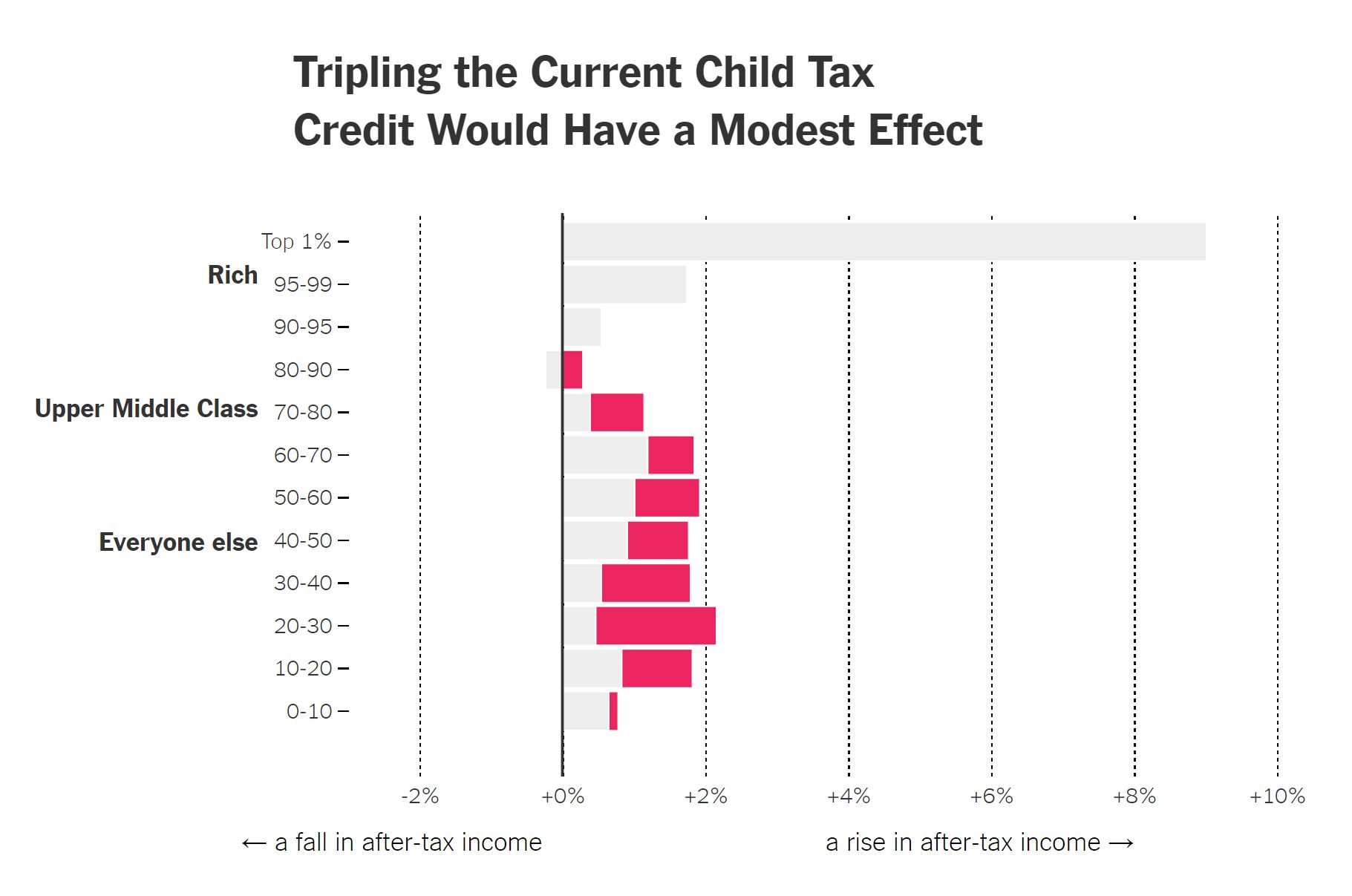

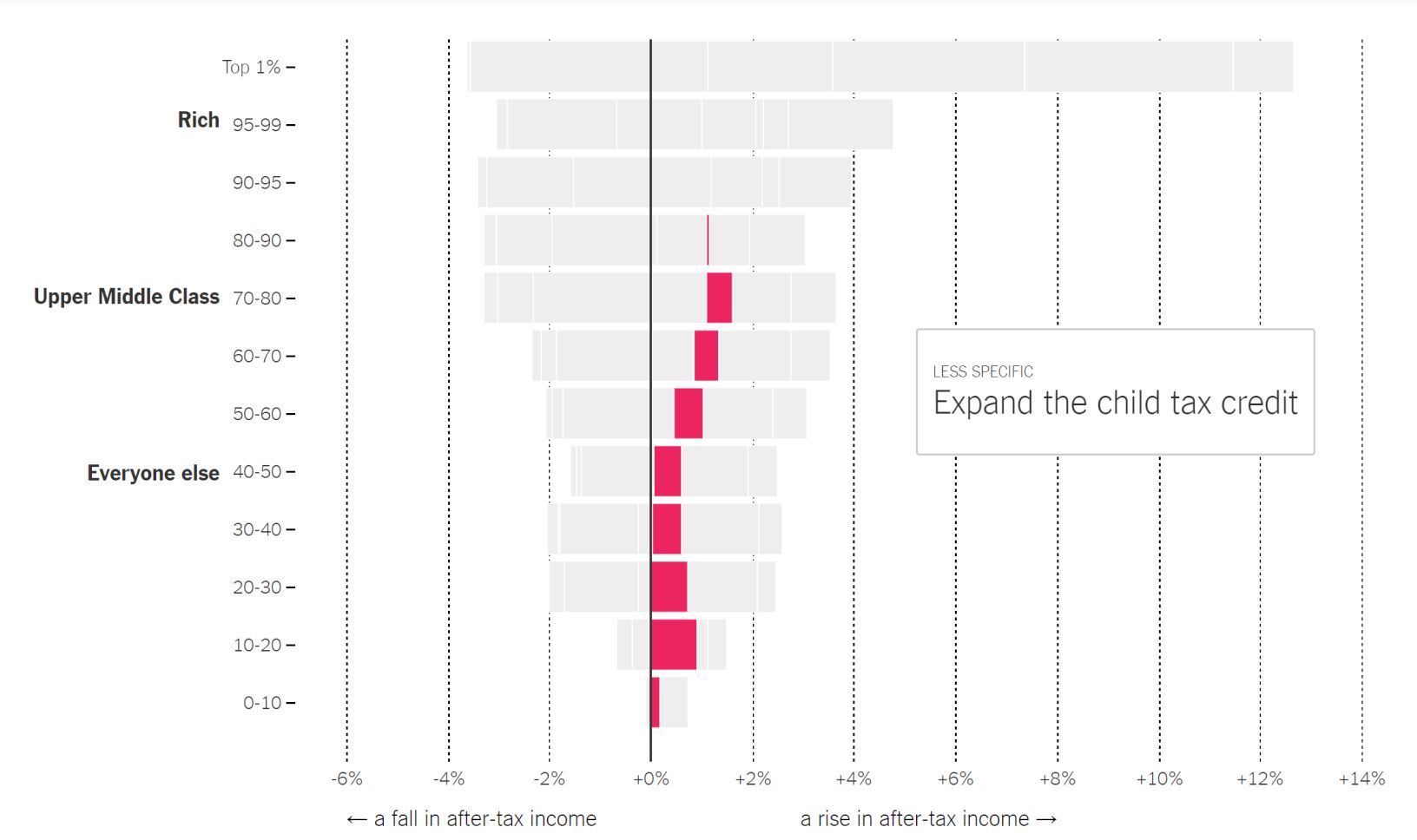

With Ivanka Trump out front, President Trump’s tax reform framework includes an idea crucial for significantly reducing taxes on middle and lower earners, who pay the least proportion of taxes: expanding the child tax credit. The New York Times displays some graphs explaining why — the grey bars are effects their economists think are uncertain because those parts of the plan are less specific, the pink effects they are more certain would result. Tripling the child tax credit, from $1,000 to $3,000 per child, is one of the policies on the table that has the most consequences for middle and lower earners.

In fact, without increasing this tax credit, it’s likely most Americans will see little tax reduction from the plans being discussed.

