Haley Joel Osment sees dead people. Government officials give them welfare benefits.

That conclusion comes from a report recently released by the Labor Department’s inspector general, providing an update on its investigations of pandemic-related unemployment fraud. Unfortunately, the document provides only the tip of the proverbial iceberg, both in identifying the scope of the problem and holding fraudsters to account.

$46 Billion Down the Drain

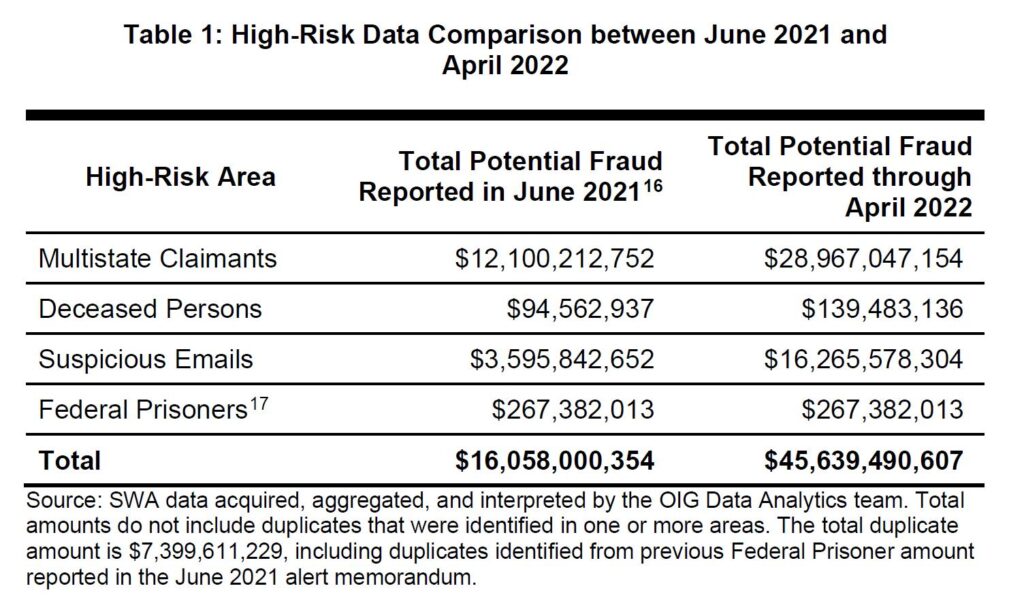

The inspector general report updated earlier documents quantifying the scope of potentially fraudulent unemployment insurance payments made during the pandemic. Specifically, the office examined four types of potential fraud: claims 1) filed in multiple states; 2) made in the name of deceased individuals; 3) using suspicious email accounts; or 4) filed by federal prisoners.

The chart below demonstrates the growth in potentially fraudulent unemployment insurance payments made since March 2020.

The $46 billion figure underestimates the potential fraud, for several reasons. For instance, investigators did not have current data on federal prisoners, so could not update last year’s estimate of suspicious payments in this category. The total also excludes potential fraud not included in one of the four categories — from claims made by state prisoners to those with less obvious red flags.

Little Accountability for Fraudsters

A press release accompanying the report hinted at the massive nature of the fraud. A few sentences discussed efforts to hold scammers to account:

With less than 140 criminal investigators, the [inspector general] leveraged data analytics to direct its limited resources to those matters that pose the greatest risk to the [unemployment insurance] program. The [inspector general] is focusing on large-scale identity theft schemes involving multiple victims and organized criminal groups, including street gangs.

In other words, if someone doesn’t belong to a gang, or “only” submitted fraudulent claims for a few thousand dollars (or even tens of thousands of dollars), he’s not going to get prosecuted.

The press release attempted to praise prosecutors for charging 1,000 individuals, and obtaining convictions that “have resulted in more than 7,000 months” — about 583 years — “of incarceration.” But given that investigators identified nearly $46 billion in fraud, the amount of accountability seems massively outweighed by the scale of the original crimes.

Government Empowering Scammers

The fraud in the Covid unemployment spending should surprise no one. The antiquated systems many states use to administer unemployment benefits (the program operates as a state-federal partnership) enabled scammers to game the system, even as individuals legitimately harmed by government lockdowns in 2020 struggled to navigate the stifling bureaucracy and claim benefits.

Even now, federal officials have yet to fully cooperate with efforts to hold people to account, albeit after the fact, for their criminal conduct. The inspector general noted that its office has the ability to require that state workforce agencies (which administer unemployment benefits) provide data and information relevant to anti-fraud efforts — but only on a temporary basis.

During the State of the Union address this March, the Biden administration made a big show out of appointing a special prosecutor to tackle Covid spending fraud. Yet the Labor Department inspector general noted that the same Biden administration continues to slow-walk efforts that would give the IG the information it needs to fight fraud.

Costly Waste

Two other points bear repeating. First, the Covid-era unemployment benefits at issue in the report paid many individuals more to stay home than they would have made working. That dynamic not only constituted bad policy by encouraging unemployment but also led to practical failures of implementation by encouraging fraud and scams.

Second, the American people will bear the costs of this wasteful “Covid spending” — on fraudulent unemployment benefits and much else — for decades to come, as our debt continues to rise to unsustainable levels. From outright scams to spending on things like ski areas and baseball stadiums, the money frittered away on frivolous projects over the past two years will come at a steep price to the next generation.

Democrats may have gotten more votes from their big-spending blowout, but our children and grandchildren will get stuck with the bill.