A bipartisan Senate working group has proposed paying for new infrastructure spending in part by providing $40 billion to the Internal Revenue Service. But before Congress even considers the legislation, conservatives rightly skeptical of doling out new funds and authority to the IRS should pose one simple request to the Biden administration: You want to audit other “rich” people? Why not audit yourself first, Mr. President?

While the press has largely ignored it in favor of wall-to-wall coverage of his predecessor’s tax practices, Biden’s returns raise their own set of questions. If the current president declines this offer, Congress should take the matter out of his hands, and propose an amendment to the infrastructure bill requiring the IRS to audit the last four years of tax returns for Joe and Jill Biden.

‘Aggressive’ Use of Loophole Biden Now Wants to Close

As I previously noted, from 2017 through 2020, Joe Biden and his wife Jill characterized the vast majority of their income—more than $13.6 million worth—as profits from two S-corporations rather than wages. In so doing, the Bidens avoided paying nearly $517,000 in payroll taxes that fund Medicare and Obamacare.

While Biden’s budget proposed closing the S-corporation loophole that he and his wife so recently exploited, the tactic currently remains legal—up to a point. The IRS requires that individuals using S-corporations must pay themselves “reasonable compensation” in the form of wages, on which they must pay payroll taxes.

On that count, Joe Biden’s actions in particular raise serious questions. In 2017, Biden reported total income of more than $9.6 million, yet paid payroll taxes on $145,833—only 1.45 percent of his income. His 2018 return followed a similar pattern, in which he paid payroll taxes on just under 10 percent of his more than $3 million of total income.

Earlier this year, Joe Biden cited his taxes as evidence of his ethics, claiming he instructed his accountant that “The foul line is 15 feet away from the basket. Never get me closer than 17 feet, because it really is a matter of the public trust.”

But after reviewing his returns, tax experts called his actions into question. Two years ago, an analyst at the liberal Tax Policy Center called the Bidens’ behavior “pretty aggressive,” while another tax analyst said the Bidens used the S-corporations solely to avoid paying Medicare and Obamacare taxes.

Scrutinizing the Returns

The Internal Revenue Manual does provide for mandatory audits of the president and vice president. But it only does so with respect to sitting office-holders, referencing “the individual tax returns and accounts of the President and Vice President of the United States in office at the time of filing” (emphasis added).

In other words, federal law does not require the IRS to audit the Bidens’ 2017, 2018, and 2019 tax returns, which were filed after Joe Biden left office as vice president, but before he returned to office as president. This is a convenient fact for Joe Biden, because it omits any automatic scrutiny of behavior that the Tax Policy Center raised concerns about.

Therein lies the question lawmakers should ask the Biden administration. A research organization run by the (liberal) Brookings Institution and (liberal) Urban Institute raised legitimate questions about the propriety of his conduct. If President Biden wants to audit others, why shouldn’t he demand that the IRS audit his own returns first—to put to bed any questions about his conduct—before trying to sic the agency on others?

If Biden finds questions about his tax practices too embarrassing to request an audit of his returns, Congress should settle the matter for him. Lawmakers should offer an amendment ordering the IRS to audit his 2017, 2018, and 2019 returns—and force Democrats to go on the record as favoring or opposing it. While the agency normally audits only returns for the last three years (in this case, 2018, 2019, and 2020), the IRS can go back into 2017 if it finds significant discrepancies in the Bidens’ most recent returns—or if Congress instructs it to do so.

‘Not-So Middle Class’ Joe

The left and the media (but I repeat myself) remain fixated on President Trump’s tax affairs. And courts in New York will pass judgment on the propriety of his business dealings in due season.

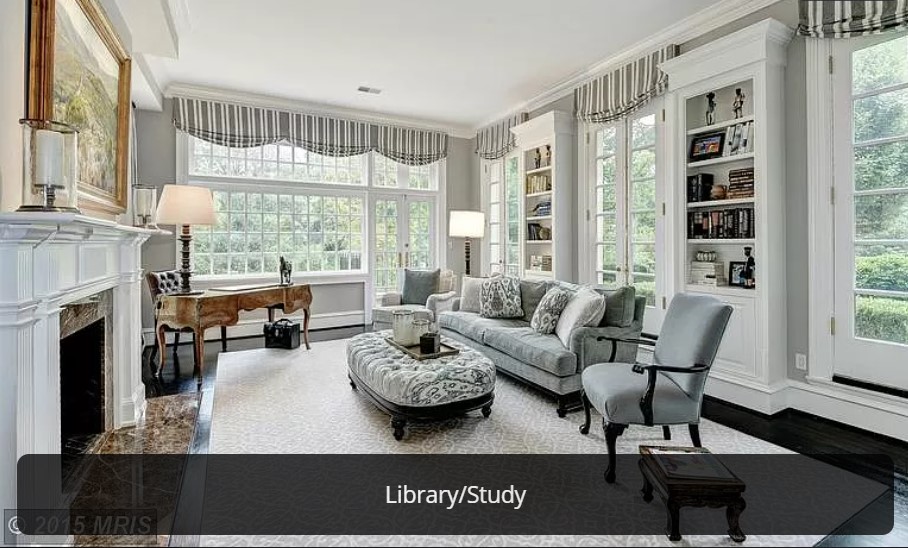

But the current occupant of the White House has far from clean hands on taxes. Recall first that Biden wants to close a loophole that he exploited mere months ago, and second that he considered renting this house outside Washington a bigger priority than paying Obamacare and Medicare taxes on all his earnings in 2017 and 2018:

For someone with this kind of checkered history to propose siccing IRS agents on others represents the height of cheek. Perhaps Joe Biden will rethink his strategy after spending some time in the barrel himself.