The popular narrative couldn’t be clearer: America, once the world’s lone superpower, is now being supplanted by China. While America is bogged down in gridlock, partisanship, and short-termism (democracy), China’s benevolent one-party rulers set long-term goals and make decisive decisions that foster breakneck economic growth. China’s President, Xi Jinping, has declared that the twenty-first century will be a “Chinese century.”

Twenty years ago, after the collapse of the Soviet Union, the term “Washington Consensus” was coined to signify the success of the classically-liberal American form of governance: limited, representative government; free markets; and free people. Some thought no economy could fully develop and thrive without adopting the principles embodied in the Washington Consensus.

But since then, in light of rapid Chinese gross domestic product(GDP) growth, the Beijing Consensus has emerged to oppose the Washington Consensus. The Beijing Consensus posits that allowing some economic freedoms, albeit with guidance from a strong central government, is the ideal way to foster economic development.

In the past decade, emerging economies such as Brazil and Russia have decided against emulating America, and instead have sought to model China. Even some among America’s elite (Tom Friedman comes to mind) have leveled measured praise towards China’s version of state-capitalism.

But the Beijing Consensus is about to fall flat. China’s one-party centralized control has led to a massive asset-price bubble and a slow-motion crisis that will bring economic stagnation. Full economic development is not possible outside of the Washington Consensus.

China’s Dangerous Mercantilism

For years, China has practiced mercantilism—the subsidization of export-driven growth—by artificially devaluing Chinese currency (the yuan). When a country exports more than it imports, the value of its currency naturally rises, as people demand more of the exporting country’s currency to purchase the exported goods. Not so in China.

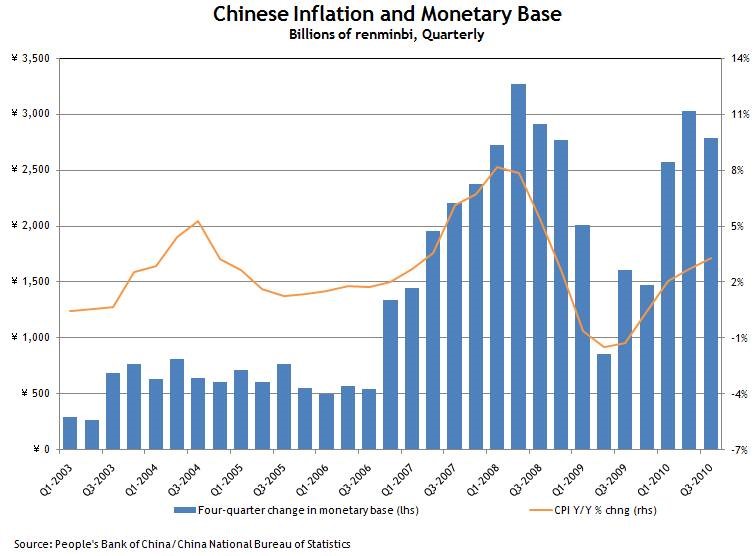

To favor exporters with vast political ties, who employ countless millions and thus reduce social unrest, China has kept the yuan pegged to the dollar by expanding the monetary base, which keeps the yuan’s value from rising. (Note: although the yuan’s value is still controlled, since 2012 China has allowed the yuan to rise slightly versus the dollar). According to the American Enterprise Institute’s Derek Scissors, China’s “M2 (a measure of money-supply) breached $20tn at the end of December (2014), a staggering 70 per cent larger than in the US, where monetary policy has hardly been tight.”

The government-caused expansion of the monetary base has led to cheap money and loose lending standards, which has sparked demand for riskier investments. The demand for risky investments has inflated a bubble.

China’s Huge Debt Accumulation

As a result of this monetary expansion, and a massive government stimulus during the global financial crisis, China has embarked on a debt-fueled binge. According to an estimate from Standard & Poor’s, China’s corporate liabilities are the world’s largest, measuring $14.2 trillion in 2013. Overall Chinese debt, including government, corporate, and household, has risen from 150 percent of GDP in 2008 to 250 percent of GDP today. This is an extremely high figure for a country at China’s level of development (McKinsey puts China’s debt-to-GDP at 282 percent, with 50 percent of loans linked to real estate).

In China’s easy-money environment, investors have a further reason to allocate capital carelessly: big government. Local governments, intent upon meeting arbitrary GDP targets, have been big issuers of debt to fuel infrastructure projects with dubious benefit to the public. This local-government debt, and even much of the private-sector’s debt, is seen as having a government-guarantee (if the debt goes bad, government will bail the investor out). Two Chinese economists estimate that this careless top-down model of development has led to $6.8 trillion in wasted investment since 2009.

The Chinese Property Bubble

And China’s expansion of its monetary base also fueled inflation. Inflation was officially about 6 percent in 2011, though unofficial estimates went much higher. As the yuan that Chinese citizens hold has lost value year-on-year, China’s state-owned banks have capped the deposit rate for savers. This effectively subsidizes the state-owned-enterprises (SOEs) that the state-owned Chinese banks almost exclusively lend to.

In years past, the rate of inflation has outpaced the deposit rate (although inflation today is down to healthier levels), and as result the Chinese have poured their money into property, the only asset that has seemed to store value. It is commonplace for a Chinese professional, with a spouse and only one child (the one-child policy), to own as many as five or more flats or properties. This explains the existence of China’s ghost cities.

