The Congressional Budget Office (CBO) and Joint Committee on Taxation (JCT) are congressional bureaucracies that wield tremendous power on Capitol Hill because of their role as fiscal scorekeepers and referees. Unfortunately, these bureaucracies lean to the Left. When CBO does economic analysis or budgetary estimates, for instance, the bureaucrats routinely make it easier for politicians to expand the burden of government spending.

This cartoon puts it more bluntly: One man asks, “Are you saying if we repeal this huge, new entitlement program it will add to the deficit?” The other replies: “Sure. Just ask the CBO!” When JCT does revenue estimates, the bureaucrats grease the skids for anti-growth tax policy by overstating revenue losses from lower tax rates and overstating revenue gains from higher tax rates.

Examples of Tax-and-Spend Bias

Here are some examples of CBO’s biased output.

- The CBO, over and over again, produced reports based on Keynesian methodology to claim that President Obama’s so-called stimulus was creating millions of jobs even as the unemployment rate was climbing.

- CBO has produced analysis asserting that higher taxes are good for the economy, even to the point of implying that growth is maximized when tax rates are 100 percent.

- Continuing a long tradition of underestimating the cost of entitlement programs, CBO facilitated Obamacare’s enactment with highly dubious projections.

- CBO also radically underestimated the job losses Obamacare would cause.

- When purporting to measure loopholes in the tax code, the CBO chose to use a left-wing benchmark that assumes government should double-tax income people save and invest.

- On rare occasions when CBO has supportive analysis of tax cuts, its bureaucrats rely on bad methodology.

But let’s not forget that the JCT produces equally dodgy analysis.

- The JCT was wildly wrong in its estimates of what would happen to tax revenue after the 2003 tax rate reductions.

- Because of the failure to properly measure the impact of tax policy on behavior, the JCT significantly overestimated the revenues from the Obamacare tax on tanning salons.

- The JCT has estimated that the rich would pay more revenue with a 100 percent tax rate even though there would be no incentive to earn and report taxable income if the government confiscated every penny. This means the JCT is more left-wing than the very statist economists who think the revenue-maximizing tax rate is about 70 percent.

- Unsurprisingly, the JCT also uses a flawed, statist benchmark when producing estimates of so-called tax expenditures.

Economic Models Can Be as Bad as Climate Models

I want to be fair. Sometimes CBO and JCT produce garbage because their political masters instruct them to put their thumbs on the scale. The fraudulent process of redefining spending increases as spending cuts, for instance, is apparently driven by legislative mandates. But the bottom line is that these bureaucracies, as currently structured and operated, aid and abet big government.

Regarding the CBO, Veronique de Rugy of Mercatus hit the nail on the head.

The CBO’s consistently flawed scoring of the cost of bills is used by Congress to justify legislation that rarely performs as promised and drags down the economy. …CBO relies heavily on Keynesian economic models, like the ones it used during the stimulus debate. Forecasters at the agency predicted the stimulus package would create more than 3 million jobs. …What looks good in the spirit world of the computer model may be very bad in the material realm of real life because people react to changes in policies in ways unaccounted for in these models.

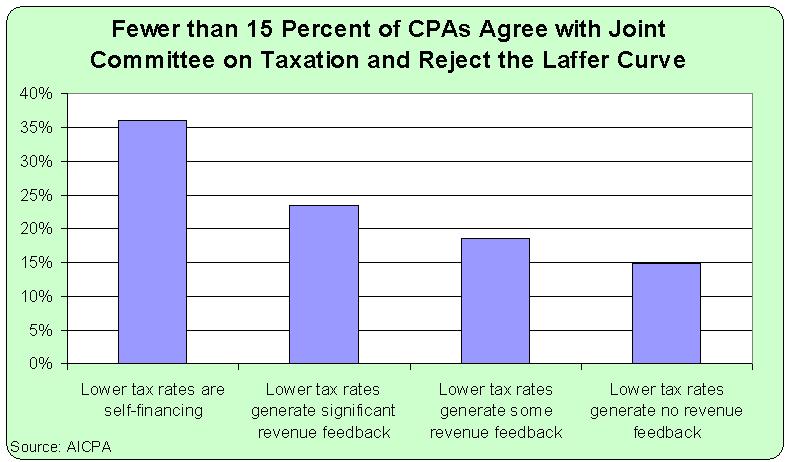

And the Wall Street Journal opines wisely about the JCT’s real role: “Joint Tax typically overestimates the revenue gains from raising tax rates, while overestimating the revenue losses from tax rate cuts. This leads to a policy bias in favor of higher tax rates, which is precisely what liberal Democrats wanted when they created the Joint Tax Committee.” Amen. For all intents and purposes, the system is designed to help statists win policy battles. No wonder only 15 percent of certified public accountants agree with JCT’s biased approach to revenue estimates.

