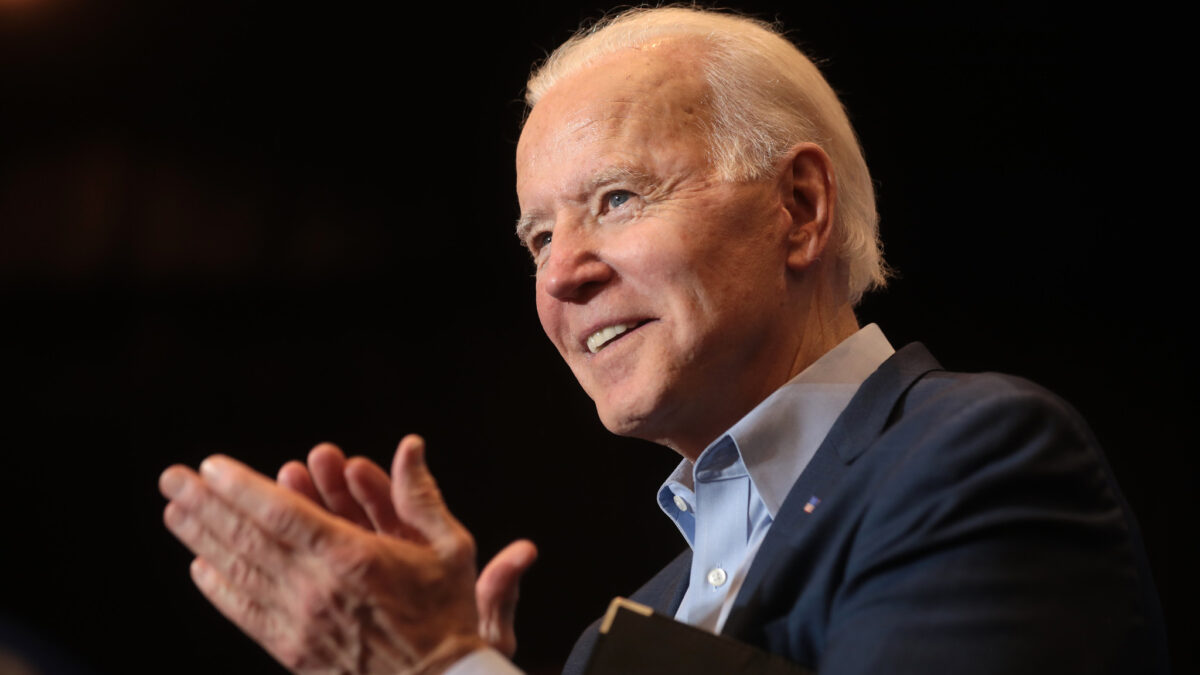

Last week, in a campaign stop at a Pennsylvania coffee shop, President Biden seemed shocked at the $6.00 price of his smoothie. When asked if the president was out of touch with the economic issues facing Americans, White House Press Secretary Karine Jean-Pierre tried to dodge the question. Finally, she answered by explaining that President Biden was just “joking around.”

That made it official. “Bidenomics” had gone from failure to punchline.

Now that the 2024 election approaches, Biden and his allies are panicky. They say you are wrong and economic times are great. You should stop complaining and thank them for what they’ve done for (to) you.

Blaming the victim will not save Biden. Here is why.

Your Money Is Worth Less and Less

In 2019, before Democrats (primarily) closed the schools and economy, the median household income in the United States was $78,250. Under Biden, real median household income dropped to $74,580. And you can’t blame Covid. Between 2021 and 2022 (after the pandemic ended), median household income dropped under Biden by 2.3 percent, and median household income after taxes dropped by 8.8 percent. People know when they bring home less money.

Under Biden, cumulative annual average inflation is nearly 20 percent. For every dollar you had in 2020, you now have only about 80 cents. During Trump’s presidency, cumulative inflation totaled a near-perfect 7.9 percent. I say “near perfect” because the Fed’s target rate over that period would be about 8.2 percent (2 percent each year), since some inflation is better than the risk of deflation.

And this comparison is not fair to Trump because his figure includes four years of inflation whereas Biden’s includes only three. Incredibly, Biden demands praise for “reducing” inflation to its current 3.4 percent rate. Yet Biden’s best year is 48 percent worse than Trump’s worst year and 70 percent worse than the Fed’s target. When your best is bad, that’s not good. People know when they pay much more for much less.

Your Savings Are Beyond Saving

Not only are your dollars worth less, but you also have less of them. Before Covid, personal savings in the U.S. reached $1.447 trillion. By year-end 2022, that figure dropped to $686 billion. You say, of course, savings were depleted; the economy was closed during Covid. In actuality, savings in the U.S. increased to $2.99 trillion during Covid. That’s what makes the depletion of savings under Biden so staggering — savings dropped from $2.99 trillion to $686 billion during Biden’s so-called “recovery.” People know when they exhaust their savings accounts.

