For the past 75 years, shipping companies owned by Americans and Europeans have stopped registering their ships in those countries and instead have had them fly “flags of convenience.” By listing their ships on the registries of nations such as Liberia, Panama, the Marshall Islands, and others, they have avoided labor laws, registration fees, environmental regulations, and taxes. The practice allowed these companies to operate more profitably at the expense of the workers they employed and the treasuries of the nations in which they operated.

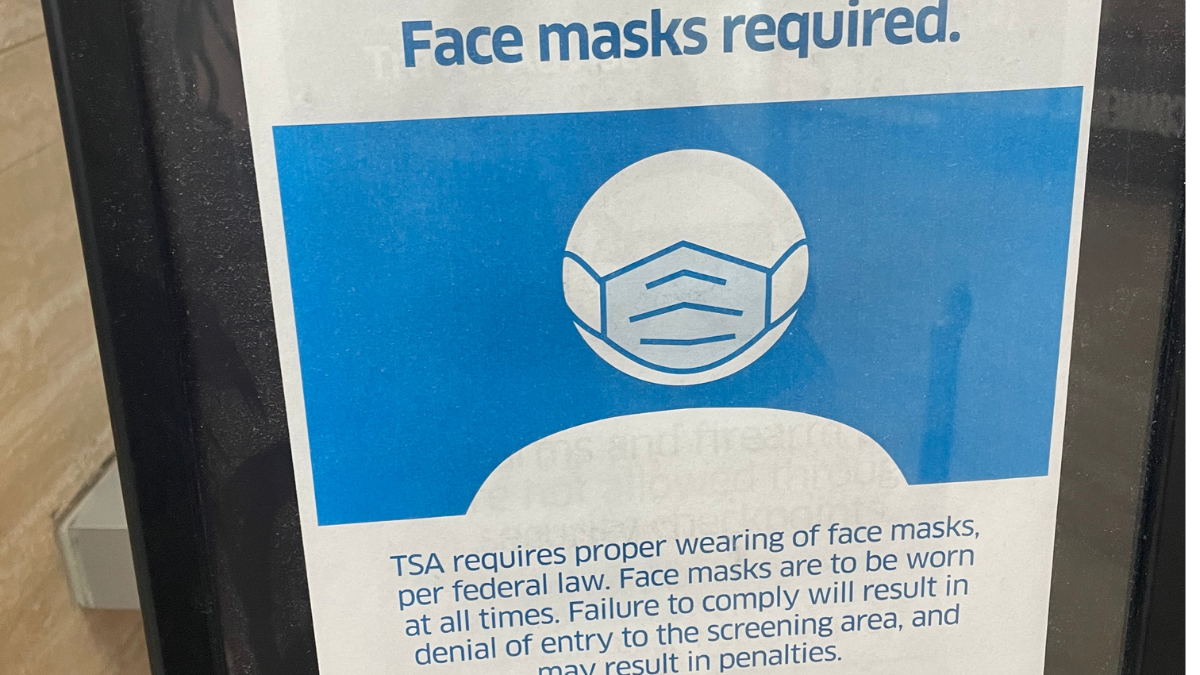

The moves were legal, even encouraged by some in the American government over the years. Now that the bottom has fallen out of the tourism industry thanks to the Wuhan coronavirus outbreak, these companies — many of which keep their main offices in the United States despite their foreign registry — are crying red-white-and-blue tears as the financial stimulus Congress passed last week excluded them.

After decades of shirking responsibilities, cruise ship companies’ comeuppance is long overdue. If they want a handout now, let them ask someone else for it.

Flying ‘Flags of Convenience’ Isn’t New

Ships once flew the flag of the nation in which they were based. Merchant ships sometimes used false flags in wartime, but the first modern peacetime shenanigans of this sort came during Prohibition as American ships adopted flags of convenience to aid in rum-running.

The former USS Zafiro, a decommissioned Navy coal ship owned by a collection of Americans and Canadians, was renamed the Belen Quezada in 1919 and registered in Panama. Thus began a tradition of ship owners pretending to be foreign to avoid the consequences of their own nations’ laws.

