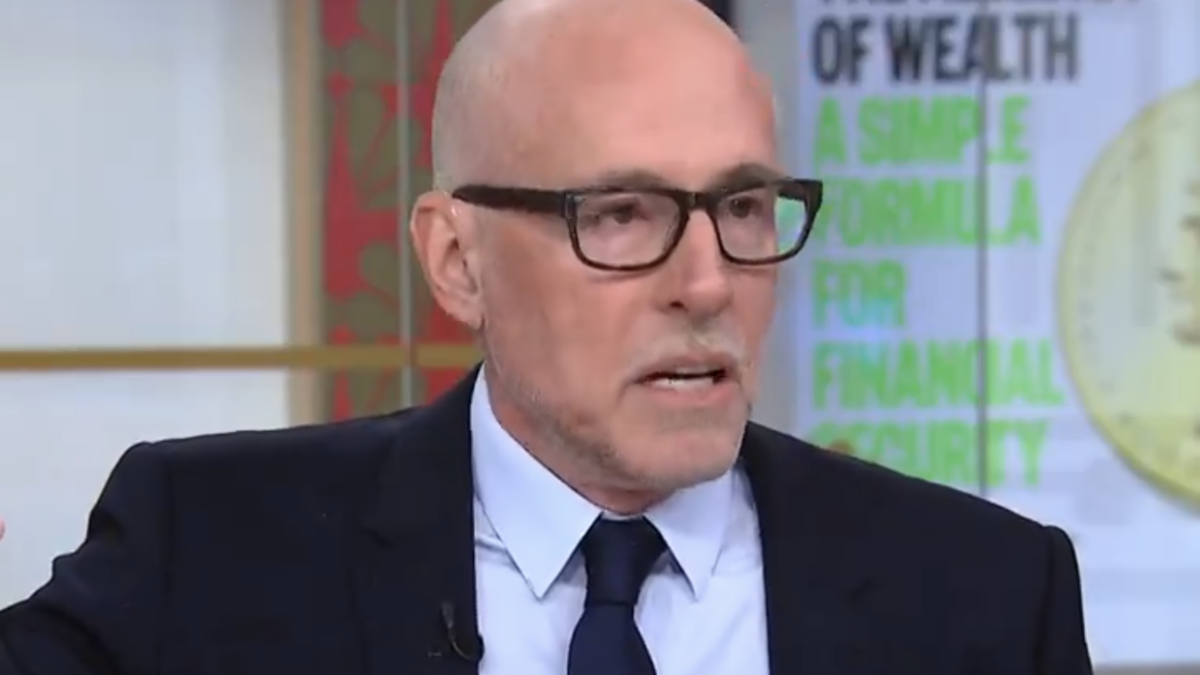

At a time there is growing resentment of and envy towards those who have prospered most in our relatively free enterprise system, one of its most successful entrepreneurs has written a book that reminds us how and why this system remains superior to all others – and that individual financial success is merely a small part of its happy residue.

In The Harder You Work, the Luckier You Get: An Entrepreneur’s Memoir, Joe Ricketts, the founder of TD Ameritrade, has written a candid, revealing, and inspiring memoir that manages to make the story of a seemingly mundane discount brokerage business compelling by telling it through the lens of the visionary entrepreneur who built it into a powerhouse. (In the interest of disclosure, I have previously consulted on unrelated projects with Ricketts.)

Making the story more compelling is that nothing for Ricketts was preordained. The self-described “weird” Nebraska-bred son of a homebuilder was always a hard worker. But little foretold that this mediocre student of modest means, who toiled as a janitor to pay his way in part through a long-delayed college graduation, and who later continued to clean bathrooms even in the early years of the Omaha-based venture that would turn him into a billionaire many times over, would end up dominating in the elite, New York-centric world of high finance.

Struggles and Opportunity

In fact, Ricketts, although long filled with dreams of building something substantial, describes a struggle in which after years of intense work and penny-pinching his family was still living hand-to-mouth, frustration boiling over at the prospect of another unappetizing frozen meal.

This meager lifestyle, during which Ricketts often worked menial and unfulfilling jobs well beneath his capability, served Ricketts well later as he struggled to keep the lights on in a business that demanded minimal overhead and every employee working all manner of disparate tasks simple and complex.

