The White House begrudgingly approved the resumption of oil and gas leases on federal lands in the early hours of Easter weekend Friday after a 15-month suspension was implemented on President Joe Biden’s first day in office.

The suspension of federal lease sales immediately suppressed oil and gas production and chilled investment in the capital- and labor-intensive industry. Production dropped from more than 11,000 barrels of crude per day the month Biden took office to nearly 9,800 in February 2021, according to the Energy Department.

Operators require new drilling prospects long before committing billions in capital to explore a particular area without fear of interruption. The resumption of leasing only comes after a federal judge overturned the president’s order last summer.

Friday’s announcement also comes with a catch. Only about 144,000 acres will be auctioned off for drilling, an 80 percent drop from what was under evaluation, according to a press release from the Department of Interior. The federal government will also spike royalty rates 50 percent, from 12.5 percent to 18.75 percent of the extracted product’s value, again increasing prices for domestic production at a time Americans face the record bills at the pump.

On Monday, White House Press Secretary Jen Psaki made clear the administration was reluctant to comply with the court-ordered continuation of federal land leases for oil and gas exploration.

“It’s not in line with the president’s policy, which is to ban federal leasing,” Psaki said, pledging an appeal to the court’s decision while going on to repeat the popular White House talking point of 9,000 unused permits hoarded by the industry.

“We don’t feel they are needed,” she finished, while the nation copes with turbulence in the global marketplace after Biden’s enthusiastic forfeiture of its energy independence.

Those 9,000 permits, however, don’t mean producers are sitting on untapped reserves ready for extraction at the flip of a switch. With oil prices as high as they are today, the deliberate refusal to operate on permitted land with full approval for drilling would be corporate malpractice.

The process for securing a federal minerals lease is long and complex. First, companies must conduct the necessary scientific exploration and find the possibility that oil or gas are present in the subsurface or a particular place.

The next step is to nominate the land for leasing. Producers may wait years for the nominated land to come up for a competitive blind offer auction. The 144,000 acres now up for sale by the administration suffered an additional 15-month delay while the Interior Department overhauled the federal oil and gas program, only to make it to public auction by the order of a federal judge once production was made more expensive.

Once the lease sale is complete and the mineral rights are in the hands of the highest bidder, an additional application process begins for access from either the Bureau of Land Management (BLM) or the U.S. Forest Service. Applying for access may take additional years to reach approval. Once access is granted, producers may drill a well to further evaluate the geography. If enough economically feasible oil and gas reserves are not found, the project may be abandoned. “Wildcat Wells,” which are wells placed more than a mile of an existing well in operation, have about a 30 percent chance of success.

Uncertainty about continued drilling on federal lands, which are already more expensive to operate on than private property due to compliance costs, has intimidated investors from aggressive exploration with permits holding no promise of lucrative returns. Even after permits are awarded, they may come with additional stipulations.

In addition, nearly 4,600 permits remain awaiting approval from the Bureau of Land Management run by a Biden-appointed ecoterrorist.

Federal lands now open for leasing are unlikely to produce anything by the end of the year, especially under an administration that publicly pledges to do all in its power to drag out the process and potentially have them canceled. What’s going up for sale out of the more than 700,000 nominated may not make much economic sense to purchase, and energy companies are coping with the same supply chain obstacles that hamper the rest of the economy.

If the Biden administration were serious about bringing down gas prices, it would have made moves long ago to unleash domestic production. Instead, Biden has played a counterproductive blame game that promises to drive up power prices in the absence of policy encouraging the development of reliable fuels.

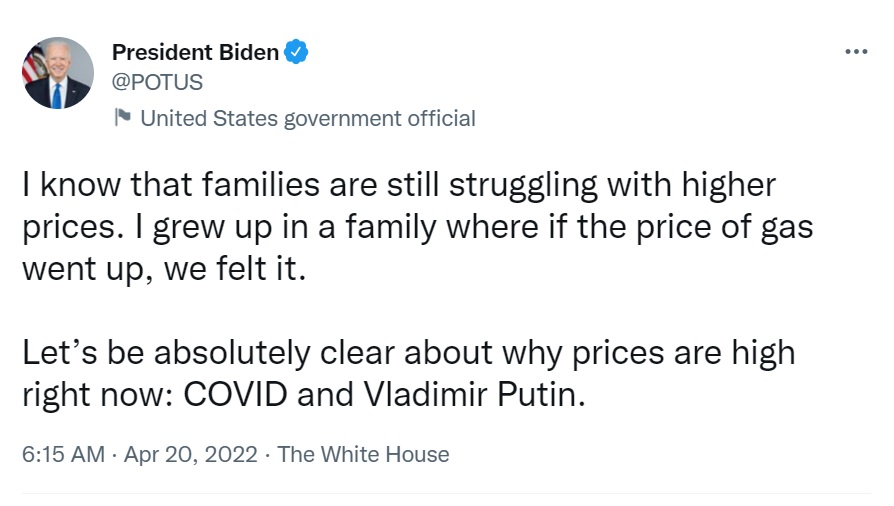

The president repeated the claim that high gas prices are driven by Russia’s invasion of Ukraine on Wednesday despite prices rising ever since Biden himself took office last year.

It wasn’t Vladimir Putin who suspended oil and gas leases for 15 months, canceled projects in the Arctic National Wildlife Refuge, and took an ax to the Keystone XL Pipeline. Last month, Bloomberg News also reported the Biden administration is planning to delay oil leases in the Gulf of Mexico for a third consecutive year as the president takes the “unprecedented” step of emptying the nation’s emergency petroleum reserves ahead of the midterms.

Biden’s plans on federal oil and gas leases is just the latest in a long line of signals to investors in the oil and gas industry that they — and American consumers — have no ally in the White House.