Would you pay $6.6 million to buy a 10-second animated video showing people walking past a giant, naked image of Donald Trump collapsed on the ground, and covered in graffiti? Probably not, right? Well, believe it or not, earlier this month, somebody did.

Welcome to the new craze in the bizarre, fast-moving world of blockchain technology: crypto art called “non-fungible tokens,” or NFTs. These digital, cryptographically secured collectibles can represent anything from music to art to sports memorabilia to memes.

Buyers don’t get copyrights or sole ownership of what they purchase. Instead, they get verification that their copy is the authentic original. And the trend is blowing up in a big way.

Remember the “Bad Luck Brian” meme? It was sold as an NFT for $36,000. Sounds like a lot of money, but it’s small beans compared to what other digital art is bringing in. A .jpg file made by the digital artist Beeple was recently sold in an online auction for nearly $70 million. Musician Grimes sold a collection of digital artworks for $6 million on Nifty Gateway, the NFT marketplace of the Winklevoss twins.

Last year, crypto art transactions totaled $250 million, and the trend is only gaining momentum in 2021. The digital art lives on a blockchain network, which is essentially a digital register that records transactions of cryptocurrencies.

There’s a big difference between NFTs and digital currencies like bitcoin, however. One bitcoin is worth exactly the same as every other bitcoin, but each NFT is unique and gains its value independently. The tokens are non-fungible, meaning each is distinct and they are not interchangeable. Think of them like digital baseball or Pokemon cards, stored in secured wallets as collectors’ items.

Traditional art collectors realize that two factors give value to pieces: rarity and authenticity, both of which have historically not been offered by digital files that can be duplicated and viewed on an indefinite number of screens for free. The rise of NFTs changes that, however, by giving the owner an incorruptible proof of ownership over the “original” piece of art through blockchain technology.

It’s not only the super-rich who are buying crypto art, either, as some tokens can sell for as little as a few dollars.

People are buying these digital assets for a number of reasons. Some are collectors of certain types of digital art, and want to display what they own to friends on social media. Some view NFTs as a way to diversify amidst inflation fears, similar to bitcoin or even precious metals. Some buy the tokens hoping to take advantage of the cryptocurrency boom and make quick returns, and some have become interested in NFTs purely for fun.

The craze has also benefitted artists, who’ve struggled to make money on digital images, videos, and music in the past, where content is easily copied and stolen. Artists, musicians, and even sports franchises now have the advantage of offering authentic copies of digital media through encrypted signatures.

Furthermore, creators can keep making money off their digital goods long after they have been sold. NFTs let artists take a percentage of all future sales of the work. On Nifty Gateway, for example, the cut is usually 10 percent.

The increased momentum for NFTs comes as bitcoin, Ethereum, and other cryptocurrencies have seen record-breaking rallies, in large part due to fears of mounting inflation. Bitcoin hit a high of $58,000 shortly after the passage of President Joe Biden’s $1.9 trillion stimulus package that will largely be funded by debt and money printing. Still, it is hard to predict the future for crypto art, which some have criticized as being a vehicle for speculation since the dollar value of tokens arguably does not correlate with their artistic value.

In several ways, COVID-19 has fueled the growth of crypto art — most in-person art galleries have been shut down for nearly a year, and people are bored at home. Meanwhile, as the economy rebounds and federal handouts are injecting cash into bank accounts, there are fears that the NFT mania is merely a bubble that will burst if there’s an economic downturn in the future.

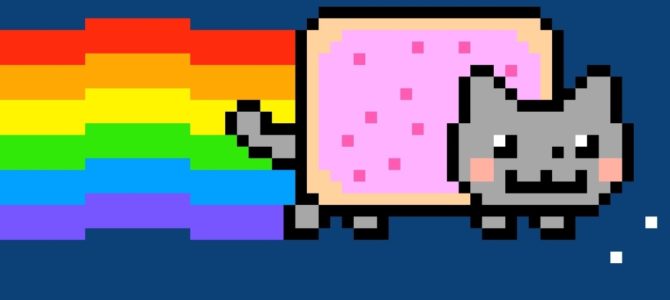

But for now, at least, NFTs are on the rise as people are increasingly attracted to a form of collecting that blends art, humor, investing, and elements of gambling. You may have assumed you would never live to see the day that an animated video of a flying cat with a Pop-Tart for a torso, flying through space, would sell for almost $600,000. But it wouldn’t be the weirdest thing to happen during the last year.