At almost every stage in his career, Ricketts faced hardships, but triumphed over them with a strong work ethic, tenacity, and a tolerance for risk. It took him nearly a decade to finish college due to the delays created by needing to work to pay tuition and, along with his wife, support his family. After laboring to finally earn the bachelor’s degree necessary to qualify for a job at the brokerage house to which he aspired, the stock market entered a lengthy and terrible bear market.

While stock prices declined and investors fled, regulatory changes signaled that the writing could be on the wall for traditional brokers. Where their commissions had always been fixed, their government-dictated pay structure was now being phased out to allow competitive rates for the benefit of consumers, threatening to crater the brokers’ already flagging earnings.

It was at this point, after years of workaholism and barely getting by, he had attained what he thought was a dream job – and all of a sudden seemed like it would be snuffed out of existence. This was the inflection point for Ricketts. Without capital or special knowledge of what was to come, Ricketts and one of his early mentors saw a major change coming and saw an opportunity to take advantage of it.

They sought to get a discount brokerage company off the ground – a company that would allow individual investors to buy and sell securities at much lower prices, making up for the decreased commissions with volume and substantially reduced overhead. The brokers would no longer cold-call customers and pitch them stocks – customers would come to the broker and freely dictate whatever order they wanted.

What would follow was a remarkable climb that at any number of stages seemed it might end in disaster via regulatory challenges, technological ruin, dishonest penny stock pickers, and market ups and downs.

Risk and Reward

There are many colorful elements of this tale. During the fledgling years, family and friends did all manner of odd jobs with long hours and low pay in cramped quarters. These family and friends often lacked formal training, yet by sheer fortitude, they played essential roles in ultimately turning the company into a smashing success.

Ricketts cleverly created a number of dissimilarly named subsidiaries to protect the reputations of the successful ventures from the failures, with the same employees answering calls on different phone lines as representatives of whichever individual entity was dialed. There were misadventures with early computers, touchtone phones, floppy disks, and the internet. And they had to overcome the stigma and challenge of attracting talent while running a financial services business in Omaha, Nebraska.

Yet, after several decades, Ricketts and TD Ameritrade rose to the pinnacle of their sector. The constants that enabled TD Ameritrade’s ultimate rise were instructive: An appetite for risk; constant innovation and iteration that might have never happened had the company not dealt with numerous constraints. And there was a burning desire to continually reduce costs while growing the customer base through constantly reinvesting earnings in the business and embracing technological advances, all while opportunistically acquiring strategic partners and doggedly marketing their business.

The real joy for Ricketts in this journey, we learn, is not the riches he earned from his company, but the means by which he built it. Wealth is the byproduct of building a business, but it is the process of building the business that entrepreneurs truly relish. Again, in Ricketts’ case, that process included experimenting with new technologies and strategies, risking the livelihood of his company with major bets on several occasions, and at every turn challenging convention and his naysayers.

In truth, Ricketts’ memoir is only facially a story of the disintermediation and democratization of the financial services industry in a time of rapid technological and regulatory change. In reality, it is the story of free enterprise, enabling a visionary entrepreneur to create a slew of products at ever-decreasing prices for the betterment of millions of individual investors, all while creating countless jobs and the attendant prosperity. In the case of TD Ameritrade, this benefited friends and family, as well as accounting, legal, consulting and IT firms, advertising and marketing agencies, technology companies, and a bevy of other enterprises.

It is remarkable to consider how genuine wealth creation through bringing something to market that people want to buy – not by obtaining a government-granted monopoly, accepting corporate welfare or rigging the deck against competition through regulations – benefits so many in a way that no bureaucrat could reverse-engineer.

An Empire Built on Liberty

Ricketts’ story is particularly inspiring given that it bears all the hallmarks of the great American entrepreneurial epics, featuring a pioneering and driven contrarian with a steel spine who makes all manner of personal and professional sacrifices in pursuit of his dreams – culminating in being able to leave a business to his family, just not the one he anticipated.

Ricketts had hoped his children would inherit and run TD Ameritrade, but it was not to be. Instead, they were bound together through their shared love of the Chicago Cubs, with his children jointly running the family-owned crown jewel of a baseball franchise.

The Harder You Work, the Luckier You Get represents an enjoyable and insightful quintessential tale of American entrepreneurship. It shows that with inordinate sacrifice, ingenuity, and determination, anyone armed with a dream and a will to achieve it can build an empire. The benefits of those empires accrue to us all. Those empires would never be built absent our culture of liberty, and the economic liberty to which it gave rise.