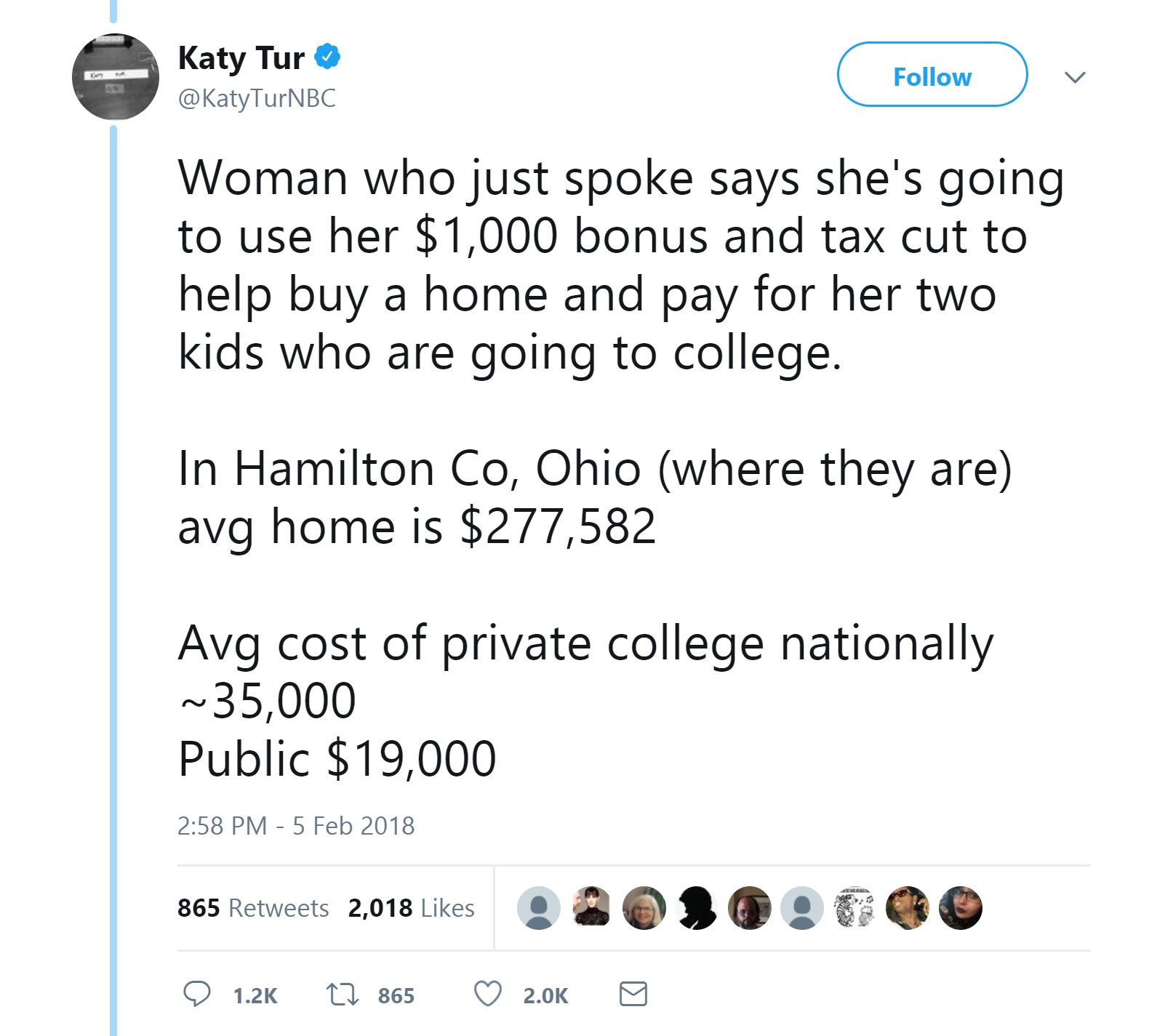

President Trump visited Ohio Monday, which included a public event at which Ohioans told what they were going to do with their $1,000 bonuses, increased wages, and lowered tax burden thanks to Republicans’ tax overhaul. NBC reporter Katy Tur decided to voice her disdain for their stories on Twitter.

