Two weeks ago, I described how provisions in a budget bill that the District of Columbia Council quietly passed would extend the reach of government-controlled health care in the nation’s capital. The provisions buried in that budget bill would not only reimpose the health insurance mandate penalty within the District of Columbia that Congress set to zero beginning in January, but would go further, by allowing DC authorities to place liens on, seize, and sell the property of individuals who cannot afford to pay the mandate tax.

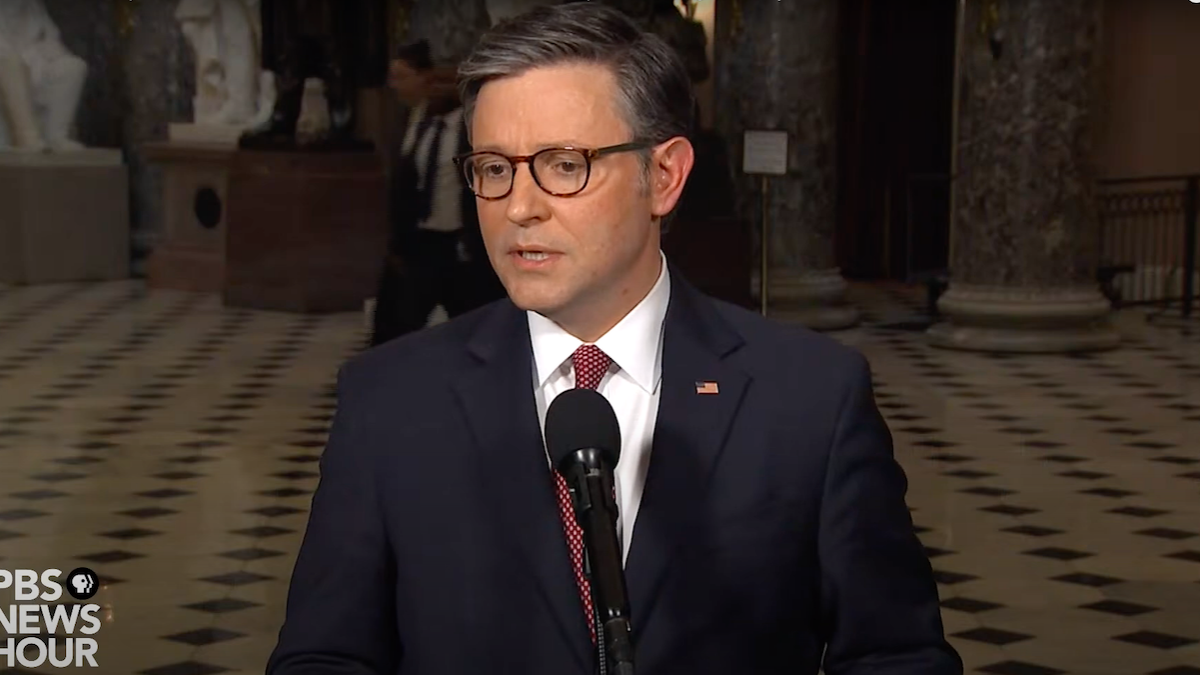

Thankfully, my post had its intended effect in raising awareness of the issue among federal policy-makers. The office of Rep. Gary Palmer (R-AL) responded, introducing an amendment to appropriations legislation that the House of Representatives will consider this week.

If enacted into law, the Palmer amendment would prohibit any funds provided in the bill—which includes the District of Columbia’s annual budget—from being used to implement the new health insurance mandate. By defunding the mandate, the Palmer amendment would effectively prohibit this tax increase, to say nothing of the threat of property seizures, from affecting residents of the nation’s capital.

