President Joe Biden released his tax returns last Friday, and the White House claimed “with this release, the President has shared a total of 24 years of tax returns with the American public, once again demonstrating his commitment to being transparent with the American people about the finances of the commander in chief.” Biden has previously boasted about his “transparency” in releasing his tax returns.

Except the most revealing parts of his tax returns are not public.

Joe and his wife Jill Biden have released their jointly filed individual tax returns, but not the corporate tax returns containing details on the S-corporations that have been the source of most of their recent income and that they set up shortly after Joe Biden left his post as vice president, as The Federalist has reported.

After he left office, Biden and his wife’s income increased massively, from a total of $396,552 in 2016 to $16,603,421 in adjusted gross income between 2017 and 2019. About $13 million of that flowed through their S-corporations.

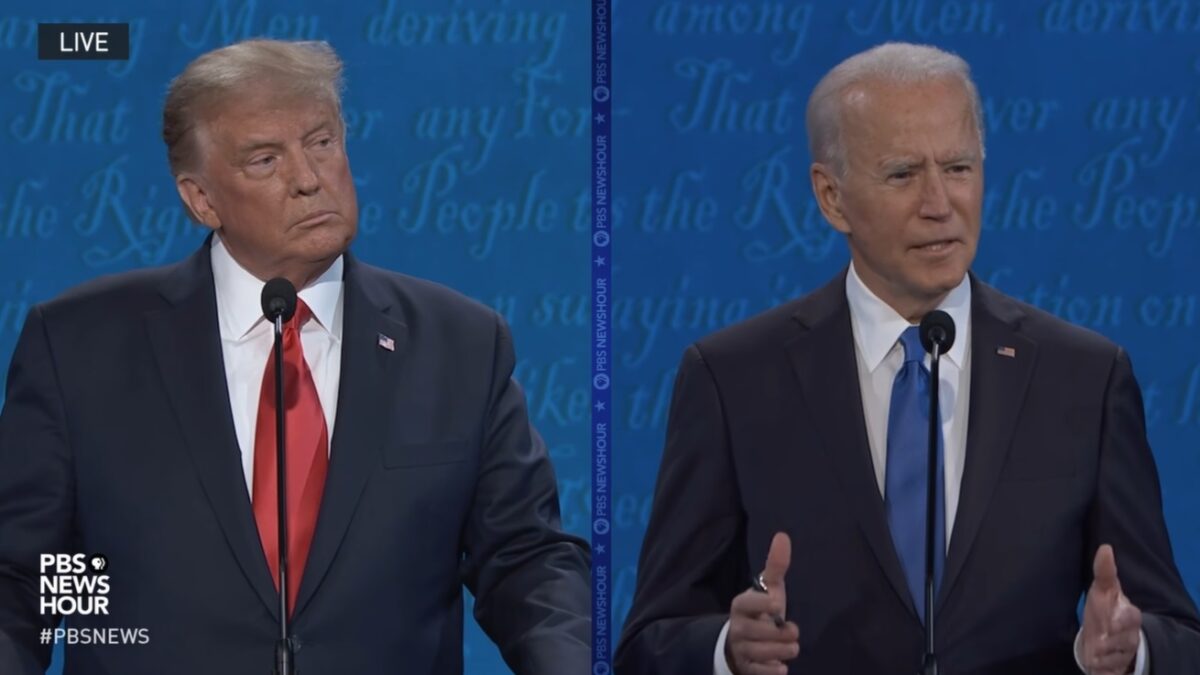

George Washington University law professor Jonathan Turley told The New York Post that while there’s “no evidence of wrongdoing,” questions about the president’s son Hunter Biden’s overseas business deals have “reached the point where the White House needs to err on the side of transparency” and release the corporate returns.

Where Did the $13 Million Come From?

“The Biden campaign explained in a press release [in 2019] that the money in those entities [the S-corporations] came from speaking engagements and book payments connected to Joe’s memoir, Promise Me, Dad, and Jill’s memoir, Where the Light Enters,” according to Forbes.

USA Today maintains that $15.6 million of the Bidens’ income from 2017 to 2019 “was from speaking fees and book deals,” citing CNN, which sources to “financial documents released by Biden’s campaign.” But those documents don’t reveal that.

The Bidens’ 2017 tax return shows that $10 million of income was via the S-corporations. The Bidens’ 2018 tax return shows $3 million in income from the S-corporations. The tax returns have no details of how the S-corporations made money.

Book Advance?

In The Federalist, Bob Anderson has explained that the Bidens’ book sales were too low to be the likely source of all the income, but that perhaps the publisher of the Biden’s book deal, Flatiron Books, paid a huge advance. Flatiron did not return requests from The Federalist to confirm a report that Flatiron gave an $8 million advance in 2017 to the Bidens.

“Political memoirs have a habit of never earning back the massive advances that are given out,” according to one book reviewer.

The publisher would understandably want the president to be the one to reveal the details of the advance.

The White House claimed that the tax returns released last week demonstrate President Biden’s “commitment to being transparent with the American people about the finances of the commander in chief.”

The White House should follow up with the tax returns for the Bidens’ S-corporations, going back to when they were founded in 2017.