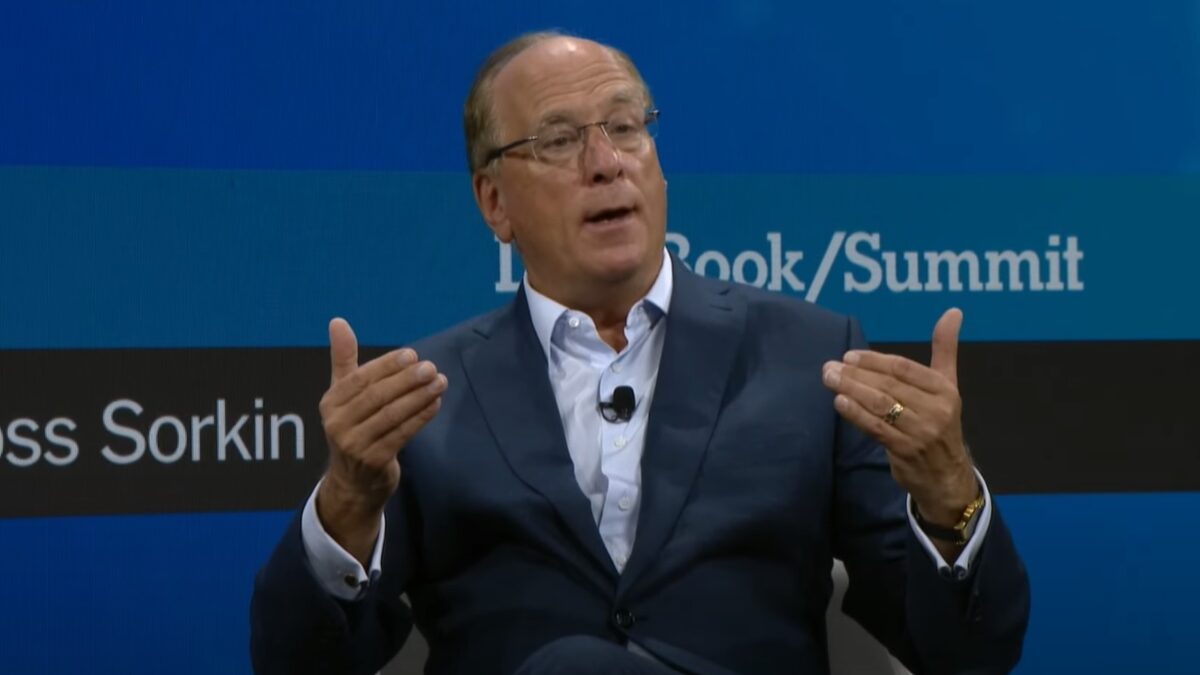

West Virginia Republican Treasurer Riley Moore became the second state chief financial officer to call on Larry Fink, CEO of the world’s largest asset management company, BlackRock, to resign.

Moore called for Fink’s resignation during an exclusive interview with The Federalist over a recent letter from North Carolina Treasurer Dale Folwell to BlackRock’s board of directors demanding Fink step down. Last Friday, Folwell admonished Fink for placing personal political priorities, of the kind embedded in so-called Environmental, Social, and Governance (ESG) standards, over the best interest of the company’s clients.

“Unfortunately, Larry Fink’s pursuit of a political agenda has gotten in the way of BlackRock’s same fiduciary duty. A focus on ESG is not a focus on returns and potentially could force us to violate our own fiduciary duty,” Folwell wrote. “Having lost confidence in his leadership to responsibly steward investors’ resources, I request, quite simply, that he resign or be removed from the asset management firm’s leadership team immediately.”

When asked whether Fink should step down, Moore agreed.

“Yes, I think Larry Fink should resign,” Moore told The Federalist, adding, “I don’t think he’s obviously somebody who’s too concerned about what policymakers in the United States think.”

In October, Fink took a victory lap for antagonizing American politicians on both sides of the aisle as head of the global financial management behemoth, which has roughly $8 trillion in assets. While Republicans charge BlackRock with manipulating their constituents’ tax dollars to pursue anti-energy policies against them, Democrats say BlackRock doesn’t do enough to tackle the left’s climate priorities.

“I’m now being attacked equally by the left and the right, so I’m doing something right,” Fink said at the annual membership meeting for the Institute of International Finance in October.

“That’s an interesting way to think of that,” Moore told The Federalist about the comment. “I think what he’s done is make everybody mad.”

