While the press and the American people focused on the Justice Department’s latest indictment of President Trump, another no less significant event was taking place on Tuesday afternoon. Specifically, Fitch Ratings announced it had officially downgraded the United States’ credit rating.

The action by Fitch comes a dozen years after Standard and Poor’s downgraded the federal government’s debt rating, meaning that two of the three credit rating agencies have stripped Washington of its vaunted “AAA” status.

It is but the latest indication of how presidents and politicians from both parties have ignored the serious fiscal problems within our nation — and yet another warning of the reckoning we will ultimately face as a people.

Storm Clouds Ahead

Fitch’s statement said that “the rating downgrade … reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance … over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.”

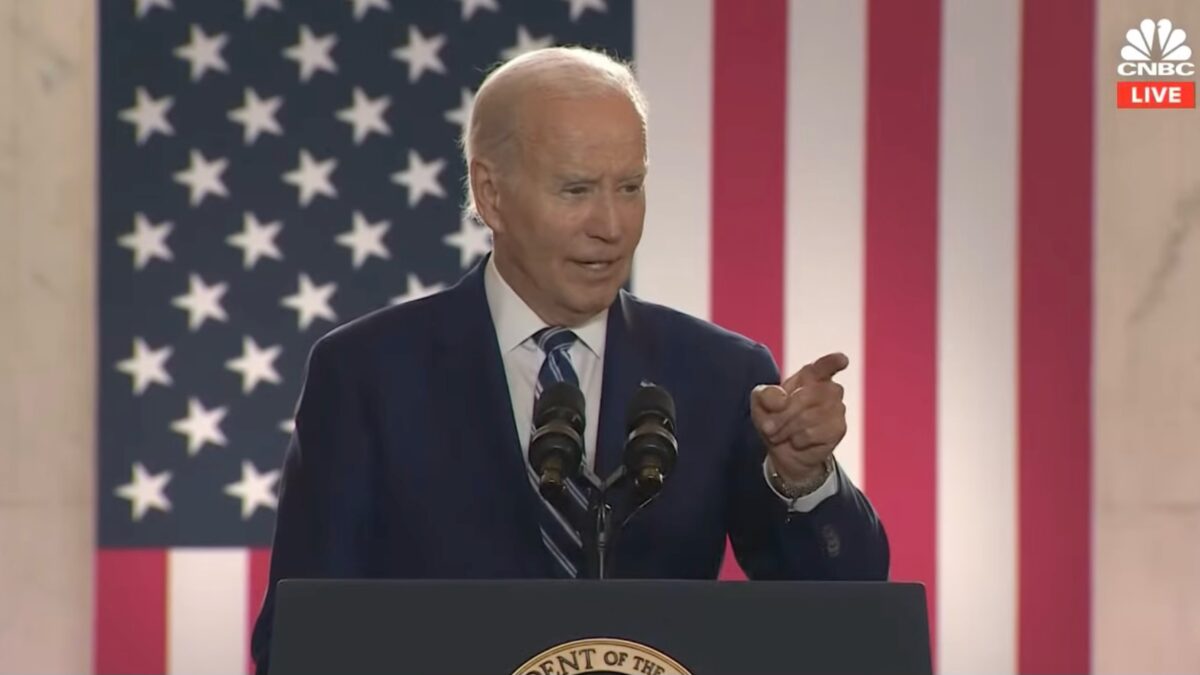

The objections to “standoffs and last-minute resolutions” seems off-base, seeing as how Congress only pretends to care about fiscal reform in the face of an imminent deadline. None other than Joe Biden himself admitted back in 1984 that Congress “should be focused on taking on the tough measures” to lower spending “when you have to raise the debt ceiling again.”

But when it comes to the deterioration of the nation’s fiscal position, Fitch is bang on the money in highlighting the depth of our problems. With regards to general government deficits — which include those incurred by state and local governments — Fitch estimates they will rise from 3.7 percent of GDP last year to 6.3 percent this year, 6.6 percent next year, and 6.9 percent of GDP in 2025.

This significant increase in deficits comes at a time when (thus far at least) the economy continues to grow at a moderate pace, and unemployment remains at historically low levels. If governments are incurring this amount of debt in comparatively good economic times, what will happen if the nation faces another severe recession?

Rising Debt

The accumulated deficits of the past several decades have led to sizable growth in the national debt. Consider that when S&P downgraded the federal credit rating in 2011, the federal debt stood at roughly 65 percent of GDP. Now, 12 years later, it has risen to nearly 100 percent, and estimates suggest it will continue to rise sharply higher.

Fitch noted that with respect to general government debt (which again includes that incurred by state and local governments), the United States is projected to have a debt ratio over three times higher than the median country with an “AAA” rating, and over 2.5 times the median country with “AA” credit by 2025.

In many respects, therefore, the question isn’t why Fitch selected this time to downgrade our debt, but why it took so long to do so.

Tax and Spend

In a statement disagreeing with Fitch’s decision, Treasury Secretary Janet Yellen among other things claimed that governance had improved under President Biden, due in part to the passage of legislation to “invest in infrastructure, and make other investments in America’s competitiveness.”

Only in an administration led by someone who once famously claimed that “we gotta go spend money to keep from going bankrupt” could an official claim with a straight face that making “investments” will somehow reduce our growing deficits in debt.

In fact, a Goldman Sachs report issued in March concluded that the green energy subsidies included in the Inflation (Reduction) Act will cost $1.2 trillion — more than three times the original Congressional Budget Office cost.

Of course, Yellen and Biden have company in their spendthrift ways. When drafting bills this summer, even House Republicans, who claim they want to eliminate the Covid-era binge still present in Congress’s annual spending bills, couldn’t help but include thousands of earmarks — er, I mean, “community project funding” — to bring the bacon home to their districts.

In Ernest Hemingway’s The Sun Also Rises, the character Mike Campbell, when asked how he went bankrupt, responded, “Two ways. Gradually and then suddenly.” Hemingway’s quote provides an apt metaphor — and warning — to Washington politicians who keep whistling past our fiscal graveyard.

The first phase went on for decades. The latter could well be arriving far sooner than anyone thinks.