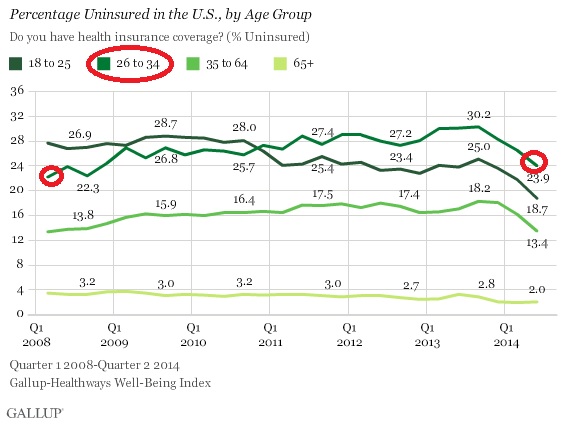

Gallup recently noted the rate of people without health insurance in the United States during the second quarter of 2014 had dropped to 13.4 percent and this was below 2008 levels, i.e., a year before POTUS started his presidency. However, one age cohort has not beaten the 2008 level: those ages 26 to 34. Despite passage of the Patient Protection and Affordable Care and the Health Care and Education Reconciliation acts of 2010, my age cohort is still 1.6 percent above the 2008 uninsured level.

One possible reason for this: The Affordable Care Act (ACA) most burdens those of us in this age group. Last year, I discussed my dilemma regarding the loss of my private healthcare plan, and that I had to choose a new plan on the federal marketplace. Here’s an update on my plan choice and an honest account of how the healthcare law is working.

One possible reason for this: The Affordable Care Act (ACA) most burdens those of us in this age group. Last year, I discussed my dilemma regarding the loss of my private healthcare plan, and that I had to choose a new plan on the federal marketplace. Here’s an update on my plan choice and an honest account of how the healthcare law is working.

The honest truth is that this law has only caused our healthcare system to become more burdensome without addressing the problem that supposedly justified its existence. I just showed how the law has failed to help my age cohort, the ones just starting their careers. Further, when the employer mandate is enforced, I, like many others in my age cohort, will have to completely give up health insurance or rely on employers to pay for overpriced health insurance. When it comes to jobs and health insurance, employers would rather “share” workers than be burdened by the ACA. Right now, I receive heavily subsidized insurance because the full law was not implemented.

Further, I may have even signed up for insurance illegally, even though I followed the directions my U.S. senator, Tim Kaine, provided. Getting insurance was an easy endeavor for people in my age cohort before the ACA. When you are starting a job, it helps when you can get cheap insurance that does not burden your employer. In fact, the scientific research post-doctoral researchers throughout the country perform is built upon the fact that we provide cheap labor. We provide this cheap labor because we are training. We are preoccupied with finding cures and treatments for diseases and less concerned with our salaries.

