President Joe Biden is expected to announce $10,000 of student loan “forgiveness” for low- and middle-income Americans earning less than $125,000 on Wednesday. While the move is ostensibly to give lower-income Americans a lift in Biden’s recession, a closer look at the numbers shows it will disproportionately aid those who are better off.

According to an analysis of Biden’s plan from the University of Pennsylvania out Tuesday, such a wide-ranging bailout will come with a price tag of $300-$980 billion for American taxpayers. Furthermore, the university calculated, “Between 69 and 73 percent of the debt forgiven accrues to households in the top 60 percent of the income distribution.”

The school’s conclusion is supported by prior data analyzed by the liberal Brookings Institution in 2020 as Democrats vying for the presidential nomination touted similar loan forgiveness as central to their platforms.

[FLASHBACK: Hardworking Iowa Dad Explains Why Making Taxpayers Pay Off Student Loans Is Unfair]

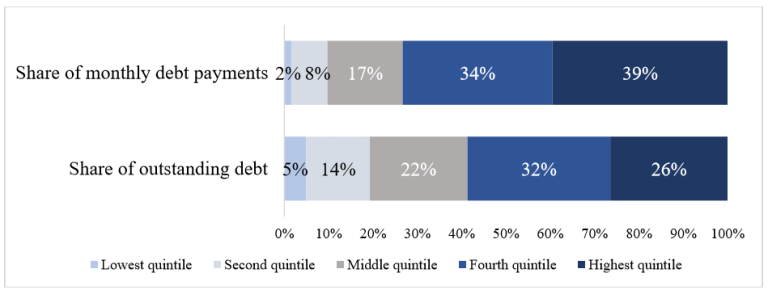

According to Brookings, “the highest-income 40 percent of households (those with incomes above $74,000) owe almost 60 percent of the outstanding education debt and make almost three-quarters of the payments.”

“The lowest-income 40 percent of households hold just under 20 percent of the outstanding debt and make only 10 percent of the payments,” the Washington D.C. think tank published along with the chart below:

Meanwhile, students who took the loans are far better equipped to pay them off than many other American taxpayers. A typical worker with a bachelor’s degree is likely to earn nearly $1 million more over their career lifetime than the same person with just a high school diploma.

“About 75 percent of student loan borrowers took loans to go to two- or four-year colleges; they account for about half of all student loan debt outstanding,” the Brookings Institute reported in January 2020. “The remaining 25 percent of borrowers went to graduate school; they account for the other half of the debt outstanding.”

At the same time, the White House’s unilateral plans are legally questionable at best. In January last year, the Department of Education released an eight-page memo stating that the agency lacks the statutory authority to “cancel, compromise, discharge, or forgive, on a blanket or mass basis, principal balances of student loans, and/or materially modify the repayment amounts or terms thereof.”

In other words, without congressional approval, Biden’s decision to wipe out a minimum of $300 billion in student debt at the stroke of a pen is unconstitutional, according to the department.