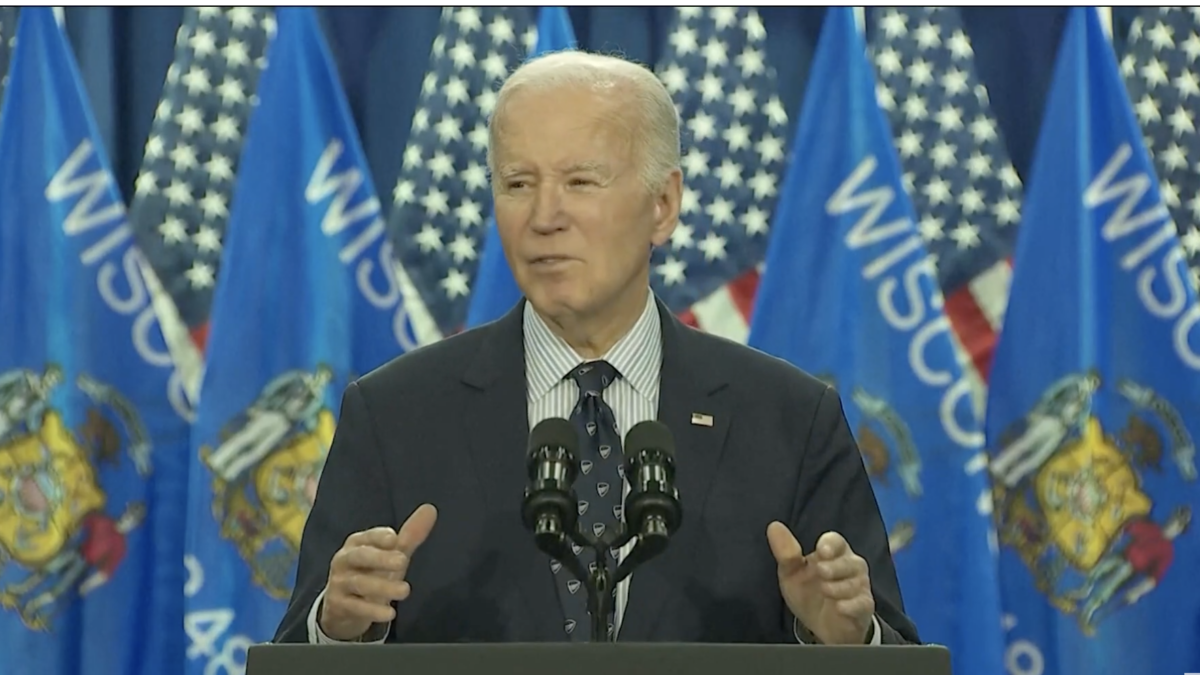

Upon news that Joe Biden had decided to completely ignore U.S. laws to attempt to force taxpayers to assume the debts of people who chose to attend college, I reached out to Federalist writers for stories of how other Americans paid their own way. Calling this particular pile of government handouts for the privileged “forgiveness” is just a way to try to hide the fact that it’s fundamentally wrong and unfair.

As the Bible says, he who doesn’t work shouldn’t eat. He who takes on obligations should pay them. Taking something without paying for it is stealing. Forcing other people to work so you can enjoy luxuries is called enslavement.

Now the Americans who made honorable, difficult choices to work for their own personal advancement and that of their children are having the fruits of their labor seized and handed to strangers instead of requiring all Americans to be held equally responsible for their financial decisions. Here are stories of how just some of these responsible Americans have worked, saved, and lived frugally to fulfill their own financial obligations, like everyone should.

My Dad Worked 14-Hour Days So His Daughter Didn’t Have To

My dad didn’t complete college. Instead, he left a state university to help run the family farm after his own father died. He never went back to college, and he didn’t need to, because he has a work ethic. My dad woke up at 3 a.m. for many days to work in uncomfortable and dangerous farm situations to save money that helped not only give me a wonderful upbringing but also pay for my college. I will never forget his sacrifices.

I worked three jobs at a time in college to help pay my costs. I also glued my behind to the study chairs to meet my scholarship requirements and make good on my dad’s investment in my life. I had seen him come home after 14-hour days with his body covered in dirt and his face white from working so hard to get me to college without a huge load of debt.

