Mitt Romney famously said during the 2012 presidential campaign that “corporations are people, my friend!” In responding to a heckler, Romney clumsily tried to make the point that in the end, a corporation is made up of nothing but living, breathing shareholders who will eventually bear the burden of corporation taxation. That’s all fine and good when you’re having a bull session during an introductory corporate finance course, but on the campaign trail it turned out to be Kryptonite.

One reason Romney’s response was so flat and tone-deaf is that thanks to the current federal tax code, corporations can take advantage of tax treatments the average person could only dream of. And while it’s true that America’s highest-corporate-tax-rate-in-the-developed-world is destroying jobs and should be lowered to make the U.S. more globally competitive, it’s also true that few people look at the tax code and say to themselves, “You know what? Those corporations sure aren’t getting a fair shake.” They instead wonder why their families, which are struggling to make ends meet, are footing the bill for what looks like a whole bunch of corporate tax chicanery.

No, corporations aren’t people. In fact, here are eight reasons why you’d rather be a corporation than an actual person.

1) The IRS Might Let You Pretend You’re A Tax-Exempt Non-Profit

A recent poll released by Harris Interactive found that NFL football was America’s favorite sport. Shockingly, the billion-dollar industry is also organized as a non-profit. The organization is incorporated under section 501(c)(6) of the federal tax code, which is generally reserved for trade associations that represent the interests of groups like homebuilders or small business owners. Here’s how the IRS describes the tax exemption:

IRC 501(c)(6) provides for exemption of business leagues, chambers of commerce, real estate boards, boards of trade, and professional football leagues (whether or not administering a pension fund for football players), which are not organized for profit and no part of the net earnings of which inures to the benefit of any private shareholder or individual.

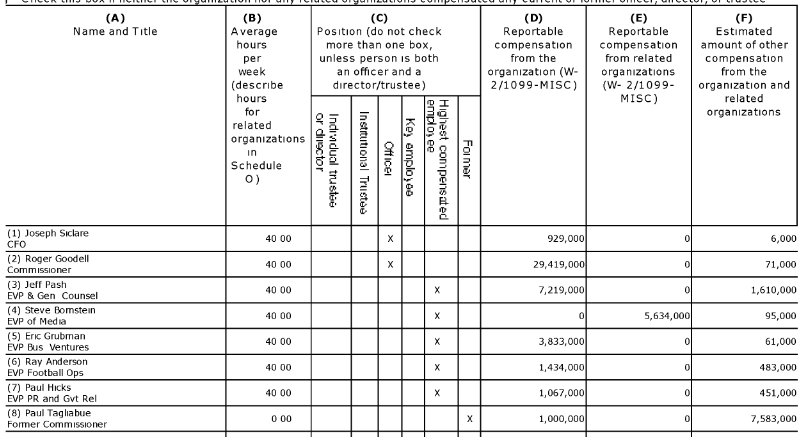

NFL commissioner Roger Goodell, himself an employee of the non-profit NFL, took home $29.4 million in salary and benefits from the organization in 2012.

Seven of the NFL’s top eight executives were paid a million dollars or more. That even includes former commissioner Paul Tagliabue who somehow booked over $1 million from the NFL despite contributing an average of precisely 0 hours each week working on behalf of the tax-exempt organization. But don’t worry, none of those fat stacks of cash are “inur[ing] to the benefit of any private individual.”

Neither the MLB nor the NBA, the second- and third-most popular sports in the U.S., claim the tax exemption that has been enjoyed by the NFL since 1966.

2) Corporations Don’t Get Sent To Prison When They Break The Law

When an individual is convicted of a serious crime, he or she generally ends up in prison. Not so for corporations, which generally escape with a fine and a stern note from the principal, chastising them for their misbehavior. Even worse, when a corporation is busted for fraud and forced to pay up, it’s not the culpable executives who have to foot the bill, it’s the shareholders (yes, the same shareholders who would end up in prison if they attempted the corporation’s shenanigans).

You’ve heard of “too big to fail,” but what about “too big to jail”? In late 2012, megabank HSBC was fined $1.9 billion by the feds for aiding and abetting money laundering by foreign drug cartels:

As part of an agreement deferring its prosecution, HSBC admitted that executives for years ignored warning signs that drug cartels in Mexico were using its branches to launder hundreds of millions of dollars through the U.S. The bank also acknowledged that its international staff had stripped identifying information on transactions through the U.S. from countries including Iran and Sudan in order to evade sanctions.

To make matters worse, HSBC received multiple warnings. U.S. regulators ordered the bank in 2003 to strengthen its anti-money laundering controls, and did so again in 2010 after finding it had continued to ignore suspicious transactions.

And yet, nobody went to jail, even though bank employees deliberately altered transaction data to hide the fact that the transactions were illegal. The moral? If you’re going to launder money, charter a bank, claim it’s too big to fail, and blame an inanimate corporate charter for any and all crimes you plan to commit. As the HSBC settlement demonstrates, that’s a foolproof plan.

