After the Republican governor of New Jersey, Chris Christie, was reelected with 60.4 percent of the vote media attention has focused on his viability as a national candidate in 2016 and his potential appeal to voters. But little discussed is his potential ability to govern the world’s most powerful nation with a $16 trillion economy. After eight years of the inadequate presidency of Barack Obama voters will likely hunger for a politician who can work with Congress and make substantial changes to the tax system and the boost job creation.

Does Chris Christie have qualifications to lead the nation? Or has his confrontational style masked a public official with few real accomplishments? Credit is due to Christie for his leadership during Hurricane Sandy in 2012. But on fiscal and economic metrics New Jersey lags behind almost every state in the nation with the 2nd highest tax burden, the 49th worst business tax climate, the highest level of emigration in the nation as residents flee high taxes, the 9st highest unemployment rate and a public pension system that is the fourth worst funded in America. The reality of New Jersey is that it ranks near the bottom on most measures and Christie has accomplished little to change those rankings.

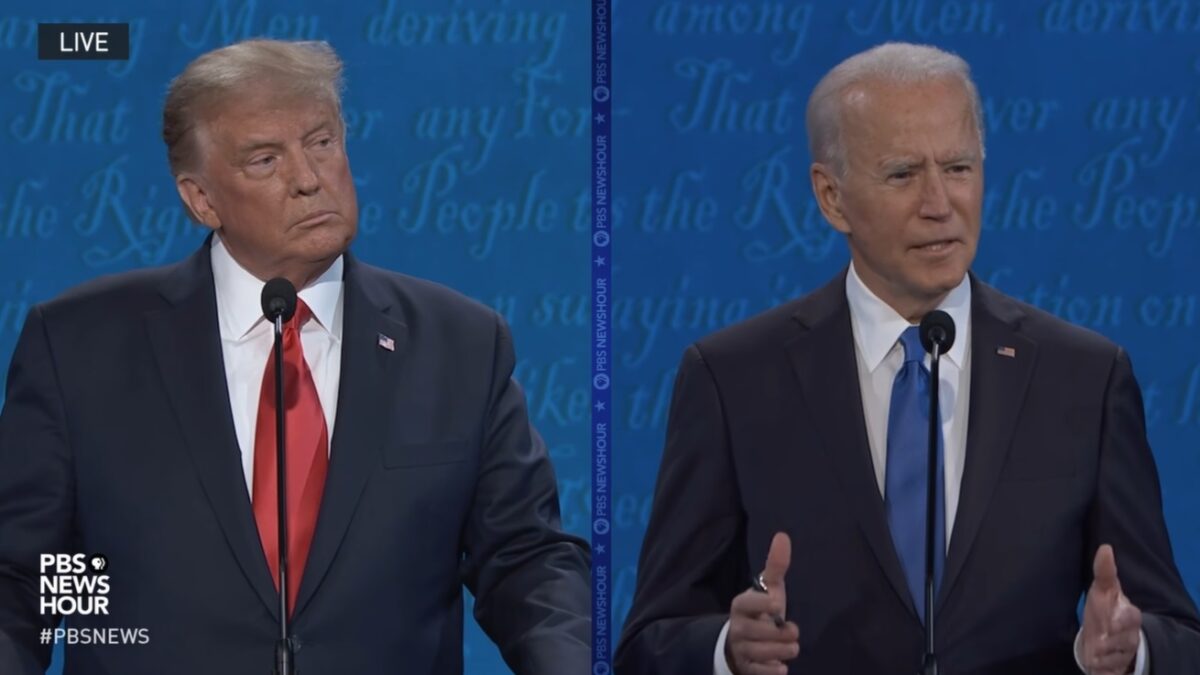

Source: Star Ledger video of 2010 press conference

New Jersey taxpayers are heavily burdened by the cost of their government and pay the second highest tax load in the nation according to the Tax Foundation. New Jersey’s state and local tax burden was 12.42 percent in 2010 well above the national average of 9.9 percent. New Jersey’s taxpayers paid $6,689 per capita in state and local taxes.

Analysis done by NJ Spotlight, a nonpartisan, independent, policy-centered online news service, explodes the popular myth that Christie is a tax cutter. Instead, New Jersey taxpayers have suffered increases in their property taxes while Christie raided property tax rebate funds to balance the state budget. From NJ Spotlight:

Net property taxes in New Jersey rose 18.6 percent in Gov. Chris Christie’s first three years in office, compared to just 6 percent in Democratic Gov. Jon Corzine’s last three years in office, a New Jersey Spotlight analysis shows.