He did that so I could read books and write essays for four years in comfort and seek the life of my dreams. My dad’s labor also helped make it possible for me to work hard to help pay off my husband’s student loans, which he took on because his parents chose low-paying professions of service to others—pastor and teacher—instead of high-paying jobs of lower social value for which they were eminently capable.

It’s disgusting to take the results of my dad’s labor to give those who refuse to take responsibility for life choices that he denied himself. —Joy Pullmann

I Worked 8-Hour Days at Age 14

Money was tight growing up, so I knew if I wanted something I had to earn the money to pay for it. Two paper routes at 12 were first, and then after my 14th birthday, I worked eight hours a day at a nearby summer camp.

From 14 on, I worked 40-hour weeks every summer and long days during fall and spring weekends. Working wasn’t hard, but not having the free time to practice tennis over the summer kept me from playing varsity doubles my senior year in addition to singles—something I desperately wanted to do at the time.

In college, I stacked my classes in the morning, 8a.m. to noon, so I could take a bus downtown in the afternoon and work from 1 to 5:30 p.m. before taking a return bus to campus, where I would eat a late dinner alone in the mostly abandoned cafeteria in my brown polyester uniform. I missed much of the “college experience” but graduated with little debt.

Law school required more financing, but I only borrowed enough to cover the tuition. After graduating, rather than spending the “big firm” salary on a nice apartment, car, and clothing, I pinched pennies and paid off the loans in three years. —Margot Cleveland

My Parents Began Saving for Me the Day I Was Born

Both of my parents got their PhDs after college, so paying off their loans was much slower of a process than many of their peers—graduate school isn’t cheap (even if you get paid to go). My parents worked diligently to live below their means such that they would be able to pay off their college loans in a timely manner.

They recognized the need to pull one’s own weight in this world, especially when it comes to keeping financial promises. If you borrow money to receive an education, you are obligated to return that money when you can.

My parents began saving the day I was born so that they would be able to help me pay for college. That money they saved over the course of 18 years could have been used for a multitude of other purposes, many of which would have been more satisfying for my parents in the short term. But they chose to play the long game and ensure that our family would not have to borrow anyone else’s money when I set off for school.

Even so, they made sure to teach me the same lessons about hard work, gathering your own resources, and paying your own way by making me responsible for the cost difference between in-state and out-of-state schooling (I went out of state). Although they could have paid for 100 percent of my education due to their long-term financial responsibility, they wanted me to see that we cannot and should not rely on others to facilitate what we want.

So I have taken out informal college loans through my parents, including interest and everything. This also motivated me to obtain scholarships, another form of hard work I had to put forth to pay my own way (in addition to working part-time jobs throughout high school and college). —Kiley

I Took Dramamine to Keep Working to Pay for College

One of my parents graduated college, the other did not, and I think that informed their prudent strategy of encouraging my brother and me not just to “go to college,” but to take inventory of our skills and choose a suitable path. For me, that was a Christian university, and because scholarship opportunities were limited, that meant lots of extra hustle. The expectation was that I would work my tail off and keep tight purse strings, and my parents would help out wherever they could.

My mom, a full-time teacher, graciously picked up some summer work during what should have been her respite, and the two of them helped me weed through the fine print of federal loans, which we decided were too costly. Instead, they helped me shop for a personal loan with a much lower interest rate that we paid off soon after my own graduation.

I picked up hours everywhere I could. During summers, that usually meant an early breakfast shift at the camp kitchen down the road, then off to my daytime coffee shop stretch, and nights and weekends waitressing. One summer, I spent the two weeks between the end of camp and the start of school sorting cucumbers in a warehouse at the pickle farm down the road — anything to make a little extra cash (even if it meant daily doses of Dramamine to counter the conveyor-belt-induced motion sickness).

During the semesters, it meant squeezing in campus jobs between classes, and I learned I could cut down my housing costs by living and working at a home for people with developmental disabilities. I’m recently married now to a wonderful man who was smart enough not to go to college, but despite his many sacrifices and those of my family to avoid debt, we’re stuck eating the costs of the many people who refused to make those sacrifices themselves. —Kylee Griswold

I Picked a Lower-Prestige School to Avoid Debt

My six older brothers attended private liberal arts colleges. When it was my turn to apply for colleges, money was tight, so I decided to attend a state university where I could qualify for grants and scholarships and commute from home. Despite having a full course load each semester, I had more than enough time to play video games, party, and work a part-time job.

