Freshman congressman Rep. Byron Donalds, R-Fla., blasted President Biden for hinting at tax increases during his recent “Good Morning America” interview Wednesday.

Speaking to Jan Jeffcoat on The National Desk Thursday, Donalds explained why raising taxes hurts even lower-income Americans.

“If you take money away from people, even the quote-unquote rich, what happens is they have less money to spend. If there is less money to spend, there is less money flowing through the economy. If there is less money flowing through the economy — who does that hurt? It hurts middle-income Americans and poor Americans,” Donalds said.

“This tax increase will be devastating to Americans at a time when we should be doing is opening up our economy," – @ByronDonalds on President Biden's federal tax hike https://t.co/OqxiYBI22T pic.twitter.com/Nf2GCk6BTO

— The National Desk (@TND) March 18, 2021

“You know how I know this? Because Joe Biden and the Democrats have no problem shoveling money all through the economy when government gets to spend it,” Donalds continued. “But they refuse to let people spend that money for themselves.”

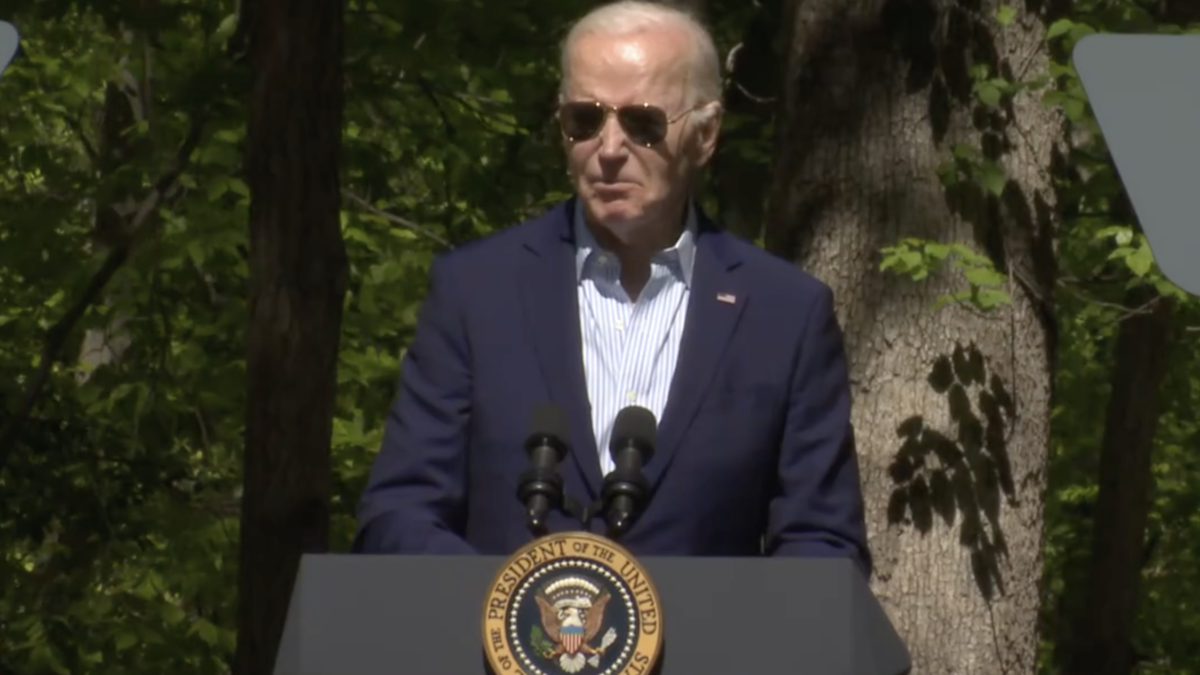

Donalds was referring to Biden’s acknowledgment that individuals making over $400,000 will experience a tax-rate increase.

“Yes, anybody making more than $400,000 will see a small to a significant tax increase,” Biden said, although White House press secretary Jen Psaki recently clarified that individuals making $200,000 a year who are married to someone making similar amounts will also be subject to the proposed tax hike.

Donalds said tax increases would be a disaster for our economy, “especially if you look at the fact that in the last two years, the federal government — under the Trump tax plan — has raised more revenue than at any point in the history of the United States,” he said.

George Stephanopoulos asked Biden if he believes he will obtain GOP votes for the increase — a leading question that Stephanopoulos indubitably knew would provide Biden the chance to further slam Republicans.

“I may not get it, but I’ll get the Democratic votes for a tax increase. If we just took the tax rate back to what it was when [George W.] Bush was president — [when] the top rate paid 39.6 percent in federal taxes — that would raise $230 billion. Yet they’re complaining because I’m providing a tax credit for child care for the poor, from middle class?” Biden said.

Biden’s interest in raising the federal tax rate to 39.6 percent, from 37 percent, is supported by a report from Bloomberg this week. Sources told Bloomberg that the president also wishes to raise the corporate tax rate from 21 to 28 percent, and increase the tax rate for capital-gains on individuals making at least $1 million a year. According to Bloomberg, Biden is planning for the largest tax increase since 1993.

“If we get to 2.6% or 2.7% on the core [inflation] number that’s the highest level we would have in 30 years,” Jim Bianco, president of Bianco Research told Axios in January. “With the 10-year yield at 1.1% and with the stock market at a new high and a forward P/E ratio of 24 [times earnings] that’s going to be a problem for risk markets to see that kind of level of inflation even if the Fed says that they want that level of inflation.”

On Monday, Psaki was asked about a so-called “wealth tax,” and if Biden aligned with Sen. Elizabeth Warren’s D-Mass. plan. Psaki noted that “those at the top” are not paying “their fair share.”

Right now, we live in an America tilted toward the ultra-rich and the powerful. The tax system is so full of loopholes and special breaks that families in the top 0.1% pay about 3.2% of their wealth in taxes while the bottom 99% pay about 7.2% in taxes.

— Elizabeth Warren (@ewarren) March 1, 2021

Psaki said that like Warren, Biden believes the upper class is not taxed enough, but his plan differs from hers.

“He laid out during the campaign his own plans for fixing this, which are different from Sen. Warren’s. But certainly, as we get to the point about discussing taxes and tax reform — or reforms of the tax system, that they share an objective.