Same song, different verse. For someone who spends much of his time claiming to defend Social Security and Medicare, President Joe Biden takes a pass one day a year: Tax Day.

For the sixth consecutive year, Biden and his wife avoided paying Medicare and Social Security taxes on some of their income by using a controversial loophole. The corporate press largely avoids this issue, but congressional Republicans interested in exposing the Bidens’ hypocrisy should not.

Residual Book Sales

In 2017, both Joe and Jill Biden set up S-corporations to handle their book and speech income. By funneling this income through the S-corporations — in Joe’s case through the CelticCapri Corporation, and in Jill’s case through the Giacoppa Corporation — they avoided payroll taxes on profits from the companies.

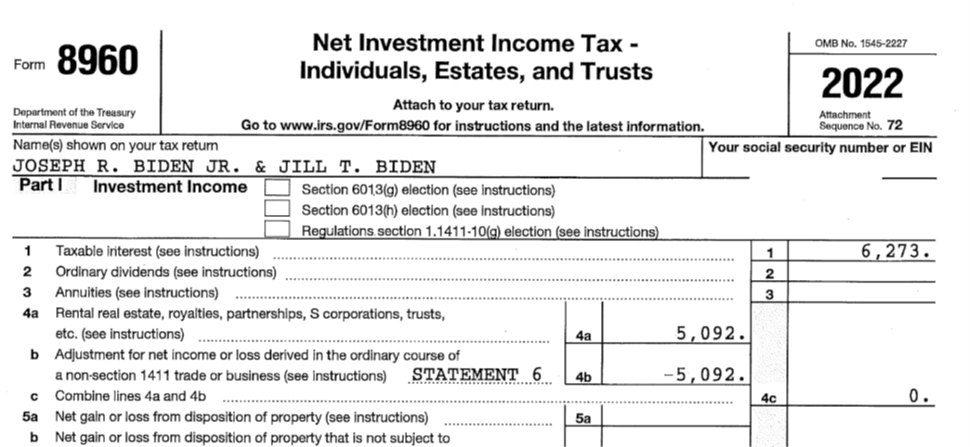

In 2022, the Bidens characterized $5,092 as corporate profits exempt from payroll taxes, as shown on page 13 of their return:

This $5,092 gets broken down in two ways — $2,933 comes from Joe’s CelticCapri Corporation, while $2,159 comes from Jill’s Giacoppa Corporation.

In the president’s case, Biden avoided paying 3.8 percent in taxes on his corporate profits — a 2.9 percent tax that funds Medicare and an additional 0.9 percent tax imposed by Obamacare. (So much for Biden’s claim that “Obamacare is personal to me.”)

Jill, who earned $82,335 as a teacher at Northern Virginia Community College, avoided more in taxes, as she did not reach last year’s Social Security wage cap of $147,000.

Because she would have had to pay Social Security taxes on all wages up to the wage cap, classifying her book income as corporate profits rather than wages meant Jill Biden didn’t just avoid paying Medicare taxes on these earnings — she avoided paying Social Security taxes as well.

Granted, the Bidens avoided a modest amount of Social Security and Medicare taxes this past year:

Joe Biden: $111.45 ($2,933 times 3.8 percent)

Jill Biden: $349.76 ($2,159 times 16.2 percent)

This tax evasion, however, comes after the Bidens previously avoided at least $517,000 in Medicare and Obamacare taxes from 2017 through 2020, and another $6,100 in 2021.

New Excuses for Evasion

In February, the White House issued a new statement attempting to rationalize the Bidens’ tax schemes. The full details are here, but in essence, the White House claims the Bidens’ book income amounts to royalties that are permanently exempt from payroll taxes.

The White House, therefore, claims the Bidens’ tax affairs have “nothing to do” with a self-described “loophole” that the Biden administration has proposed closing.

Those claims don’t pass muster, on several different levels:

- The White House cited obscure regulations to claim payroll taxes do not apply to the Bidens’ book income. The administration’s defense amounts to, “We didn’t use the ‘S-corporation loophole’ to avoid payroll taxes — we found a whole other obscure loophole to avoid paying into Medicare and Social Security!”

- On the face of it, the Bidens’ actions conflict with basic guidance on the IRS website, which says, “Royalties from copyrights, patents, and oil, gas and mineral properties are taxable as ordinary income.”

- The White House claims the IRS “conclusively agreed” with the Bidens’ interpretation of the obscure regulations. But independent tax experts have publicly disagreed with the IRS’s interpretation.

Moreover, an analyst at the liberal Tax Policy Center said the House Ways and Means Committee should investigate why the IRS did not pursue a repayment from the Bidens on a related issue — namely, that the Bidens paid themselves far too low a salary in 2017 and 2018 so as to characterize most of their income as corporate profits exempt from payroll taxes.

In 2017, Biden paid himself a salary of $145,833, compared to corporate profits of $9,490,857. In 2018, Biden paid himself a salary of $300,000, compared to corporate profits of $2,730,667.

The ratio of salary to profits was so lopsided that I filed a whistleblower complaint with the IRS, asking them to claw back some of Biden’s unpaid payroll taxes. (The IRS dismissed the complaint.)

Even discounting numbers one through three above, the Bidens still used the “S-corporation loophole” that the Treasury Department wants to close.

Even if one agrees with the Bidens’ interpretation of their book income as royalties somehow exempt from payroll taxes, that interpretation does not (and cannot) apply to the over $3.3 million in income that Joe Biden received from speaking engagements in 2017 and 2018.

In other words, he’s still a hypocrite for using a loophole he wants to eliminate, even if he funneled “only” $3.3 million through the “S-corporation loophole,” as opposed to more than $13 million.

Time to Investigate

The real question surrounding the Bidens’ taxes is why the IRS agreed to go along with these shenanigans.

First, the agency agreed to accept an interpretation of an obscure regulation that contradicts a plain instruction on the IRS website. Then, the IRS refused even to examine why Biden paid himself such a low salary in 2017 and 2018.

The other question is why House Republicans have yet to announce a formal investigation into this matter. If they want to make a case as to why $80 billion in IRS funding (and 87,000 new employees) will be used to harass ordinary Americans, then the fact that the IRS improperly let Biden off scot-free will bring that message home in a tangible way.

If House Republicans want to use their newly won majority to conduct robust oversight of a woke and weaponized government, exposing the IRS’s outrageous conduct regarding the Biden family is a great way to do so.

Time’s a wastin’, Congress.