Before Covid, retirement assets for Americans totaled nearly $41 trillion. Retirement assets dropped to $37.8 trillion in 2022 and to $35.7 trillion by third quarter 2023. Again you ask, Covid? Not so. American retirement assets actually peaked at $44 trillion during Covid. It was the Bidenomics “recovery” that caused retirement assets to drop substantially. People know when they deplete their retirement accounts.

Americans Are Deep In Debt and Poverty

Under “Bidenomics,” credit card debt has soared. In the third quarter of 2023, American credit card debt increased an astonishing 16.6 percent year-over-year. Again, you can’t blame Covid because this increase occurred after Covid under the Bidenomics “recovery.” Not only do you have more debt, but you pay higher interest rates on that debt. According to WalletHub, the average credit card interest rate when Biden took office was about 14.7 percent. By November 2023, that rate rose to 21.47 percent.

When Biden took office, the average interest rate for an auto loan was 4.56 percent, and the average home loan was just over 3 percent. By the end of August 2023, the auto rate rose to 7.4 percent, and the home loan rate had more than doubled. If you could afford a $500,000 house under Trump, you can only afford a $325,000 house under Biden. People know when they cannot afford a home and when they pay high interest rates for credit.

“Bidenomics” increased the federal debt to $34 trillion. Paying interest on the debt in 2023 cost the American people $659 billion. This represents close to 25 percent of all 2023 federal income tax receipts. One out of every four of your 2023 income tax dollars paid for … nothing. If the federal government confiscated all personal savings from every American, it might cover next year’s interest payment on the debt. Then again, it might not. This interest figure has nearly doubled since Biden took office. Under Biden, paying interest is the government’s fourth largest spending “program.”

Not only has Bidenomics created more federal debt, but it has also raised the interest rates that taxpayers must pay to service that debt. Bidenomics has caused interest rates to increase for everything, including government debt. The interest paid now is weighted in favor of pre-Bidenomics, low-interest government debt. In future years, interest payments will be weighted more heavily in favor of high-interest Bidenomics debt. People know they, their children, and their grandchildren will have to pay these outrageous bills.

Add to this list that in 2022, the supplemental poverty and supplemental child poverty rates increased by 59 percent and 138 percent, respectively, and that under Biden the number of homeless Americans has reached its highest level since HUD started keeping the figure.

The Economy Is Not Growing

Biden points to “low” unemployment and GDP “growth” as evidence of success. But those characterizations are misleading. Before Covid, the unemployment rate was 3.5 percent. Now it is 3.7 percent — which is not “low” compared to the pre-pandemic rate. Furthermore, the labor-force participation rate under Biden was a paltry 62.5 percent as of December 2023, nearly a full point below pre-Covid labor participation. This means a smaller percentage of Americans are working under Biden than pre-Covid, regardless of the unemployment rate.

Biden’s “job creation” claims likewise are deceptive. In July 2023, 161.26 million Americans were employed. By December 2023, that number dropped to 161.18 million. Yet during this same period, the Labor Department reported that the economy added more than 1 million jobs. You ask, how can this be? It’s simple, these two statistics measure different things.

The first measures the number of people employed. The second measures the number of jobs people are working. The two numbers reconcile in the following way: More people are having to work more than one job. Under Biden, the number of people working multiple jobs has been on the increase since the spring of 2020. For many Americans, “Bidenomics” is a sentence to hard labor. People know when they have to work harder to feed their families.

Biden faces similar problems with his economic “growth” argument. During Covid, Democrats (primarily) closed down large portions of the economy. Of course, GDP was going to grow once the economy reopened. There would have been GDP growth had we put The Three Stooges in charge. But by going from substantially closed to completely open, the economy should have grown robustly. In fact, average GDP growth during Biden’s term will be less than the historical U.S. average since 1950. Moreover, much of this “growth” has been sustained by the depletion of savings and retirement assets, increased consumer borrowing, and outlandish government deficit spending. Decreased savings and increased borrowing suggest high near-term consumption at the expense of steady, long-term consumption. It is a form of GDP “channel stuffing.”

Yet the bigger problem for Biden and his allies is their comical obliviousness to the deeply personal pain Bidenomics has inflicted on Americans to “achieve” Biden’s so-called “results.” That pain includes earnings losses, massive inflation, depletion of savings and retirement assets, excessive debt, exorbitant interest rates, harder work, increased poverty, and out-of-control government spending. People know when their lives are worse and their futures look bleak, no matter how many times Biden claims otherwise.

“Bidenomics” has attained punchline status. Unfortunately for most Americans, it is gallows humor.