Tur probably thinks of this as a “factcheck,” but it’s actually a reality check about what seems to be her wild ignorance of common American household expenses. For one thing, almost nobody pays the full cost of the medical care necessary during pregnancy and birth. That’s why we commoners pay for insurance on top of shelling out the taxes to cover the Medicaid bills of half the nation’s births. Thanks to Obamacare forcing us all to pay for care we don’t want or need, health deductibles and premiums have exploded. Yet a thousand bucks still is likely to comprise a hefty portion of the birth bill a family actually ends up paying.

Next math memo to Katy: Most Americans don’t buy their houses in one fell swoop. We get these things called mortgages, which typically require shelling out a sizeable chunk of the home’s value with a promise to pay a certain amount monthly towards the rest, plus interest to the bank for fronting the full cost immediately. One thousand dollars towards amassing that chunk is a significant boost. It would be even better if interest rates weren’t garbage thanks to long-time federal monetary policies that effectively steal Americans’ savings, but I digress.

Further, the typical estimation measure economists use when doing a comparison like Tur’s is median price, rather than average, because a few high-dollar items that aren’t representative of the market can wildly distort averages.

Zillow says the median home price in Cincinnati’s Hamilton County, Ohio is $139,100. For the standard 30-year mortgage on a house at that price, a buyer would have to put $27,820 down and then have a monthly payment of $547 (you coasters can start crying now). Tossing an extra $1,000 early into the principal would take three months off the loan length plus another $1,000 off what the would-be homeowner is scheduled to pay in interest. Maybe Katy Tur’s income is so awesome that $2,000 saved means nothing to her, but I’ve got a long list of useful things I could buy my kids for that kind of money.

As for higher education, Tur’s disparagement not only seems to imply this sort of meanness:

Me: "I want to start saving for a house"

Katy: "NYAAAAAAAAAAAAAH you'll never make it!"

— Jay (@OneFineJay) February 5, 2018

but also reveal a deep ignorance of the power of compound interest. One thousand dollars invested in a tax-advantaged 529 savings account when a child is three years old is likely to yield more than $3,000 for junior at age 18.

Compound this with ignorance about college sticker price versus actual bills to families. Nearly every breathing human being in America qualifies for federal college subsidies, and 85 percent of college students get them. Median current costs for tuition are hard to find because colleges benefit from keeping their pricing systems a secret. But the average annual net prices for college — the sticker price minus their discounts — are the following, according to the College Board:

-Two-year community college: $7,560

-In-state at public college: $14,210

-Private college: $26,080

Research has found that there is often little earnings difference between community college and Ivy League graduates, meaning this mom Tur implies is an idiot could actually get her kids their credentials at a deep discount by applying that $1,000 to community college for them. If this mom invested it early enough in that 529 plan, she’d have even more in the bank by high school graduation. Instead of stupid, I’d call that set of choices brilliant.

Since we’ve become a nation of moochers, people thinking ahead about paying their own family’s expenses using their own earnings should be celebrated, not belittled. It’s as if Tur thinks it’s impossible or meaningless to save up to pay for any purchase. If you don’t have all the money for it right away, just forget it.