The West Virginia treasurer pointed out that BlackRock lost $2 trillion under Fink just this year. The day after Fink’s remark about bipartisan frustration, Reuters reported BlackRock’s assets fell below $8 trillion following a $10 trillion high in January.

“Does that sound like a guy who’s doing something right?” Moore said. “If anything, it’s a cautionary tale to focus on the maximization of your return for your beneficiaries and your shareholders.”

Last year, Moore led a coalition of 15 GOP state treasurers who threatened to yank $600 billion in taxpayer assets away from firms that refuse investment in fossil fuels. Now several are following through on their pledge to protest “woke capitalism” with divestment from BlackRock, a Wall Street pillar of ESG investing to reach net-zero carbon emissions. Fink’s desire to conduct and maintain business with the Chinese Communist Party (CCP) to the detriment of U.S. security has also drawn the ire of lawmakers.

In his letter to BlackRock’s board of directors last week, Folwell informed the firm’s leadership that the financial giant may no longer oversee the state’s $14 billion from the North Carolina Retirement Systems fund. Moore already pulled the plug in January and became the first state treasurer to block BlackRock from managing $8 billion in tax dollars from West Virginia’s Board of Treasury Investments. Other states have begun to follow suit.

In March, Arkansas Republican Treasurer Dennis Milligan pulled $125 million from BlackRock’s management. Milligan’s move was followed by Utah Treasurer Marlo Oaks moving $100 million away from BlackRock to different asset managers in September. In October, Louisiana divested nearly $800 million from the New York firm, South Carolina withdrew $200 million, and Missouri pulled out $500 million.

Earlier this month, Florida gutted $2 billion from BlackRock’s management following a resolution from Republican Gov. Ron DeSantis, who overwhelmingly won re-election in November by a nearly 20-point margin.

Arizona Republican Treasurer Kimberly Yee, who was the only Republican to win statewide this cycle without a contested result, announced last week that the Copper State would join the growing movement of divestment from BlackRock. Yee said in a statement that the decision is the result of a review from the treasurer’s Investment Risk Management Committee (IRMC).

“Part of the review by IRMC involved reading the annual letters by CEO Larry Fink, which in recent years, began dictating to businesses in the United States to follow his personal political beliefs,” Yee wrote in a press release. “In short, BlackRock moved from a traditional asset manager to a political action committee. Our internal investment team believed this moved the firm away from its fiduciary duty in general as an asset manager.”

The Arizona treasurer added that her office already stripped $543 million from BlackRock’s oversight in February “and reduced our exposure to BlackRock by 97 percent this year.”

In Texas, where lawmakers have banned state and local governments from conducting business with firms that boycott fossil fuels, senators grilled a BlackRock executive on Thursday over the firm’s promotion of ESG standards and membership in Climate Action 100+.

Climate Action 100+ is a coalition of investors pushing strict environmental standards to eliminate fossil fuels through public and private policy. Last week, House Republicans on Capitol Hill launched an antitrust probe into the group, describing the coalition as a “cartel” aiming to undermine a reliable power grid with intermittent wind and solar.

Bud Brigham, the first witness in Thursday’s Texas state Senate hearing, explained to lawmakers that he was denied a loan from a bank restricting capital to firms that might bring down the financial institution’s ESG score.

“I knew there was no way we were going to do the deal,” Brigham said after the bank demanded Brigham capitulate to the firm’s left-wing talking points on climate change.

In August, the Texas comptroller ordered a divestment of state pension funds from BlackRock.

Will Hild, the executive director of Consumers’ Research, has repeatedly warned about BlackRock’s mission to drive left-wing ESG standards as the default standard among Western financial institutions. Earlier this year, Hild’s watchdog group published a new website detailing Fink’s dual loyalty to the CCP in particular, WhoIsLarryFink.com.

Hild told The Federalist that Americans can expect to see more divestment from the firm in 2023, on top of additional oversight from congressional Republicans after they reclaimed the House. More hearings in state legislatures over BlackRock’s practices are also likely over the next year.

“The big thing you’re going to see is a continued amount of divestment,” Hild said, with states passing anti-ESG legislation to strip more tax dollars from Wall Street firms such as BlackRock that use those tax dollars to wreak havoc on constituents’ industries.

“They’ve been using the power of those assets to push political objectives,” Hild explained, fueling the cascade of divestment from state policymakers.