Kentucky Republican State Treasurer Allison Ball put nearly a dozen financial firms on notice that they may be subject to divestment for boycotting fossil fuels.

On Tuesday, Ball named 11 financial institutions that will have to choose between managing taxpayer assets well or their continued animosity toward American energy.

“When companies boycott fossil fuels, they intentionally choke off the lifeblood of capital to Kentucky’s signature industries,” Ball said in a press release. “Traditional energy sources fuel our Kentucky economy, provide much needed jobs, and warm our homes. Kentucky must not allow our signature industries to be irreparably damaged based upon the ideological whims of a select few.”

According to the treasurer’s office, the energy sector is responsible for nearly 8 percent of state employment. The U.S. Energy Department reported last summer that more than 70 percent of the state’s electricity came from coal in 2021, giving Kentucky residents the 12th-lowest prices in the nation.

Ball gave state agencies 30 days to report any direct or indirect holdings in firms identified as refusing investment in fossil fuels. Firms listed include Citigroup, JPMorgan Chase, and BlackRock, among others.

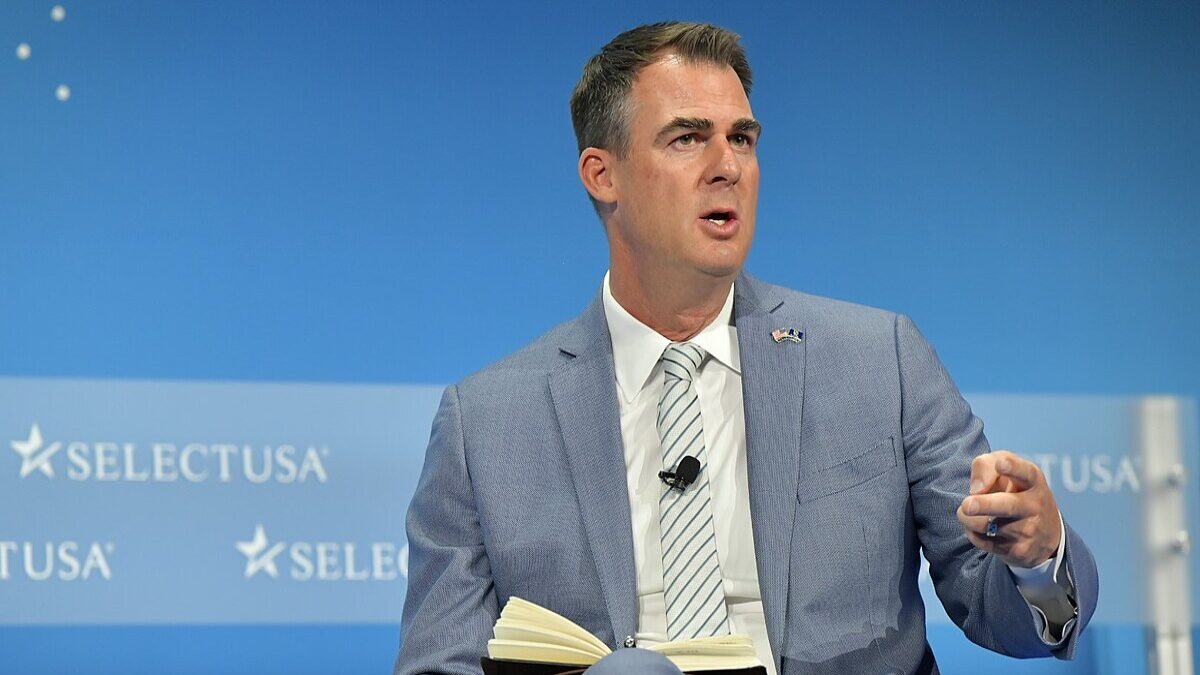

In December, West Virginia Treasurer Riley Moore called on BlackRock CEO Larry Fink to resign over the firm’s championing of anti-energy environmental, social, and governance (ESG) standards to the detriment of shareholders. The colossal Wall Street firm ended last year with roughly $8 trillion in assets after it began 2022 with a record $10 trillion.

“Does that sound like a guy who’s doing something right?” Moore asked in an exclusive interview with The Federalist. “If anything, it’s a cautionary tale to focus on the maximization of your return for your beneficiaries and your shareholders.”

BlackRock, however, remains fixated on driving ESG standards, which require total decarbonization, as the norm on Wall Street. In a letter to CEOs last year, Fink celebrated a “tectonic shift in capital” toward BlackRock’s commitment to net-zero carbon emissions as Americans pay record energy prices.

Moore’s call for Fink to step down followed North Carolina GOP Treasurer Dale Folwell’s call for the BlackRock executive’s exit the week prior.

In January last year, Moore became the first state treasurer to take an axe to constituents’ state-sponsored relationship with the Wall Street behemoth, gutting from BlackRock’s management about $8 billion in funds from West Virginia’s Board of Treasury Investments.

Republican policymakers around the country began to follow suit. Chief financial officers in Arkansas, Utah, Louisiana, South Carolina, Missouri, Florida, Arizona, and Texas have now ordered taxpayer assets be stripped from BlackRock.