usually takes two years or fewer. If a college counselor reflexively pushes you towards four-year college and doesn’t suggest other potential pathways, find some other advisors. I recommend CollegePlus, which helps young people get a variety of credentials employers will accept, including a degree, in far less time than usual and far less money (I have no connection to CollegePlus, financial or otherwise). You can even get college credit for your paid work experiences.

Unless you are going to a genuine liberal arts school, do not go to college unless you have a specific career or life goal for doing so and you know it must take college to get you there. This should be obvious, but obviously Americans aren’t getting the message, because we’re doubling down on college even as it’s not getting us better jobs during the recession.

4. Take On as Little Debt as Possible

If you must go to college and you must borrow money to do so, borrow as little as possible. Choose the school that gives you the best financial aid package. Calculate before signing those enrollment papers what your total loans will be upon graduation, and—possibly more important—what your likely monthly loan payments will be as a result. Again, unless you are going to a serious school that knows what it’s about (I have a mental list of about just twelve of those in the entire country) and whose curriculum is not interchangeable with those of every other generic college out there, go to the cheapest school to get that damned piece of sheepskin. Complete your first two years at a community college while working a job because those classes are going to be easy, then transfer those credits to a four-year state university.

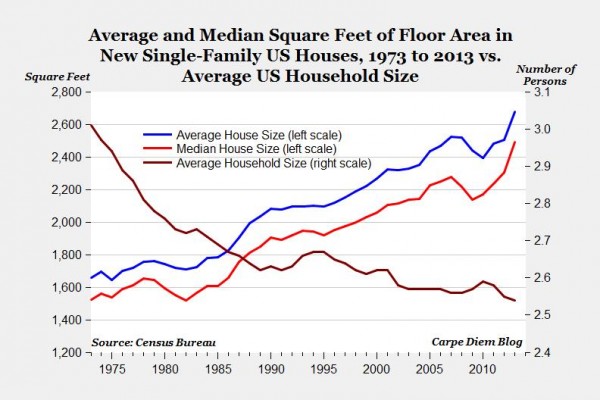

Adjust your expectations for the house size you should or can buy. As Mark Perry points out, American house sizes have increased drastically, while the number of people living in these monstrosities has shrunk. You don’t need a playroom and living room and a study and a dining room and a den. Really, you don’t. Don’t get as big a loan as the lenders say you can afford. Their job is to get more interest out of you. Your job is to get a house at the price you choose to pay. We bought a house with a loan about a third of the size our lender had approved us for, and we’re on track to own it outright about three years after signing the papers. It’s a little house, but it fits us and three kids just fine.

Don’t finance your first (or second) car. Buy an older, reliable car with the cash you have. This was the first serious financial advice my dad gave me, when I came to him in high school with my desire to buy a respectable-looking car. I had enough for the down payment, I had a job to cover the monthly payments, and I needed him to cosign the loan. He said he would, but recommended taking my $3,000 down payment and buying a car outright. He emphasized to me the burden of any debt and the desirability of avoiding it if at all possible. I followed his advice, and it was an excellent choice. He helped me find a car I drove at a very low cost all through college, until some idiot T-boned it after blowing a stop sign one early morning and skipped out on paying for my totaled car because Michigan has idiotic no-fault crash laws. I then repeated the process and remain very pleased with what is now an effective car-buying habit.

There are two practical reasons to avoid debt. First, debt is very expensive. If you are in debt and spend $5 on a latte, that latte will cost you $6 or even $8 (or more!) down the road because you bought that thing with someone else’s money, and that someone else must be paid for your demand to use his cash.

