Happy Tax Day, America! It’s not every day that you either get to write a big fat check to Uncle Sam or discover that you’d been loaning him money interest-free for the last year. But have no fear: at least your hard-earned money has been spent on vital projects essential to America’s well-being. Projects like studying shrimp running on treadmills (seriously, you paid for that), or Bridges to Nowhere. Super important stuff like that.

In honor of tax day, here are 8 facts that will make you even angrier than you already are about the state of the U.S. tax system.

1. It will take you 111 days this year just to pay off the government.

According to the Tax Foundation, a non-profit which compiles detailed tax statistics, it will take 111 days this year for American workers to collectively pay their tax bills. That means that every cent you earn throughout those first 111 days of the year gets collected and consumed by government. The Tax Foundation pegs Tax Freedom Day — the day on which the money you earn effectively belongs to you rather than America’s governmental bureaucracy — as April 21 this year. So as you sign your tax returns today, you can rest easy knowing that you’ll still need to work another 6 days before the American tax leviathan will be satisfied.

2. Those federal bureaucrats whose salaries you pay? A bunch of them are tax cheats.

According to an investigative report by Sen. Tom Coburn (R-Okla.), over 300,000 federal employees and retirees were delinquent on their own taxes to the tune of $3.5 billion:

While millions of Americans continue to send back portions of their hard earned wages to Washington, many federal employees are tax cheats.

During the year of sweeping budget cuts, millions of federal employees faced layoffs, furloughs, and other cutbacks as a result of Congress’ failure to replace sequestration with responsible, targeted cuts. Most of these federal employees are responsible citizens who pay their taxes. Some, however, don’t feel they have to live by the rules like other Americans. In 2011, the IRS found nearly 312,000 federal employees and retirees were delinquent on their federal income taxes, owing a total of $3.5 billion in unpaid federal income taxes. This represented an 11.5 percent increase in the number of federal employees failing to pay their taxes, and a 2.9 percent increase in the total taxes owed the Treasury by these public servants.

3. You probably pay more in Medicare and Social Security taxes than you do in income taxes…

A lot of tax day commentary focuses on the income tax, but the vast majority of Americans — 80 percent or more — actually pay more in federal payroll taxes (the FICA line on your pay stub) than they do in federal income taxes. Those payroll taxes pay for Medicare and Social Security, the two largest federal entitlement programs.

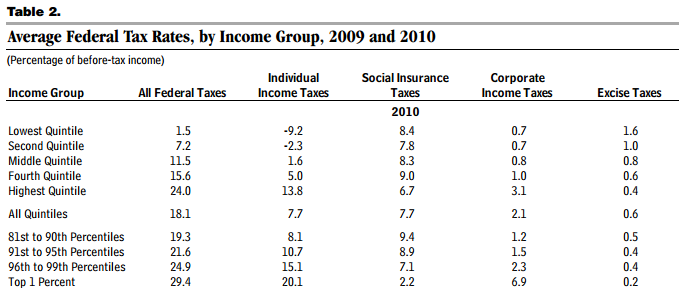

A 2013 study from the Congressional Budget Office (CBO) found that each of the bottom four quintiles of income earners in America (the bottom 80 percent) pays a higher effective payroll tax rate than income tax rate. The middle quintile, for example, pays an average payroll tax rate of 8.3 percent and an average effective income tax rate of 1.6 percent. Only the top quintile pays a higher effective income tax rate than it does a payroll tax rate.

4. …And if you’re young, you’re probably never going to get that money back.

Rather than a program that takes your contributions and deposits them into a savings account with your name on it, Social Security is actually a massive transfer program, and in less than 20 years, the program will effectively be bankrupt. Workers today pay for retirees today, and payments to tomorrow’s retirees will come from tomorrow’s workers. But due to major demographic changes since Social Security was first created, there are far fewer workers per retiree now, and actuaries expect that trend to continue for the foreseeable future.

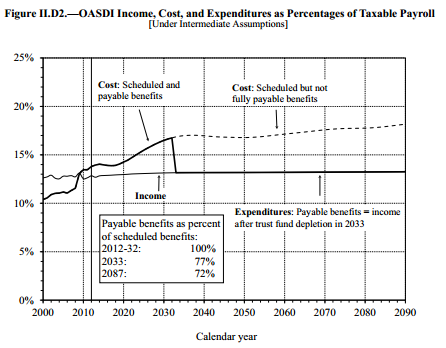

The major financial consequence of that change in demography is that we have promised future retirees far more than future workers will be able to pay. In fact, the Social Security trust fund started running operational deficits in 2009, meaning that the program was paying out more in benefits than it collected from workers in the form of payroll taxes.

Without significant reforms to the system, the Social Security trust fund is expected to run dry in 2033, according to the program’s trustees (the trust fund balance increases when income exceeds benefits paid out, and decreases when benefits exceed income). When that happens, benefits will fall overnight by 23 percent. Millennials should keep that in mind next time politicians talk about raising their payroll taxes to pay for benefits they’ll never receive.

