This year marks the 50th anniversary of the “War on Poverty” (announced in January of 1964) and the “Great Society” (announced 50 years ago yesterday). These were America’s two great experiments in using the power of the federal government to transform and radically improve the country. Fifty years and some 15 or 20 trillion dollars—depending on how you count—is a pretty good test and plenty of time to conclude that it has failed.

As I have argued elsewhere, the result of the War on Poverty has been to ameliorate some of the effects of poverty, but not to ameliorate poverty itself. In other words, the result has been to “make the poor more secure in their poverty,” which is precisely what LBJ promised not to do. As I pointed out more recently, LBJ’s claim that this would lead to a Great Society of elevated spiritual refinement is—well, let’s say it is even more preposterous now than it was when it first emerged from the lips of a foul-mouthed political opportunist.

It seems beyond the point to rehash these old arguments, precisely because it has been so long and the results are so clear. If the War on Poverty were going to end poverty and its pathologies, it would have done so already. Since it didn’t, it’s time to move on to something else. For the political right, this means moving on from criticizing the Great Society programs and tackling for ourselves, based on our own principles and our own observations of economic reality, the question of how we can help make it possible for more people to pull themselves up out of poverty and into the middle class, and from the middle class to wealth.

We need to do it because the left has pretty much given up. They are too committed to a reactionary defense of their 50-year-old failures, or they are too busy working themselves up into a frenzy of envy aimed at anyone who is richer than they are. It is telling that in Thomas Piketty’s blockbuster book on inequality, his one big proposal is a wealth tax meant to cut down the people at the top—not any program to lift up the people at the bottom.

Is it strange that pro-capitalists and individualists—even hard-core Ayn Rand fans like myself—should take up the mantle of fighting poverty? Only if you accept the cartoon caricature of the pro-capitalist as a lackey of top-hat-and-monocle-wearing plutocrats. Which is to say, if you subscribe to the New York Times. In reality, advocates of capitalism are advocates for the self-made man, for the person who rises up through talent and hard work. (As for Ayn Rand, the ultimate worshipper of the self-made man, notice that at least half of her heroes came from poverty or endure poverty at some point during the course of her novels, while most of her villains are rich. But clearing up those misconceptions is a topic for another day.) We love stories of people who start from modest beginnings and create enormously productive businesses—and we want everyone to be able to do the same thing on some scale. That is what capitalism is all about.

Of course people aren’t going to have equal outcomes. People have unequal abilities, come up with unequal ideas (one guy comes up with Amazon, another with Pets.com), and make different decisions about what they want out of life, choosing to go into more or less lucrative fields of work. But unless you have a pathological obsession with comparing your income to that of others (paging Professor Krugman…), the only thing that really matters is that you are free to rise by your own effort, to climb up the ladder of economic advancement.

So what are the rungs of the ladder? How do individuals actually climb from poverty to prosperity?

This is an enormous topic and what I offer below is just a first pass, an overview of a vast territory.

The first things I am going to list are not broad social conditions or government programs, but actions taken by individuals, because that is the biggest truth we need to grasp about climbing the ladder. You can’t just be pulled up by others. If you don’t act through your own effort and initiative, you will get nowhere. Or to put it differently, the progress from poverty to prosperity is precisely the progress from dependence to self-reliance.

That is confirmed by the first rung of the ladder.

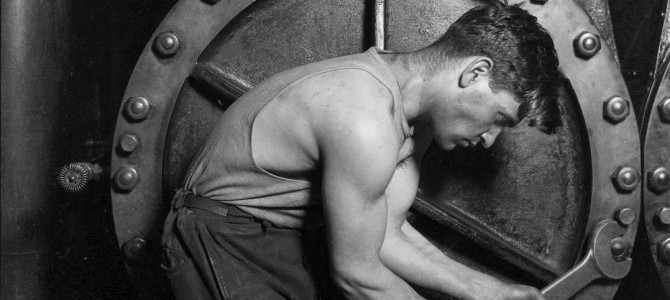

1) Work

This is a matter of common sense—work is how we make money, after all—so it’s no surprise that the statistics are utterly unambiguous on this one. As Derek Thompson points out, the problem of poverty is not about low wages, it’s about no wages. “In households with at least one fully employed person, the poverty rate just 4.6 percent—two-thirds below the national average. The poverty rate among all full-time workers is even lower, at 2.9 percent—scarcely a fifth of the national figure.” For those who don’t work, the poverty rate is 33%. The only surprise is that it isn’t higher. (Presumably the other two thirds are living on government support or are dependent on a family member.)

