President Joe Biden campaigned in swing-state Wisconsin on Monday to sell his latest student loan bailout program, a multibillion-dollar election-year bribe that delivers a shaky middle finger to the Supreme Court.

Not surprisingly, the Democrat’s friends in the accomplice media regurgitated White House talking points on Biden’s Plan B loan- and interest-forgiveness initiative without mentioning the cost to federal debt-burdened U.S. taxpayers.

According to Wisconsin Public Radio:

Under the proposal, debt would be canceled for people already eligible for certain federal student loan forgiveness programs. It would also cancel debt for anyone who began repaying their undergraduate loans more than 20 years ago, or graduate loans more than 25 years ago…

According to a press release, the plan would eliminate all accrued interest for 23 million people and cancel out debt for 4 million people.

The federally subsidized public radio outlet didn’t bother with details like the price tag to taxpayers. Neither did the Milwaukee Journal Sentinel in its promotional piece for Biden’s new bailout. At least The New York Times, while performing its role of Biden administration water carrier, acknowledged, “Officials did not say how much the new plan would cost in coming years, but critics have said it could increase inflation and add to the federal debt by billions of dollars.”

How could it not? The New York Post estimated Biden’s latest bribe could rival his last failed student debt forgiveness program, a $400 billion-plus unconstitutional behemoth.

Who is going to pay to shrink student loan debt for 23 million borrowers? The complete bailout of 4 million Americans? Debt buyouts of $5,000 or better for 10 million college loan debt holders (More than $50 billion on that account alone)?

Taxpayers. Taxpayers with student loan debt. Taxpayers without student loan debt. Taxpayers of all kinds, particularly future taxpayers. Because unless Biden and Congress suddenly wake up and begin wholesale cutting government programs to deal with a $34.6 trillion U.S. debt — and rapidly rising — this borrower forgiveness plan will be borne by today’s consumers and future generations.

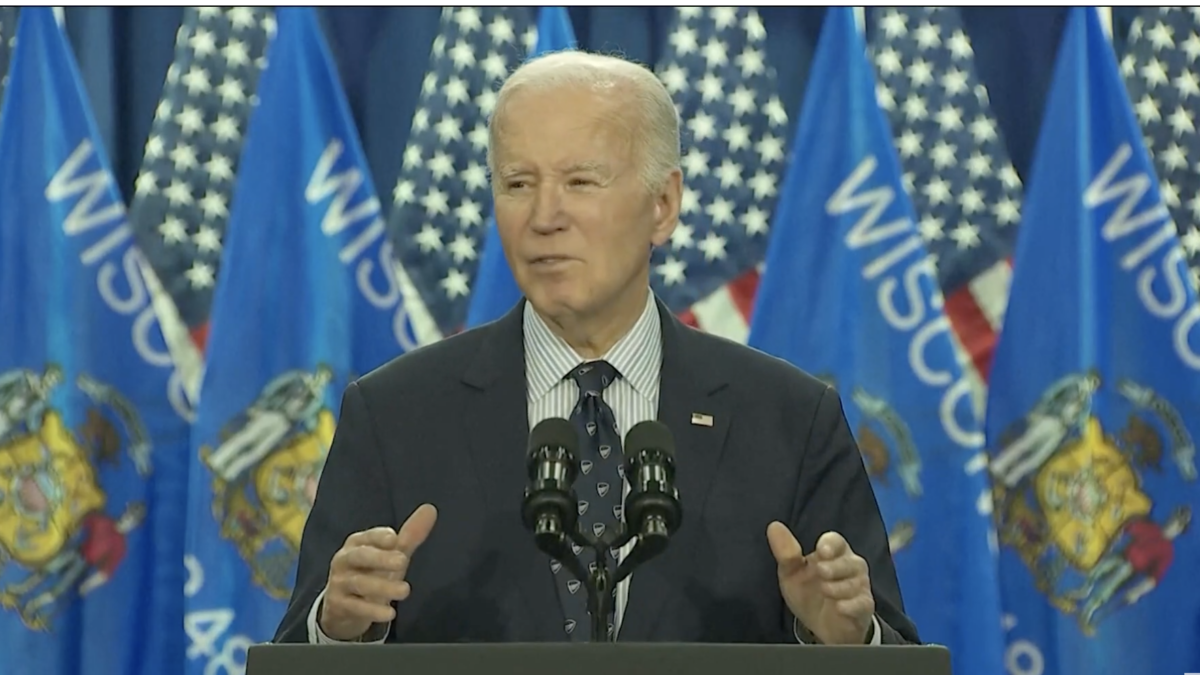

“We’re giving people a chance to make it,” Biden told an assemblage of liberals gathered in a gymnasium at Madison Area Technical College in Wisconsin’s capital city. The Democrat will need to roll up huge vote totals again in the big-government city and left-heavy Dane County if he wants to win Wisconsin, a critical battleground he won by a razor-thin margin in 2020.

