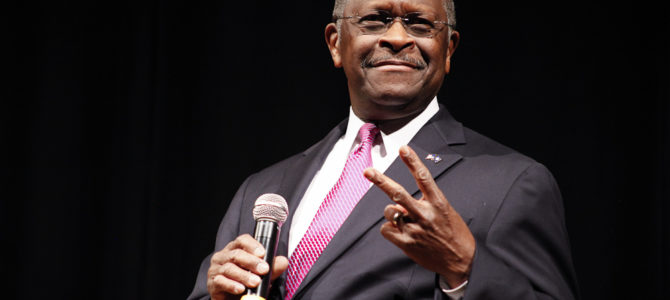

President Trump has announced that he may nominate Herman Cain to the seven-person Federal Reserve Board. Although Cain hasn’t been officially nominated yet, many on the left and some on the right have voiced their objections.

A Washington Post op-ed calls Cain’s potential nomination a “reckless” move. Is Cain the best candidate for the Federal Reserve’s Board of Governors? I will let the U.S. Senate decide at Cain’s confirmation hearing, should that happen. But the firestorm of condemnations of Cain aren’t all justified.

Criticism of Cain can be summarized into three main points. I’ll discuss them below.

1. Herman Cain Doesn’t Understand Economics

Catherine Rampell, a columnist for the Washington Post, wrote last week “Nein, nein, nein. That should be the Senate response if President Trump actually nominates his friend Herman Cain.” While she acknowledges that Trump’s past Fed nominees are “competent, well-qualified professionals,” she clearly looks down on Cain, referring to him as a “former pizza magnate turned failed Republican presidential candidate.”

It’s true that Cain is neither an economist nor a banker, the two professions that traditionally have dominated Federal Reserve officials. But Cain’s life is a quintessential American economic success story, the kind that Joe Biden can only wish he could plagiarize.

A native of Atlanta, Georgia, Cain was born into a poor family. His mother worked as a maid and his father was once a chauffeur. From this humble background, Cain went to college, got a master’s degree in computer science from Purdue University, and worked his way up from analyst to chief executive in corporate America. One of his business accomplishments was the turnaround of the Godfather’s Pizza chain in 14 months when he was its president and CEO.

But there is more. In 1992, Cain became one of the board of directors for the Federal Reserve Bank of Kansas City and was the board’s chairman from 1995 to 1996. In 2012, he sought the Republican presidential nomination with an 9-9-9 economic plan: 9 percent business flat tax, 9 percent personal flat tax, 9 percent sales tax. He was a long shot, but he won the Florida Straw Poll in 2011, beating seasoned politicians like Mitt Romney.

Cain has a better grasp of economics and policies than Paul Krugman, a well-known economist, Nobel economics laureate, and New York Times columnist. One of Krugman’s infamous blunders was when he predicted the day after 2016’s election that Trump would bring a global recession and the U.S. stock market would never recover. The U.S. stock market has risen to a record level under President Trump and American workers are enjoying the best job market ever with a record low unemployment rate in a booming economy.

Krugman has been wrong on many other significant topics, including the fiscal policies in Demark, the trade war with China and on bitcoin. Of course, Krugman was one of the first to criticize Cain’s nomination in a tweet.

2. The Gold Standard Is a Ridiculous Idea

Many Americans are not familiar with gold standard today, so it is easier for political pundits and even some economists to dismiss the gold standard as a fringe idea. But in 1800s, almost all the nations in the world adopted the gold standard, which “guaranteed that the government would redeem any amount of paper money for its value in gold.” The beauty of the gold standard is that because there is a limited supply of gold, it serves as a natural constraint on government spending and inflation.

Investment strategist Mark Luschini says the gold standard “forces the U.S. to live within its means…Think of it as a person with a debit card rather than a credit card. The debit card holder can only spend what he or she has in the bank.” Clear evidence—for example, here and here—shows that under the gold standard, the U.S. economy was relatively healthy, stable, and productive.

The United States was on the gold standard for 179 years until August 15, 1971, when President Nixon ordered the Fed not to redeem U.S. dollars with gold, essentially ending the gold standard in the United States (note to those who claimed that the Federal Reserve has always been independent). Since then, the U.S. dollar has been running on a fiat money system because its value is not linked to any real asset. Consequently, monetary disorders followed. Four decades after we abandoned the gold standard, the U.S. dollar has lost more than 96 percent of its value and our national debt stands at close to $22 trillion.

It’s true today most mainstream economists oppose restoring the gold standard. But even Bloomberg admits their opposition doesn’t mean Cain and other proponents of the gold standard are wrong. The criticism against the gold standard mainly rests on the notion that it will limit the Federal Reserve’s ability to manage the economy through manipulating the money supply and interest rates, especially in times of financial crisis. Yet even economists who are against the gold standard acknowledge that the Fed has made plenty of mistakes too.

The United States probably will never go back to the gold standard for other practical reasons as well: we don’t have enough gold reserves to pay off our debt; and if we are the only country that uses the gold standard in this integrated global economy, other nations that have trade surpluses with us will demand gold in payment, which will drain our gold supply. While all these arguments against the gold standards sound reasonable, Tyler Cowen, an economist at George Mason University, says it is wrong to assume someone who supports the gold standard is either crazy or ignorant.

Many smart people favor the gold standard besides Cain, including Steven Moore, another Trump Federal Reserve nominee, and former congressman Ron Paul. In 2012, the Republican Party platform called for the creation of a gold commission to evaluate restoring the gold standard. Former Federal Reserve Chairman Alan Greenspan, whom even many on the left respect as a mainstream economist, admitted ”if the gold standard were in place today we would not have reached the situation in which we now find ourselves.”

3. Cain Would Politicize the Federal Reserve

Cain is an unapologetic and outspoken conservative. When he was the leader of the National Restaurants Association, he criticized Hillary Clinton’s health care nationalization plan. He frequently disagreed with former President Obama. One of his well-known criticism was “Hope and change is not a solution. Hope and change is not a job.”

Therefore, many on the left charge that should Cain, and Moore, become Federal Reserve Board members, they would ruin the “independence“ of the Fed because they are both Trump loyalists who would politicize future monetary decisions.

It’s a valid concern that we don’t want our central bank to become an overly partisan institution. Our country is already very much politically divided. Having a central bank that can remain above the political fray and make decisions based on what’s best for the country, not by which direction the political wind blows, is a good thing.

At the same time, it is naive to think the Fed has always been truly “independent.” According to economist Peter Earle, the very set up of the Fed from the beginning means it has always been under political influence, including the facts that: Fed officials are appointed by the executive branch and confirmed by Congress; and private meetings between the Fed chairman and presidents are a long-standing fixture of economic policy coordination and implementation.

In his piece for the American Institute for Economic Research, Earle documented many instances throughout the U.S. history that, from Lyndon Johnson to Bill Clinton and George W. Bush, almost every president tried to exert influence on the Federal Reserve’s monetary decisions: “Presidents attempting to influence the Fed did not start with, and will not end with, the current Chief Executive.”

Acknowledging past presidential influence on the Fed doesn’t mean Fed officials should not strive for as much independent thinking as they can. Cain can help make his own case by either dissolving or at least dissociating himself from America Fighting Back, a pro-Trump group he set up. He also needs to tone down his political rhetoric and start demonstrating his understanding of economic policies by talking about real economic issues.

Cain is an unconventional choice for the Federal Reserve. But we shouldn’t be surprised, because President Trump is nothing if not unconventional. Should President Trump go ahead nominating Cain for the top job in the Fed, the U.S. Senate should give Cain a fair hearing rather than being dissuaded by some of these unfair criticisms.