Hot on the heels of passing an $8.5 billion coronavirus bill, the White House and congressional lawmakers have proposed yet more pork-laden coronavirus “rescue” packages with a running price tag of more than $1.3 trillion.

The Families First Coronavirus Response Act (FFCRA) passed with overwhelming support in the House of Representatives on Saturday. The Senate will likely vote to approve the legislation this afternoon.

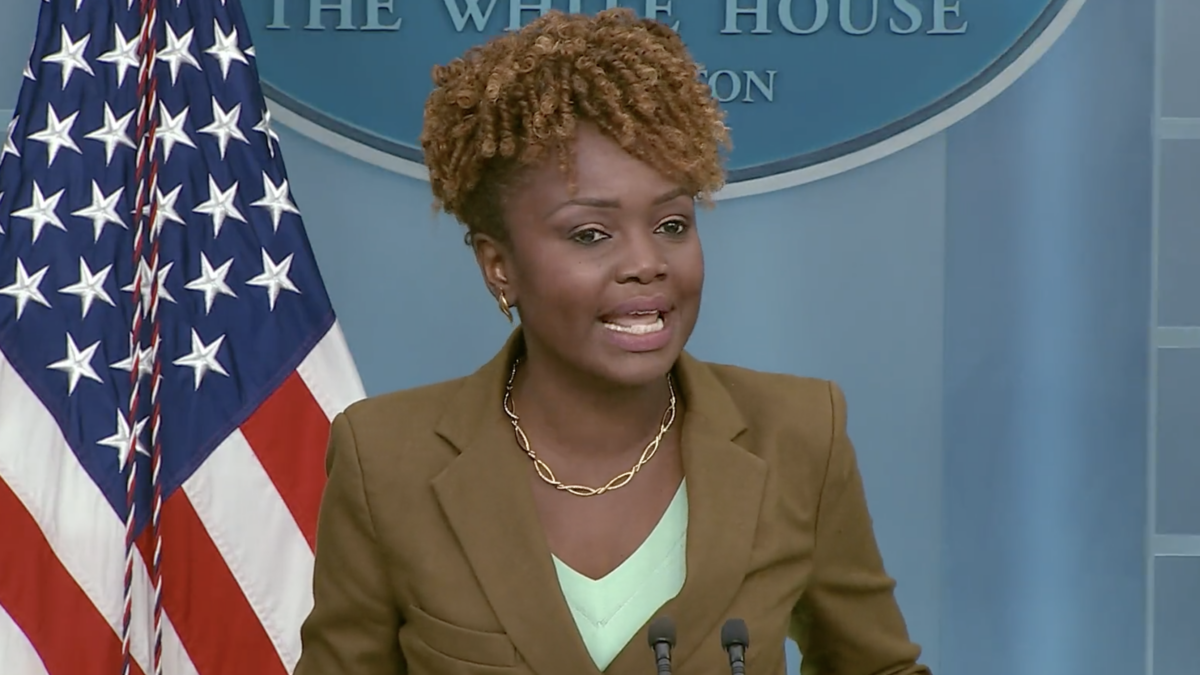

With the help of Trump administration officials, House Democrats drafted and passed the FFCRA so quickly that the Congressional Budget Office was unable to estimate its total cost, meaning taxpayers could be on the hook financially for an indeterminate amount.

Amazingly, the FFCRA will not be the last word of the federal government on the coronavirus crisis. News broke earlier this week that the Trump administration is requesting a $1 trillion stimulus and bailout package—significantly larger than the $831 billion stimulus package passed in 2009 under the Obama administration that provoked cries of “socialism!” from conservatives everywhere.

Where Is the Money Going?

The emergency measures include a grab bag of long-sought leftist priorities. Perhaps worst of all are the two new federal paid leave mandates, lasting until the end of the year, for companies with fewer than 500 employees. The first requires companies to pay for up to two weeks of sick leave. The second provides employees three months of paid family and medical leave if their children’s school or daycare closes or if a family member is quarantined.

Since school closures around the country encompass more than half the nation’s school-children, it is not inconceivable that nearly all parents fitting the requirements might take advantage of these two new entitlement programs, both of which will be profoundly costly to businesses and the federal budget.

Businesses will be compensated for these expensive benefit mandates with money from the U.S. Treasury through a complex scheme of tax refunds administered by the IRS. Yet there remain concerns that some cash-poor businesses cannot remain solvent long enough to survive until they receive the credits. Additionally, the government reimbursement for these programs fails to consider all the costs for businesses when employees do not show up for work.

Another component of the legislation is sure to irritate welfare state reformers: the FFCRA obliterates the Trump administration’s bid to limit food stamp benefits for able-bodied adults without children. The long-planned reform, which had been slated to go into effect in April, would have strengthened the work and training requirement for some single adults collecting food stamps.