The solution may seem like a no-brainer, then: get people to work. Yet a whole network of government programs is designed to reduce and discourage employment.

The centerpiece of the left’s current campaign, for example, is an increase in the minimum wage. But if work is more important for getting people out of poverty than higher wages, jacking up the minimum wage is exactly the wrong solution: it improves the condition of those who are already working, while ensuring that there will be fewer of them.

Let’s put it this way: the minimum wage ensures that you will be able to have a more intelligent conversation with your barista at Starbucks, because if Starbucks has to pay higher wages, by golly they might as well pick up some of the next batch of unemployed college graduates, while leaving uneducated, unskilled workers behind.

Then there is the disturbing increase in those on Social Security disability, often as the next step after using up all of the extensions for long-term unemployment benefits. The longer someone is out of the job market, the less the chance he will ever get back in. So the worst thing you can do is to encourage someone to leave the job market for a long period of time. Yet we have whole programs designed expressly for this purpose.

That’s not to mention the effect of the welfare state on the incentive to work. If you get a job and slowly become self-reliant when you could have been collecting government benefits, then in effect, you don’t get paid your hourly wage. You get paid the difference between your hourly wage and what you would get if you sat at home and did nothing. For those on the bottom rung of the ladder, that difference often isn’t very much, which makes the initial reward for working much smaller.

This has a devastating impact because aside from the income itself, even the lowest minimum-wage job usually teaches skills that help make workers more employable in the future. A teenager’s first summer job helps him learn how to show up on time and manage a work schedule. He learns how to listen to and execute instructions, how to deal with coworkers and customers, how to dress in an appropriate way, and whole set of other basic skills. All of these things will make it easier for him to rise up in his current job or get another job later on. But that’s assuming he gets that first job, and high youth unemployment, particularly among minority youth, is one of the most devastating effects of the Obama economy on the future prospects of millions of young people.

Yes, it is difficult to live on the minimum wage, much less to support a family on it. That’s why work itself is only the first rung of the ladder.

2) Education

If you want to make more than the minimum wage, and if you want to outrun the ability of machines to take over your job, then you will need to make your labor more productive, which means acquiring new skills. This can mean simply working your way up at your job—going from sweeper at the quickie mart to cashier to manager, which is how a lot of people do it. But by far the most effective way to increase your pay and your prospects is through education.

That can mean technical education that qualifies you to become a skilled tradesman or office worker. Or it can mean a college education that gives you a credential (if nothing else) that opens up a whole range of white-collar jobs. The figures on this are also unambiguous. At every level, from high school to college to advanced degrees, those with more education enjoy a much higher median income and a relatively low unemployment rate. For the college educated, these are not exactly boom times, but it hasn’t been that much of a recession, either.

Education is one of the most spectacular failures of big government, which has squandered enormous, ever-growing sums and only seems to do a worse job. That’s true of public high schools, where every few years we are promised another scheme by which bureaucrats in Washington, DC, are really going to fix things this time around, and somehow they never do.

But in direct economic terms, the biggest disaster is probably the spiraling cost of higher education. As I have argued elsewhere, it is precisely the decades of increasing government subsidies to higher education that have made it less affordable. Some time ago, we passed the key dividing line: you can no longer work your way through college. Driven upward by government subsidies, the expense of tuition has moved beyond what a young person can make working full time at a menial job.

That was an important rung up the ladder for the ambitious kid trying to rise out of poverty. He might not have any money, but as long as he worked hard and had a good head on his shoulders, he could work his way through school and get his ticket to join the middle class. These days, it might still be possible to get through college with student loans—but that just means that young people from modest backgrounds start out their working lives in the hole, crawling out from under a burden of debt.

