The House and Senate tax bills ignited a mini controversy over proposing to tax at 1.4 percent the annual income from college endowments worth $250,000 per student or more for colleges of at least 500 students.

An endowment is like a retirement account: a pot of economic investments expected to generate annual returns that fund college programs and scholarships. An endowment at $250,000 per student at a 5 percent average annual rate of return would generate $12,500 per student per year. Approximately 65 colleges fit the criteria for this new tax should it become law (here’s a list).

A late amendment to the Senate bill would apply the tax only to colleges with assets of $500,000 per student, approximately 30 higher education institutions. That level of assets with a 5 percent rate of return generates $25,000 per student per year, or about enough to cover half a student’s tuition costs at a typical private college.

The Chronicle of Higher Education reports that some version of these provisions is likely to remain inside the final bill going through conference committee, which is currently likely to come out for a vote Friday.

There’s No Real Good Justification for This Carveout

Yet it’s not exactly clear why the tax bills contain this provision, as part of the justification for tax reform at all is simplifying the tax code and eliminating carveouts aimed at select groups decided by narrow political preferences. By this principle, if there are changes to investment taxes they should apply to all investment income for all endowments, trust funds, retirement accounts, and the like, or none at all.

If the goal is to “soak the rich,” it’s not only unjust to target those who take more care to provide for their own students and long-term stability, it’s class warfare, which is built upon a foundation of envy and therefore despicable. It could be, as Tim Carney suggests, motivated by culture war politics; but conservatives “shouldn’t use tax law to target the other side’s institutions, because a war between the Leviathan State and the institutions of civil society is a war that conservatives automatically lose.”

If the goal is to pay for some of the tax cuts elsewhere in the bill, that could be done much more fairly, with better profit for students and Americans, and with bigger savings to taxpayers by instead cutting federal college subsidies, period. Otherwise, this provision penalizes prudent institutions that fund themselves through economic activities that benefit the public as well as charity, and rewards those dependent on money pulled from taxpayers’ pockets.