The FFCRA also expands unemployment insurance and federal Medicaid funding, and provides more than $1 billion in additional funding for food welfare programs.

Although the details of the mammoth $1 trillion stimulus package are still in flux, a Treasury Department memo suggests the newly proposed coronavirus stimulus package would give a $50 billion bailout to the airline industry. The package includes an additional $150 billion in loan guarantees to other affected industries and a payroll tax cut sure to expedite the coming insolvency of Social Security.

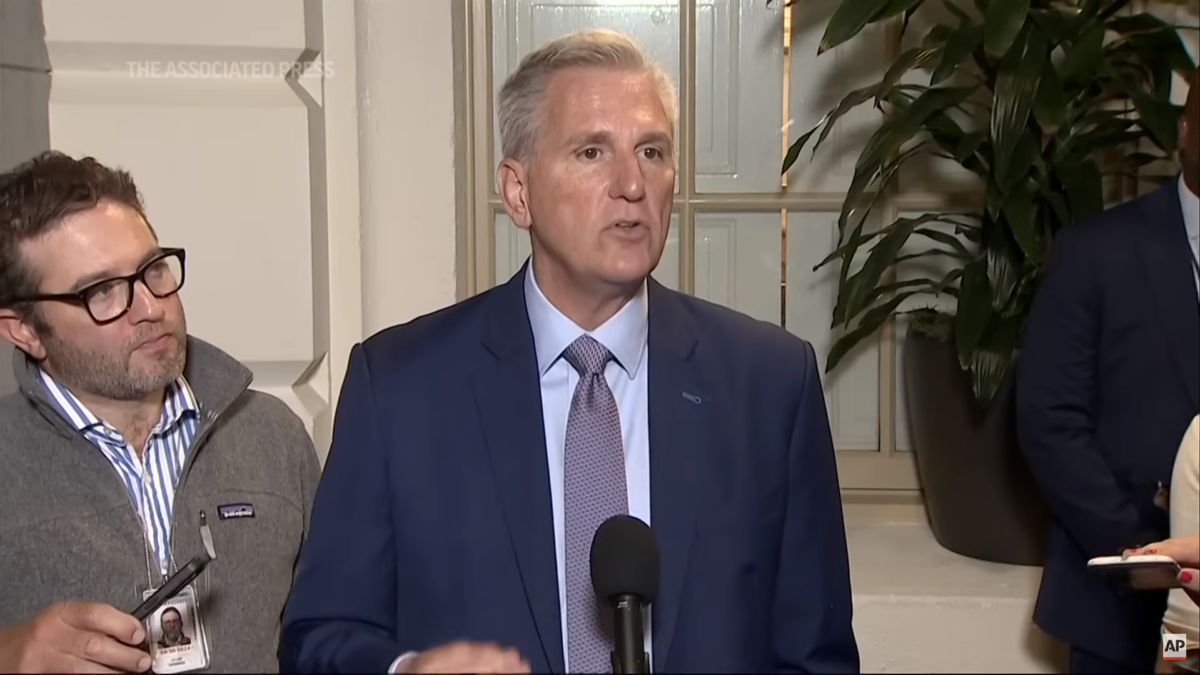

During a Tuesday press conference, President Trump and Treasury Secretary Steven Mnuchin announced their intention to distribute “big” direct cash payments to Americans, perhaps in denominations of $1,000 or more per person. This measure is estimated cost taxpayers $500 billion.

Bad Economic News

Here are five reasons the “Family First Coronavirus Response Act” and other coming bailout and stimulus packages are economic bad news for Americans.

Bad Precedent: Due to our human nature, we make quick studies in dependency when “free” things offered to us. These new entitlements and bailouts may prove to be the proverbial camel’s nose under the tent, just as have nearly all other welfare expansions.

Once the bad precedent is established, it is all too likely that the electorate will have a harder time resisting demands from politicians for greater government control of the economy. These “temporary” programs make permanent national sick leave and paid family leave more likely in the future.

National Debt: The debt the federal government owes currently sits at $23.5 trillion. This means every American citizen born in 2020 enters the world owing $73,500 to our nation’s creditors.

Emergency spending for the coronavirus only adds to the unconscionable level of debt we already owe. The money this nation borrows will need to be repaid through inflation or higher taxes sometime in the future.

Inflation: If taxes are not immediately raised to cover the emergency spending, the Federal Reserve will need to print new dollars—create money out of thin air—to finance these new programs.

This inflation in the money supply predictably leads to price inflation. One of the most basic economic principles is that a greater quantity of dollars chasing the same number of goods eventually results in rising prices.

Higher Taxes: Increased government spending and national debt will necessitate higher taxes for all Americans and businesses, whether sooner or later.

