Another apparent “sweetheart deal” negotiated by President Biden’s Justice Department in a politically charged case is drawing scrutiny.

Former IRS contractor Charles Edward Littlejohn, who stole and helped publicize the confidential tax records of Donald Trump and an estimated 7,500 other wealthy Americans, could face little or no jail time when he’s sentenced later this month, because the DOJ allowed him to plead guilty to a single felony count.

In a new court filing, prosecutors acknowledge the plea deal “does not account for the fact that he leaked thousands of individuals’ tax returns. His [sentencing] range would be the same today if he had leaked only a single return.”

But instead of seeking prison time for each of his offenses — or even for the two separate mass thefts he committed, one in 2019 and another in 2020 — the DOJ is asking a federal judge to sentence Littlejohn to just 60 months, the maximum for a single offense under the statute. Some political leaders angry over the plea deal say he should get 60 years, not months, for his crime — the biggest heist of IRS taxpayer data in history.

Attorneys for Littlejohn, 38, argue he actually deserves an even lower sentence, closer to the presentencing report’s range of four to 10 months, in part because he leaked the reams of stolen private income-tax data to “reputable news organizations — The New York Times and ProPublica — that he knew would handle the information responsibly.” They say a 60-month term is “equivalent to a 15-level upward departure” from the range prosecutors originally agreed to in the plea deal, and such a wide departure would be unprecedented.

The D.C. judge deciding Littlejohn’s fate “does not have unfettered discretion to depart from the applicable sentencing guidelines,” Littlejohn’s attorney Lisa Manning advised the court in papers filed last week.

U.S. District Judge Ana Reyes, a Biden appointee who has a record of meting out lenient sentences, will decide his punishment on Jan. 29.

The Times and ProPublica published dozens of stories based on the personal tax files the former Booz Allen Hamilton contractor electronically smuggled out of the IRS. Those articles largely advanced Democratic calls for further investigations into Trump and the need to raise taxes on the wealthy.

Against the backdrop of prosecutions of Donald Trump in an election year and the collapse of Hunter Biden’s earlier no-jail plea deal, which a Delaware judge rejected because it was “not straightforward” and contained “atypical provisions,” Littlejohn’s plea agreement is raising new questions about the politicization of justice.

Trump lawyer Alina Habba said Littlejohn’s admission of guilt looks “more like a Hunter Biden plea deal.” House Ways and Means Committee Chairman Jason Smith agreed, complaining he’s getting off “with just a slap on the wrist.”

At a minimum, the Missouri Republican argues, Littlejohn, a Democrat donor who sought to damage Trump soon after his 2016 election, should have been charged with two “separate and distinct” unauthorized disclosures — one of Trump’s returns to the Times in 2019 and the separate tranche of thousands of returns he delivered to ProPublica in 2020.

“While some argue that he should have been charged with one count per taxpayer, it is clear to us that at a minimum he should have been charged with two counts of unauthorized disclosure and potentially with at least one count of obstruction of justice,” Smith wrote the DOJ in a recent letter, noting that Littlejohn took a number of measures to foil investigators.

Prosecutors say his victims total “over 1,000.” But the number of taxpayers whose privacy he violated could run in the several thousand.