College Subsidies Inflate Tuition and Fleece Taxpayers

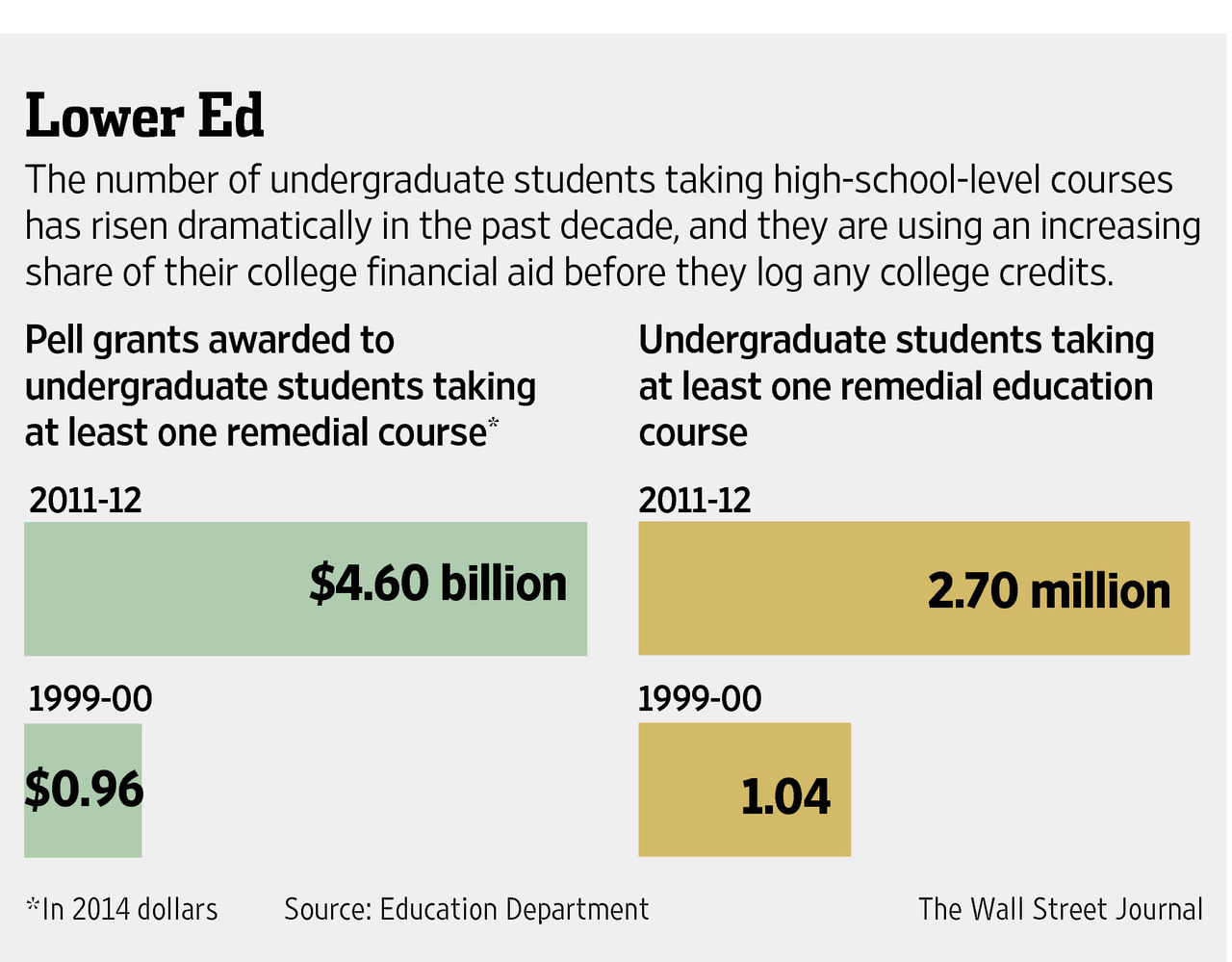

Currently, federal taxpayers subsidize colleges and universities to the tune of more than $130 billion every year, most of that going to student loans and grants. While some say federal student loans make taxpayers money, the truth is they cost taxpayers money, partially because many self-described students are the equivalent of a subprime mortgage, a situation easy federal money has exacerbated. Federal higher education subsidies have also nearly doubled since 2000, meaning it wasn’t the “old bad days” when we spent much less.

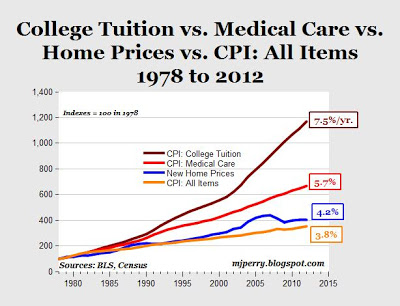

Further, we now have a consistent set of economic research finding that federal student “aid” actually hurts both taxpayers and students by inflating the cost of college. One of the more recent such studies came from the Federal Reserve, which concluded that every $1 in federal “aid” increased college tuition by approximately 55 to 65 cents. Easy federal money is literally making the college cost problem worse.

As a result, college tuition growth has far outpaced the growth in high-inflation sectors such as medical care, as economist Mark Perry and others have shown repeatedly:

The increased “access” some like to tout as a sacrosanct federal policy goal has largely resulted in more dropouts, higher remediation rates, and more unprepared students wasting their time and taxpayers’ money not earning degrees while also taking on debt they don’t get the credentials to help them pay off. This is the dark underbelly of attempts to “increase college access” by tossing money U.S. taxpayers don’t have (does anyone care we’re drowning our kids in debt at unfathomable levels?) at a pack of 18-year-olds regardless of their academic preparation.

