After initially telling Robert Malone to turn over “historical transactions” with his bank to continue receiving income from his Substack newsletter with 320,000 subscribers, the payment processor Stripe provided the prominent scientist an alternate option.

One week ago, Malone posted that Stripe was demanding he “provide all of [the] current and historic financial records associated with the bank account into which Stripe deposits Substack subscriber payments” within seven days, or it would ban Malone’s subscribers from paying him.

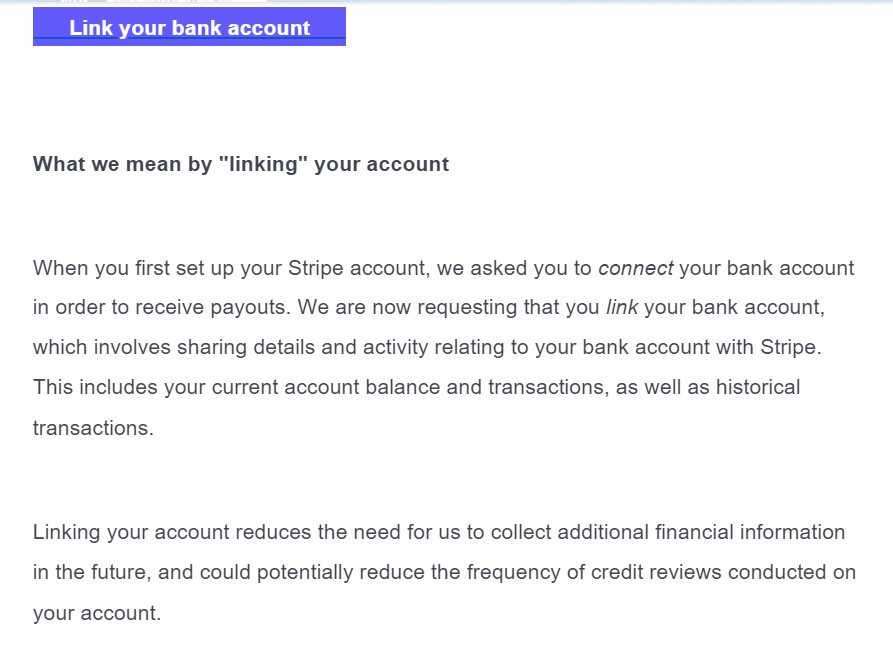

“We are now requesting that you link your bank account, which involves sharing details and activity relating to your bank account with Stripe,” says a Stripe email to Malone’s account that Malone’s attorney, Mark Meuser of Dhillon Law Group, forwarded to The Federalist. “This includes your current account balance and transactions, as well as historical transactions.” That would give Stripe access to every transaction that ever went through Malone’s linked bank account, even those that have nothing to do with Stripe’s payment processing.

Malone said in his post this could give Stripe “comprehensive information on all of my customers, patients and clients, all of my travel (historic and planned), all of my purchases, and any donations (and donor information).” He worried the spread of such private information would enable social credit-style punishments such as those congressional investigations have found federal agencies pushing financial institutions to implement against Americans who lawfully buy guns and Bibles. Malone and Meuser said they know of three other Substack authors who received similar emails.

A Stripe spokesperson told The Federalist the company uses the requested financial information to assess credit risk. The payment processor facilitated $1 trillion in transactions in 2023, meaning that if enough customers demand refunds that businesses don’t reimburse, Stripe loses a lot of money.

“Factors indicating high credit risk include elevated dispute activity, elevated refund rates, long delivery windows, long billing periods, and sharp volume increases,” says a Stripe FAQ. “Stripe reviews accounts continuously, with the frequency depending on the risk signals detected in day-to-day activity.”

There’s also another option to linking private or business accounts and providing their full financial histories to Stripe, the spokesperson said. Individuals and companies flagged for this risk assessment can fill out a form that requires very little personal information instead of granting Stripe full historical data for their bank accounts.

“Stripe does not require its users to link their bank account using Financial Connections as part of Stripe’s credit risk diligence of each user,” Stripe’s spokesperson said in a statement to The Federalist. “Stripe may, in certain instances, request users to link their bank account to assess businesses’ liquidity as part of the underwriting process, but also allows businesses to submit a form with relevant information in lieu of linking their bank account.”

Questions on this form provided to Malone include, Meuser said in a phone call Friday, “Do you accept payment before customers get your product or service? How are funds managed until the product or service is fulfilled? Do you anticipate additional liquidity needs in the next six months?”

Meuser said Stripe didn’t inform Malone of this alternative when it demanded he send them his bank data to continue receiving Substack income. That option does not appear in the email from Stripe to Malone that Meuser sent The Federalist.

Bank risk assessments that penalize political and social views appear to have resulted in the debanking of conservatives including Brexit leader Nigel Farage. After a portion of Donald Trump rallygoers rioted at the U.S. Capitol on Jan. 6, 2021, while Trump tweeted at them to “go home,” Stripe and Paypal denied further service to the Trump campaign. Substack, X, and Locals all use Stripe to let creators earn money using their platforms. Substack didn’t return Federalist requests for comment.