5. Pretty much everybody’s tax rates went up in 2013 thanks to Obamacare and the so-called fiscal cliff deal.

The so-called fiscal cliff deal that was signed into law in January of 2013 raised taxes for a lot of people — 77 percent of people, by some estimates. That’s because the deal allowed payroll tax rates to increase, goring anyone with earned income.

From the New York Times:

Jack Andrews and his wife no longer enjoy what they call date night, their once-a-month outing to the movies and a steak dinner at Logan’s Roadhouse in Augusta, Ga. In Harlem, Eddie Phillips’s life insurance payment will have to wait a few more weeks. And Jessica Price is buying cheaper food near her home in Orlando, Fla., even though she worries it may not be as healthy.

Like millions of other Americans, they are feeling the bite from the sharp increase in payroll taxes that took effect at the beginning of January. There are growing signs that the broader economy is suffering, too.

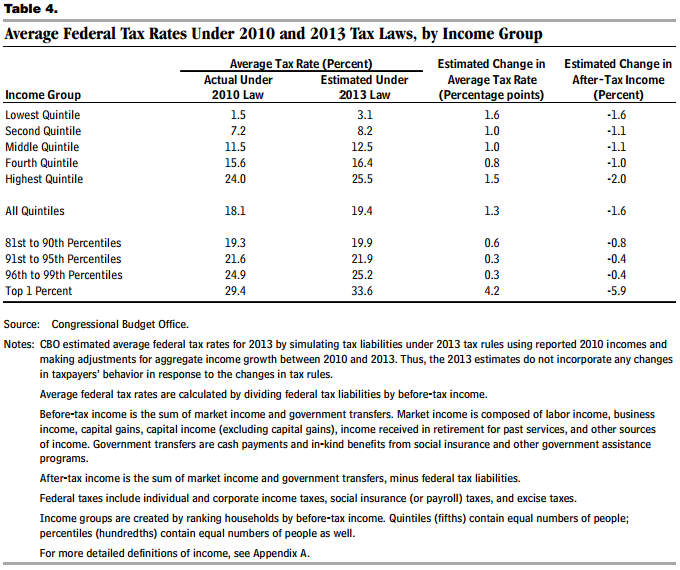

CBO looked at the effects of the fiscal cliff bill, compared it to what the law was in 2010, and found that average tax rates would increase for every single income quintile.

But that’s not all! Obamacare also hiked taxes beginning in 2013. The president’s health law instituted a new 3.8 percent tax on net investment income, as well as a brand new 0.9 percent “Additional Medicare Tax.” And yes, that’s actually what they called it.

6. Most Americans believe their taxes are too high.

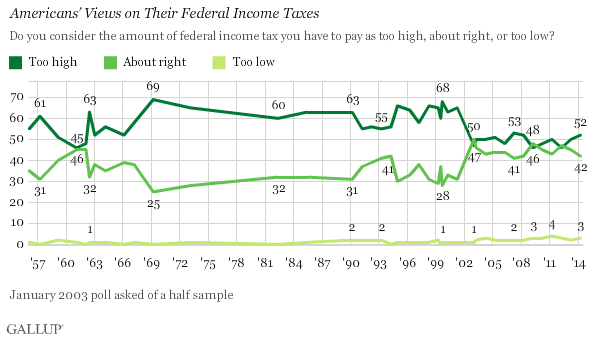

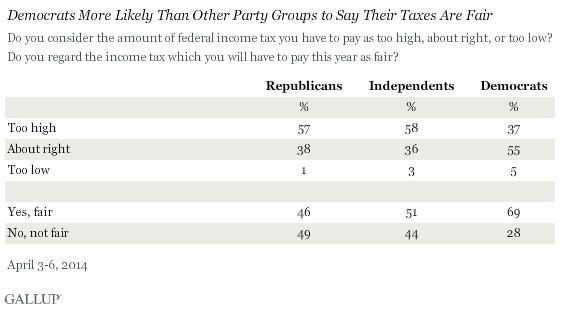

A new poll released yesterday by Gallup shows that most Americans believe they pay too much in taxes. According to Gallup, 52 percent of those surveyed said taxes were too high, while 42 percent said they were about right. For some reason, 3 percent of respondents said taxes were too low.

7. Even as they try to raise your taxes, only 5 percent of Democrats think their own taxes are too low.

The same Gallup poll broke down tax sentiment by party affiliation. Unsurprisingly, 57 percent of Republicans responded that their own taxes were too high. Fifty-eight percent of Independents agreed, while only 37 percent of Democrats said the amount they paid in taxes was too high. Shockingly, given the Democratic Party’s steadfast belief that tax rates should always be higher, only 5 percent of Democrats felt that their own taxes were too low.

8. Corporations are people? Not so much. They get way better tax treatment than actual people.

While it’s true that corporate tax burdens are eventually borne by their investors and shareholders, it’s also true that corporations have access to a vast array of deductions and credits that are not available to individual taxpayers. Corporations can deduct nearly all expenses — things like rent, utilities and gas — from their income in order to reduce their tax liability. They can also deduct health insurance premiums, a benefit not available to families who may have to buy insurance on their own rather than having it provided by an employer. And when a corporation gets busted for tax fraud, it usually gets off the hook with a fine, since you can’t send a piece of paper to prison for its crimes.