A typical Washington fight erupted last week, as Democrats expressed outrage at the thought of anyone or anything slowing down their “tax-and-spend express.” The controversy emerged when Senate Minority Leader Mitch McConnell, R-Kentucky, made comments to Punchbowl News regarding an increase in the debt limit:

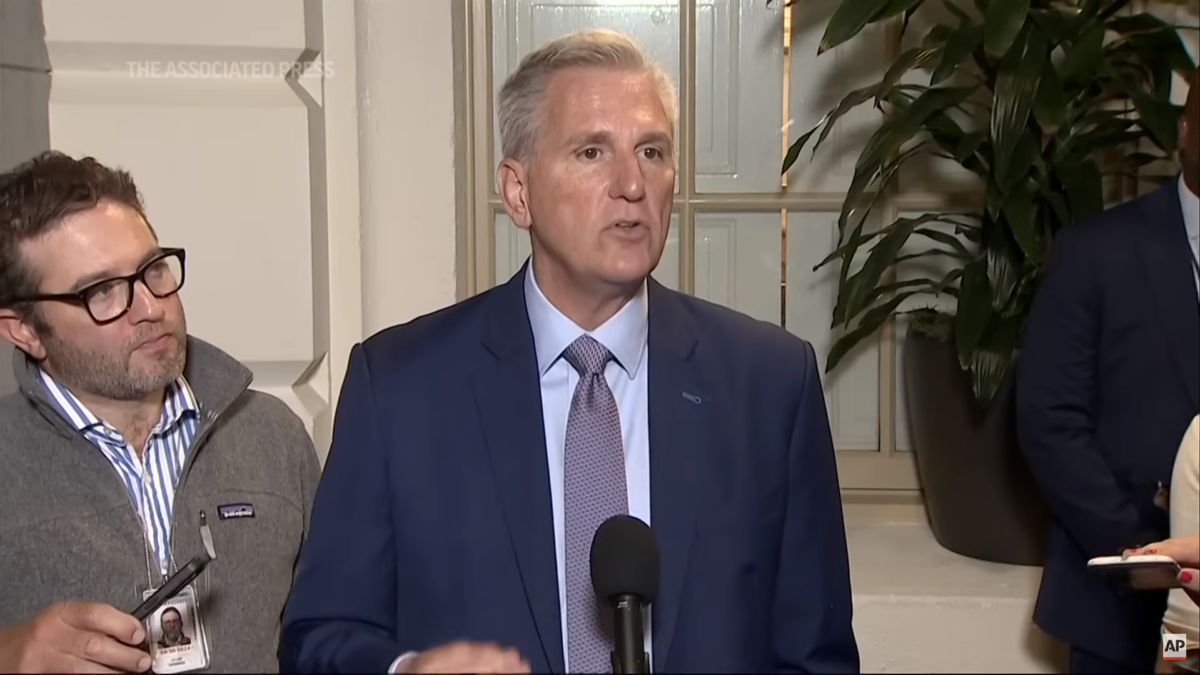

I can’t imagine there will be a single Republican voting to raise the debt ceiling after what we’ve been experiencing… I can’t imagine a single Republican in this environment that we’re in now—this free-for-all for taxes and spending—to vote to raise the debt limit.

His Senate counterpart, Majority Leader Chuck Schumer, D-New York, retorted that McConnell “should not be playing political games with the full faith and credit of the United States,” claiming that “this debt is Trump debt. It’s COVID debt.”

Not ‘Trump Debt’

Except much of it isn’t. The most recent debt limit bill suspended the statutory limit on borrowing through August 1, at which point it will reset at its higher level. Most of the COVID spending approved last year, and under the last administration, took place under the current suspension.

On the other hand, any additional debt incurred as a result of this year’s “COVID relief” bill—including the $1.1 trillion in spending this fiscal year, and $709.8 billion in fiscal year 2022 and beyond—represents debt that Democrats and Democrats alone, not the Trump administration, incurred.

Republicans should indeed have done a better job cutting rather than increasing spending, and paying for any tax relief they provided the American people. But Republican lawmakers’ profligacy should not and does not give Democrats carte blanche to pursue even more reckless levels of spending, “paid for” by silly budgetary gimmicks.