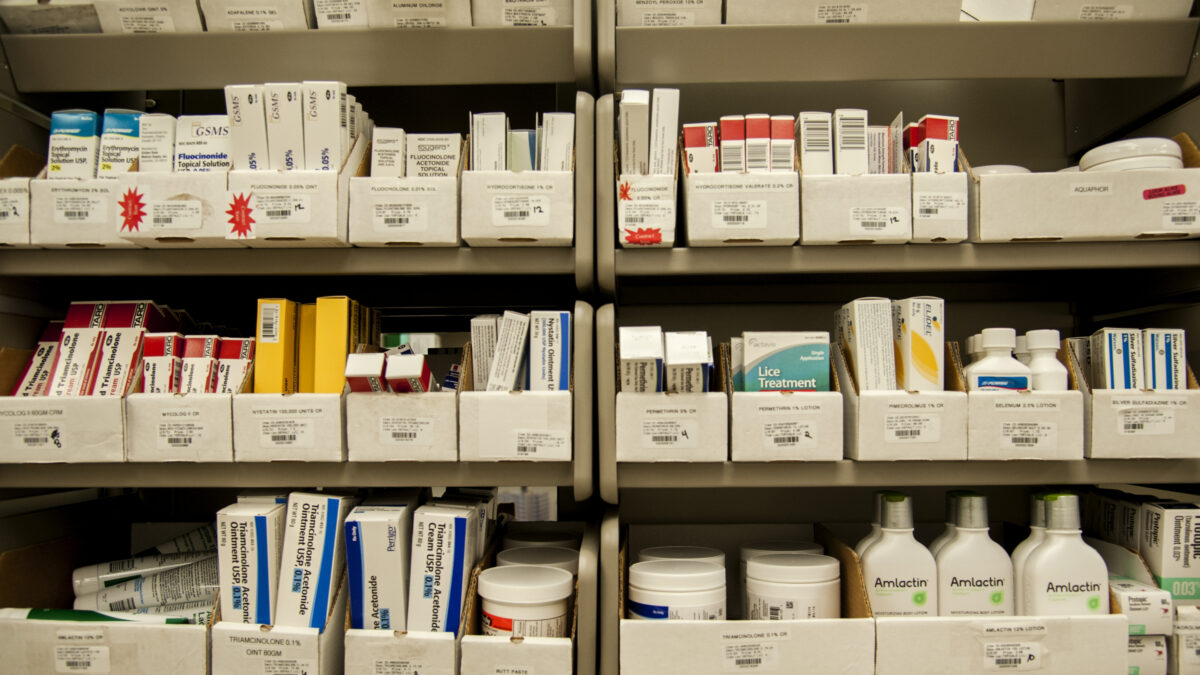

Prevents Affordable Options from Qualifying

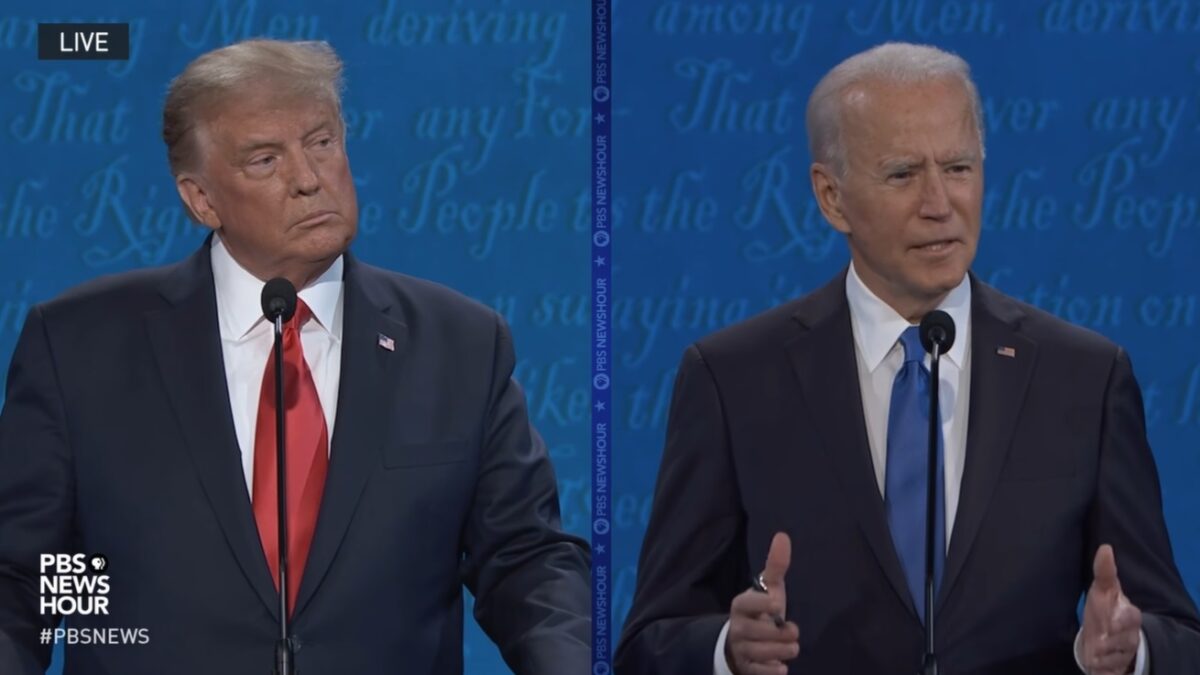

The Palmer amendment would also allow individuals to purchase the type of health coverage they desire without getting hit with a “stealth” tax bill after-the-fact. If the District’s law goes into effect in January, individuals buying the new, more affordable coverage options proposed by the Trump administration could face exactly that.

The mandate the DC Council approved (see pages 168-82 here) effectively re-imposes on the District Obamacare’s individual mandate as it existed last December 15—the date the congressional conferees on the tax bill filed their conference report (i.e., before legislation setting the federal mandate penalty to zero was signed into law). By linking the District’s mandate to the policies and regulations in place as of last December 15, the DC mandate also prevents the new options the Trump administration is introducing from qualifying as “minimum essential coverage” for purposes of complying with the mandate.

For instance, the DC law defines “minimum essential coverage” as “minimum essential coverage as defined by section 5000A of the [federal] Internal Revenue Code of 1986 and its implementing regulations, as that section and its implementing regulations were in effect on December 15, 2017.” It further specifies that “minimum essential coverage” shall include:

Health coverage provided under a multiple employer welfare arrangement; provided that the multiple employer welfare arrangement provided coverage in the District on December 15, 2017, or complies with federal law and regulations applicable to multiple employer welfare arrangements that were in place as of December 15, 2017.

This language effectively prohibits coverage under the Trump administration’s new association health plans, which the administration first proposed in the Federal Register edition of January 5, 2018, from qualifying under the District’s health insurance mandate. Individuals who purchase such plans would face a tax penalty the following year, unless they also purchased other qualifying coverage (an unlikely scenario).

Locks Out Short-Term Coverage, Too