Libs of TikTok account creator Chaya Raichik posted in February that Stripe had also disabled her account: “They’re also holding onto my funds and won’t release them. I called and emailed and they aren’t giving me a straight answer. This has been going on for a month. Nobody has been able to subscribe to my newsletter and my funds are frozen.” Stripe also attributed that instance to a minor technical error and restored Raichik’s payment processing.

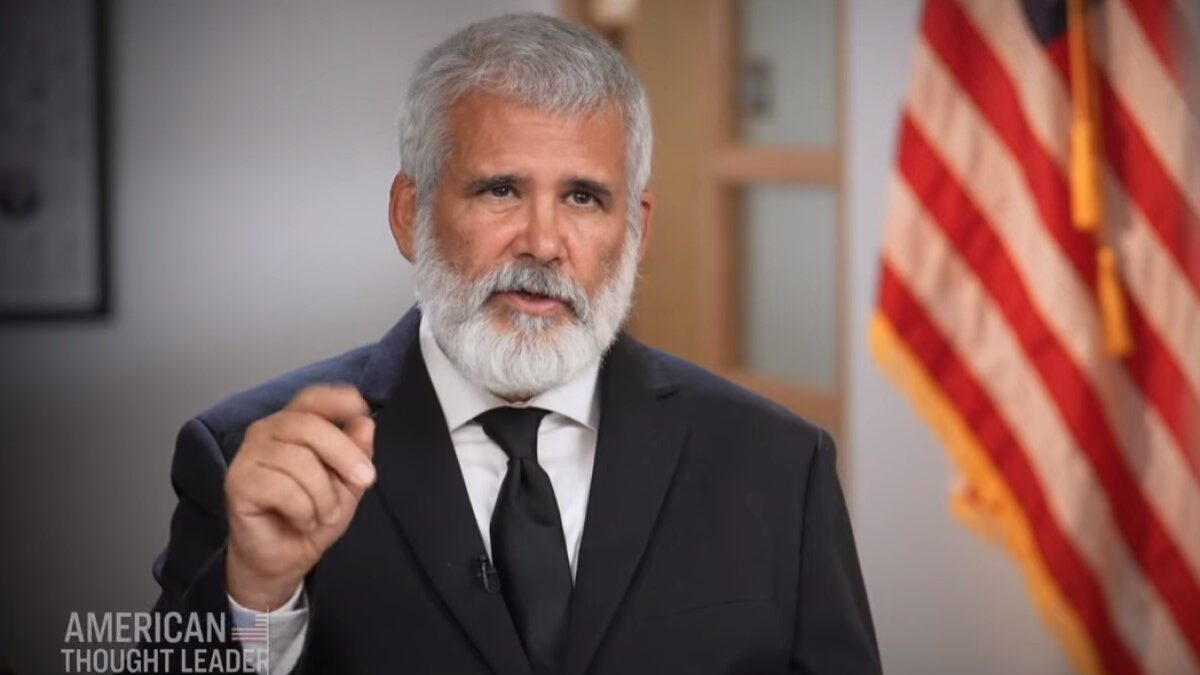

Amid a heavy-handed federal vaccine mandate, Malone blew up the internet in 2022 in an interview with podcaster Joe Rogan. Malone told Rogan mRNA gene therapies labeled “vaccines,” which use technology Malone helped invent, have serious side effects that government and health officials were attempting to cover up. Malone also said he had experienced worrisome side effects from taking a Covid injection and wasn’t going to take boosters.

YouTube banned the interview from its No. 1 streaming video platform in the United States. Twitter banned Malone and clips of the interview. Rocker Neil Young yanked his archive from Spotify to pressure the platform to cancel Rogan for talking to Malone. Myriad corporate outlets including The Washington Post and New York Times wrote articles that pressured Spotify to cancel Rogan.

Rogan is Spotify’s No. 1 show, with 14.5 million listeners. He and Spotify inked a $250 million renewal last month.

Months later, lawsuits and journalist investigations uncovered that federal officials send internet platforms hit lists of Americans to censor and have developed algorithmic censorship tools to prevent another Malone-like exponential sharing of facts that dispute government claims from ever occurring again. Algorithmic censorship also prevents high-profile bannings that generate negative publicity for tech companies.

Congressional investigations have uncovered that federal agencies are recommending similar tools to financial institutions. Such tools enable financial surveillance, flagging as potential terrorists, and canceling bank accounts of Americans who engage in constitutionally protected actions such as buying Christian books and shopping at sporting goods stores.

The Viewpoint Diversity Score finds the majority of large banks’ policies allow them to cancel customers for constitutionally protected free speech. That project of the nonprofit law firm Alliance Defending Freedom also highlights the growing instances of Americans losing access to their bank accounts for disagreeing with government officials about health and social policy. Affected Americans include former Sen. Sam Brownback and a Tennessee charity that feeds starving African children.

Western nations including infamously Canada have used debanking as a repression tool to end constitutional self-government enabled by free speech and free assembly.