Half of states across America have announced they will stop participating in the federal government’s weekly $300 unemployment bonuses. The plans were set to expire in September, but 25 states looked at April’s jobs report and knew it couldn’t wait.

Why couldn’t it wait? Because open jobs were remaining unfilled, while millions of people collected unemployment. Economists predicted 1 million new jobs in April. Instead, only 266,000 jobs were added.

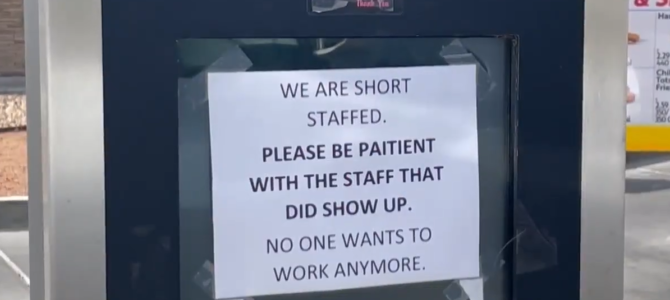

Newspapers nationwide have been filled with stories of empty job fairs, interview no-shows, and employers begging for people to come back to work. It’s nearly impossible to drive across town without seeing a “now hiring” sign in a storefront window. There are 8.1 million job openings across the country waiting to be filled — a record high — yet unemployment actually rose to 6.1 percent in April.

It’s not just the industries hit hardest by lockdowns, like the leisure and hospitality sectors, struggling to find workers. U.S. manufacturers reported a record high of 700,000 jobs available last month, but few takers. Some blame so-called “starvation wages,” but wages are rising faster than they have in years. In fact, every single non-farm private sector of the U.S. economy saw wage growth in April.

Jobs are paying more than ever, and there are more jobs than ever from which applicants can choose. All these signs should point to an economic boom, but there’s just one problem: the federal government is paying people to stay home, and it’s crushing small businesses.

Unemployment was created to provide temporary assistance to people who lost jobs through no fault of their own and are actively seeking work. But when politicians shut down the American economy to “flatten the curve,” it prevented millions of workers from earning a living for their families. Government officials promptly expanded welfare programs to unprecedented levels in an attempt to fix the mess they created. But they only made things worse.

Congress boosted and extended unemployment benefits, relaxed eligibility rules, and suspended work search requirements. They made it as easy — and lucrative — as possible for people to live without having to work. As a result, many individuals can collect more benefits by staying home, all without having to meet even work search requirements.

Congress also created new tax credits and relaxed eligibility rules for other assistance programs like food stamps and Medicaid. For some Americans, now just staying home can generate more than $44,000 per year in cash and benefits. In Hawaii, the monthly benefits can be as high as $4,300 per month, or more than $52,000 per year.

How can local businesses possibly be expected to compete with that? To match these benefits, a small business would have to pay even unskilled workers more than $21 per hour. The Foundation for Government Accountability notes that is higher than the median wages for several skilled industries across the country, including “pipe layers, roofers, stonemasons, truck drivers, welders, accounting and auditing clerks, and pharmacy and dental technicians.”

Most local employers cannot afford to pay that kind of money, but they also can’t run their businesses with no staff. The government has put them in an impossible position. No wonder 73 percent of small-business owners are having a hard time finding workers right now.

The costs of competing with government handouts have been enormous for small businesses, sometimes requiring them to shut their doors or turn down new customers and opportunities. Almost one-third of small businesses still operating say if the labor shortage doesn’t change, they will likely close in the next year.

For these struggling businesses, every day the federal unemployment bonus and other pandemic perks continue is a day closer to shutting down for good. States know Congress has extended the federal unemployment insurance bonus and other pandemic relief programs multiple times, and some Democrats are calling for making these policies permanent and expanding unemployment even further.

Congress should allow these programs to expire, but we don’t need to wait until they do. If states want to get their residents back to work and economies back to full speed, they cannot afford to wait for Washington to do the right thing.