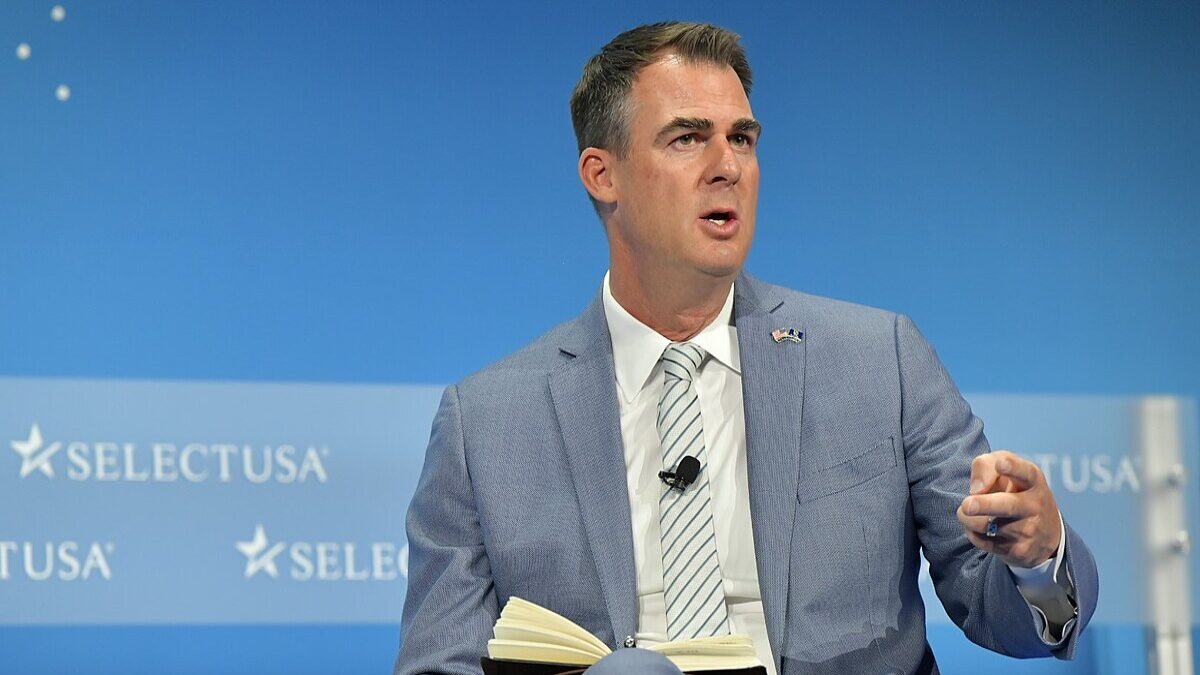

California released a plan Tuesday to reopen businesses. One thing conspicuously missing from the governor’s slideshow was any sort of timeline, replaced instead by a six-point plan to remake society around fear of the coronavirus. Could be June, he said in a press conference, or even July or August. One thing conspicuously included was the observation that “things will look different,” including restaurants having to open “with fewer tables.”

California’s Gov. Gavin Newsom is right that “things will look different”: When our front doors finally swing open and we come out blinking in the sunshine, our cities and towns will be mere husks of what they were just a month ago. Empty storefronts, boarded-up shops, terrible “local art” installations in windows that once showed friends and families laughing over their favorite dish and bottle of wine.

Nine states have issued similar “plans.” Washington, D.C. chimed in Wednesday, extending the shutdown another month. Meanwhile, the House and Senate are fighting when they’re talking at all. The ideas batting about Capitol Hill are more money for leftist projects, more for employees, and more for that last plan that isn’t working. There is, however, a major resource to stop this nightmare that has not been tapped yet — one the president, who has spent far more years as a businessman than politician, teased on Friday.

The Problem

The Senate’s phase III Paycheck Protection Plan funds are “going fast” and set to run out “this week,” one small bank president told The Federalist; not that it mattered much to a lot of restaurants anyway. Politicians’ plan to give small businesses funds on the condition they either pay it back on an impossible deadline or disperse it to their employees wasn’t in their interest for actually surviving this crisis.

As one restaurateur told The Federalist, “My employees are already on unemployment. What am I going to do, hire them all when there’s no work to do, only to have to let them go again in June when the money runs out and we’re still not able to open? Back into the unemployment line, which could be longer by then? That’s not good for any of us.”

The reality is many of the small businesses we love might never open up again. Because even when bars, restaurants, and event spaces, for example, can legally open their doors, how many will be able to? For most of those, profit margins aren’t big.

Do leaders like California’s governor actually, really, honestly think that telling a steakhouse they can only have half as many customers will keep them in business? That the owner of a diner that needs to put six feet between each customer will still get up for work at 3 a.m. every morning? That a man will build a 50-foot bar so he can seat eight patrons? How about the neighborhood Italian or Chinese or Mexican spot that stacked table on table but you didn’t mind because you loved the food and the staff? Or you and your spouse’s favorite cozy little date spot? Gone, shuttered. It isn’t worth it for them to stay open, so they won’t.

This, by the way, is happening right now. Rent was due April 1. Five days later, on April 5, it was late. Ten days after that, on Wednesday, tenants began to get eviction letters. While some landlords will offer forgiveness and some tenants will pay the rent, those tenants who cannot afford the rent also can’t pay the legal fees to stay.

That means decision time is here. And every day, every week, every long month this drags on without serious relief for real small business owners — not just the employees, but the entrepreneurs — decision time comes for more and more of the people who’ve chosen the harder path and taken on personal risk to create our Main Streets, employ our neighbors, and help build our middle class.

Many of the banks either aren’t properly equipped to help or don’t think it’s in their business interest to shell out loans at 1 percent interest (if the feds don’t simply forgive them). For other banks who consider it a service to their local community, it’s still been a grind.

“Volumes have been surreal,” the small bank president told The Federalist. “We have done more in the past two weeks than in a traditional year. On top of that, huge refinancings due to lower interest rates. The combination is daunting to a degree. My staff have literally been working remotely in what seems at times like 24/7.”

A Way Forward

There is a business that is not scrambling to help, however: It’s the insurance industry, which is strange because a huge number of small business owners have been paying high premiums for years for disruption of business coverage. After SARS, the insurance companies banded together and decided they wouldn’t cover pandemics, but the policies still cover when access to the restaurant is restricted, as it was when the government stepped in.

“You have people,” President Donald Trump said Friday, “that have never asked for business-interruption insurance, and they’ve been paying a lot of money for a lot of years for the privilege of having it. And then when they finally need it, the insurance company says, ‘We’re not going to give it.’”

“We can’t,” he concluded, “let that happen.”

The insurance companies, of course, don’t want to make these payments. We all know they never want to pay anything, but in this case the burden really could sink them. They do, however, have the roll calls and the means of disbursement and even the amounts to be disbursed already in their systems. It’s pretty amazing, really, and makes you wonder why politicians have tried instead to funnel relief through institutions like TD Bank, which is so overwhelmed that desperate business owners say it’s one of many banks barely even picking up the phones anymore.

While Washington is printing money that is increasingly going to the wealthier companies with more accountants and more lawyers, and while the politicians are busy crafting the next stage of their economic relief plan, the offer of reward, the threat of punishment, and the insurance companies should play a major role.

There are a lot of people on Wall Street and in Washington who see no problem with an America defined by big box stores and chain restaurants. Money will be made regardless. Treasury Secretary Steven Mnuchin’s friends will make money regardless. But those among us who value our towns, who care about our middle class, and who love our small business owners can’t accept this. Let’s hope our politicians agree; and when this is over, remember those who didn’t.