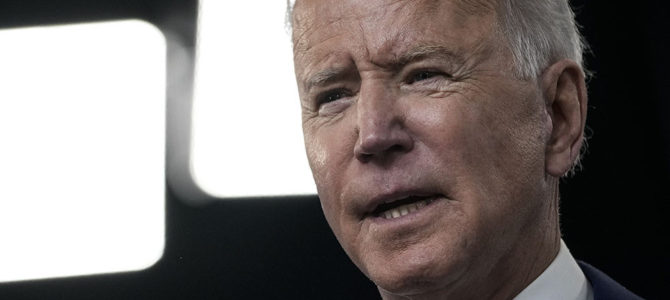

Rather than support American jobs and our economy, President Biden’s infrastructure plan would cripple our economy and substantially harm our ability to compete internationally.

To pay for its initial $2 trillion in spending, the White House’s plan raises the federal corporate tax rate to 28 percent from the previous 21 percent. This change puts us above even notoriously entrepreneurship unfriendly countries like England (at 19 percent) and nations fallaciously hailed by the left as positive examples of socialist tendencies, including Finland (20 percent), Sweden (21.4 percent), Norway (22 percent), and Denmark (22 percent). China is below the proposed rate with 25 percent.

In fact, the U.S. corporate tax rate will be the highest of the 37 countries in the Organisation for Economic Co-operation and Development (OECD) once France implements their reduction to 25.83 percent over the next year. Sweden and the Netherlands are likewise reducing their tax rates on businesses.

These dramatic increases to corporate income taxes may help provide funding for the infrastructure bill’s provisions in the short term, but will hinder the economy’s growth and therefore the government’s long-term ability to accrue revenue.

The United States holding so relatively high a corporate tax rate will be detrimental to investment and entrepreneurship. Treasury Secretary Janet Yellen told Congress during her confirmation hearing that she could “assure the competitiveness of American corporations even with a somewhat higher corporate tax,” but only with the cooperation with fellow Organisation for Economic Development and Cooperation countries to prevent a global “race to the bottom.”

Unfortunately, it appears that the Biden administration is ignoring the cooperative aspect Yellen thinks is required for this plan to work, instead choosing to go ahead on the comparative tax increase as many of the aforementioned countries are actively decreasing their tax rates in an effort to stimulate their economies after COVID and improve their competitive advantage.

With so many foreign countries enacting tax policies that will make their economies more appealing to investment and entrepreneurship, the U.S. economy is in danger of falling behind. It’s ironic that Biden’s policy is described as “made in America,” as this will likely push new business away from the United States and onto the shores of countries with more habitable economies.

The infrastructure bill does attempt to prevent existing U.S. companies from evading these taxes by increasing the tax on foreign income from 10 percent to 21 percent. This change is estimated to predominately affect companies that already have decent portions of their operations abroad, particularly in the tech sector.

Rather than force these companies to hand over a larger share of their profits to the government or move operations domestic, this shift may encourage companies to sell some of their foreign operations to non-US based companies, the U.S. Chamber of Commerce’s chief tax policy counsel Caroline Harris told the Wall Street Journal.

Along with incentivizing entrepreneurship and investment to avoid the United States, this tax hike is likely to contribute to slowed wage growth and lost jobs. Along with typical slowed growth associated with less money remaining with the company, the comparatively high taxes would harm U.S. companies’ ability to financially compete with those that are foreign-based due to tax discrepancies.

Although intended to pay for infrastructure, the Biden administration’s tax hikes would severely harm the U.S. economy and weaken us relative to other countries.