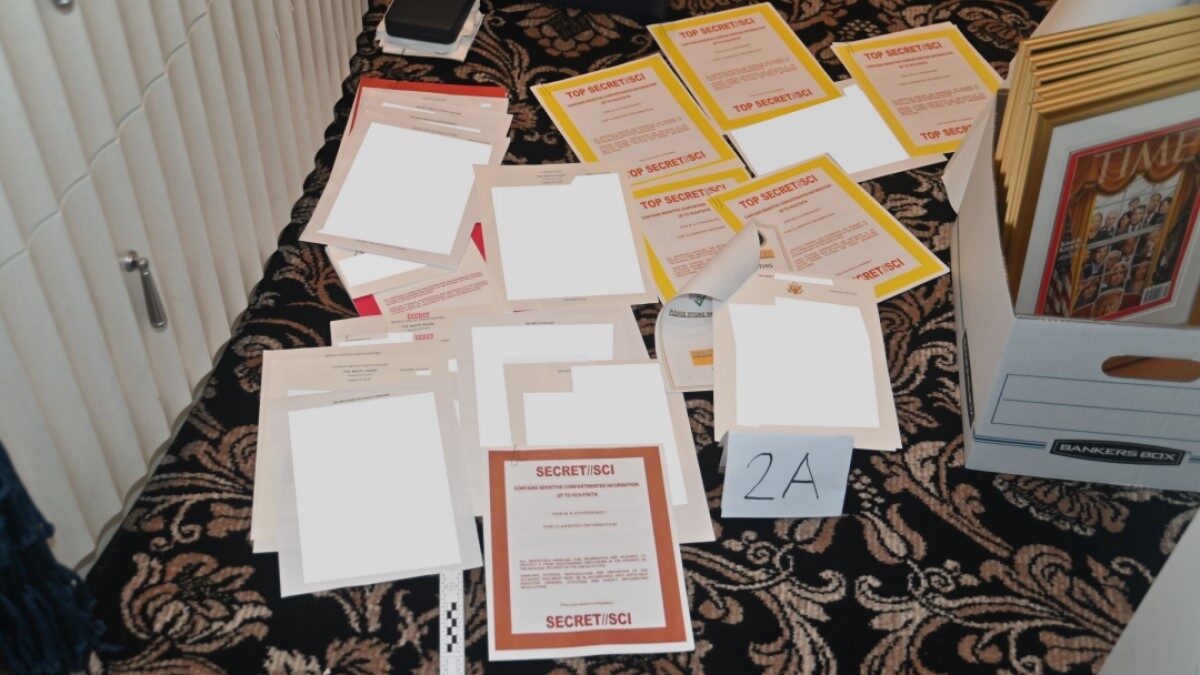

According to recent court papers, Littlejohn rejoined Booz Allen in 2017 with the express purpose of getting assigned to the IRS and stealing Trump’s tax returns, which he downloaded in 2018. Then in June 2020, he began conducting searches of the IRS database to pull historic tax data on the wealthiest taxpayers in the country. Specifically, he constructed a query designed to call up the top 500 taxpayers by income by year for the previous 15 years. After running the query, he stole the entire data set, put it on a flash drive, and gave it to reporters at ProPublica, a left-leaning nonprofit funded by George Soros and other wealthy liberal donors. ProPublica, in turn, published nearly 50 articles using the purloined tax returns to show how the rich use loopholes in the tax code to avoid paying taxes. Congressional Democrats cited the series in their push for higher taxes on the wealthy.

There are so many victims of Littlejohn’s breach of protected taxpayer information — the largest in history — that DOJ has asked a federal judge in Washington for permission to create a public website to notify victims without reaching out to each person individually. Taxpayers will have to proactively search the site to discover if their most private financial records have been compromised.

“[The] number of potential victims in this case makes it impracticable to provide all of the victims the rights provided under the Crime Victims’ Rights Act,” the department said.

DOJ has notified only 152 victims of Littlejohn’s crime. Thousands more high-net-worth taxpayers remain in the dark about whether the rogue Booz Allen contractor shared their most private financial data with the media, which still possess the confidential information and continue to publish stories based on it.

Littlejohn, who goes by “Chaz,” did not just disclose income and tax data. He also leaked charitable donations, investments, stock trades, gambling winnings and losses, as well as the results of IRS audits — all with the hope that journalists would expose “salacious details” about Trump and other wealthy taxpayers, many of them Trump donors, according to the new court filings. This egregious invasion of privacy was “a core purpose” of his steal-and-leak scheme.

And the illegal invasions of privacy are ongoing. Neither the Times nor ProPublica has returned what Littlejohn stole from the IRS, despite requests from victims like billionaire hedge-fund manager Kenneth Griffin, who is suing the IRS over the leak of his tax returns to ProPublica.

“Victims have no assurance that their personal information will not be the subject of a news article tomorrow, next week, next month or even next year,” prosecutors told the court in their latest filing. “The harm arising from defendant’s crime is accordingly so extensive and ongoing that it is impossible to quantify.”

Critics say such admissions only deepen their suspicion that Littlejohn was undercharged for political reasons.

In the wake of other large thefts of confidential government information by politically inspired figures — including former Treasury official Natalie Mayflower Sours Edwards, who got a plea negotiated six months after leaking Trump-related bank data to BuzzFeed — the Littlejohn case raises fresh questions about the message the government is sending to bureaucrats and others who politically weaponize private financial information.