How important is it to increase the child tax credit? Very important for working class https://t.co/XbkKqM7dYE

— Ed Dolan (@dolanecon) October 7, 2017

Expanding the credit might be the only way Donald Trump gives some American families the tax cut he has promised https://t.co/RokSHo1tgD

— The Economist (@TheEconomist) October 17, 2017

The real reason most tax reforms most affect the wealthiest Americans, of course, is because the wealthiest Americans pay for the lion’s share of America’s heavily redistributive social welfare state. It’s basically impossible to reform taxes for everyone without benefitting high earners, since the rest of us are paying so little of what we allow our representatives to spend. With a flat tax rate, the rich would still pay more than others because it’s an equal percentage of a larger pie.

A fairer tax system is not on the table because Americans are on the whole too envious to allow it, but this does establish the baseline that our current tax system makes value judgments. It rewards those our policy makers find deserving and punishes those they find less deserving. Given that this is unlikely to change soon, although I disagree with this unequal treatment, our tax system should reward people differently than it does right now, with a significant expansion of the child tax credit.

That’s because creating children who are likely to grow up into productive adults and capable citizens is non-negotiable to the nation’s long-term health, both socially and fiscally. We are facing an increasing reduction in citizens like this because the Americans with the best intellectual and economic capacity to nurture human beings have the fewest children. This is why tax reform should also be targeted particularly at married couples of childbearing age, who are most likely to create future high-productivity adults and statistically most likely to build social capital for all because they have two committed adults available for that purpose.

A Welfare State Socializes Childbearing

Despite the typical perception otherwise, the United States is a major welfare state. It is in fact the highest-spending social welfare state in the world, after France, according to percentage of GDP spent on personal government subsidies. Economists have found one major effect of such socialized economies is to repress childbearing. There are many theories about how this works, but mine is that social welfare states don’t merely redistribute money, but also family.

It takes from families who have well-functioning relationships and tries to redistribute their resulting social and economic resources to individuals who have fewer such relationships, either through accident or choice. This reduces the incentives to not only produce a family, mainly through marrying and having children, but also the incentives to treat that family well. That increases the number of people choosing to reduce their available social capital, as opposed to those who by accident fall into the same situation. Here’s how that works.

One’s children are a long-term source of riches, both in economic and personal terms. Humans have believed this throughout history, because it’s true. That’s why larger families were seen as a sign of honor, wealth, and security until the pill popped about 50 years ago. Of course, children are a rather long-term investment today: One typically has to spend something like 25 years caring for them nowadays until they become self-sustaining.

But, if all goes well, soon they start contributing even further to your joy and meaning in life by beginning to produce grandchildren. Another 25 or so years after that, they and those grandchildren become your support system as you age. Politico published a heart-rending article a few weeks ago about shifts in end-of-life care in an era of smaller families and a bigger welfare state. The tradeoffs it depicts between these two induce some sobering thoughts.

Families, too, have changed since hospice took root in the U.S. health system. They tend to be smaller, and live farther apart. More women work–making it harder for them to take on traditional roles as full-time caregivers. And millions of old, frail Americans—divorced, widowed, or never married—now live alone without family nearby, or without family at all. The most isolated are sometimes called ‘the unbefriended.’…

‘The patients who genuinely don’t have loved ones who can essentially move in with them—most of those people do not die at home.’ They end up getting care they don’t want, in a place they don’t want to be in—and it costs more. ‘The ER, a hospital bed or a nursing home. That is our long-term care system for people who don’t have a support system.’

It’s not just aging, either: families are of course support systems for any number of life’s challenges, such as when any member gets hit by a bus or contracts an illness or loses a job. Or even just wants to get together a picnic or birthday party, move house, or uproot a tree stump in his yard without having to pay $1,000 to a removal company. Or go out to dinner with his wife without having to double the cost of dinner in paying a non-family babysitter.

Socializing Kids Doesn’t Work, But It Does Fool People

The bigger a functioning family you have, the better financial, emotional, and social capital support system you have, at any age and with any need in life. Now, just think about the problems you may face in your lifetime, then with that criteria in mind, think about how large you want your family to be. At the current average of 1.8 children per American woman? Try again. That rate means a reduction in overall family size each generation. It shrinks your support network.

