I’m a fan of Freddie deBoer, who’s one of the most interesting writers on the left these days. In his newsletter this morning, he takes aim at a short piece I wrote debunking the silly talking point comparing PPP and student loan “forgiveness:”

Here’s the Federalist summarizing a lot of conservative sentiment on the comparison between student loan forgiveness and PPP loans:

PPP loans, unlike student loans, were intended to be cash transfers from the government. They were structured to be forgivable “loans” before the law was passed. No one broke a contract. No one changed the parameters of the loans. No president walked in and unilaterally transferred the responsibility of PPP payments to other businesses.

This is supposed to be some kind of gotcha, but as a moral distinction it fails utterly. OK, they weren’t really loans but cash transfers. So: why were cash transfers given to many vastly rich businesses and individuals and not to people struggling under the weight of student loans?

DeBoer seems unaware that the PPP program wasn’t aimed at “vastly rich businesses” but small businesses with 500 or fewer employees. Nor was PPP a “stimulative grant.” “Stimulus” bills are inflation-inducing, job growth-chilling cronyistic boondoggles for big business and big unions, and I am happy to oppose them. PPP was implemented by the Small Business Administration, and stands for “Paycheck Protection Program,” because its purpose was job retention—in reaction to the state forcibly shutting down the economy and potentially destroying millions of livelihoods.

Like most massive government programs, PPP was clumsily implemented and rife with corruption. And yet, for all its faults, PPP was far more effective in helping working people than sending them checks, because it saved their jobs and maintained stability by allowing full-time employees to hold onto their benefits, health insurance, etc. The “loans” were only “forgivable” if companies, big or small, proved funds had been principally spent on keeping people employed.

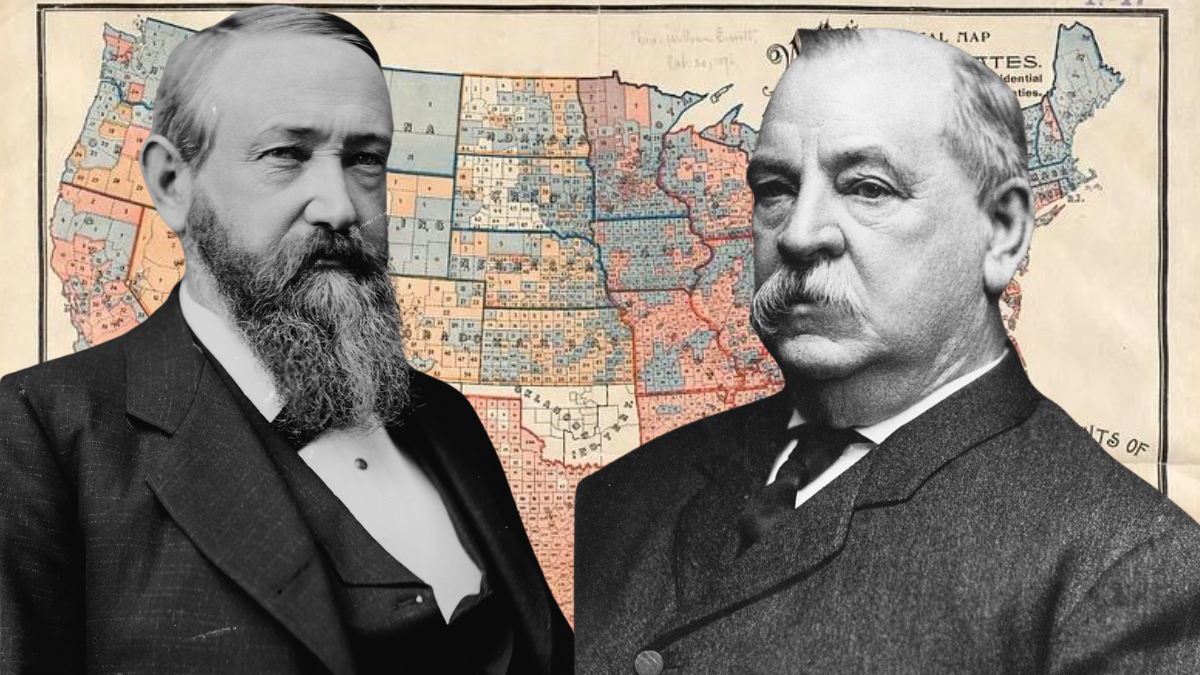

DeBoer contends, like many others on the left, that it’s irrelevant whether PPP was a cash transfer or not. Setting aside the fact Joe Biden enacted the student loan “forgiveness” like a dictator—unmentioned in deBoer’s piece; perhaps it’s also irrelevant to him—the substantive difference between the two is that unlike those taking PPP loans, student loan signees legally agreed to pay them back. There was no expectation of “forgiveness.” The government’s guaranteeing of those loans already creates a moral hazard. This just exacerbates the problems of high tuition. But surely the fact that the president unilaterally broke existing contracts for a narrow group of voters (probably unconstitutionally), and then transferred those payment obligations to others, is somewhat relevant both legally and morally.

I assume many people find it more “ethical” to save the employment of lower- and middle-class workers, whose jobs were threatened not by their actions but by state diktats, than it is to compel those lower- or middle-class workers to pay off the loans of a person who is getting some advanced liberal arts degree. Or any degree, actually. One reason is that Americans don’t struggle “under the weight of student loans” any more than they do the weight of mortgages or car loans. According to Brookings, around 30 percent of undergrads graduate with zero debt, and 25 percent with less than $20,000. Only 6 percent of graduates owe more than $100,000. Many of those borrowers will be making six-figure salaries in the future. Loans for graduate degrees, for instance, constitute 50 percent of all outstanding loans. Those graduates will be making $2-3 million more in their careers than the high school graduate on average. Pay your own way.

“If you think Biden’s $10k is bad policy, say so,” deBoer writes. Well, I called it an unjust, cynical abuse of power, not to mention a moral hazard, counterproductive, and fundamentally immoral. But there was never a debate over any “policy.” Loan “cancellation” was implemented by fiat. That matters, too. Those who believed that Trump should allocate funding for a southern border wall through executive action to stem illegal immigration also saw it as the moral choice. Public policy can never be calibrated to meet everyone’s moral expectations. Nor should it. This is why we have legislators and separation of powers. But if deBoer believes that high school graduates should be on the hook for $6,000 apiece in loans they didn’t take out, or that there is no limiting principle in how a country enacts policies he finds moral, he should just say so.