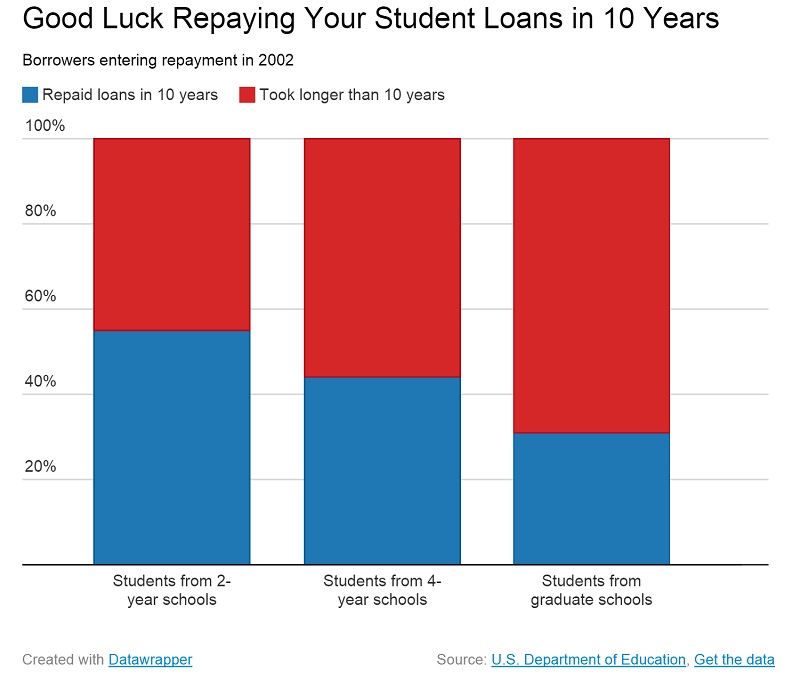

Then just scale up the cost of a $5 latte to a modest $20,000 in loans, which will not cost you $20,000, but $28,000 if you pay it off at going rates over the next 10 years (and, as the HuffPo graph below shows, most people take longer than 10 years). It’s all about delayed gratification. That tuition will cost you $20,000 if you spent a year to earn that before entering college. It will cost you $28,000 if you had to enter college immediately because you couldn’t wait the year to earn tuition upfront.

Second, debt is emotionally distressing. Debt is the leading cause of stress for Americans and for marriages, and it causes health and relationship problems. Why sign yourself up for that?

The third major issue with debt relates to one’s character. If you habitually seize more than you can afford, you have a character problem. It’s called greed, envy, or sometimes lust. If you indulge habits of greed, envy, and lust, you will create many problems for yourself throughout life, and possibly into eternity. Worse, you will form your own character in such a way that you will also inevitably hurt those you love. Call it the moral Butterfly Effect.

C.S. Lewis expressed it this way: “All your life long you are slowly turning this central [part of you] either into a heavenly creature or a hellish creature: either into a creature that is in harmony with God, and with other creatures, and with itself, or else into one that is in a state of war and hatred with God, and with its fellow-creatures, and with itself. To be one kind of creature is heaven: that is, it is joy and peace and knowledge and power. To be the other means madness, horror, idiocy, rage, impotence, and eternal loneliness. Each of us at each moment is progressing to the one state or another.”

5. Marry Promptly

Most of the young people I know have less of a problem finding a person of marriage material and interest than they do in believing it’s possible to pay for a wedding to that person. (Difficulty finding a potential partner usually starts in late 20s and early 30s, after people have filtered through a few serious significant others without settling down with them.) There are two major factors at play here. The first, as we’ve discussed exhaustively, is that young people now typically start life not with a blank slate or a full bank account from several years of wisely investing their youthful energy in money-making work, but in a significant amount of debt thanks to the college bubble.

The second factor is that cultural expectations for weddings have increased at approximately the rate of cultural expectations for houses. That is to say, we now have extremely expensive weddings—at an average cost of $30,000 in 2014. Again, I shouldn’t need to tell you this is outrageous. But obviously I do. You have to decide whether you want to increase your happiness for life by marrying that man (or woman) now with a simple wedding, or put off your chances at life happiness by trying to make him (or her) wait around until you feel you can shell out $30,000.

I am lucky to know a number of prudent young people who have secured very lovely, very inexpensive weddings ($5,000 or less, and, yes, that can include a full dinner and dancing) that launched them into very happy marriages. My first friend to do it the year after we were sophomores in college recommended this book to me, and there are several others with the same theme. The extravagance of your wedding has nothing to do with your happiness in what comes after, which is the main thing. A series of family difficulties (too complicated to relate here) required my then-fiancé and I to marry in a simple church ceremony at which only about 10 people were present. It took me a few years to finish mourning for my lost wedding, but I’m now so happy with the husband it got me that my whining about it has almost completely disappeared. Trust me—it’s totally worth it.

And let me put in a plug for marriage as soon as you’ve found a good person, if you aren’t a religious type like us bound by commands of premarital chastity where the compunction is therefore more obvious: A bird in hand is worth two in the bush. If we’re talking a husband or wife, we’re talking worth ten in the bush. Once you’re married, your nervous wonderings and wanderings are over. Yes, you have to deal with this person, and it’s going to be hard, but occasionally abrasive companionship is typically far better than lifelong loneliness. Married people are, on average, happier, healthier, and richer than singles.

And if you marry before you’re 30, it’s like having kids before 30: Your life patterns and dreams are not entirely set, so you get to set them together, which makes it easier and even exciting. Speaking of kids before 30…

6. Aim for Kids Before 30

You may not be able to bust out all the babies you want by age 30, but it’s probably a good idea to start your brood by then if you manage to have a choice in the matter. I realize this depends on, you know, finding a husband or wife, and even people trying hard for that sometimes cannot. My mom didn’t start kids until age 30 because she didn’t marry until 30. And then she had seven, with the last at age 45. Again, the laws of averages don’t necessarily apply to individuals.

