Sen. Elizabeth Warren, a front-runner Democrat in the 2020 presidential race, seems to have a plan for every problem under the sun, from free child care, to free college, to climate change solutions, to “Medicare for all.” However, she has proposed only one plan to pay for all these “free” offerings, which, according to her own estimates, will cost our nation a whopping $52 trillion: raising taxes on the rich.

In January, Warren proposed a “wealth tax” of 2 percent on Americans with $50 million-plus in assets and 3 percent on those with assets over $1 billion. After being criticized by both the left and the right saying this tax won’t raise enough money to pay for all the government programs Warren wants to offer, she decided to double down. Last Friday, Warren announced she would double the wealth tax for those with assets over $1 billion from 3 percent to 6 percent.

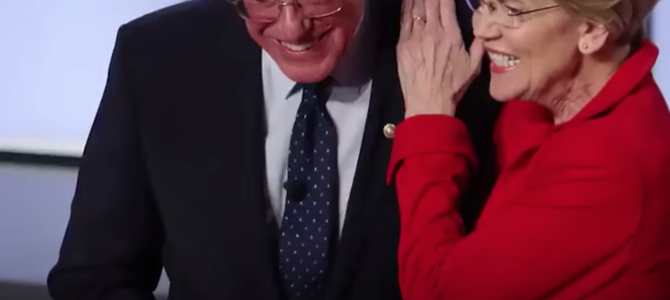

Of course, she is not the only Democratic candidate waging class warfare against wealthy Americans. Sen. Bernie Sanders proposed his very own income inequality tax plan. All other Democratic presidential candidates want to soak the rich in similar fashion, and they’ve justified their socialist proposals by pointing to the new U.S. Census Bureau data showing that in 2018, the income gap between the rich and the poor in the United States was the widest it’s been in 50 years.

Democratic Policy Proposals Are Based on Bogus Data

The census data Democrats rely on is inaccurate, however. Phil Gramm, former chairman of the Senate Banking Committee, and John Early, former assistant commissioner at the Bureau of Labor Statistics, wrote for the Wall Street Journal this week. Based on their analysis, the census data distorted U.S. income inequality by “omitting one-third of all household income paid in federal, state and local taxes,” as well as the annual public transfer payments to the lower income households through “some 95 federal programs such as Medicare, Medicaid and food stamps, which make up more than 40% of federal spending, along with dozens of state and local programs.”

The scale of such government transfer is astounding. According to Gramm and Early, “The average bottom-quintile household earns only $4,908,” but “receives $45,389 in government transfers; private transfers from charitable and family sources provide another $3,313.” They go on to state that since “the average household in the bottom quintile pays $2,709 in taxes, mostly sales, property and excise taxes, the net result is that the average household in the bottom quintile has $50,901 of available resources — well within the range of American middle-class earnings.” Such annual government transfer totals about $1.9 trillion.

The U.S. government is able to make this enormous wealth transfer every year because of its highly progressive income tax system. Warren claims her “wealth tax” is simply asking the rich to pay a fair share and “pitch in a little bit more,” but according to the National Taxpayers Union Foundation, the rich already pitched in by far the most. In 2017, the top 1 percent of earners (with incomes over $515,371) paid nearly 39 percent of all income tax revenue, the top 10 percent of earners paid 70 percent, and the top 50 percent of earners paid 97 percent of all income tax revenue. In the meantime, “the bottom 50 percent of earners took home 11 percent of total nationwide income while owing 3 percent of all income taxes.”

The conclusion? The census data “overstates the income inequality by more than 300%” by leaving out income tax paid by the rich and the annual government payment transfer. Besides being aware of the problematic data the Democrats rely on to make policy proposals, Americans should also ask if the kind of income equality the Democrats want to achieve at all costs is even desirable.

‘Equal People Are Not Free’

The Gini coefficient is a popular but imperfect tool for measuring income inequality. A country with perfect income equality would have a Gini coefficient of zero. Supposedly, the higher the Gini coefficient (up to one), the worse the country’s income inequality problem.

As of 2018, the United States had a Gini coefficient of 0.45. The following countries had more equal income distribution based on their Gini coefficient: Afghanistan (0.27), Albania (0.29), Cambodia (0.30), and Liberia (0.33). Does any American want to live in any of these countries? I doubt it. These countries are some of the poorest in the world.

Take Afghanistan, for example. Its gross domestic product per capita was only $521 as of 2018, but it has a more “desirable” Gini coefficient than ours because poverty is more equally distributed in Afghanistan. Is this kind of income equality desirable? Hardly.

Larry Reed, the former president of the Foundation for Economic Education (FEE) and a dear friend of mine, once made the important statement that “free people are not equal, and equal people are not free.” He meant we all have different talents, interests, habits, skills, and work ethics. When we are free to choose how to live our lives, we are bound to have different outcomes, including making different income.

A government can attempt to achieve an equal outcome among its people only by taking away their freedoms. As the history of socialism has demonstrated, such attempts usually end with an equal distribution of poverty and misery.

As Americans, we should be proud to live in a country with the highest number of self-made billionaires in the world. From Jeff Bezos of Amazon, to Bill Gates of Microsoft, Ken Langone of Home Depot, and Larry Page of Google, many of today’s American billionaires became ultra-rich by taking risks, founding corporations, employing hundreds of thousands of people, and providing goods and services that people around the world — including millions of average Americans — need or want. In a letter to Warren, billionaire Leon Cooperman, son of an immigrant and a plumber, said his success and that of other self-made billionaires is “the embodiment of the American dream.”

Furthermore, these billionaires do not hide their enormous wealth underneath the mattress. They put their wealth right back into the economy by taking on new business ventures, creating better products, providing better services, creating more jobs, or bettering communities through voluntarily donating millions via philanthropy work.

In that same letter, Cooperman said he had established a scholar program with the goal of putting 500 public school students from disadvantaged backgrounds into college. He also signed onto the Buffett/Gates giving pledge and plans to give away all his wealth. He mentioned his friend, Langone, donated $100 million last year and assisted in raising an additional $350 million to help pay tuition for every New York University medical student. These are just two examples from the extensive list of such generous acts.

The Left’s Efforts to End Income Inequality Will Fail

As a society, of course we should care about Americans who live at the bottom of the economic ladder and find viable ways to help them. But vilifying these billionaires and attempting to use the government’s tax power to confiscate and redistribute their wealth won’t help the poor. As Winston Churchill once said, “You don’t make the poor rich by making the rich poorer.”

Even the progressive French government learned this lesson the hard way — its wealth tax contributed to the exodus of an estimated “42,000 millionaires between 2000 and 2012, among other problems.” Eventually, France terminated its wealth tax in 2018. Should that kind of exodus take place in the United States as the result of President Warren’s wealth tax or President Sanders’ income equality tax, our economy and communities will suffer. Ultimately, the Americans who need jobs and charitable support will suffer most.

Plenty of evidence has shown there are more effective ways to help the poor climb up the economic ladder, including cutting taxes and eliminating ruinous regulations so the economy will grow. A growing economy would provide plenty of employment opportunities. Our country should also widen school choice, so students from disadvantaged backgrounds can receive a quality education, rather than being trapped in underperforming schools. Democrats’ focus on eliminating income inequality is a misdirected approach that is doomed to fail.