Unwillingly Burdening My Fellow Taxpayers

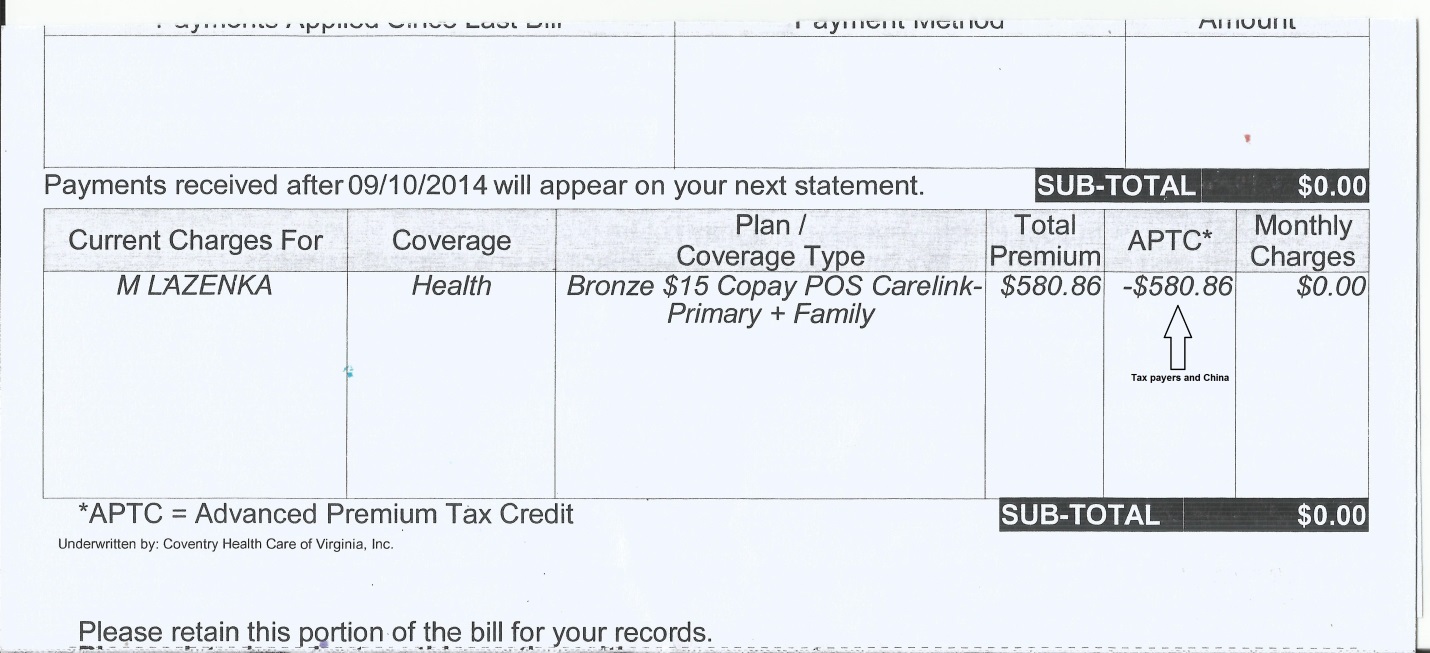

I chose the cheapest plan available on the Virginia federal marketplace, which was still twice as expensive as my previous insurance with comparable benefits. My previous ACA plan was cheap because I am young and healthy and so is my family. Now, being young and healthy is a bad thing. It’s like having a credit score of 800 being a bad thing, even after you worked so hard to get it. My bronze plan cost $580 per month, which is actually less than the subsidy offered to me. One thing that may have thrown off the subsidy calculation, and which I will have to pay back, is that I purchased this plan differently than the law allows. The way the law was written, my children were supposed to be put onto Medicaid through the Children’s Health Insurance Program, or CHIP. But it took the Medicaid office 120 days to determine if my children were eligible (it is supposed to take 45 days). So Kaine said I could purchase family health insurance through the federal marketplace if I did not receive a reply from the Department of Social Services by the March 31 deadline. I have no clue if that was lawful. Below, see the text I received from Kaine. Note that this was the end of February.

According our records and in checking our systems, Mr. Matthew F. Lazenka has applied for health insurance with the Federal Health Insurance Marketplace (HIM)as he stated in his letter. Mr Lazenka stated that he applied for medical insurance through CommonHelp (unable to find any application listed in his name). If Mr. Lazenka completed an application through CommonHelp, we would need his tracking T-no. According to the Virginia Department of Social Services (VDSS) Mr. Lazenka applied for the HIM; and he should’ve received an application ID# (9-digits). Currently, VDSS is processing October 2013 applications. The Federal HIM system automatically sends the application into VDSS system. Applications are being sent in the date order they were received. VDSS are unable to view any applications that are in the Federal HIM.

Once the VDSS process an applications Mr. Lazenka will receive a letter to indicate the status of his application. The City of Richmond Department of Social Services will not receive the applications until a final eligibility has been made on each application. The VDSS is still working on making this a more effective process for everyone.

If Mr. Lazenka would like to apply for Medicaid Assistance through our CommonHelp online application, I would offer to assist him in making sure his application is registered and assigned to an assigned worker.

