The Washington Post informed its readers this month that college students are going hungry, in a report titled, “The hidden crisis on college campuses: Many students don’t have enough to eat.” Two days later, the Kansas City Star reported even more urgently, “Think college students are privileged? Nearly a third are hungry and homeless.” So what’s going on? Are American college students really going hungry and living on the streets?

Eh, not so much.

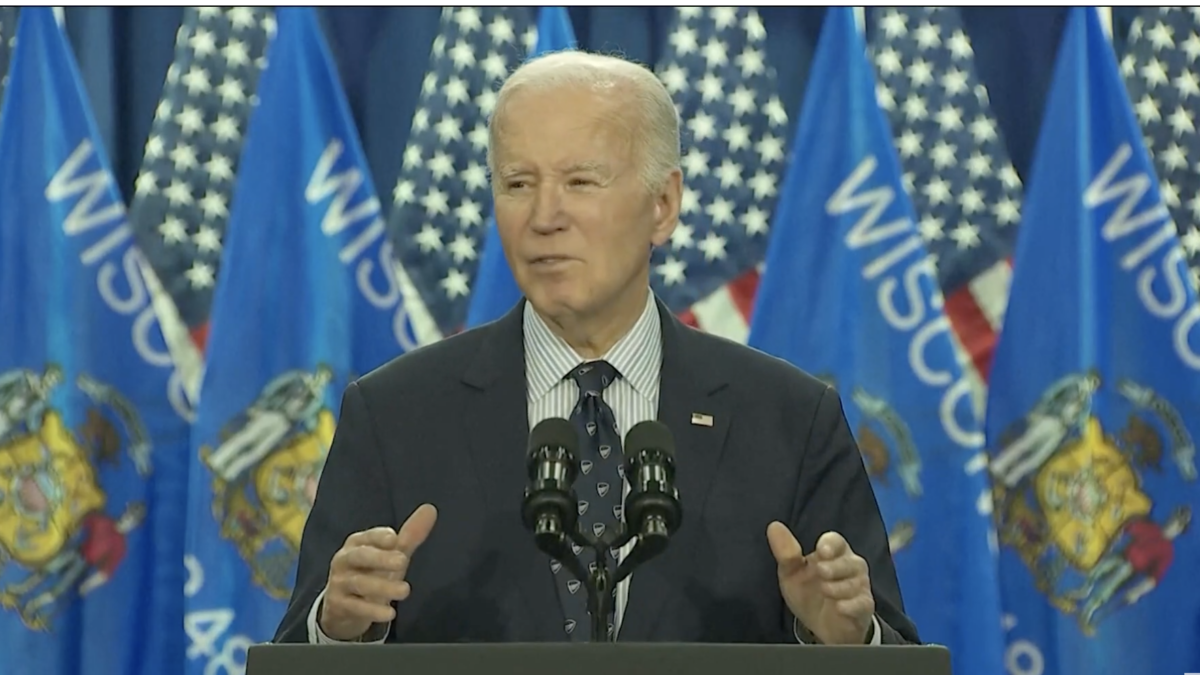

Both these reports are based on a study out of the University of Wisconsin-Madison, “Still Hungry and Homeless at College,” which itself is based off an extensive survey of students at both two- and four-year colleges, including the responses of 43,000 students, at the 66 colleges and universities which responded to an open invitation to participate.

So far, so good. However, student participation at those participating institutions was voluntary, with the incentive of a chance at $100 gift cards as a reward. The total response rate was 7.3 percent. This is not a high enough response rate to inspire confidence, especially on a subject where students who are more affected by the issue at hand will be more receptive to the request to complete the survey, and especially if they’re told, as the researchers expressed in The Washington Post article, that the purpose of the survey is to advocate for more funds to help them.

In fact, the demographic characteristics of the students who responded indicate that they aren’t representative of the overall student body: 70 percent at 4-year and 71 percent at 2-year universities are female (plus another 3 percent claiming to be non-binary), and 45 percent of the 2-year and 44 percent of the 4-year students said they receive Pell Grants (compared to only 32 percent nationally).

In addition to the likelihood that students with a vested interest in promoting the issue of food- and housing-insecurity were more likely to take the survey, there’s a problem with the questions themselves. They’re just as likely to really describe typical college experiences as they are genuinely serious needs.

