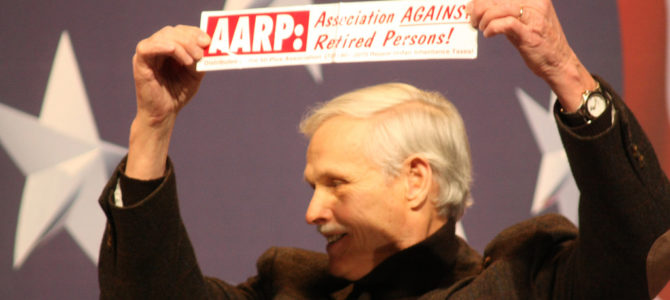

Over the past few weeks, AARP—an organization that purportedly advocates on behalf of seniors—has been running advertisements claiming that the House health-care bill would impose an “age tax” on seniors by allowing for greater variation in premiums. It knows of which it speaks: AARP has literally made billions of dollars by imposing its own “tax” on seniors buying health insurance policies, not to mention denying care to individuals with disabilities.

While the public may think of AARP as a membership organization that advocates for liberal causes or gives seniors discounts at restaurants and hotels, most of its money comes from selling the AARP name. In 2015, the organization received nearly three times as much revenue from “royalty fees” than it did from member dues. Most of those royalty fees come from selling insurance products issued by UnitedHealthGroup.

Only We Can Profit On the Elderly

As documented on its tax returns and in congressional oversight reports, AARP royalty fees from UnitedHealthGroup come largely from the sale of Medigap supplemental insurance plans. As the House Ways and Means Committee noted in 2011, while AARP receives a flat-sum licensing fee for branding its Medicare Advantage plans, the organization has a much sweeter deal with respect to Medigap: “State insurance rate filings show that, in 2010, AARP retained 4.95% of seniors’ premiums for every Medigap policy sold under its name. Therefore, the more seniors enroll in the AARP-branded Medigap plan, the more money AARP receives from United.”

So in the sale of Medigap plans, AARP imposes—you guessed it!—a 4.95 percent age tax on seniors. AARP not only makes more money the more people enroll in its Medigap plans, it makes more money if individuals buy more expensive insurance.

Even worse, AARP refused good governance practices that would disclose the existence of that tax to seniors at the time they apply for Medigap insurance. While working for Sen. Jim DeMint in 2012, I helped write a letter to AARP that referenced the National Association of Insurance Commissioners’ Producer Model Licensing Act.

Specifically, Section 18 of that act recommends that states require explicit disclosure to consumers of percentage-based compensation arrangements at the time of sale, due to the potential for abuse. DeMint’s letter asked AARP to “outline the steps [it] has taken to ensure that your Medigap percentage-based compensation model is in full compliance with the letter and spirit of” those requirements. AARP never gave a substantive reply to this congressional oversight request.

Don’t Screw With Obamacare, It’s Making Us Billions

AARP’s silence might stem from the fact that its hidden taxes have made the organization billions. Between 2010—the year Obamacare was signed into law—and 2015, the most recent year for which financial information is available, AARP received $2.96 billion in “royalty fees” from UnitedHealthGroup. During that same period, AARP made an additional $195.6 million in investment income from its grantor trust.

Essentially, AARP makes money off other people’s money—perhaps receiving insurance premium payments on the 1st of the month, transferring them to UnitedHealth or its other insurance affiliates on the 15th of the month, and pocketing the interest accrued over the intervening two weeks. That’s nearly $3.2 billion in profit over six years, just from selling insurance plans. AARP received much of that $3.2 billion in part because Medigap coverage received multiple exemptions in Obamacare. The law exempted Medigap plans from the health insurer tax, and medical loss ratio requirements.

Most importantly, Medigap plans are exempt from the law’s myriad insurance regulations, including Obamacare’s pre-existing condition exclusions—which means AARP can continue its prior practice of imposing waiting periods on Medigap applicants. You read that right: Not only did Obamacare not end the denial of care for pre-existing conditions, the law allowed AARP to continue to deny care for individuals with disabilities, as insurers can and do reject Medigap applications when individuals qualify for Medicare early due to a disability.

The Obama administration helped AARP in other important ways. Regulators at the Department of Health and Human Services (HHS) exempted Medigap policies from insurance rate review of “excessive” premium increases, an exemption that particularly benefited AARP. Because the organization imposes its 4.95 percent “age tax” on individuals applying for coverage, AARP has a clear financial incentive to raise premiums, sell seniors more insurance than they require, and sell seniors policies that they don’t need. Yet rather than addressing these inherent conflicts, HHS decided to look the other way and allow AARP to continue its shady practices.

The Cronyism Stinks to High Heaven

Obama administration officials not only did not scrutinize AARP’s insurance abuses, they praised the organization as a model corporate citizen. Then-HHS Secretary Kathleen Sebelius, when speaking to its 2010 convention, called AARP the “gold standard” in providing seniors with “accurate information”—even though the organization declined requests to disclose the conflicts arising from its percentage-based Medigap “royalties.” However, Sebelius’ tone is perhaps not surprising from an administration whose officials plotted with AARP executives to enact Obamacare over AARP members’ strong objections.

AARP will claim in its defense that it’s not an insurance company, which is true. Insurance companies must risk capital to pay claims, and face losses if claims exceed premiums charged. By contrast, AARP need never risk one dime. It can just sit back, license its brand, and watch the profits roll in. Its $561.9 million received from UnitedHealthGroup in 2015 exceeded the profits of many large insurers that year, including multi-billion dollar carriers like Centene, Health Net, and Molina Healthcare.

But if the AARP now suddenly cares about “taxing” the aged so much, Washington should grant them their wish. The Trump administration and Congress should investigate and crack down on AARP’s insurance shenanigans. Congress should subpoena Sebelius and Sylvia Mathews Burwell, her successor, and ask why each turned a blind eye to its sordid business practices. HHS should write to state insurance commissioners, and ask them to enforce existing best practices that require greater disclosure from entities (like AARP) operating on a percentage-based commission.

And both Congress and the administration should ask why, if AARP cares about its members as much as it claims, the organization somehow “forgot” to lobby for Medigap reforms—not just prior to Obamacare’s passage, but now. AARP’s fourth quarter lobbying report showed that the organization contacted Congress on 77 separate bills, including issues as minor as the cost of lifetime National Parks passes, yet failed to discuss Medigap reform at all.

Given that AARP made more than $3 billion in profits from the status quo—denying care to individuals with pre-existing conditions, and earning more money by generating more, and higher, premiums—its silence makes sense on one level. But if AARP really wants to make insurance markets fair, and stop “taxing” the aged, all it has to do is look in the mirror.