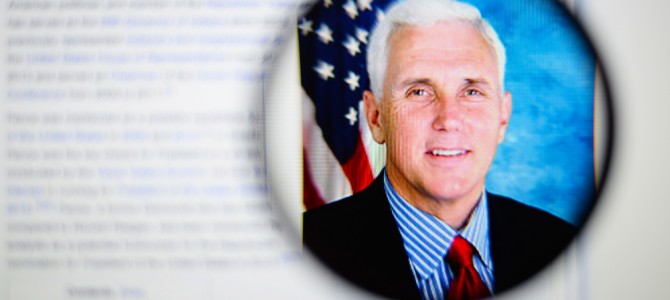

On Tuesday, Indiana Gov. Mike Pence joined a growing number of state GOP leaders in the misconception that it’s possible to expand Medicaid in a “conservative” way under Obamacare. Pence announced federal approval of his expansion plan and proclaimed it to be both conservative and innovative, a “proven model” for “consumer-driven” Medicaid reform.

Alas, just because a Republican governor says a policy is conservative does not make it so. A close look at Pence’s plan reveals what is perhaps the worst of all the Republican Medicaid expansion “alternatives” to date.

The Pence plan is called HIP 2.0 because it ratchets up the Healthy Indiana Plan, a waiver program from 2008 that expanded Medicaid eligibility to 200 percent of the federal poverty level (about $44,000 a year for a family of four, at the time) and offered a limited health benefits with a health savings account, much like the high-deductible, “consumer-driver” plans available on the private market. Enrollees had to meet a $1,100 deductible—mostly funded with Medicaid dollars—before coverage kicked in, and they had to contribute monthly to their health savings account based on income: no more than 2 percent of income for those below the poverty line. If you stopped contributing, you were kicked out of the program for a year, and enrollment was capped based on available funding.

The idea was that injecting Medicaid with elements of a consumer-driven plan would encourage Medicaid patients to act more like consumers—pay attention to costs, only use the emergency Room for emergencies, keep their appointments. By giving enrollees “skin in the game,” they would transition from being passive recipients of welfare to cost-conscious consumers of healthcare.

Expanding Welfare for Able-Bodied Adults

That’s a fine idea in theory, but it formed the template for the new HIP 2.0, which goes far beyond what the original waiver envisioned. It dragoons the entire non-disabled Medicaid population into the expansion scheme, not just those above the poverty line, and offers them a choice between a HIP Basic and a HIP Plus plan (some can also choose a plan that supplements employer coverage, a long-standing feature of traditional Medicaid), both of which feature a health savings account with a $2,500 deductible funded almost entirely by taxpayers.

The basic plan essentially requires nothing of enrollees. They get a health savings account and can either pay into it or not—the state will still cover the entire cost of the deductible and copayments will be limited to 5 percent of income, as they are for all Medicaid programs everywhere.

The HIP Plus plan includes vision and dental coverage, comprehensive prescription drug coverage, and requires no cost-sharing as long as enrollees keep up with monthly contributions to their account, which range from $3 to $25 a month. If an enrollee stops paying into the account, they won’t be kicked out of the program but simply get put on the basic plan.

HIP 2.0 Turns Medicaid Into an Irresistible Poverty Trap

Without delving into every last detail (which you can do here if you like), suffice to say that this is perhaps the most generous Medicaid expansion yet from any state, red or blue—and that’s precisely why it’s the worst. Not because we should punish the poor with sub-par coverage, but because Medicaid should be a last resort—especially for able-bodied, working-age adults. HIP 2.0 turns Medicaid into an irresistible poverty trap.

Conservatives often complain that welfare—Medicaid included—tends to trap the poor in a cycle of dependence on government largesse for the simple reason that all means-tested welfare programs come with strong disincentives for beneficiaries to increase their income. If your pay increases beyond a certain point, you lose taxpayer-funded benefits, which are almost always worth more than a slight bump in pay. Policy wonks call this an “income cliff,” and Pence’s plan has the highest one yet for the Medicaid expansion population.

Consider than under Pence’s plan, a Hoosier earning $16,104 (or 138 percent of the federal poverty level, the income limit for Medicaid expansion under Obamacare) will pay a maximum of $322 a year for very generous HIP 2.0 coverage with no other out-of-pocket costs. If this person’s income increases at all, he loses his HIP account and will be forced to buy coverage on the Obamacare exchange, where his healthcare costs will skyrocket to nearly $2,800 a year in deductibles and copays for the benchmark silver plan.

Faced with such a choice, who would ever choose to earn more? In his statement, Pence said his goal is “to ensure that low-income Hoosiers have access to a health care plan that empowers them to take charge of their health and prepares them to move to private insurance as they improve their lives.” Yet the incentives built into his Medicaid scheme almost guarantee that poor Hoosiers will never opt to move to private insurance. They will instead become permanent dependents of Indiana’s expanding welfare system.

Back in 2008, then-Gov. Mitch Daniels paid for the first iteration of Medicaid expansion with a 126 percent tax hike on cigarettes. Eventually, Pence will have to tap Indiana taxpayers to fund his more extreme version of Medicaid expansion—especially when new enrollees realize they have no reason ever to leave the program.