“When the criminal leaker was finally caught, we expected that he would face severe consequences for his actions that would both punish him while also serving to deter future, similar misconduct,” Smith wrote DOJ. A sentence of four to 10 months “comes nowhere close to having a deterrent effect on government employees who might be thinking about breaking the law.”

Smith said the case only adds “more fuel to the fire” to growing perceptions of a two-tiered system of justice in Washington where criminals who seek to damage Trump get off easy, while those who break the law supporting Trump — such as trespassing on restricted government grounds — get the book thrown at them.

In 2021, for example, former FBI attorney Kevin Clinesmith received a sentence of 12 months probation for doctoring evidence so a Trump adviser could be spied on under the false premise he was an agent for Russia. An Obama-appointed judge in D.C. sympathized with Clinesmith, a liberal Democrat who, internal FBI messages revealed, hated Trump.

Echoing those on the left who hail Littlejohn as a “whistleblower” and a “hero,” his defense’s lawyers are now appealing to another Democrat judge in D.C. to give their client a pass because he acted out of “deep, moral belief” to expose Trump whom he viewed as “dangerous and a threat to democracy.” In other words, the “moral” end justified his criminal means.

His lawyers further suggested he was influenced in his views and motivated to act by The New York Times, which ran articles demanding Trump release his tax returns because it suspected he could be hiding nefarious financial ties to Russia. The paper’s reporting had long pushed the false notion that Trump had financial ties to the Kremlin.

Littlejohn’s lawyer Manning noted in a motion asking the judge for leniency that her client had been faithfully reading the paper and “made up his mind to act” in response to the steady stream of anti-Trump articles it published. (Manning is a partner in the Washington law firm that represented Trump-Russia dossier fabricator Igor Danchenko.)

Between May 2019 and August 2019, Littlejohn huddled multiple times with Times reporters about how they would publicize Trump’s stolen tax records.

“Based on his discussions with the reporters,” Manning said, “Mr. Littlejohn felt that the New York Times shared his belief that the American public had a right to know the president’s tax information.”

Following a meeting in June, one of the Times reporters (unnamed) wrote to Littlejohn: “[I]t was great meeting you last night. That was a (really) big step, and we respect the courage it took. I hope we land on a good path forward. I completely respect your concerns and want you to feel right about any decision / decisions you make… I can’t help but reflect that it’s something the three of us ended up together last night because a certain person won’t disclose information that people absolutely need to see and have for decades. I appreciate you share this concern and recognize one person can make a difference.”

On Sept. 27, 2020 — five weeks before the election — the Times published data from 15 years of Trump’s tax records in a more than 10,000-word story headlined, “Long-concealed records show Trump’s chronic losses and years of tax avoidance.” Times reporters Russ Buettner, Susanne Craig, and Mike McIntire shared a byline on the piece. The Times noted that none of the stolen IRS records revealed “any previously unreported connections to Russia.”

Trump lawyer Habba said she suspects Littlejohn was an operative in a broader political conspiracy to sabotage the former president before the 2020 election. “What Mr. Littlejohn did, I do not believe he did alone,” she said. Habba added that the leak probably “cost my client thousands of votes and was all by design.”

Court filings reveal Littlejohn didn’t just steal Trump’s tax filings but also those of “entities and individuals” related to him. It’s not clear if the tax returns of Trump’s family members were also leaked.

In mid-2017, Littlejohn reapplied for a job at Booz Allen, where he had worked previously, “with the goal of getting access to” Trump’s tax returns so he could leak them to the press, according to DOJ’s new sentencing memo. (DOJ does not identify Booz Allen by name in the document, but instead refers to Littlejohn’s employer as “Company A.” However, in a separate filing last week involving Griffin’s civil case, the DOJ’s tax division stated that Littlejohn was “a contractor employed by Booz Allen Hamilton,” confirming RealClearInvestigations’ reporting last October.)

Booz Allen rehired Littlejohn in September 2017, three months after former FBI Director Robert Mueller handed the McLean, Virginia-based contractor a report into its weak security procedures — including lapses in how it screens employees for potential threats. “We are committed to doing our part to detect potential insider threats,” the company stated at the time.

