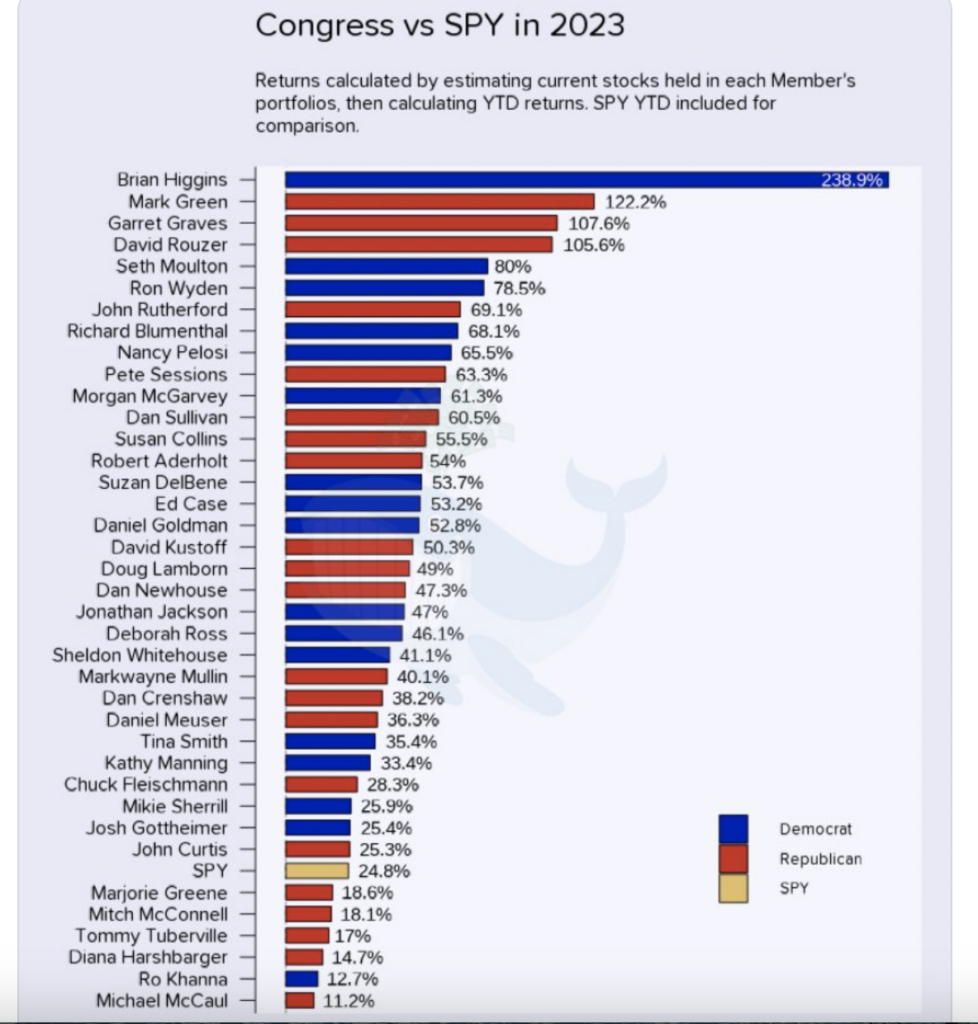

The 118th Congress traded more than $1 billion in 2023, with a third of trading members beating the fund that tracks S&P 500 growth — demonstrating once again that if you’re privy to the insider information that’s readily available to the nation’s primary legislative body, it’s not hard to beat the market.

Financial data platform Unusual Whales released a report detailing the stock purchasing and selling activity of the more than 100 members who disclosed their stock trading decisions.

Legislators have tried and failed several times to ban their peers from trading stocks, a stipulation that 86 percent of U.S. voters support. The lucrative lure of bullish and bearish ebb and flow, however, has proven too great for Congress to cut it off.

Such was the case in 2023 which, for Congress, was marked by selling more than buying.

Members technically traded less in 2023 than they did in the past few years, with close to 11,000 transactions. The number of elected members of Congress trading also declined last year, to 115.

Unusual Whales concluded that lagging participation from serial congressional traders like Rep. Nancy Pelosi, who infamously profits millions from her and her husband’s shares, was likely a campaign strategy since voters “vigorously” keep an eye on members and their trading activity.

“A general rule I’ve found is that if they’re up for re-election in 2024, then they’ve severely decreased and/or stopped their trading activity in the last year,” the report states.