3) Corporations Can Deduct Everyday Expenses Like Rent, Gas, And Phone Bills

While individual Americans get taxed based on their adjusted gross income (AGI), corporations get taxed on net income. The difference between gross and net is a big one — it means corporations only get taxed on whatever’s left after they’ve paid every possible expense under the sun. While actual people are afforded a few credits and deductions to lower their tax liabilities, it’s nothing compared to the deductions available to corporations, which are allowed to use Generally Accepted Accounting Principles (GAAP).

GAAP allows companies to deduct expenses like rent, gas for their car fleets, cell phone bills for their employees, and tickets for sporting events (to woo clients, of course). But if you’re a mom who has to drive around town every day to take your kids to school, ballet, and baseball practice, you’re on your own when it comes time to fill up the gas tank.

4) Corporations Can Use Losses In Previous Years To Offset Taxes In The Future

If you’ve ever wondered how companies that book massive profits somehow manage to pay no income taxes, wonder no longer. Net operating loss carryforwards, or NOL carryforwards, are responsible. They allow companies to use losses from previous years to offset profits in the future, a benefit that can allow very profitable companies to nonetheless pay no income taxes.

The NOL carryforward makes sense as a way to create incentives to invest in start-up companies: they require large infusions of cash to cover years’ worth of losses as they develop products and build a customer base. And unlike massive companies with various subsidiaries, they can’t take advantage of those losses today by using them to offset gains from profitable subsidiaries. As a result, Congress gave them the freedom to book those losses in the future for tax purposes.

But what about individuals who may spend a year or more without a job and without an income? There are no venture capital investors out there willing to float cash to a person until he can get back on his feet. Most individuals can’t exist for years with negative income like corporations can because normal people simply don’t have the same type of cash reserves (nor does the tax code allow individuals to deduct everyday expenses to reduce their tax liabilities). While individuals do have a limited ability to apply a previous year’s business losses to a future year’s tax return, it’s nothing compared to what is available via the corporate tax code.

5) Corporations Can Shift Income And Expenses Around To Different Countries To Minimize Their Tax Liabilities

Wouldn’t it be great if 1) your everyday individual expenses were deductible, and 2) you could book your income in jurisdictions with low tax rates and book your expenses in jurisdictions with really high tax rates in order to minimize your overall tax liability? As a U.S. corporation, you can do that. As an individual, you cannot. The practice is called “income shifting,” and it’s incredibly common among U.S. multinationals:

Google Inc. cut its taxes by $3.1 billion in the last three years using a technique that moves most of its foreign profits through Ireland and the Netherlands to Bermuda. Google’s income shifting — involving strategies known to lawyers as the “Double Irish” and the “Dutch Sandwich” — helped reduce its overseas tax rate to 2.4 percent, the lowest of the top five U.S. technology companies by market capitalization, according to regulatory filings in six countries.

[…]

The tactics of Google and Facebook depend on “transfer pricing,” paper transactions among corporate subsidiaries that allow for allocating income to tax havens while attributing expenses to higher-tax countries. Such income shifting costs the U.S. government as much as $60 billion in annual revenue, according to Kimberly A. Clausing, an economics professor at Reed College in Portland, Oregon.

6) You Can’t Automatically Deduct Health Insurance Premiums, But Big Corporations Can

Are you a corporation looking to provide health insurance to your employees? Great! You can claim a deduction for the employer-paid portion of their health premiums. Are you an individual whose employer does not provide insurance coverage for you or your family? Too bad! No deduction for you. In order to qualify for the health insurance premium deduction, not only do you have to itemize your return, your medical expenses (including insurance premiums) must exceed 7.5 percent of your adjusted gross income (AGI).

7) Depreciation Deduction For Company-Owned Corporate Headquarters? Absolutely. But For The Home You Own And Live in? Not So Much.

The tax code straight-up punishes individual homeowners relative to corporate HQ inhabitants. Both groups can deduct mortgage interest expense from their taxable income, but only one can deduct the regular wear and tear on buildings and equipment that accountants refer to as depreciation. Now, if you are an individual who owns a residential property and rents it to tenants, you can take advantage of the depreciation deduction. But not if you happen to live in the home you are owning. Here are the IRS rules for individual income tax depreciation of real estate:

You can depreciate your property if it meets all the following requirements.

You own the property.

You use the property in your business or income-producing activity (such as rental property).

The property has a determinable useful life.

The property is expected to last more than one year.

8) Credit Card Interest Expenses Are Deductible For Corporations, Not Deductible For Actual People

Buried under mountains of debt? Can’t seem to find a way out? Good news! The government is here to help…as long as you’re not an actual human being, according to the IRS:

You cannot deduct personal interest. Personal interest includes interest paid on a loan to purchase a car for personal use. Personal interest also includes credit card and installment interest incurred for personal expenses.

Interest expenses for credit card purchases of business items, however, are completely deductible. What does that mean? If you’re out of cash and need to use your credit card to buy diapers or formula for your baby, you can’t deduct the interest on those purchases. But if you’re a corporation whose CEO needs a new $87,000 rug, go ahead and put it on the Amex black card. Uncle Sam will help you out with those interest payments, no questions asked.