When your family — and good substitutes and enhancements, like churches — can meet your major social and economic needs, of course, you are less likely to force strangers to try to backfill through taxes to various welfare programs. As the Politico article shows, even if well-funded — which they rarely are, because free to them is a price at which everyone’s willing to ring bills up — social welfare programs cannot hope to meet people’s real needs, the social and spiritual deficits that, in a prosperous country like the United States, are usually the underlying causes of lack.

Even if Medicare does manage to fund your nursing home stay, who will watch your prescriptions and medical chart while you’re ailing, to make sure everything is exactly right every single time there’s a change? Who will advocate for proper care when you can’t advocate for yourself? Who will come hold your hand and talk to you in your waning years of life?

Money can’t buy you love. Yet we’d like to think it can, because ultimately money is easier to generate and redistribute.

More Babies From Married Parents Needed

Socializing children, like socializing every other resource, tends to destroy wealth. As I see fewer direct personal benefits to having children and staying close to my family, I am less likely to work to ensure those realities. Why would I have children when I can tap other people’s children to pay for my welfare? Of course, this creates one of those vicious cycles, where people increasingly erode their own as well as future generations’ ability to rely on such systems due to backwards incentives. They increasingly spend down social wealth rather than preserve and expand it.

This is precisely what has happened with America’s largest social welfare programs, which, despite the tendency of many of their recipients to blame “Mexicans” or “welfare mommas” for America’s dangerous fiscal condition, are Social Security and Medicare (along with Medicaid). The current ratio of workers paying into these old-age programs to people tapping them is currently about 3.8 workers for every Medicare recipient and 2.9 for every Social Security recipient. The ratio worsens soon, and in related news, both programs are also soon insolvent.

Like most Western countries, the United States is not feeling the full effects of our low fertility rates because we import so many immigrants to make up for the birth deficit. But, first, U.S. immigration levels are falling currently, especially as Mexico’s economy has improved. Second, all the developed countries are fighting over a relatively small pool of highly skilled potential immigrants. Third, as Europe has been discovering, even if you desperately need workers to pay taxes to sustain unsustainable old-age welfare programs, sometimes importing those workers can present a whole new array of social and economic problems. That cure could be worse than the disease.

The wisest course of action seems to be to grow our own productive population, “in house,” as it were. Other social welfare programs also work against this need by subsidizing and therefore incentivizing precisely the family arrangements most likely to increase another kind of needy population — i.e. those who have children without marriage. Children born to these circumstances are much more likely to be tapping societal resources than helping sustain them, because not living inside their married, biological parents’ home tends to harm children emotionally and intellectually.

For eight years running, at least 40 percent of babies born inside the United States have been born to unmarried mothers. Factor in divorce, and something like half of U.S. children are born into circumstances handicapped in their ability to help pull us out of our impending social welfare collapse.

That brings us back to the child tax credit. As the above shows, I am fully aware that the United States really cannot afford tax credits now or really for about 50 years. We’ve had annual deficit budgets for essentially 50 years, at least (meaning, of course, shelling out far more than taxes rake in). Our only way out of the fiscal hole we’ve dug for ourselves is economic growth. Besides major economic deregulation and government spending cuts, an increase in the population is fuel for economic growth, because more people means more demand and more production. Married men and women with children are the most economically productive citizens, as well as the ones most likely to contribute social goods you can’t measure with money until they’re gone (like coaching Little League or driving grandma to her doctor’s appointments).

No Western country has yet come up with a solution for demographic winter — the bleak, soon-arriving future of social welfare states that have inevitably run out of money and, more importantly, the children who produce it. It is truly an existential crisis. A significantly expanded child tax credit could help solve our current and future economic problems by directly addressing their roots, especially if it includes a marriage incentive such as applying only or at a higher rate to intact families. Most Americans want more children than we’re having, and cite economic worries as the reason they’re not. So, relieve the baby blockage for them.

The other root of these problems, of course, is federal overspending. The right thing to do would be increase this tax credit while cutting and reforming federal spending on entitlement programs that form another current of downward pressure on American families. The country needs those kids as much as their potential parents, siblings, cousins, aunts, uncles, and grandparents do.