Joe Biden has proposed wiping out student loan debt for millions of student loan borrowers. Biden wants to make taxpayers pay off all undergraduate federal student debt for borrowers who earn an income of less than $125,000 per year and who attended a public college, a “historically black” college,” or a “minority-serving institution.”

On Election Day, Senate Minority Leader Chuck Schumer, D-N.Y., urged Biden to enact a plan, authored by him and Sen. Elizabeth Warren, D-Mass., to eliminate up to $50,000 in borrowers’ student loan debt by executive order. Warren and Schumer have since renewed that call, and dozens of Democrats reintroduced a bicameral resolution earlier this month urging Biden to take such action.

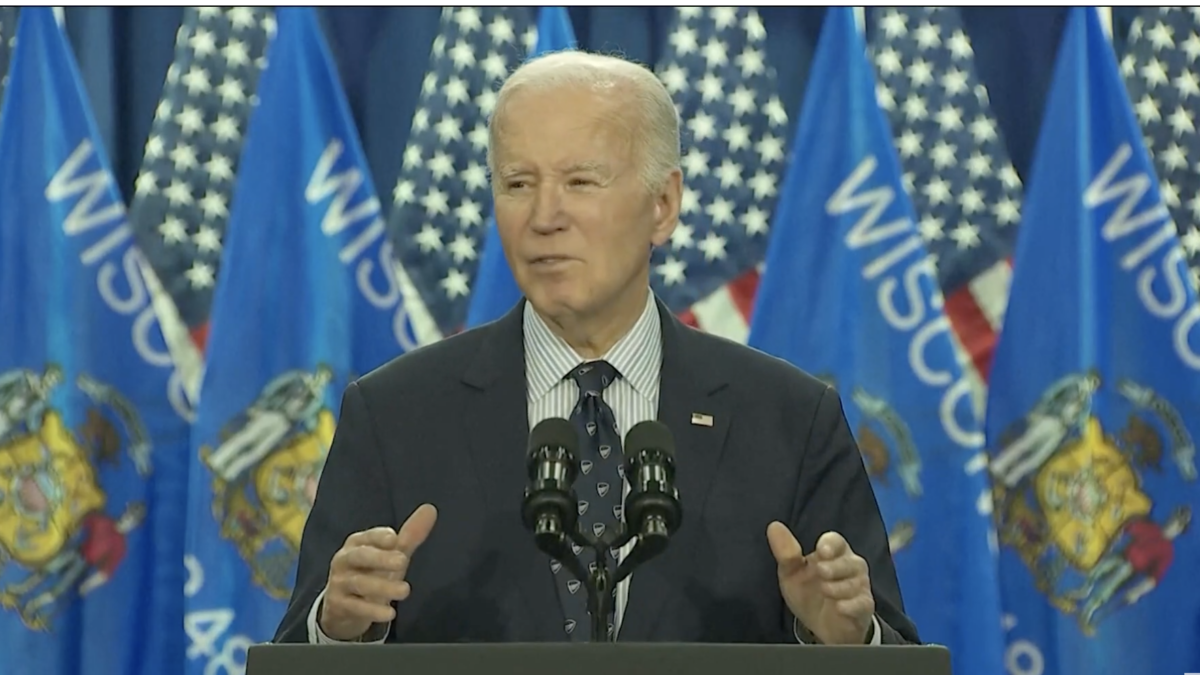

Biden has stated that making taxpayers pay off $10,000 of every person’s outstanding student debt should be done “immediately” as part of a broader coronavirus spending package. At a CNN town hall in Milwaukee, Wisconsin last week, Biden resisted the call to cancel $50,000 in debt per borrower but emphasized that he is “prepared to write off” $10,000 in debt.

He also reiterated his belief that community colleges should be free for everyone and that all public four-year colleges should be free for students from families making less than $125,000 per year. Biden’s debt bailout plan is bad for a variety of reasons. I list five of them here.

It’s Unfair

According to the National Center for Educational Statistics, only 35 percent of Americans attain a bachelor’s degree. This means forcing 65 percent of Americans—many of whom are blue-collar workers who neither want nor need college degrees—to subsidize others’ careers.

It’s unfair to require those families to pay off the college debts of others, especially when, according to a McKinsey report relying on U.S. Bureau of Labor Statistics figures, nearly half of graduates from four-year colleges are working in jobs that don’t require a four-year degree.

Also, what of college graduates who worked hard and paid off their loans or made substantial headway toward doing so? Would they get reimbursed? Biden doesn’t say. Is it fair that, after paying down their loans, they now must be required to pay off everyone else’s? Clearly not.

Moreover, Biden is dodgy on whether his loan bailout would be a one-shot deal or a new, permanent entitlement program. As the New York Times stated, if it’s a one-time deal, the plan “would create a generation of student loan lottery winners, with losers on either side. People who had already paid back their loans would get nothing. People with future loans would get nothing. People with debt on the day the legislation was enacted would be rewarded.”

Given that Biden has already signed on to the idea that public colleges and universities should be tuition-free for students from families with incomes up to $125,000, it’s a fair bet that he wants this to be a new, and prospectively applied, entitlement.

It Punishes the Poor and Hard-Working

The countries that provide socialized higher education have jacked up the taxes on working citizens. Germany, for example, saw a 37 percent increase in the college subsidy cost to taxpayers once public universities removed tuition. Placing a tax burden on lower-income workers for the benefit of students who will go on to become doctors, lawyers, engineers, and other professionals is unfair to those who earn less.

