Conceived in a back room with cut-and-paste editing, the Patient Protection and Affordable Care Act was rushed to passage before anyone read it. The consequences of these poorly written rules are Supreme Court challenges and more than a few ways to game the system. As the second Annual Open Enrollment period comes to a close, here are five ways that people can game the system to reduce or eliminate costs and potential risk.

1. Buy Nine, Get Three Free

Under Obamacare’s individual mandate, you can go 90 days without insurance before you have to pay any amount of the individual shared-responsibility tax. When combined with open enrollment that runs from mid-November to mid-February, this 90-day window allows individuals to hold off on paying premiums in December, January, and February. They can then submit a new application at healthcare.gov by February 15 and begin coverage on March 1.

Of course, this assumes you stay healthy. However, because Obamacare also allows a 90-day grace period, if you become ill or injured during that time, you have the ability to pay the back premiums and there’s no lapse in coverage.

2. Understate Your Income

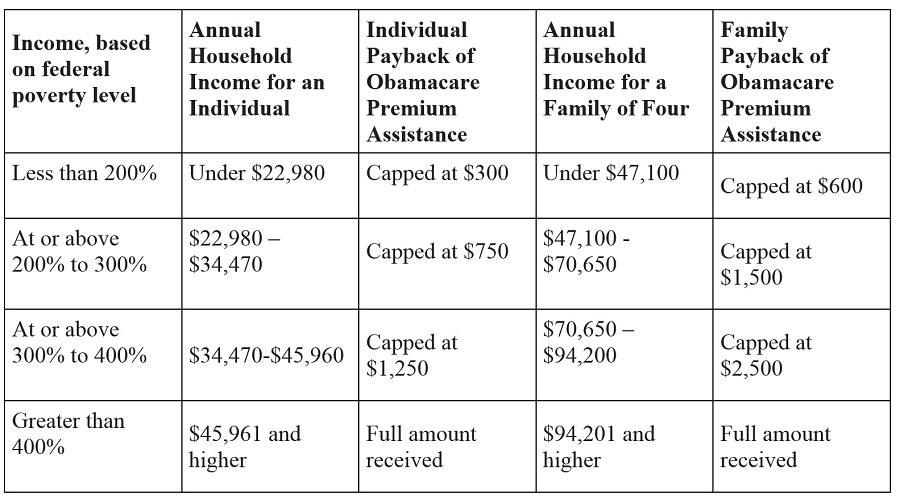

If you think your premiums are unaffordable, simply understate your projected income. Obamacare limits the amount of subsidy someone has to pay back to the government if he underestimates his income. In most situations the “clawback,” as it is referred to, is less than the subsidy received. The table below shows the clawback maximums.

By understating your income and staying under 400 percent of the federal poverty level, there is a strong likelihood that you will receive more than you will have to pay back. Here’s an example: If a family of four makes $85,000 but states their income is $52,000, they would have a significant difference in subsidy. This subsidy—close to $5,000—would far exceed the payback limitation of $2,500.

3. Are You Sure You Use Tobacco?

If so, you will be charged more for health insurance. Under the law, you can be charged up to 50 percent more than a non-tobacco-user. That can add up to a significantly larger premium, especially considering tax subsidies are based on non-tobacco rates.

How do they know if a person uses tobacco? Since there is no medical underwriting under Obamacare, there is no way of knowing whether an individual signing up for coverage uses tobacco. It’s an honor system, and the only thing an insurance company can do is retroactively impose the tobacco rate back to the beginning of the plan year. They can’t cancel the policy because you provided false information. Plus, insurance companies don’t have the resources to police this, which leads one to believe that we could have a 100 percent tobacco-free insurance pool—on paper.

4. Buy it. Change it. Use it. Drop it

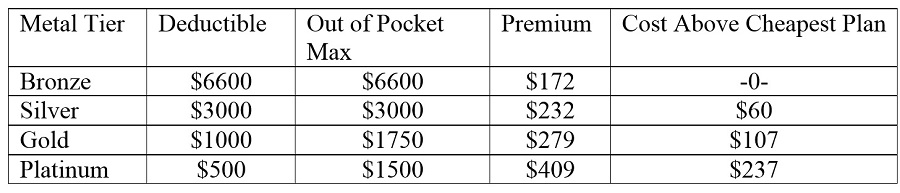

Every year at Open Enrollment, people can enroll regardless of health status. They also can switch plans. The bare-bones Bronze plans come with low premiums and high deductibles. In most cases, these deductibles range between $5,000 and $6,600 per person. They have very limited benefits for prescriptions and most don’t cover specialist visits until the deductible is met. More important, they don’t have broad physician and hospital networks.

Gold and Platinum plans have more comprehensive benefits and typically cover a more robust network of providers. These plans come at a higher price. A healthy 40-year-old making $31,000 could pick from the following plans:

He is healthy and purchases the most cost-effective plan for him, the Bronze option. During the year, he suffers a knee injury. He can’t afford the MRI and potential surgery so he puts the procedure off. At open enrollment, he changes his insurance and “buys up” to the Gold plan, which offers the most comprehensive coverage and least out-of-pocket (aside from premiums). As soon as his new plan is in place, he schedules his MRI and has knee surgery. Since he really can’t afford the expensive Gold plan, after his treatment he simply drops his insurance and “goes bare.”

5. Pay The Tax for Being Uninsured

Why would anyone do this? Because the tax is scheduled to be less than the cost of premiums. In Northwest Ohio, the tipping point occurs between an adjusted gross income of $18,000 and $19,000. Even heavily subsidized premiums cost more than the 2 percent shared-responsibility tax from $19,000 of income and up. Anyone willing to roll the dice would find it less costly to pay more in taxes than in premium.

As the Obamacare abyss continues, it will be more likely that people will look toward these mechanisms to avoid paying the high premiums. It should be noted that, although not all of these options are necessarily ethical, they all fall within the law.

We should also note: since when has government said anything about Obamacare it has ethically presented to the public?