4 Options for Debt Limit Increase

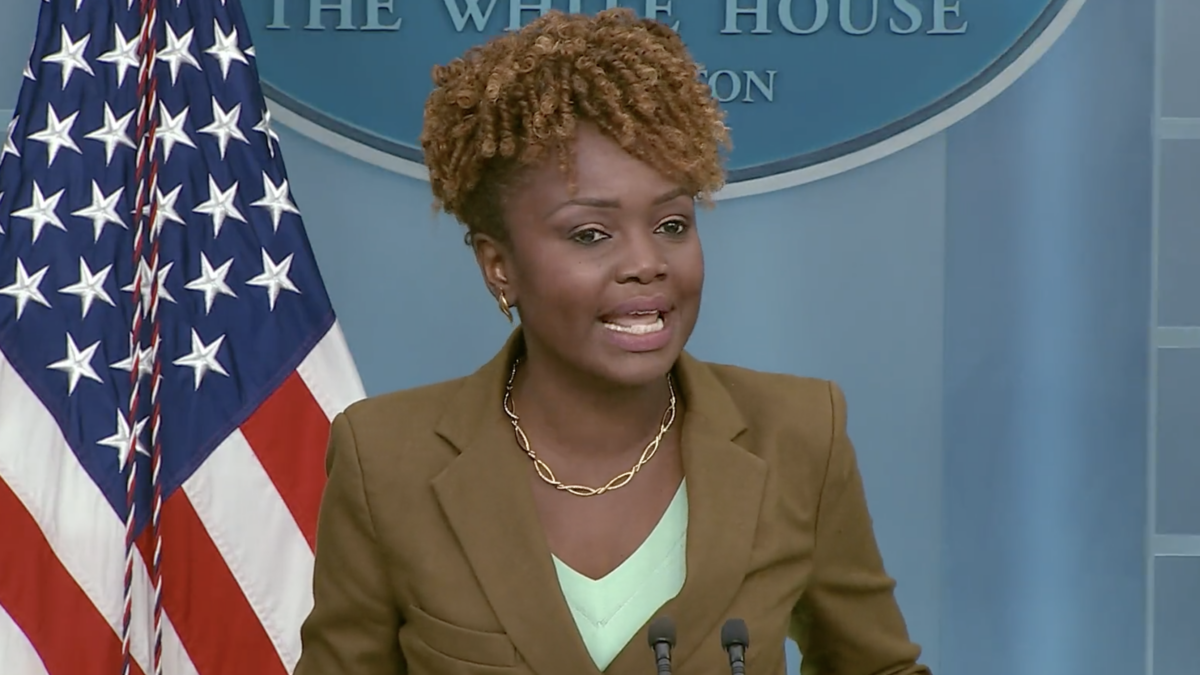

Schumer and House Speaker Nancy Pelosi (D-CA) have four ways to increase the debt limit.

Stand-alone increase via budget reconciliation: The most straightforward option would see Schumer and Pelosi passing a budget resolution that calls for an increase in the debt limit, then pass a debt limit increase as a stand-alone budget reconciliation bill.

But Congress has never used this option in the history of budget reconciliation, likely because voting for a bill that raises the debt limit, and only raises the debt limit, represents perhaps the ultimate losing issue politically. Moreover, four Senate Democrats voted against the last debt limit increase, in 2019; if even one follows suit this time, the strategy will fail, as Schumer will lack a majority.

Increase as part of a large budget reconciliation bill: In his interview last week, McConnell suggested “the answer [to how to raise the debt limit] is they [i.e., Democrats] need to put it in the reconciliation bill.” But here again, lawmakers like Sen. Joe Manchin, D-West Virginia, and Jon Tester, D-Montana, may object to passing the debt limit increase in this manner, again leaving Schumer without a majority.

Moreover, depending on how quickly the reconciliation package comes together (or doesn’t), Democrats could end up using the debt limit deadline to ram the multi-trillion-dollar bill through, or, if the bigger bill gets bogged down, end up flailing around at the last minute looking for another debt limit option.

Negotiate a compromise with Republicans: If Democrats decide not to pursue the reconciliation route, breaking a Senate filibuster will require at least 10 Republicans to agree to a debt limit increase. As McConnell suggested, getting this level of Republican support will require structural reforms to the federal budget—spending restraint at a time Democrats just want to spend, spend, spend.

Try to “jam” Republicans: Schumer and Pelosi could try to wait until the last minute, attach a debt limit increase to some piece of legislation—for instance, a continuing resolution needed to keep the government running after the end of the fiscal year on September 30—and dare Republicans to block it. But if this game of “chicken” doesn’t work—and McConnell said very clearly last week he thinks it won’t—then Schumer and Pelosi will have to go back to square one, and without much time to spare.

Uncertain Timing

A short Congressional Budget Office report released Wednesday indicated the “extraordinary measures” Treasury will employ once the debt limit gets reinstated August 1 could provide for sufficient borrowing through “October or November.” That date represents a later estimate than this author referenced earlier this year, largely because CBO notes the Treasury Department has kept historically high cash balances over the last fiscal year, allowing the Department to “extend the time [it] has to continue financing government operations without issuing debt.”

That said, Treasury Secretary Janet Yellen on Friday demanded that Congress pass a debt limit increase immediately, citing the uncertainty the current large levels of spending place on the federal government’s cash flows. In so doing, Yellen helped to make conservatives’ case for them, because that gusher of spending provides as good a reason as any for lawmakers to demand fiscal reforms—and real spending reductions—in exchange for an increase in the debt limit.