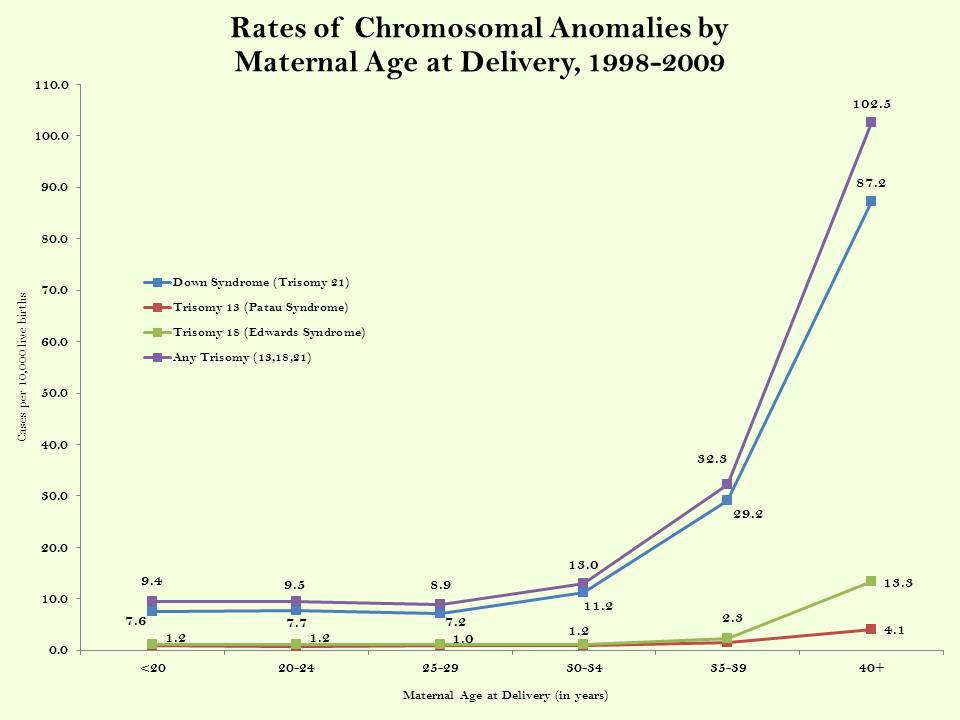

But, if you have this as an option, I recommend it. First, for physical reasons. Your body will simply have an easier time during and post-pregnancy when you’re younger, and your babies have a far-reduced likelihood for birth defects such as Downs Syndrome. And don’t even get me started on in-vitro fertilization and hormone therapies, which become necessary for women trying to conceive in their forties. They’re expensive, risky, and morally dubious. Do save yourself that pressure.

Second, for career reasons. Women in their late 20s have less to lose from taking time off for children. They’re earning less and lower on the totem pole. Front-loading the kids works better for shifting into or out of grad school, and your career is less likely to punish you for a spotty work record early in life, both in earnings and in your ability to get back on the ramp later. It’s a lot easier to get a spot where you left off if you left off lower down the pole.

Third, for sundry parenting and lifestyle reasons. Do you want to have children still cheeping about your nest when you are in your fifties (or, God forbid, sixties)? Probably not. Do you want to have the energy and capability to wrestle on the floor with them, scoop up their little bodies at need, and go without sleep for months on end without needing a ride to the emergency room? All of this is better accomplished with a younger, more flexible body.

7. Find Wealth In Doing What’s Right

The biggest source of discontentment with life and money I see among my peers results from an overemphasis on material goods rather than enduring things that matter far more. And material goods are not just big houses, cushy jobs, and international travel. Many fellow millennials shell out for “experiences” they technically cannot afford, such as roadtrips, travel to visit friends, nights out on the town, or a name-brand college. Demanding these things may feel more spiritual or relationship-based, but ultimately are as materialistic, or self-focused, as shopping at J. Crew when your budget indicates you should visit Goodwill.

Materialism is when we love our own comfort more than we love doing what is just and right. The ability to sacrifice what we want for doing our duty may be the single largest hallmark of maturity. How you manage your money and relationships indicates how you manage your entire self, from the inside out. Material riches often follow people who have developed integrity and a commitment to justice, but that is not the reason to put doing what’s right ahead of doing what’s comfortable. Adults do the right thing because they have learned the deeper truth about being: A man is truly free if he can govern his own soul, which means habituating it to loving others as he loves himself.

These little financial and life decisions are public declarations of the man or woman making them. All the riches and the power in the world cannot redeem someone who has not developed the character to use them rightly, and character is what matters to someone who hopes to live a good life. Indeed, character is what develops when you face crises, big and small, and make the right choice. It is, after all, he who is faithful in small things who is also faithful with much.