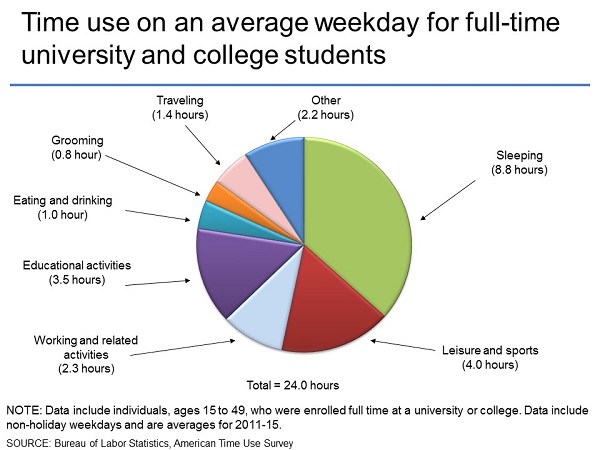

Even if they do manage to get themselves through college, it’s questionable whether graduates have learned much in those now-standard five years. As I wrote in 2015, a landmark 2011 study found that more than a third of college students made no learning gains between freshman and sophomore year.” U.S. Bureau of Labor Statistics time-use studies find that college students engage in more “leisure and sports” than they do in “educational activities.” The average so-called “full-time” U.S. college student spends just 15 hours per week studying, plus a similar amount in class.

This is preposterous. U.S. taxpayers should not be funding five years of beer- and sex-drenched water-treading from able-bodied young citizens, especially when we have a national debt of $20 trillion we need their help to start paying off, and especially when it results in little economic gains for them or the rest of us (research tends to find that the people who graduate and do well with their degrees were going to do well whether they got credentialed or not, professions like doctors and lawyering of course excepted given the need for special training in such cases).

People should be responsible for paying for their own college educations, because only they are best-suited to know whether the financial risks are a good fit for their abilities and interests. No state or federal constitution entitles anyone, especially the upper-middle-class that exudes the most pressure for these payouts, to reach into his neighbor’s pocket to further his own economic gains. Taxpayers provide K-12 education because basic civic literacy is necessary for our system of self-government. A “higher” education neither produces measurable citizenship improvements nor is any person’s right. Therefore, financing it should be an individual’s responsibility.

What This All Has to Do With Endowments

This all brings us back to the endowment question. An endowment offers an opportunity for charitable donors to help finance what they believe is a good education for deserving applicants, upon criteria and for purposes they are invited by the recipients to inspect and buy into through free choice. Rather than snitching from fellow citizens using the police power of government, endowments actually generate wealth for fellow citizens because they make money through investing in other Americans’ enterprise, again all on a voluntary rather than coercive basis for all parties involved. It’s a win-win.

In fact, there’s another win here: students, who are helped to afford a college education that would otherwise be out of their current and often even future earnings capacity. I have been such a student, and so has my husband. We are both graduates of a college that due to culture war enemy-hunting was somewhat randomly dragged into this discussion — Hillsdale College, due to its long history of funding itself through free donations rather than coerced government subsidies, thanks partly to its endowment.

We could not afford that school even with our parents’ help. But we still got our degrees, and were debt-free within two years of graduation despite graduating with liberal arts degrees and the average amount of student debt. Based on the assumptions driving this endowment discussion, that should be impossible. The assumptions are that young people are stupid, lazy, and incapable of making a life for themselves.

These assumptions are wrong. So are the ones leading politicians to penalize schools for prudence rather than admitting it’s politicians who have made the college and federal spending messes. It’s time to stop assuming it’s government’s job to redistribute people’s wealth for them instead of setting them free to earn and give it to each other. The latter produces an atmosphere of joy, which leads to healthy growth; the former, of enslavement, which leads to the cancerous growth we see inside America’s college bubble.

Congress can indeed help fix this problem: not by penalizing the givers and the earners, but by telling young Americans it’s time for them to start running their own lives and being responsible for the results. Who knows — if they live like that, maybe later in life they will have the chance to pay it back by helping launch others into adulthood, whether through college or not.