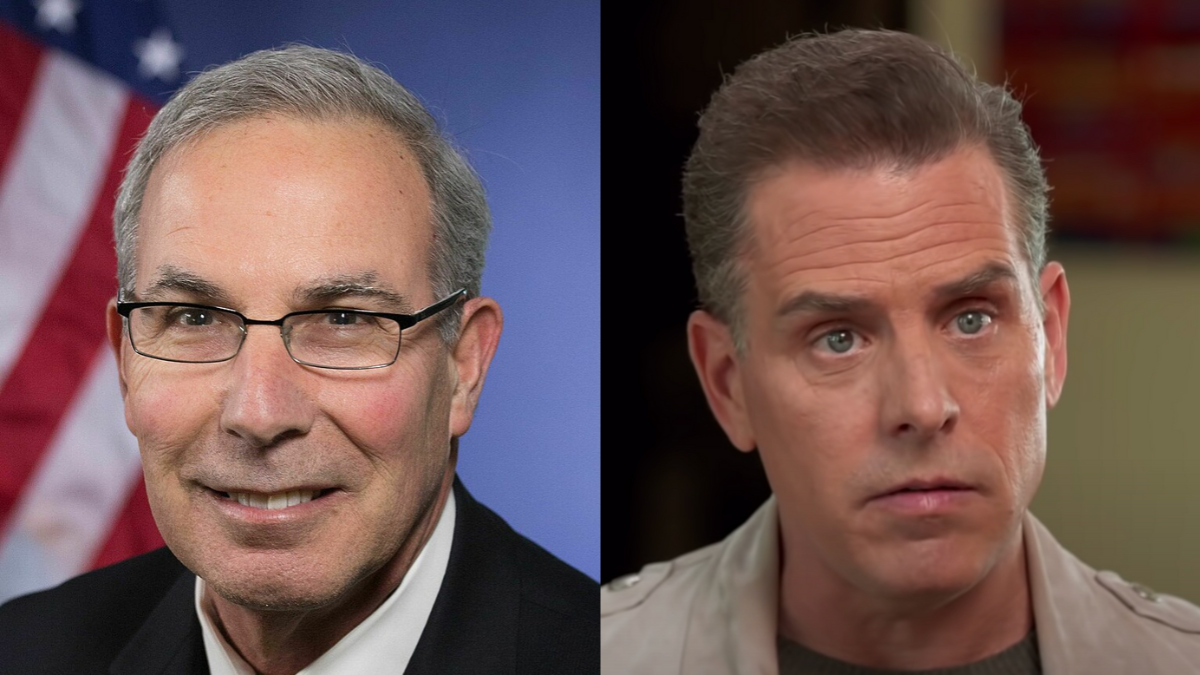

Hunter Biden’s lawyers filed four separate motions to dismiss with the Delaware federal court Monday, asking the judge to toss the three felony gun charges brought by Special Counsel David Weiss following the collapse of the sweetheart plea deal gifted to the president’s son. While the Delaware case is distinct from the nine-count indictment charging tax offenses, which was recently returned by a California federal grand jury, Hunter Biden’s motion to dismiss based on the pretrial diversion agreement could well doom the California tax charges too. Here’s why.

In his motion to dismiss the three felony gun charges based on the pretrial diversion agreement, Hunter Biden argues that agreement contractually binds the government to the terms, as detailed in the agreement. According to Hunter’s lawyers, the pretrial diversion agreement was a wholly distinct contract from the plea agreement that fell apart when the president’s son appeared before federal Judge Maryellen Noreika in July of 2023 to plead guilty to two misdemeanor tax offenses. Thus, Hunter posits in his Monday motion, the government is bound by the terms of the pretrial diversion agreement and specifically the government’s “agreement not to prosecute,” even though he never pleaded guilty to the tax offenses.

The pretrial diversion agreement focused solely on Hunter Biden’s knowing possession of a firearm as an unlawful user or addict of a controlled substance, with the government committing not to prosecute the president’s son if he complied with the terms of the agreement for 24 months, which basically required Hunter Biden to remain sober and drug-free and not to purchase any firearms. But the government’s agreement not to prosecute extended much beyond any potential gun charges, including “any federal crimes encompassed” in two attachments, one a statement of facts related to the gun charges and a second a statement of facts concerning Hunter Biden’s business operations and tax offenses.

Thus, if the pretrial diversion agreement is valid and enforceable, as Hunter Biden argues, then not only will Weiss be barred from prosecuting the gun charges in Delaware, but the tax charges in California will also be off-limits to the government.

So will Judge Noreika hold that the pretrial diversion agreement is a valid and enforceable contract? That’s the $1 million question.

Comments the federal judge made during the plea hearing suggest she will reach one of two conclusions. First, Noreika might conclude the pretrial diversion agreement is not a binding contract because the government and Hunter Biden never had a “meeting of the minds” concerning whether the pretrial diversion agreement and the plea agreement were each conditioned on the other agreement being executed. If Noreika reaches that conclusion, she will hold there is no contract and deny Hunter’s motion to dismiss based on the pretrial diversion agreement.

Alternatively, Judge Noreika might instead rule the pretrial diversion agreement is a valid contract but that the government exceeded its authority in promising not to prosecute Hunter Biden for crimes unrelated to the crime underlying that agreement. In other words, Noreika might hold Weiss to his commitment not to prosecute Hunter Biden so long as he stays clean and sober for 24 months, but rule that the promise not to prosecute, as a matter of law, applied only to the gun charges and could not be extended to other crimes, such as the tax offenses.

While Noreika could also accept Hunter Biden’s argument and hold that the government is bound by the terms of the pretrial diversion agreement, that outcome seems unlikely given the concerns she expressed during the plea hearing. Unfortunately, case law provides little guidance in this case because the government concocted the unique plea agreement/pretrial diversion agreement combo just to placate the Biden family. No matter how she rules, though, rest assured the losing party will appeal to the Second Circuit and then try for the U.S. Supreme Court.

And those procedural machinations concern solely Hunter Biden’s motion based on the pretrial diversion agreement. On Monday, his attorneys filed three other motions to dismiss, including one that argued Weiss was not properly appointed. That motion is unlikely to go anywhere, though, as Weiss had authority, separately, as the Delaware U.S. attorney to charge Hunter Biden.

Hunter Biden also argues Special Counsel Weiss engaged in vindictive and selective prosecution by bringing charges only after right-wing backlash forced him to do so. That motion seems doomed as well given that the backlash resulted from the initial improper favoritism shown by Weiss and his team.

Finally, Hunter Biden asserts that the gun charges fail as a matter of constitutional law because Congress could not criminalize the possession of a gun by an addict. And since Congress could not criminalize possession by an addict, it also could not make lying about being an addict a crime. Therefore, Hunter Biden argues the three gun charges fail. At least on the first claim here, Hunter Biden has a point, with controlling circuit precedent supporting the position. Whether the trial court agrees remains to be seen.

However, even if the court holds Congress exceeded its Second Amendment authority by prohibiting addicts from possessing guns, that holding will not affect the California tax indictment. Conversely, a ruling in favor of Hunter Biden based on the pretrial diversion agreement could well doom the California tax case — meaning the president’s son would have his cake and eat it too.