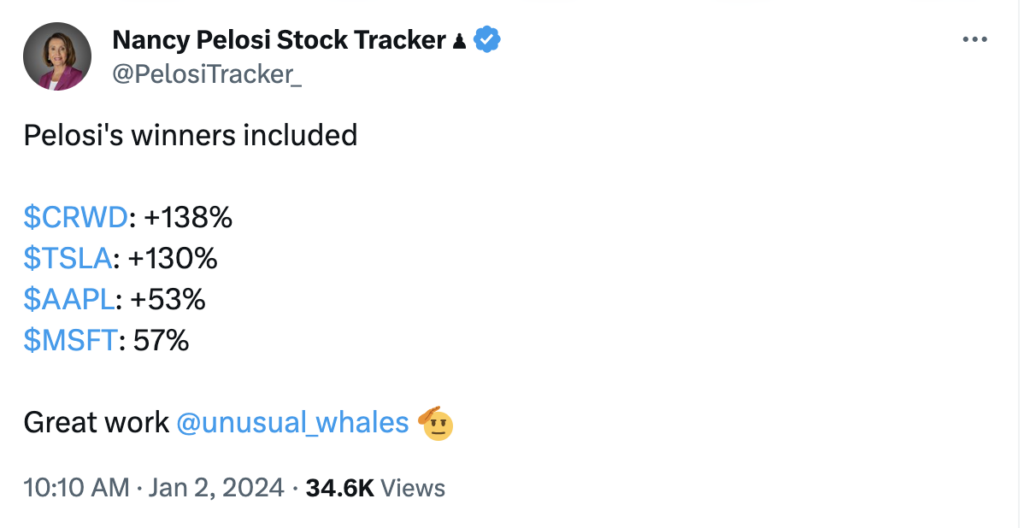

Even though Pelosi significantly reduced her share activity in 2023, she still raked in big gains from several of her favorite NASDAQ participants including Crowdstrike, Tesla, Apple, and Microsoft.

Overall, profitability on the shares that did exchange hands, including on Congress’s “many unusual trades and conflicts,” was on par with previous years.

“Many of the large portfolio gains are members who are holding unrealized gains in stocks like NVDA, or META, or other tech stocks,” the report states.

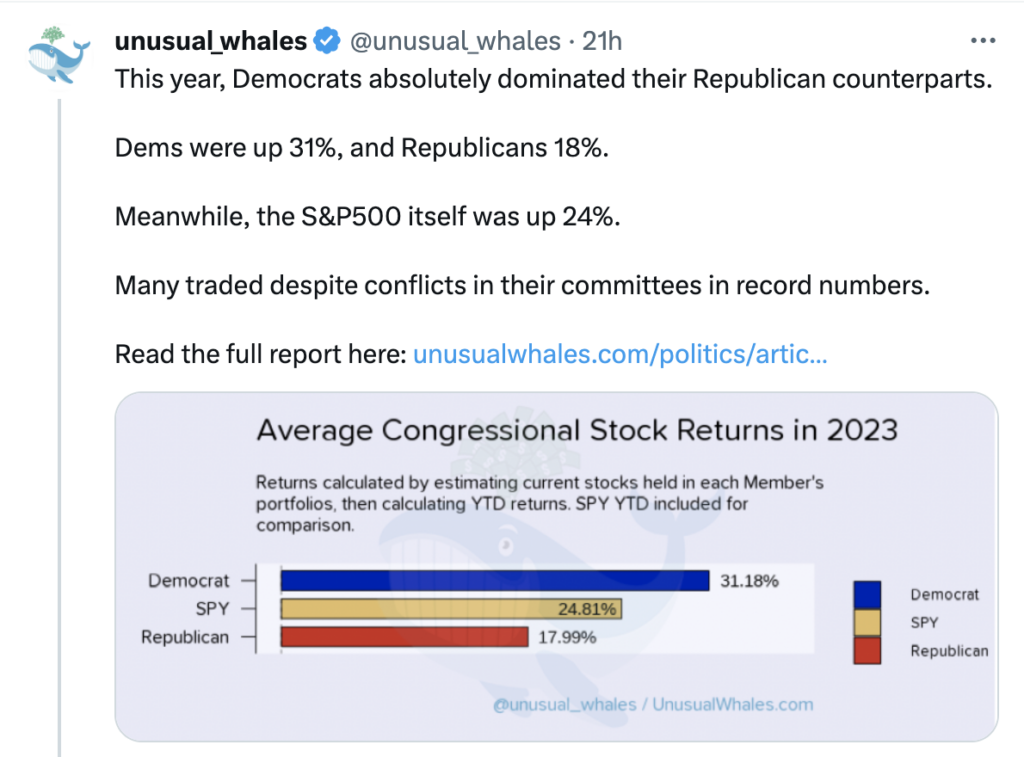

Democrats had a leg up on their Republican colleagues by what Unusual Whales called a “massive margin.” While Republican members were up 18 percent from previous years, Democrats saw a 31 percent increase in stock returns.

Some members “disclosed more stock trades than legislative votes.” Democrat Rep. Ro Khanna, who sits on the House Armed Services and House Oversight and Accountability committees, disclosed the most stock market purchases for 2023 at 1,589, and more than $25 million in stock sales.

The next highest stock trading activity came from Republican Rep. Michael McCaul, a member of the House Foreign Affairs and House Homeland Security committees, who bought more than 140 technology stocks and sold more than $42 million worth of shares in technology, health care, and other sectors.

Democrat Rep. Josh Gottheimer, who sits on the House Intelligence and House Financial Services committees, recorded 91 technology stock purchases.