Lest we forget, every dollar taken from us in taxes is a dollar we cannot spend on the things we need and want. We will have to foot the bill for all this extra spending—and that comes at the price of future economic growth and a lower standard of living for everyday Americans.

Reduced Future Economic Growth: All these inflationary effects and higher taxes will inevitably hinder the growth of the economy in the future. Higher taxes make it more difficult for businesses to save and reinvest profits in expanding operations, boosting employee pay and benefits, or engaging in research and development.

Similarly, higher taxes for individuals discourages productivity and results in less household saving and investment. This means there will be less capital available for businesses to expand operations and boost productivity.

Rising productivity and profits, greater saving and investment, and more funding for research and development are all needed for robust economic growth. Economic recoveries tend to be lackluster without the necessary combination of these fundamentals.

Let us look back in economic history for a case study. During the economic troubles following the stock market crash of 1929, President Franklin D. Roosevelt’s “New Deal” relief and recovery policies created greater government interventions into the economy, ultimately with the result of reducing profits and raising taxes on businesses.

These New Deal policies exacerbated and prolonged the downturn, turning it into a “great” depression that lasted 15 years. In fact, a study by University of California at Los Angeles economics professors calculated that the interventionist policies of the New Deal elongated the Great Depression by seven years, delaying the natural market corrections and recovery that would have occurred otherwise.

Like the New Deal, every additional billion dollars in stimulus and bailout spending will further delay the economic recovery we all want and need. Ironically, these government interventions always end up aggravating the recessions and depressions they are intended to alleviate, causing even greater economic complications in the long run.

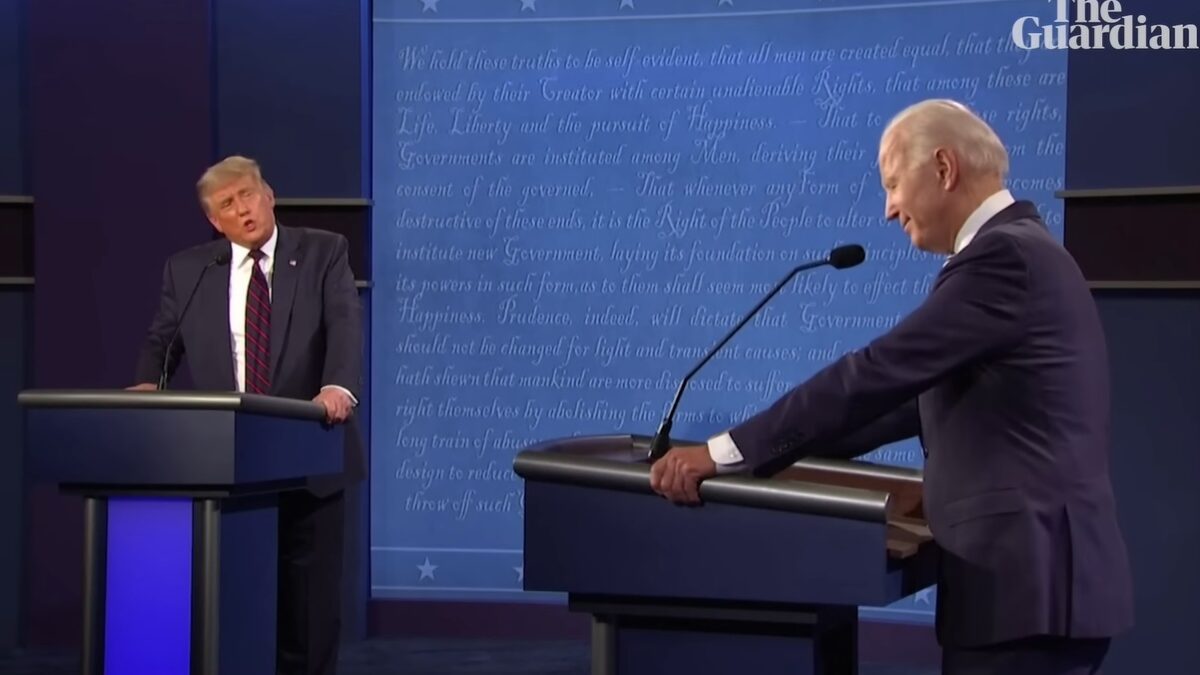

How This Affects President Trump’s Reelection Chances

In summary, the newly proposed bailout and stimulus packages smack of big government welfarism and crony capitalism. These are the sort of policies that will move the needle toward socialism, impoverishing us and stripping the productive engines of our economy.

If President Trump wants to win reelection on his economic record, he had better drop his support of this legislation, which is sure to cause lasting economic problems.

Likewise, if the president’s supporters in the Senate want a quick and sustainable economic recovery post-coronavirus, they had better gather their senses and stand firm against bailouts and stimulus packages like this economically disastrous legislation. Our financial wellbeing and the future of our liberties depend upon it.