Christie, who made attacks on “Corzine Democrats” a centerpiece of his reelection campaign, touted his record of holding down overall property tax increases. But when Christie’s rebate reductions are factored in, his property tax record is not so clear-cut. What happened to New Jersey taxpayers? NJ Spotlight again:

While Corzine doubled average property tax rebates from 2006 to 2009 and provided rebates to families earning as much as $250,000, Christie sharply cut the size of rebate payments and limited eligibility for non-seniors to those earning $75,000 or less.

As a result, average net property taxes — the actual cost of property taxes for the average New Jerseyan after rebates are deducted — rose from $6,244 in 2009, Corzine’s last year in office, to $7,405 in 2012, Christie’s third year in office, state Department of Community Affairs data shows.

This may sound like a technical tax issue, but New Jersey is suffering the the nation’s largest exodus of people moving to other states. The most common reason cited by those leaving is the high cost of living and taxes. As Rutgers economist James Hughes commented:

Hughes says, ‘People are leaving because New Jersey is a very expensive place to live. We have high taxes and we have high housing costs per se – you can cash out on your very expensive house in New Jersey and move to a much more affordable state, and purchase an equivalent house at maybe half the price – half the taxes – and live quite well.’

New Jersey is a leading example of tax flight and the record shows that Christie has done little to address this hollowing out of the economic core of his state.

The rating agency Moody’s had harsh things to say about the fiscal and economic conditions in New Jersey in an April 2013 report (requires free registration):

New Jersey’s Aa3 general obligation rating incorporates a weak financial position highlighted by low liquidity levels, rapidly rising fixed costs, economic recovery that has lagged the nation, and lack of a plan to rebuild liquidity and fund balances. In addition, pension and other post-employment benefit (OPEB) liabilities continue to escalate, pressuring the already high-debt state. The Aa3 rating further incorporates New Jersey’s diverse economy and high wealth levels, as well as the governor’s broad powers to reduce expenditures.

STRENGTHS

— High resident wealth levels and diversified economy

— Recent revenue growth suggesting improved economic stability

— Proactive approach to managing future liabilities and cost growth

— Broad executive powers to reduce expenditures

CHALLENGES

— Narrowed reserves and weakened liquidity, with no specified plan to rebuild balances

— Continued structural budget imbalance

— Revenue growth that is unlikely to keep pace with rapidly increasing fixed-cost expenditures

— Budgetary pressure from rapidly growing pension and OPEB costs, adding to already-high debt service costs

— Fourth-highest debt per capita and above-average pension and retiree health benefit liabilities

— Absence of certain best governance practices

What about Christie’s claim to have tackled a $11 billion deficit when he took office? This would have been a monumental feat given the state’s $29 billion in 2009. NJ Spotlight again:

During his first gubernatorial debate with Democratic challenger Barbara Buono, Gov. Chris Christie repeated his claim that “he closed an $11 billion budget deficit without raising taxes.” For Christie or any New Jersey governor, that would have been quite a feat because it would have represented a 37 percent cut in what was then a $29 billion budget — and clearly, Christie didn’t make a 37 percent cut in every government program from school aid to prisons to colleges to psychiatric hospitals.

No, what Christie was talking about is what budget experts call the “structural deficit” — an often-misunderstood calculation that represents the difference between projected state revenues at existing tax rates and the projected cost of funding all current programs at the same or increased levels and the current phased-in cost of meeting all future state obligations.

The structural deficit is an accounting projection rather a real hole in the state’s cash flow that would require real cuts or tax hikes. Here is how Christie has played the issue to political advantage (NJ Spotlight again):

When he was running for governor, Christie said the [Office of Legislative Service’s] summer 2009 projection of a $7.9 billion structural deficit was so bad that Democratic Gov. Jon Corzine “should stand up” and “say out of shame, ‘I’m not going to seek reelection.’” Republican legislators called unsuccessfully for public hearings on the “budget gap.”

One year later, when OLS projected a $10.5 billion structural deficit in the summer of 2010, Christie, now the governor, dismissed the projection as “completely fake” and an Assembly Budget Committee hearing as a meaningless partisan exercise.

Will Christie be able to reverse the dynamics of his weak state? Christie has broad constitutional executive powers which he will likely have to use since his reelection had no coat tails in the New Jersey Legislature. Bloomberg reports:

Christie will also face a challenging governing environment in New Jersey, as he contemplates a potential White House bid. His political reach didn’t extend to the Democratic Legislature, where Republicans picked up just one Assembly seat.

Christie has a few years to continue serving as New Jersey’s governor and improve the state’s metrics before voters nationally will be asked to judge if he has political skills and muscle to run the nation. Given the weak state of New Jersey Christie has some very heavy lifting ahead of him. We’ll see if his confrontational political style has the power to strengthen and reinvigorate New Jersey.