In the Senate, Republicans Tommy Tuberville and Markwayne Mullin purchased dozens of stocks across multiple sectors. Tuberville also sold $1.7 million in technology stocks and $1.2 in basic material stocks. Republican Sen. Rick Scott sold another $7 million in technology stocks.

Across the political aisle, Democrat Sens. John Hickenlooper and Richard Blumenthal sold $1.7 million and $1.5 million in communication services stocks, respectively.

The committees known for regulating the health care, financial, and technology sectors also purchased and sold stocks traded in those same sectors.

In the House, members of the Oversight and Accountability and Armed Services committees purchased hundreds of stocks worth tens of millions of dollars at the same time that they held hearings and meetings about the future of the industries where they acquired shares. Similarly, members on those same committees collectively sold more than 1,000 stocks in the health care, financial, and technology sectors for more than $62 million.

In the Senate, members of the Health, Education, Labor, and Pensions Committee combined with members of the Armed Services, Veterans’ Affairs, and Agriculture, Nutrition, and Forestry committees purchased millions in healthcare, financial services, and technology stocks. They, along with members of the Environment and Public Works, Homeland Security and Governmental Affairs, Aging, and Budget committees, also sold millions of shares.

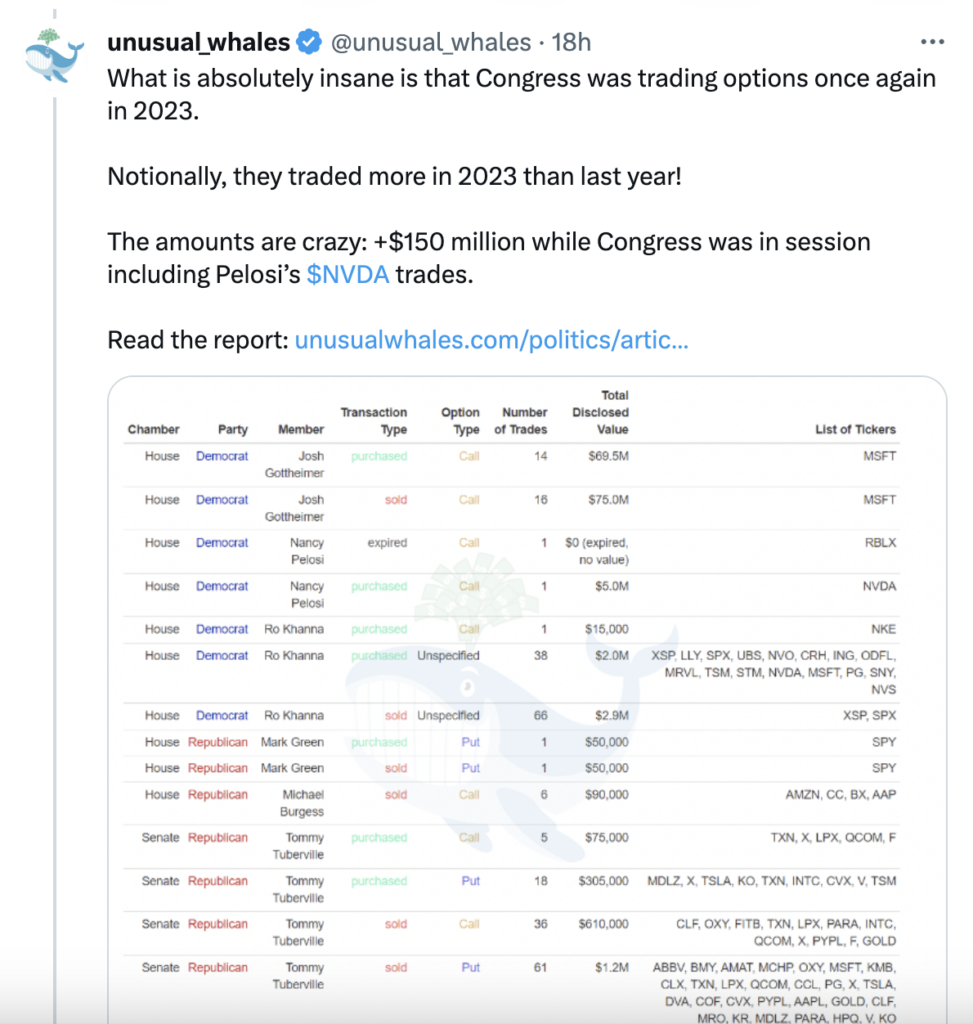

Not only did members make millions trading stocks, but they also raked in financial reward for resuming options trading.

“You read that right, Congress is once again buying leveraged positions on equities they hold. In fact, in 2023 US Congress traded more options than they did in 2022 AND 2021!” the report notes. “Some notable highlights here, Josh Gottheimer traded, and this is no exaggeration, NEARLY $150 MILLION (!!!!) of option contracts in 2023. This was often done while Congress was in session.”

The $1 billion in exchanges calculated by Unusual Whales is already a jarring number, but it may not even represent the totality of congressional trades in 2023. A significant number of elected officials in the upper and lower chambers have a history of failing to disclose their trades until they are caught.