The company in 2016 had retained Mueller — who would go on to be the Russiagate special counsel — after one of its computer analysts, Harold Martin III, was arrested for stealing data from the National Security Agency. The breach occurred three years after another Booz Allen analyst, Edward Snowden, fled the country with thousands of top-secret documents that he soon leaked to journalists, exposing the NSA’s worldwide anti-terror surveillance program.

In February 2018, after Mueller’s recommendations, the company granted Littlejohn access to unmasked taxpayer data, whereupon he immediately began to develop a plan to secretly download Trump’s tax returns from an internal IRS database.

In an RCI interview, Booz Allen spokeswoman Jessica Klenk declined to say what, if any, reforms it implemented after the Mueller review to safeguard such sensitive information. She also would not discuss any steps taken to vet and monitor Littlejohn to determine whether he posed a security threat before and after assigning him to work on IRS computers. But in a company statement, Booz Allen said it “fully supported the U.S. government in its investigation into this matter.”

“We condemn in the strongest possible terms the actions of this individual, who was active with the company years ago,” the statement continued. “We have zero tolerance for violations of the law and operate under the highest ethical and professional guidelines.”

Booz Allen employs more than 20,000 consultants with government security clearances handling some of the nation’s most confidential data.

The most profitable government contractor in the world, Booz Allen has been connected to a number of high-profile Democrats over the years, including former employee James Clapper, who served as President Obama’s intelligence czar.

Activist Camouflaged as Bureaucrat

At least two Obama administration alumni sit on Booz Allen’s board. President Clinton’s IRS commissioner also holds a seat. In the 2020 election cycle, federal records show Booz Allen contributed a total of $238,776 to Joe Biden versus $85,657 to Trump. The company also gave almost four times more money to the Democratic National Committee than to the Republican National Committee.

Despite Booz Allen’s track record of security breaches, the Biden administration has trusted it to help modernize the entire IRS computer system. Even as federal investigators were closing in on Littlejohn this summer, the Biden administration’s IRS decided to rehire his employer to update its databases. The seven-year contract, with a ceiling value of $2.6 billion, involves consolidating roughly 400 different systems into a new, cloud-based architecture. That means Booz Allen employees will have access to IRS data through 2030.

The massive new IRS contract may explain why DOJ has been reluctant to identify Littlejohn’s employer by name in court papers and press releases about the case. The Washington media have largely gone along with the blackout, describing Littlejohn only as an “IRS contractor” while explaining to their audiences that his employer “wasn’t identified” by the government.

“That’s troubling,” said Susan Shelley, spokeswoman for Howard Jarvis Taxpayers Association, a taxpayer advocacy group. “The House Ways and Means Committee should take a very close look at that contract.”

The tax-writing body is demanding more answers. In a Jan. 8 letter to Commissioner Danny Werfel, Ways and Means Chair Smith pressed the IRS to explain what it is doing to prevent breaches of taxpayer information from happening again. For starters, Smith wants to know how many contractors currently have access to IRS databases, and whether the IRS is doing anything to reduce that number.

Booz Allen hasn’t even protected its own data, let alone the federal agencies with whom it contracts. In 2022, it had to notify its employees that their personal information — including Social Security numbers and dates of birth — were exposed in a breach of its internal network. It offered each of its workers up to $1 million of identity theft insurance coverage to pay for potential losses from identity thieves.

The IRS declined to address why it’s allowing Booz Allen, with its long history of data breaches and security problems, to have even deeper and broader access to taxpayer databases. In a press statement following Littlejohn’s arrest, the IRS’s Werfel said the agency has “tightened security” in the wake of the leaks.

Treasury’s inspector general is still investigating the massive breach, however, and plans to report on whether the agency is still vulnerable to such political weaponization of taxpayer information by rogue contractors and employees.

In 2018, when Littlejohn was stealing Trump’s tax returns, the IG found no fewer than 88 physical security control weaknesses and more than 1,700 improperly configured user accounts. In 2020, moreover, auditors determined that 54 percent of employees had unneeded access privileges to the “IRS Centralized Authorization File” storing the agency’s most sensitive information. They also discovered IRS supervisors “could not provide an accurate inventory of all applications that store or process taxpayer data.”

In its sentencing memo, DOJ warned that Littlejohn’s crime “has undermined the faith and confidence in the IRS, an institution that is critical to the effective functioning of our government.”

This article was originally published by RealClearInvestigations.