Additionally, please know that if a decision regarding your child’s FAMIS eligibility is not made by March 31, you should be able to enroll them based on a ‘qualifying event’ such as loss of eligibility for Medicaid or CHIP (FAMIS).

The funny thing is that my children have always qualified for CHIP in Virginia, because I only make $39,264 as a post-doctoral fellow with a PhD in neuroscience. Before the ACA, I did not have to burden my state with paying for my children’s health insurance because my previous healthcare plan cost $240 a month, all of which was reimbursed through a federal research grant from funds already approved by Congress.

My previous premium represented around 7 percent of my yearly income, now it represents around 18 percent. Without the subsidy, I would have to eliminate any discretionary spending, which hurts the economy and my family. When I receive the subsidy, I’m taking discretionary spending out of the hands of my fellow taxpayers. I have already discussed how my previous health insurance was more than adequate, so I will not discuss that further. What you should be aware of is something I will have to deal with during open enrollment: Obamacare forces me to put my children onto Medicaid. That will ultimately further burden the state as it cuts $21 million in state funding for the university where I work. That is not something I am willing to do.

So based on my current salary and having a family of five, the health care plan I chose is actually completely covered by taxpayers, which you can see in the image below:

If I cancel my health insurance, I will be fined (or, if you want to use the Supreme Court’s language, “taxed”). If I want to change my health insurance, I can only do so during open enrollment. Actually, I cannot even sign into my account anymore because of the Heartbleed virus. I tried resetting my password, but the system does not recognize my reset password. This lack of choice has made me decide to seek an alternative form of health insurance in 2015. This will be a good thing in the long run because I will be unable to afford health insurance after 2016 anyway.

If I cancel my health insurance, I will be fined (or, if you want to use the Supreme Court’s language, “taxed”). If I want to change my health insurance, I can only do so during open enrollment. Actually, I cannot even sign into my account anymore because of the Heartbleed virus. I tried resetting my password, but the system does not recognize my reset password. This lack of choice has made me decide to seek an alternative form of health insurance in 2015. This will be a good thing in the long run because I will be unable to afford health insurance after 2016 anyway.

Forget ‘Essential’ Dental Benefits

Even though there are supposed to be ten essential benefits with ACA-approved plans, one benefit has been removed. This is pediatric dental insurance, even though that was touted by ACA supporters as an essential health benefit. It turns out you have to purchase a rider to cover pediatric dental coverage, but federal marketplace representatives did not know that, at least not when I talked to them. I was unable to purchase a rider for my children. I learned that the hard way when I had to pay out of pocket for my children’s dental visits. That was not a big deal because I could afford to do that. However, many poor people cannot.

What is covered is preventive care, such as immunizations, for children. That is a nice feature of the law, but really only saves me $25 a visit. The problem is that my new health insurance provider, Coventry Care (purchased by Aetna to take advantage of the ACA), did not initially pay for this preventive care. Their argument was that the pediatric provider I went to was not in-network. You see, my network is so narrow that Coventry Care thought they could remove in-network providers at will. The consequence is that the university hospital I work for is in a second tier under my new insurance, so the out-of-pocket costs are higher. That was not true with my previous insurance plan. The short story is that it took two months for Coventry Care to pay the claim after they refused to pay two more times. (I want to note that the customer service representatives for Coventry Care were excellent—it is the policies that are a disaster.)

The billing department at my pediatric office took care of the situation, as this dispute involved several families. That would be the end of the story if Coventry Care weren’t currently refusing to pay a similar claim. My previous insurance never denied these claims, which provides further proof that the current insurance plans are worse than the old private plans. Another case in which the new plans are worse is the tiered drug programs. An acquaintance is not the only one who now has to pay more for drugs under their new federal marketplace plan. He belongs to the 26-34 age cohort and had his insurance eliminated, along with up to 250,000 other Virginians who will lose their insurance this year.