Consider the questions related to housing insecurity: Students are deemed “housing insecure” — 36 percent of the total at 4-year colleges — if they meet one or more of the following criteria:

- Did not pay full amount of utilities

- Had a rent or mortgage increase that made it difficult to pay

- Moved in with other people due to financial problems

- Did not pay full amount of rent or mortgage

- Lived with others beyond the expected capacity of the housing

- Moved two or more times

Fifteen percent of students responded that they moved two or more times in the past year. Thirteen percent said they had rent that was “difficult to pay.” Eleven percent “moved in with other people,” and 7 percent lived in housing beyond its “expected capacity.” In the grand scheme of things, are these percentages truly all that worrisome?

Likewise, students report high levels of food insecurity based on their responses to highly subjective questions such as, “I couldn’t afford to eat balanced meals.” That could mean anything from eating ramen noodles three times a day to being unable to eat the degree of fresh organic produce one was used to at home. Here’s another example — “I worried whether my food would run out before I got money to buy more.” Others actually addressed a serious problem, such as asking whether the student was in fact missing meals due to lack of food.

There was quite a bit of variation among community colleges and universities when it comes to food insecurity, however. Estimates at community colleges ranged from 30 to 60 percent, though the colleges with larger survey samples clustered near the mean of 43 percent. The variation was even more pronounced at the universities, with estimates ranging from 15 to over 60 percent, but most between 30 and 40 percent.

How much of this is due to different demographic characteristics at the various responding schools, and how much to variability in the degree to which universities marketed the survey more intentionally to poorer students isn’t at all clear.

So What’s Really Going On?

All this being said, there are real issues, and Sara Goldrick-Rab, who spearheaded the UW study, wrote an entire book about it titled “Paying The Price” (University of Chicago Press, 2016). She describes students who are ineligible for financial aid because the financial aid formulas deem their families able to pay, and the actual unwillingness of those parents to do so leaves the students unable to fund their education.

She reports that universities may underestimate the reported student living costs (though her research team may instead be overstating them in their comparison, calculating their own estimates based on students living alone, rather than with roommates) upon which financial aid awards are based, leaving students and their families to make up the difference.

Cost of Attendance calculations also assume that students are able to live at home without incurring additional expenses during winter and spring breaks, and financial aid awards for students living at home likewise assume they have lower or no living expenses. In addition, in recessionary times, students may be unable to find the part-time jobs that financial aid officers build into their calculations.

In addition to these “someone else’s fault” issues, Goldrick-Rab identifies issues that are less straightforwardly the result of insufficient aid money. Despite reports of students spending their student loan money on parties and spring break trips, the actual statistics for students from low-income families show the reverse — that nearly half of those students did not accept the loans offered to them due to fear of debt, but instead tried to make do without them.

She reports that some students admit that, whether due to lack of will or ability, they manage their money poorly. And the calculus of financial aid misses the fact that, among the poorest of families, these students are not just expected to support themselves but also to contribute to family finances and maintain responsibilities at home, such as childcare for younger siblings, that make the usual part-time job expectation difficult or impossible to manage.

Whether it’s right or wrong that a student whose “need” is “met” through the financial aid formula goes hungry because the money designated for the student’s living expenses goes to pay for a family members’s utility bill or car repair costs, it’s nonetheless the case that it’s happening. She also describes lack of counseling by both high school and university staff that leaves students unable to really understand their financial picture and assess whether their planned course of action is feasible.

Her extensive discussion of students whose part-time jobs leave them without time to study also raises issues of judgement: Is it better to fall into debt to avoid working, or reduce one’s course-load, and is it right or wrong for policymakers to push students to take 15 credits per semester?

When it comes down to it, the system is built for families where the parents are willing and able to meet the “Expected Family Contribution” and fund the student’s living expenses when class is not in session, and is not as effective for students outside these boundaries, resulting in problems that are much narrower than a vague “American college students don’t have enough money,” and require solutions on the one hand much larger than “start an on-campus food pantry” and at the same time much more targeted than “give them all more more money.”

And for Goldrick-Rab to promote an expansive message of “1/3 of college students are starving and homeless” (because whether or not they intended this, the finer points of their survey are lost on journalists) does their cause more harm than good. Readers are more likely to react with a “So what? Everyone is expected to make financial sacrifices in college,” rather than gain a better understanding of the real issues that could indicate a policy response is needed.