So many years later, I can say that I got what I paid for: a mediocre education that was nonetheless convenient and conferred the paper I needed. But at least it didn’t put me in debt. Of course, if the federal government forced taxpayers to simply pay off my debts, I would’ve done the same as my brothers and sought out a better school. But, as it was, I made the choice.

It was only much later in life that I took up reading and writing seriously. Unfortunately, by that point, my brain wasn’t quite as fast, creative, or strong as it was during my time in college. —Auguste Meyrat

My Dad Ate Squirrels to Afford College

My father didn’t receive any financial help from his parents when he was accepted to Auburn University in 1967. So he served in ROTC to cover tuition and worked at a hot dog stand to pay other bills. He had so little money for food that he used his .22 rifle to shoot squirrels and rabbits, which the folks at Auburn’s dining hall graciously agreed to cook for him.

When I was accepted to the University of Virginia, my parents could just afford to pay my tuition and other expenses, but after my first year I agreed to pay for everything but tuition and housing, and after my second year, for everything but tuition. I taught tennis classes, coached a local high school team, and worked at the university library doing digital preservation of historical documents to pay for all my expenses.

I think having to work about 20 hours per week in addition to a full course load accelerated my maturation into adulthood, and clarified the fact that whatever I studied in college should actually prepare me for the workforce. What lesson does this student debt forgiveness impart? —Casey Chalk

Paying Your Way Is What Adulthood Means

I completed an A.A. degree at community college at age 18, utilizing Washington State’s “Running Start” program to do the first two years of college tuition-free. The last two years at the University of Washington racked up more than $50,000 in debt between myself and my husband. We worked entry-level jobs at fast food joints and office supply stores until we finally found better-paying white-collar work.

Instead of spending all our income on our lifestyle and simply making minimum payments, we got seriously frugal: We sold the financed car (after getting above-water on it) for a much older sedan we paid cash for, only ate at home except on special occasions, and even slashed our budget for family birthday gifts (no one seemed to mind). We paid it off in less than three years. For more on how we did this and began investing for early retirement, see our book.

Inflation is a significant challenge to today’s college borrowers, but I believe the vast majority of students can pay off their loans in a timely manner if they make it a priority and exercise fiscal discipline.

Not only is it unfair to push the cost of these loans onto taxpayers, especially people who already paid theirs off, but it deprives young people of the satisfaction of fulfilling their obligations, of knowing they can take care of it themselves, even if they felt cheated by the college experience. Making mistakes is part of being an adult, and so is paying off your own debts. —Georgi Boorman

My Parents and Grandparents Never Went to College

I worked my way through college as an Applebees waitress, then worked at Burdines (a store in Florida), and finally student loans and every scholarship I could find. Same for grad school. Worked all day at the U.S. Treasury then ate Pop-Tarts for dinner while I loaded up classes at night.

My parents and grandparents never went to college, so my graduations were very special to me. Nothing replaces the feeling of busting your ass to make something happen and earning it yourself. That’s what the government doesn’t understand.

The problem in all of this is tuition in the first place and the artificial market the feds have created. Why don’t we deal with that? — Morgan Ortagus

I Ate Inexpensive Chicken Gizzards to Graduate Debt-Free

I passed up the opportunity to attend a prestigious private college and went to a small public university because it was more affordable and it awarded me a merit-based scholarship. The scholarship wasn’t enough to cover everything, so I paid for the rest by having three part-time jobs.

To save money, I ate leftovers at a Chinese restaurant whenever I could. Other times, I bought the cheapest food in the grocery store—usually carrots and chicken gizzards. Thanks to these sacrifices and hard work, I was able to graduate debt free. Lacking a degree from an elite college didn’t prevent me from finding a good-paying starting job.

My husband attended an elite college. He paid for his school through a combination of scholarships, grants, loans, and part-time jobs. When he graduated, he carried about $27,000 in student loan debt.

He’s the most frugal person I’ve ever known. He always went to the cheapest barbershop and had his hair cut so short that he wouldn’t get a haircut too often (to save money). His lunch and dinner usually consisted of Ramen noodles, and his socks often had holes in them.

Other than visiting his parents, he rarely took any vacations. Due to his extreme savings habits and diligence in paying more than the monthly minimum loan, he eventually paid off his student debt in six years.

We’ve all made sacrifices and taken the financially responsible route to earn our college education. Biden’s student loan cancellation is incredibly unfair and morally indefensible. —Helen Raleigh