Targeting Young Families

It’s not just young people older than 26 who are disproportionately and negatively affected by Obamacare. Another cohort that is affected is young people with families. I made the apparent mistake of belonging to this cohort, as well. This issue will hit the fan when the employer mandate is enforced. A big glitch in the law that has barely received any media attention is that family coverage does not have to be affordable for employees. Instead, it only has to be affordable for a single person. The ACA says health insurance need only be affordable for a single person and spouses need not be covered by employer-offered insurance.

Further, I am reimbursed for my insurance through a federal grant (or at least I was), an arrangement that is being eliminated by the employer mandate. Basically, in 2016, the university will have to provide for my health insurance, and I will lose my current federal subsidies. The current family health insurance plan my employer provides currently costs between $13,000 and $15,000 annually, or approximately 30 percent of my gross annual income.

Because I will not be able to get reimbursed for this insurance, there is no conceivable way for me to afford it. Instead, I will have to get single coverage through my university and buy separate coverage for my wife and children. Most likely, I would have to put my children on Medicaid. It is hard to imagine that putting people on Medicaid is considered a success whereas providing good jobs is not. The university could try to cover the entire cost, which would likely lead to increases in college tuition. The University of North Carolina System, along with other universities, will have to make some tough decisions. Universities sometimes make choices based on their wallets, which the University of Virginia did, sharply increasing employee costs. Universities thrive on cheap labor, so the employer mandate is going to hurt them especially hard, making it more difficult for me to continue in academe.

The ACA Is a Poverty Trap

I want to conclude by highlighting some key issues here. First and foremost, like all legislation, there are winners and losers from the ACA. The biggest winners are health insurance companies. Basically, the policies offered in the federal marketplace are overpriced in many cases and offer few benefits. In my own case, I can only use one hospital system or face much higher costs going to the medical center run by the same university where I work. Further, I have to pay a lot more for certain drugs with little knowledge of how drugs are covered. There is good reason to believe health insurers will use drug history information to tier drugs based on the patient population covered by them. Why else did I receive a call from Coventry Care asking to release my medical information to them? I have tried to find an answer to that and would greatly appreciate the input. CEOs of health insurance companies are already reaping the benefits but people like me are not.

You can rightfully point out that the ACA has helped some people. I will concede there were some lottery winners. Those winners were mostly people who were older, sicker and managed to earn less than 138 percent of the poverty line in states that expanded Medicaid. But this begs the question of why our entire health insurance system had to be changed to help a small minority. Now these people are ensnared, like me, in a poverty trap. If they try to make more than 138 percent of the poverty line, their extra earnings will go towards health insurance. In my case, if I continue to work in my present career, any increase in my earnings will go towards providing health insurance for my family. This was not the case prior to the ACA.

The ACA, because it increases burdens on employers, will also reduce the number of jobs available for unskilled workers. In the research field, an extra $15,000 that goes towards funding my health insurance is $15,000 dollars that is not available to hire another employee or to test a hypothesis that may lead to a medical breakthrough. This is also true of any other business. This is one reason the employment rate for young people is dismal and will continue to be dismal. Once a young person turns 26, they are too expensive. If the Democrats really cared about the health and well-being of poor people, they would have put more effort into improving the economy. Employment goes a long way in improving the mental health status of people, even single mothers on welfare.

The biggest losers of the ACA are predominantly small businesses, the upper-middle class, young people ages 26-34, and families. Without full implementation of the law, I have not had to go without health insurance. However, I know that will not be true in the future, just like I knew the president misunderstood his own law when he said we could keep our health insurance.

The ACA is worse than what the majority of the media has reported. It helps that the Internet is replete with personal stories so those who have been affected can receive some consolation knowing we are not alone. As a father, I respect the president for elevating the persona of what a good father should be, and I commend him for that. It is certainly far better than learning, as a child, that the POTUS enjoys questionable activities with young women. But the ACA has put a huge strain on my ability to take care of my family, as it puts into doubt whether I can afford health insurance in the future. For young people, the president has certainly brought a lot of change; however, we are beginning to lose hope.