The relationship between Chinese inflation and the money supply

There Are No Bankruptcies in China

China-bulls look at the bubble and shrug. They correctly point out that the debt provincial Chinese governments, property firms, and perennially inefficient SOEs have built can be paid off by China’s massive store of capital reserves. In other words, China has enough money lying around to bail everything out.

Yet here is the flaw in the Beijing Consensus. The healthy thing for China to do would be to allow the bubble to burst, allow a serious recession to occur, and allow the yuan to rise in value according to market forces. This would fully transition China into a modern, service-based consumer economy. But China will never make a move that restores market discipline, because the necessary short-term pain and mass unemployment needed to purge the economy of its excesses would threaten the Chinese Communist Party’s grip on power.

Our slow and indecisive government limits U.S. politicans, and if America goes into recession the worst thing that can happen is that politicians get booted out of office. In China, the Communist Party official’s wealth and safety depends on preserving party power, which depends on absolutely minimal amounts of social unrest, which in turn depends on constant and steady GDP growth. All the incentives—and power—are there for Chinese officials to do everything possible to maintain the status quo, even if it means damning future growth potential.

This is why, according to The Wall Street Journal, China hasn’t had a major bankruptcy in recent years and has an irregularly low level of firms that are allowed to go bust. Local governments usually bail them out, and central government currently allows no defaults in the public bond market. One of the more entertaining examples of this attitude toward the necessary “creative destruction” of capitalism came with the government-orchestrated bailout of an investment product titled “Credit Equals Gold No. 1.”

China also seems intent on blowing up the credit bubble further, as the central bank—against its own wishes and under prodding from top party officials—cut interest rates last month and more recently cut its reserve requirement ratio for banks in an attempt to maintain liquidity (keep lending going) as investors pull cash from the Chinese economy.

The Flawed Beijing Consensus

China’s appetite for continual bailouts and economic stimulus won’t stave off an economic crisis. Rather, as Bloomberg’s William Pesek aptly pointed out, China’s reticence to allow failure will lead to a Japan-esque prolonged period of stagnant growth.

Government policy is causing investors to misallocate capital, and continual bailouts and government-guaranteed support will lead to people employing even more capital in the most inefficient manner possible. Instead of money going to a new school or hospital, or the next Apple or Google, money will pour into a failing mining firm or property firm that enjoys strong government ties, maintaining wasteful overcapacity in both sectors.

This is why the Beijing Consensus will never create Chinese prosperity. A government powerful enough to dominate the political landscape will without question intrude upon the market economy in harmful ways, no matter its economically-liberal intentions. A totalitarian government is not smarter than an American-style democracy, nor is it more capable of thinking in the long term.

Of course, American politicians do harm, but limited government restrains their power to do so. Even worse for China’s model of governance—and a frightening prospect for Communist Party officials if major unrest occurs—many Chinese officials have used their unchecked power for personal enrichment. The Beijing Consensus, or state capitalism, is just another term for the crony capitalism that invariably occurs under a big government.

The truth is that any real Chinese growth has come from the principles embodied in the Washington Consensus, not from government-owned firms. According to Nicholas Lardy’s book, “Markets Over Mao,” China’s “bamboo capitalists” (private firms), not state-owned firms, have been the source of Chinese economic growth. According to Lardy, private firms are “the major source of economic growth, the sole source of job creation and the major contributor to China’s still-growing role as a global trader.” We should hold China’s bamboo capitalists in high regard, but as long as China’s current government is in place, even the bamboo capitalist’s best efforts will not be enough to lift the nation into prosperity.

The Twenty-First Century Remains the American Century

Here’s the bottom line: China’s eventual overtaking of America is overhyped.

China’s GDP is still roughly half the size of America’s, and measures using purchasing power parity (PPP) that showed China overtaking the United States in 2014, according to Scissors and Jim Pethokoukis, resorted to a flawed measurement of economic power (if you even buy statistics from the Chinese Communist Party in the first place). Further, a decent portion of China’s measured GDP growth has been debt-fueled infrastructure projects local governments have undertaken in attempts to meet growth targets. This spuriously affects GDP measurement.

The reality is that China is far behind America. China’s top-down approach fueled by state-capitalism and one-party rule have led to bourgeoning income inequality, a disaffected population of young men, mass environmental degradation reminiscent of the Soviet Union’s environmental record (inevitable when the state owns industry and no private property rights exist), and now the possibility of falling productivity.

This is not to say that China won’t pose a geopolitical threat to Pax Americana. For example, it is highly plausible that China looks to divert attention away from a slowing economy at home by starting a scuffle with Japan over the Senkaku Islands. Yet it does mean that the place people the globe over want to be a part of, the place they would give life and limb to come to, the place driving innovation and human advancement, will still be America in the years to come.

There is an important caveat, though: China’s eventual passing of America is overhyped as long as America sticks to its founding principles.

Too many politicians in Washington, especially on the Left, seek to emulate the Beijing Consensus rather than learn from its lessons. Politicians like Sen. Elizabeth Warren and our president preach class warfare as an excuse for funneling ever more dollars through Washington. They fail to realize that this is the path to cronyism, corruption, and the destruction of middle-class wealth, not the path to prosperity.

The American model of limited representative government, free markets, and a free people fundamentally works. It has led to the greatest, most diverse nation the world has ever known. If America can stick with the Washington Consensus, the twenty-first century will be another American century.