An article by Adam Green in The Economist’s magazine, 1843, tells the rest of the story:

Many American vessels would follow suit; dry cruise ships were worried about losing out to their European competitors, who could serve alcohol to passengers, and shipping companies wished to evade America’s increasingly strict labour laws. Panama’s shipping registry continued to balloon in the 1930s with an eclectic mix of new entrants: from Danzig oil tankers to Norwegian whalers; from Greek weapons smugglers to a short-lived pirate radio station operating off the coast of Los Angeles.

It wasn’t long before the financial services industry took notice of Panama’s laissez-faire regulatory regime. In 1927, Wall Street helped Panama pass a series of laws that allowed anyone to form anonymous tax-free corporations with few questions asked.

Other nations soon got in on Panama’s game. Professor Elizabeth R. DeSombre wrote in her 2006 book, “Flagging Standards,” that the Liberian ship registry was promoted by former U.S. Secretary of State Edward Stettinius as a cost-effective registry for oil tankers. The Marshall Islands’ registry, DeSombre noted, is not even based in the Marshall Islands; it is run by a successor to Stettinius’ company out of an office in Reston, Virginia.

Rule-Dodging Has Consequences

This is all a way for shipping companies to dodge taxes, avoid regulations, hire non-union maritime labor, and scoff at environmental laws. The biggest trade-off, until now, has been the loss of corporate citizenship that once guaranteed a ship’s home nation would protect it.

Since the end of the Second World War, though, American and allied navies have been dedicated to the freedom of the seas as a broader concept, not just for their own merchant vessels. Keeping international waters open and free of piracy has been the West’s gift to the world, regardless of ship registry.

The trade-offs here are not unlike those facing all of American industry. We impose a lot of rules — rules to protect workers, rules to protect investors, rules to protect the environment, and taxes to pay for it all. But we also keep an open door to the world, meaning the rational economic reaction to those rules is often to take one’s business elsewhere. Free trade lets corporations abandon their American workforce this way. Open shipping registries make the task even easier for cruise ship owners.

Congress talks tough but gives business an easy way out. Effectively, it has encouraged this sort of behavior. Stettinius was no rogue freebooter; he was a former cabinet official and ambassador with ties to America’s richest men and most powerful corporations. His Liberian venture had the blessing — and often the participation — of these people and organizations. Similar to the bipartisan free trade consensus that prevailed until recently, the people it hurt, such as maritime labor, were ignored, and their numbers dwindled.

Nobody Likes Handouts to Foreign Companies

These shipping companies are now recognizing another trade-off: American taxpayers don’t love handouts to American corporations, but they really hate handouts to foreign companies. And if those “foreign” companies only became foreign to avoid American taxes and laws? It’s a heavy lift for any politician to say such a company should get money from the taxes of American workers and American companies that actually stayed here.

Republican Sen. Josh Hawley of Missouri has expressed opposition to a foreign cruise line bailout. Last week, in response to a news story about the companies, he tweeted, “Come back to America. And pay your taxes. How about that?” President Trump echoed Hawley’s concerns two days later at a news conference. “I do like the concept,” he said, “of perhaps, coming in and registering here. Coming into the United States. It’s very tough to make a loan to a company when they’re based in a different country.”

Democrats agreed with Hawley and Trump on the issue. Rep. Hakeem Jeffries of New York tweeted, “The major cruise lines sail under foreign flags to avoid paying the U.S. corporate tax rate. And now some want the American taxpayer to bail them out? Get. Lost.” Rep. Peter A. DeFazio of Oregon, also a Democrat, said the same: “They aren’t American. They don’t pay taxes in the United States of America.”

The current epidemic has produced a few examples of bipartisan cooperation, and this is one of them. No one — Democrat, Republican, or independent — wants to give taxpayer money to companies that fled our nation to save money and avoid regulation.

Trump has said that while he opposes bailing them out directly, “the cruise line business is very important,” and, “we can’t let the cruise lines go out of business.” Fortunately, we may not have to do anything to save them. Although they are excluded from federal loan guarantees, they still can borrow money from banks, and the banks appear ready to lend. According to Bloomberg News, Carnival Corporation is in talks with bankers to raise billions in bond issuances, all without the help of Uncle Sam.

That would be a fine solution: a business staying afloat in tough times without the aid of government. It should be the only solution available to foreign-flagged cruise ship companies. Lending American companies money is not necessarily bad; when this is over, workers will need jobs to go back to. But if Royal Caribbean wants a handout, let them ask Liberia to pick up the tab.