The District’s statute also would exclude short-term health plans from qualifying as “minimum essential coverage” for purposes of its health insurance mandate. Obamacare itself defined “minimum essential coverage” to include “coverage under a health plan offered in the individual market within a state.” But because another portion of federal law says “‘individual health insurance coverage’ means health insurance coverage offered to individuals in the individual market, but does not include short-term limited duration insurance,” short-term plans would not qualify.

Obamacare did give the secretary of Health and Human Services, along with the secretary of the Treasury, discretion in determining other forms of “minimum essential coverage” for purposes of the federal mandate. However, because the District linked its mandate to those federal definitions in effect as of December 15, 2017—well before the Trump administration first proposed its changes to the regulation of short-term plans on February 20, 2018—short-term plans would not qualify as acceptable coverage under the District’s mandate.

District residents who purchase short-term plans, like those who access the expanded association health plans, would not comply with the new coverage requirements. Particularly given the very quiet way the DC Council enacted the legislation, many individuals may not know that the District re-imposed a health insurance mandate or that certain types of coverage do not comply with it, and face an unpleasant tax “surprise” in the spring of 2020 (as they file their DC tax returns for 2019). Unless, of course, Congress enacts the Palmer amendment into law.

Congress’s Constitutional Duty

As Congress debates the Palmer amendment this week, expect all manner of self-righteous indignation from DC officials over the federal legislature interfering in the District’s affairs. Such complaints of course ignore the fact that the Constitution places sovereignty over the nation’s capital squarely within the federal purview.

Moreover, it also belies the fact that DC officials made little attempt—one could argue purposefully made little attempt—to publicize the council’s deliberations over this change. I e-mailed three people in Mayor Muriel Bowser’s press office about the council’s actions two weeks ago, and still have yet to receive so much as an acknowledgement.

Bowser can argue all she wants about “Taxation without Representation,” but given that her office made zero attempt to represent me, she has little right to complain. The House should pass the Palmer amendment this week, and prevent the strong-arm tactics associated with government-controlled health care from taking root in the nation’s capital.