After a week of being attacked for shady bookkeeping and questionable expenditures, the Clinton Foundation is fighting back. In a tweet posted last week, the Clinton Foundation claimed that 88 percent of its expenditures went “directly to [the foundation’s] life-changing work.”

More than 88% of our expenditures go directly to our life-changing work: http://t.co/5BrnpBtIp6 pic.twitter.com/GoKfRE9rKq

Clinton Foundation (@ClintonFdn) April 25, 2015

There’s only one problem: that claim is demonstrably false. And it is false not according to some partisan spin on the numbers, but because the organization’s own tax filings contradict the claim.

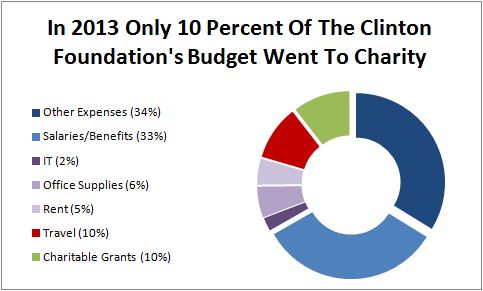

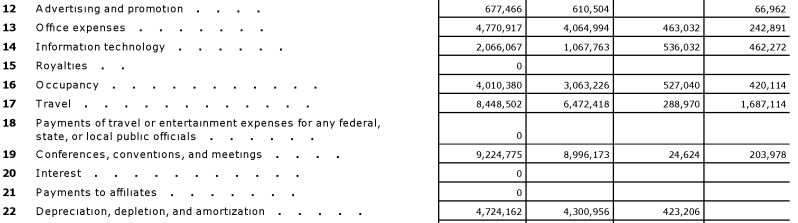

In order for the 88 percent claim to be even remotely close to the truth, the words “directly” and “life-changing” have to mean something other than “directly” and “life-changing.” For example, the Clinton Foundation spent nearly $8.5 million–10 percent of all 2013 expenditures–on travel. Do plane tickets and hotel accommodations directly change lives? Nearly $4.8 million–5.6 percent of all expenditures–was spent on office supplies. Are ink cartridges and staplers “life-changing” commodities?

Those two categories alone comprise over 15 percent of all Clinton Foundation expenses in 2013, and we haven’t even examined other spending categories like employee fringe benefits ($3.7 million), IT costs ($2.1 million), rent ($4 million) or conferences and conventions ($9.2 million). Yet, the tax-exempt organization claimed in its tweet that no more than 12 percent of its expenditures went to these overhead expenses.

How can both claims be true? Easy: they’re not. The claim from the Clinton Foundation that 88 percent of all expenditures go directly to life-changing work is demonstrably false. Office chairs do not directly save lives. The internet connection for the group’s headquarters does not directly change lives.

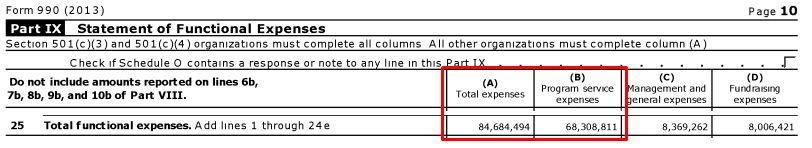

But what if those employees and those IT costs and those travel expenses indirectly save lives, you might ask. Sure, it’s overhead, but what if it’s overhead in the service of a larger mission? Fair question. Even using the broadest definition of “program expenses” possible, however, the 88 percent claim is still false. How do we know? Because the IRS 990 forms submitted by the Clinton Foundation include a specific and detailed accounting of these programmatic expenses. And even using extremely broad definitions–definitions that allow office supply, rent, travel, and IT costs to be counted as programmatic costs–the Clinton Foundation fails its own test.

According to 2013 tax forms filed by the Clinton Foundation, a mere 80 percent of the organization’s expenditures were characterized as functional programmatic expenses. That’s a far cry from the 88 percent claimed by the organization just last week.

If you take a narrower, and more realistic, view of the tax-exempt group’s expenditures by excluding obvious overhead expenses and focusing on direct grants to charities and governments, the numbers look much worse. In 2013, for example, only 10 percent of the Clinton Foundation’s expenditures were for direct charitable grants. The amount it spent on charitable grants–$8.8 million–was dwarfed by the $17.2 million it cumulatively spent on travel, rent, and office supplies. Between 2011 and 2013, the organization spent only 9.9 percent of the $252 million it collected on direct charitable grants.

While some may claim that the Clinton Foundation does its charity by itself, rather than outsourcing to other organizations in the form of grants, there appears to be little evidence of that activity in 2013. In 2008, for example, the Clinton Foundation spent nearly $100 million purchasing and distributing medicine and working with its care partners. In 2009, the organization spent $126 million on pharmaceutical and care partner expenses. By 2011, those activities were virtually non-existent. The group spent nothing on pharmaceutical expenses and only $1.2 million on care partner expenses. In 2012 and 2013, the Clinton Foundation spent $0. In just a few short years, the Clinton’s primary philanthropic project transitioned from a massive player in global pharmaceutical distribution to a bloated travel agency and conference organizing business that just happened to be tax-exempt.

The Clinton Foundation announced last week that it would be refiling its tax returns for the last five years because it had improperly failed to disclose millions of dollars in donations from foreign sources while Hillary Clinton was serving as Secretary of State.