Purely from the perspective of helping young people rise out of poverty, this has been a colossal failure.

3) Marriage

Let’s go back to the figures cited by Derek Thompson. If poverty is caused by not working, one of the biggest causes of not working is being a single parent—which usually means being a single mother. The demands of a full-time job and the demands of raising children tend to be incompatible, particularly in the early years. Extended family can help fill the gap; what would we do without grandma and grandpa? But the best way to raise children is to have a parent who works full time while another stays home or works part-time, or to have two working parents with enough flexibility in their hours that they can cover the needs of their children between the two of them. It’s not easy, not even at higher levels of income, but it works.

Speaking of unambiguous numbers, Willis Krumholz runs down all the statistics showing how much more likely you are to be poor if you live in a household without a father.

Yet we get the cultural left offering spectacularly bad advice on this, telling women that they’re better off without the no-good blue collar fathers of their children. Aside from being horrendously patronizing (one detects a certain distaste for blue-collar men), this is totally wrong-headed. In fact, young women are better off having children only when they know there will be two parents responsible enough to care for them.

Aside from the cultural collapse of marriage as an institution, there is a whole host of ways that government penalizes or discourages marriage, not least by creating the illusion that government itself can stand in the place of a husband and father.

Each of these steps out of poverty has a generational impact, by the way. If one of your parents worked, if that was the example you grew up with and the values you learned, then you are more likely to work and less likely to be poor. If your parents went to college, you are more likely to go to college. If your parents were married, then you are more likely to get and stay married and less likely to be poor—and so on for your own children. This is a kind of cultural capital that builds up over time.

But there’s also a lot to be said for good old-fashioned monetary capital, which leads us to the next rung.

4) Saving

Savings provide a cushion against setbacks and provide the capital that makes it possible to climb some of the other rungs: saving for education, or to buy a house, or to start a business.

The left’s intellectual hero of the moment is the French economic Thomas Piketty, whose arguments about inequality have been boiled down into a simple formula: r > g, where “r” is the rate of return on capital, and “g” is the overall growth of the economy, which stands in for the growth of wage and salaries. In Piketty’s telling, this is why the rich are just going to keep pulling away from everyone else: the rate at which they can grow their wealth is inherently faster than the rate at which the rest of us can increase our income. His solution is a massive tax meant to grab a bunch of money from the “r” people and presumably pour it into government programs aimed at “g” people.

The much more sensible conclusion is that if we want people to get ahead, we should encourage them to get some “r” of their own. We should encourage saving and try to make everyone into capitalists. In short, Thomas Piketty inadvertently makes the case for privatizing Social Security.

Social Security is already implicitly means-tested so that it is a better deal for the poor and a really bad deal for the middle class. So its main function is to suppress wealth-creation among the middle class, making it harder for them to climb the ladder to join the wealthy (which is precisely the result Piketty is complaining about). But the cruelest part of Social Security for both the poor and the middle class is that it dies with you. This hits the poor and minorities hardest, because they tend to live less healthy lifestyles and have less access to top-quality medical care, so they die younger. Savings collected over forty years of working life, even at a modest rate, are an asset that is owned by the individual and can be left to the kids, giving them a leg up. But Social Security is not savings and it is not an asset. It is a claim on government handouts, and that claim ceases to exist when you do, leaving nothing for the next generation.

And then some leftist who has vigorously opposed any change to Social Security comes along to complain about inequality between the poor and the rich.

You know what else is an asset that can be left to the next generation? Your home. Which leads us to the next rung on the ladder.

5) Homeownership

Buying a home is an important form of savings. Owning a home free and clear and not having to worry about making the rent every month is an important source of economic stability for the elderly, and its also a very substantial asset that can be handed down to one’s children.

There has been an effort recently to argue that homeownership isn’t really a good investment, and certainly a speculative investment in housing is risky. But as Megan McArdle points out, these arguments depend on the assumption that instead of putting money into their homes, people will put it into the stock market and invest it wisely there—assumptions that are dubious. There’s also another factor ignored in most of these analyses. For those who have no capital but plenty of their own labor, one of the best investments they can make is to build “sweat equity” in their homes by working on do-it-yourself improvements. It’s a point that tends to elude urban, white-collar finance geeks.