While proponents of socialized college argue that it gives students from lower socio-economic classes the opportunity for upward mobility, in reality it does not work out that way. England is perfect example. Once college there became free, enrollment skyrocketed. Because the government lacked the funds to cover the cost, it imposed strict caps on enrollment.

To ration the limited seats, colleges raised their admissions standards. Since families with more money could afford to pay for better schools and tutors, those who benefitted from free college were students from well-off families who tended to have higher test scores and a resume of extracurricular activities. Even Karl Marx recognized that socialized college mainly benefits the rich.

Because rationing is necessary in all countries with taxpayer-paid college tuition, most end up accepting just a fraction of applicants. Consequently, they regularly rank low among developed countries for college-degree attainment.

According to U.S. statistics, out of 36 developed countries, the United States ranks fifth highest in percentage of the population who have attained a postsecondary degree – behind only Japan, Israel, South Korea, and Canada, none of which offer free college. In fact, as of 2017 (the most recent year for which data is available), the percentage of Americans aged 25 to 64 years who had attained a postsecondary degree was far higher than in those countries where college tuition is tax-paid.

According to the Manhattan Institute, many programs 2020 Democrats pushed “transfer society’s resources to upper-middle-class professionals at the expense of lower-income households.” Biden’s debt-canceling plan fits comfortably within this model. A working paper released last month by the prestigious University of Chicago Booth School of Business confirms this.

It Eliminates Accountability

When schools know the government will cover the cost of students’ education, they do not cut costs to keep tuition down. In 2015, the Federal Reserve Bank of New York issued a study that found that for every additional dollar the federal government allows students to borrow, colleges and universities increase their tuition by 60 cents, thereby increasing the number of students who need loans to afford college in the first place.

A Harvard University study found that tuition at for-profit colleges eligible for federal student aid is 78 percent higher than at colleges ineligible for such programs. The National Bureau for Economic Research cited expansions in borrowing limits as “the single most important factor” in driving up college tuition.

Not only are schools raising tuition, they’re not spending the bulk of this additional money on education. In 2012, The New York Times reported that “A decade-long spending binge to build academic buildings, dormitories and recreational facilities … has left colleges and universities saddled with large amounts of debt. Oftentimes, students are stuck picking up the bill.”

Despite the soaring cost of tuition, colleges and universities carry an average aggregate debt bill of approximately $125 billion, according to a December 2017 analysis by Moody’s. Biden’s plan does nothing to address this out-of-control spending, and in fact likely makes it worse.

Similarly, Biden’s plan fails to encourage accountability by borrowers. By eliminating repayment obligations, students are incentivized to take out loans with no intention of paying them back, or to borrow more than they need.

As explained by the director of the Federal Education Budget Project at the New America Foundation, this makes students “price-indifferent.” We should be encouraging students to consider seriously their educational options, including trade schools, and, above all, to be fiscally responsible with their areas of study. Biden’s plan encourages none of this.

Although federal loan money has historically been handed out with little scrutiny about students’ ability to pay it back, Biden’s plan also includes no details on how, if at all, the federal government plans to address the expansion in borrowing limits. Without meaningful provisions holding schools, borrowers, and the federal government accountable for the problem of enormous educational debt, Biden’s plan is a kludge that does nothing to address, long term, any of the root causes of the student debt problem.

It’s Expensive and Paid For By Small Businesses

Even before Biden added debt cancellation to his college plan, it had already racked up a staggering $750 billion price tag. Biden’s plan to pay for this is to restore the Section 461(l) limitation.

As part of the Tax Cuts and Jobs Act, Section 461(l) of the IRS Code was amended to limit how much partnerships, S-corporations and pass-throughs could claim in losses against non-business income in a given year. With the passage of the CARES Act, that limitation was suspended, thereby benefitting most, if not all, small businesses.

Since most small businesses are organized as S-corporations, partnerships, and sole proprietorships, Biden’s plan to restore the Section 461(l) limitation would hurt those who have suffered most during the pandemic: small business owners. It would also allow large C-Corporations—such as Walmart, Home Depot, and the big box stores—to continue enjoying the loss limitation relief.

So much for Biden’s declaration that “taxes on small businesses won’t go up” in a Biden administration. In fact, the tax burden on ordinary Americans would swell to epic proportions if Biden’s plans are enacted.

It’s Likely Unconstitutional

Biden’s plan calls for bailing out federal debt for borrowers who attended private institutions only if those institutions were Historically Black Colleges and Universities (HBCUs) or schools registered with the U.S. Department of Education as a “minority serving institution” (MSI).

Allowing the federal government to cancel federal debt for private college tuition only for those who attended HBCUs or MSIs sparks serious constitutional concerns. To begin, it seems to violate the guarantee of equal protection recognized under the Due Process Clause of the Fifth Amendment.

Since Biden’s plan expressly favors only some races and ethnicities, it would be subject to strict scrutiny by the courts—the most exacting standard of review. Also, since Biden’s plan would effectively penalize all students—including blacks and other minorities—who attended any of the more than 2,000 non-MSI private institutions in our country (more than half of our nation’s private colleges and universities) it is hard to see how it would pass constitutional muster.

Further, assuming that Biden’s plan eliminates future, not just past, federal loan debt, it also implicates the First Amendment’s freedom of association, and possibly the freedom of religion under the Free Exercise clause.

While the educational loan debt problem is a grave one, Biden’s plan is no solution. Indeed, in Federalist 10, Madison remarked that forcing people to pay others’ debts is a “wicked project.” Democrats, however, kneel at the altar of socialism, raise high the poisoned chalice of debt cancellation, and ignore the wisdom of our founders.