It’s time to puncture the myth that libertarians are congenitally pessimistic. We’re going to look at some fiscal data that must be very depressing for President Obama and other advocates of big government. But that means this information must be very good news for American taxpayers!

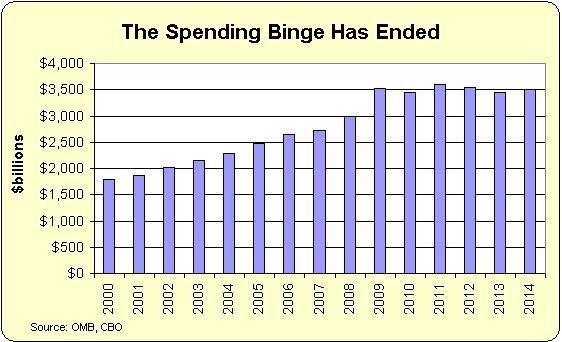

Here’s a chart looking at annual federal spending since 2000. You’ll notice that spending skyrocketed from 2000-2009 (a time when libertarians were justifiably glum), but look at how the growth of government came to a screeching halt after 2009.

Here are some specific numbers culled from the Office of Management and Budget data and Congressional Budget Office data. In fiscal year 2009, the federal government spent about $3.52 trillion. In fiscal year 2014 (which ended on September 30), the federal government spent about $3.50 trillion. In other words, there’s been no growth in nominal government spending over the past five years. This hasn’t received nearly as much attention as it deserves, but there’s been a spending freeze in Washington.

When I’ve argued in favor of an overall cap on government outlays in the past, my leftist friends always said this would produce catastrophic consequences. They had lots of rhetoric about “unmet needs” and “human costs,” so let’s contemplate societal outcomes since 2009:

Did children starve? Nope.

Did widows die in the snow? Nope.

Did planes fall from the sky? Nope.

Did poisoned food plague the country? Nope.

Did sick people get turned away from hospitals? Nope.

Did the North Koreans take over the world? Nope.

Gee, it appears that spending restraint doesn’t result in chaos. Not that we should be surprised, based on research on “public sector efficiency” from the European Central Bank. So we can logically conclude that spending restraint doesn’t lead to societal disarray. Now let’s look at what does happen when government is put on a diet.

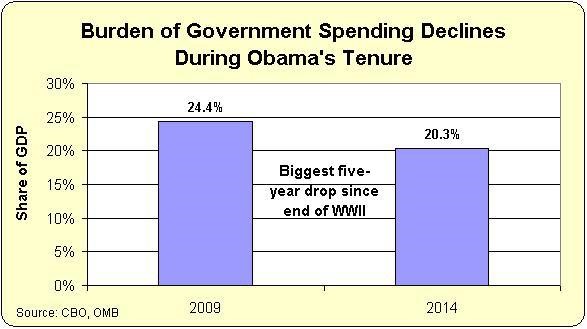

I’ve periodically discussed my Golden Rule, which says that good fiscal policy takes place when government spending grows slower than the private sector. Even though we haven’t had impressive growth during the Obama years, there have been modest increases in both nominal gross domestic product and inflation-adjusted (real) GDP. In other words, the Golden Rule has been in effect since 2009. As a result, the burden of government spending, relative to the economy’s productive sector, has been declining.

Here’s another chart that will be very depressing for the president and other statists.

What’s really remarkable is that we’ve seen the biggest drop in the burden of government spending since the end of World War II. Heck, the fiscal restraint over the past five years has resulted in a bigger drop in the relative size of government in America than what Switzerland achieved over the past ten years thanks to its “debt brake.”

At this point, some readers may be wondering who or what deserves credit for this positive development. I’ll offer a couple of explanations. The first two points are about why we shouldn’t overstate what’s actually happened.

- The good news is somewhat exaggerated because we had a huge spike in federal spending in 2009. To use an analogy, it’s easy to lose some weight if you first go on an eating binge for a couple of years.

- Some of the fiscal discipline is illusory because certain revenues that flow to the U.S. Treasury, such as Toxic Assets Relief Program repayments from banks, actually count as negative spending. I explained this phenomenon when measuring which presidents have been the biggest spenders.

But there also are some real reasons why we’ve seen genuine spending restraint.

- The “Tea Party” election of 2010 resulted in a GOP-controlled House that was somewhat sincere about controlling federal outlays.

- The spending caps adopted as part of the debt limit fight in 2011 have curtailed spending increases as part of the appropriations process.

- In the biggest fiscal loss President Obama has suffered, we got a sequester that reduced the growth of federal spending.

- Many states have refused to expand Medicaid, notwithstanding the lure of temporary free money from Uncle Sam.

- Government shutdown fights may be messy, but they tend to produce a greater amount of fiscal restraint.

There are surely other reasons to list, including the long-overdue end of seemingly permanent unemployment benefits and falling defense outlays as forces are withdrawn from Iraq and Afghanistan. The bottom line is that the past five years have produced a victory for advocates of limited government.

Now for the bad news. All this progress will be wiped out very quickly if there’s not genuine entitlement reform. The long-run fiscal forecasts, whether from CBO or international bureaucracies such as the International Monetary Fund, Bank for International Settlements, and Organization for Economic Cooperation and Development, show that America will become a European-style welfare state over the next couple of decades in the absence of reform.

So let’s enjoy our temporary victory but work even harder to avert a future fiscal crisis.

This article is reprinted from the author’s blog.