But leave it to the government to turn housing from a form of savings into an engine of debt. The federal government’s “affordable housing” policies had much the same effect as the Paradox of Subsidies in higher education: inflating housing prices and encouraging people to take on more and more debt, with less and less equity, in what became a speculative investment.

That’s why I put “homeownership” on this list after “savings,” because buying a house is only a rung on the ladder if it represents saving rather than debt.

Oh, and I mentioned student loans, right? Because they are preventing millennials from buying homes, ensuring that they will come late to the process of building capital.

6) Entrepreneurship

There are many stories of people who have risen out of poverty to great wealth by seeing a new opportunity and starting their own business.

The more mundane reality is that for many, the road from poverty to the middle class lies in starting and running a business. A small investment in initial capital—a beat-up old moving van, a set of cleaning supplies—coupled with a lot of hard and unglamorous work can turn into a small business that pays the bills and sends the kids to college.

On all levels, entrepreneurship remains one of the great engines of upward economic mobility. I smiled when reading recently, in a commentary on Thomas Piketty’s book, that there is no way in today’s economy a college dropout could rise to be CEO of General Electric. Maybe not, but one of them can start up a company in his garage that becomes (for a while, at least) more valuable than General Electric (as well as a whole lot of other things). Or he can go from poor immigrant on food stamps to billionaire.

Check out a great list of billionaires who started out poor, and note how their stories keep repeating the rungs of the ladder: they worked at menial jobs starting at a young age, put themselves through school with a combination of work and scholarships, and set aside savings to start their own businesses. No, I’m not saying everyone can become a billionaire, but by climbing the rungs of the ladder, they can end up better off than when they started.

But the government does plenty to discourage entrepreneurship, through things as small as unnecessary and burdensome occupational licensing, through a tangled web of business regulation, and through progressive taxation, in which taxes on “millionaires and billionaires” kick in basically at the first point that you begin to rise into the upper middle class, giving you a steep hill to climb if you want to put aside enough savings and investment to actually become a millionaire.

Needless to say, the folks who lecture entrepreneurs that “you didn’t build that” are unlikely to create the kind of conditions in which they can, in fact, build it.

This is a broad overview of the steps that individuals take to rise up through their own effort—and they indicate some of the ways we can change our culture and the policies of our government to make it easier to climb the rungs of the ladder.

We need economic freedom: fewer regulations to tangle entrepreneurs and small businesses and lower taxes to allow people to devote more of their money to savings. We need a policy of economic growth. Half the battle of achieving growth is actually wanting it, as opposed to subordinating growth to the agenda of anti-industrial pressure groups like the environmentalists. One of the fastest-growing industries right now is fracking for natural gas, but it is treated by the administration as a scourge to be suppressed because it doesn’t fit with their “green” agenda.

Above all else, helping the poor to advance requires that we promote what you might call the “middle class values” of self-reliance, personal responsibility, individual initiative, and the ambition to make something of yourself. These middle class values include a lot of things that successful, educated upper-middle-class people already do, but which they refuse to advocate to others for fear of being seen as cold-hearted conservative scolds or blue-nosed religious zealots. They would like to help the poor, really they would, just so long as they don’t have to risk getting made fun of by Jon Stewart. It’s time for them to get over it and own up to the hypocrisy of living by a code they know is good for them, but pretending that it isn’t good for anyone else.

Identifying the rungs of the ladder, advocating for them, and clearing away government obstacles is the basis for a true anti-poverty program, and one with quite a good track record: America’s history is proof that the best war on poverty is capitalism. This is also a program big enough to serve as the centerpiece for the agenda of a major American political party, which is precisely the task I think Republicans should take up.

As I pointed out above, the Democrats have effectively dropped the issue, and there will be rewards for a party that can convincingly pick it up. Then there’s the minor fact that we can do a lot of good for the country, and improve the lives of millions of individuals, by putting America back on track for the actual conquest of poverty. Maybe it will even make us a great society.

Follow Robert on Twitter.