“Today, too many Americans — especially young people — are saddled with unsustainable debts in exchange for college,” Biden said in a 15-minute mumbling speech as a historic solar eclipse darkened wide swaths of the nation’s skies. An ominous sign?

‘Presidential Do-Over’

You didn’t need special glasses to see that Biden’s bailout, coming less than seven months before the presidential election, is designed to help bailout the octogenarian’s slumping poll numbers.

The most recent RealClearPolitics average of polls shows Biden and former President Donald Trump in a dead heat nationally. But Trump leads Biden in six of the seven swing states, which have a significant say over who will occupy the White House next year, according to a Wall Street Journal poll. Biden leads only in Wisconsin, by 3 percentage points, according to the poll. Trump leads by as much as 8 points in North Carolina, and as few as 2 points in Michigan.

“Biden wants to use your tax dollars to buy votes because more and more young people are supporting President Trump,” Republican National Committee Chairman Michael Whatley said in a statement. He called Biden’s trip to Wisconsin the Bankrupting American Tour.

“Biden’s student loan bailout for the wealthy was already struck down by the Supreme Court and his policies are driving historic inflation,” Whatley added.

Indeed. Biden’s previous $400 billion student debt bailout order aimed at 43 million borrowers was released in the summer of 2022, months before the midterm elections. The Supreme Court struck down his executive fiat, declaring it an unconstitutional overreach of the executive branch. Biden has since dabbled around the edges, waving his presidential pen to knock out smaller amounts of outstanding student loan payments.

The Times called it a “presidential do-over.” That’s not a thing. At least it doesn’t appear to be a legal thing.

Last month, Kansas led 11 states in a lawsuit against Biden’s so-called SAVE Plan, which has canceled loans for more than 150,000 borrowers, according to the White House. The states charge that the president has again overstepped his authority and defied the Supreme Court.

The Job Creators Network Foundation sued the Biden administration over its debt cancellation initiative struck down by the high court. The lawsuit, filed in Texas federal court, blocked the bailout at the district level and halted the application process, “allowing the legal challenge to go to the Supreme Court,” according to the conservative advocacy organization.

‘A Blank Check’

Elaine Parker, president of the Job Creators Network, said Biden’s latest bailout suffers from the same fundamental problems. It illegally bypasses Congress and does nothing to hold the nation’s colleges and universities accountable for making much of the existing mess through exorbitant higher education costs.

“In fact, every time this administration forgives more loans, it’s a blank check to these universities telling them to keep raising their tuition like they have been and overcharging these students,” Parker told me Monday afternoon on “The Vicki McKenna Show.”

Biden’s boss, President Barack Obama, drove the massive federal takeover of the student loan program that has proved so costly. Former U.S. Rep. John J. Faso laid out the Obama-inflicted wound in September 2022.

The New York Republican noted that Obama promoted the federal takeover of student lending as part of the bill that brought us Obamacare — the Affordable Care Act — in 2010. Another example of why you don’t pull a Pelosi and pass a bill “so you can find out what’s in it.”

“At that time, Obama proclaimed that by cutting out the ‘middleman’, taxpayers would save $68 billion. Banks would no longer underwrite student loans and the federal government would directly lend to students,” Faso wrote. “Every one of Obama’s promises turned out to be untrue. The program didn’t save any money. Loan defaults increased. Colleges accelerated increases in tuitions and fees and student debt skyrocketed. Today’s student loan mess was caused largely by Obama’s failed program.”

As he pitched his new attempted end-around of the Supreme Court ruling, Biden surely hoped the student loan debt-laden “folks” in swing-state Wisconsin would repay his taxpayer-funded generosity with their votes in November. The White says the new program could take effect “early this fall,” or not long before the election, the the New York Post reported. Impeccable timing.

As Parker noted, Congress passed bipartisan legislation last year blocking Biden’s student loan bailouts by executive fiat. Biden vetoed it. She said other reforms are stuck in the Senate.

“Senate Democrats do not want to take it up and discuss anything remotely close to solutions because they are in an election year and their goal is to buy these votes,” she said.

Listen to the full interview with Elaine Parker of the Job Creators Network Foundation.