What Congress Should Do about These Bureaucracies

So what’s the best way to deal with this mess? Some Republicans on the Hill have nudged these bureaucracies to make their models more realistic. That’s a helpful start, but I think the only effective long-run option is to replace the top staff with people who have a more accurate understanding of fiscal policy. That’s exactly what I said to Peter Roff, a columnist for U.S. News and World Report.

…the new congressional leadership should be looking at ways to reform the way the institution does its business – and the first place for it to start is the Congressional Budget Office. Most Americans don’t know what the CBO is, how it was created or what it does. They also don’t know how vitally important it is to the legislative process, especially where taxes, spending and entitlement reform are concerned. As Dan Mitchell, a well-respected economist with the libertarian Cato Institute, puts it in an email, the CBO ‘has a number-crunching role that gives the bureaucracy a lot of power to aid or hinder legislation, so it is very important for Republicans to select a director who understands the economic consequences of excessive spending and punitive tax rates.’

Heck, it’s not just “very important” to put in a good person at CBO (and JCT). As I’ve written before, it’s a test of whether the GOP has both the brains and resolve to fix a system that’s been rigged against them for decades. So what will happen? I’m not sure, but Roll Call has a report on the behind-the-scenes discussions on Capitol Hill.

Flush from their capture of the Senate, Republicans in both chambers are reviewing more than a dozen potential candidates to succeed Douglas W. Elmendorf as director of the Congressional Budget Office after his term expires Jan. 3. …The appointment is being closely watched, with a number of Republicans pushing for CBO to change its budget scoring rules to use dynamic scoring, which would try to account for the projected impact of tax cuts and budget changes on the economy.

So who will it be? The Wall Street Journal weighs in, pointing out that CBO has been a tool that bloats government.

…the budget rules are rigged to expand government and hide the true cost of entitlements. CBO scores aren’t unambiguous facts but are guesses about the future, biased by the Keynesian assumptions and models its political masters in Congress instruct it to use. Republicans who now run Congress can help taxpayers by appointing a new CBO director, as is their right as the majority. …The Tax Foundation’s Steve Entin would be an inspired pick.

I disagree with one part of the above excerpt. Steve Entin is superb, but he would be an inspired pick for JCT, not CBO. I do fully agree with the WSJ’s characterization that budget rules are used to grease the skids for bigger government. In a column for National Review, Dustin Siggins writes that Bill Beach, my old colleague from my days at the Heritage Foundation, would be a good choice for CBO.

…few Americans may realize that the budget process is at least as twisted as the budget itself. While one man can’t fix it all, Republicans who want to be taken seriously about budget reform should approve Bill Beach to head the Congressional Budget Office (CBO). Putting the right person in charge as Congress’s official “scorekeeper” would be an important first step in proving that the party is serious about honest, transparent, and efficient government. …CBO has several major structural problems that a new CBO director should fix.

Hmm… Entin at JCT and Beach at CBO. That might even bring a smile to my dour face. But it doesn’t have to be those two specific people. There are lots of well-regarded policy scholars who could take on the jobs of reforming and modernizing the work of JCT and CBO. But that will only happen if Republicans are willing to show some fortitude. That means they need to be ready to deal with screeching from leftists who want to maintain their control of these institutions.

Incoming: Leftist Air War over Maintaining Bureaucracies

For example, Peter Orszag, a former CBO director who then became Budget Director for Obama (an easy transition), wrote for Bloomberg that he’s worried GOPers won’t pick someone with his statist views.

The Congressional Budget Office should be able to celebrate its 40th anniversary this coming February with pride. …The occasion will be ruined, however, if the new Republican Congress breaks its long tradition of naming an objective economist/policy analyst as CBO director, when the position becomes vacant next year, and instead appoints a party hack.

By the way, it shows a remarkable lack of self-awareness for someone like Orszag to complain about the possibility of a “party hack” heading CBO. In any event, that’s just the tip of the iceberg. I fully expect we’ll also see editorials very soon from the New York Times, Washington Post, and other statist outlets about the need to preserve the “independence” of CBO and JCT. Just keep in mind that their real goal is to maintain their side’s control over the process.

By the way, there’s another Capitol Hill bureaucracy, the Congressional Research Service, that also generates leftist fiscal policy analysis. Fortunately, CRS doesn’t have any scorekeeper or referee role, so it doesn’t cause nearly as much trouble. Nonetheless, any bureaucracy that produces “research” about higher taxes being good for the economy needs to be abolished or completely revamped.

This article is reprinted, with permission, from the author’s personal website.