*Little girl takes dollar she earned doing chores and puts it in a piggy bank*

*Katy Tur busts through the door*

"ACKSHUALLY THE AVERAGE BRATZ DOLL COSTS ABOUT 100 OF THOSE SO GOOD LUCK EVER GETTING ONE, IDIOT." https://t.co/OpzA4NUFvK

— Noam Blum (@neontaster) February 5, 2018

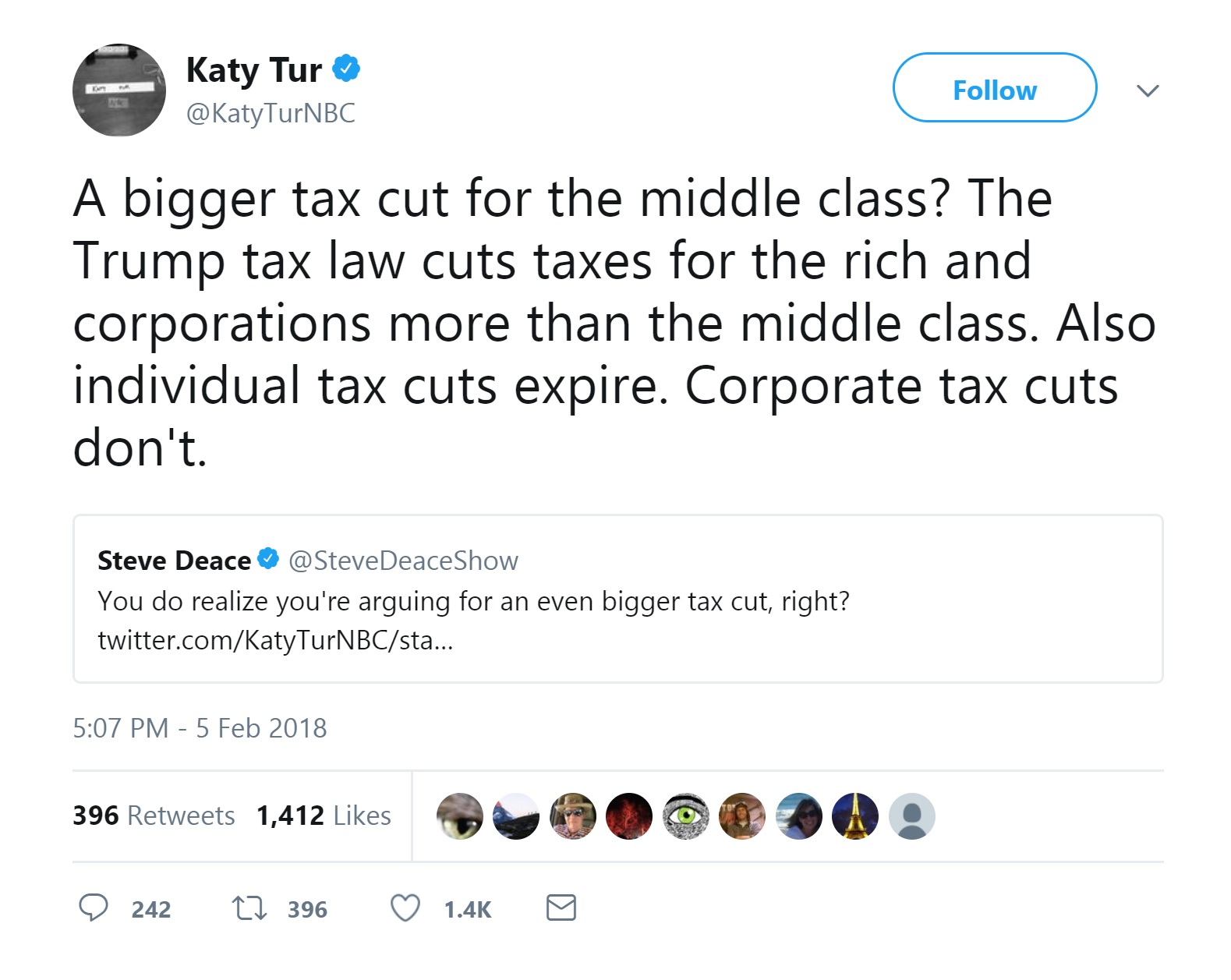

A key way to give people the power to support themselves is to keep government to the few things it does well, thus allowing citizens to keep more of what they earn. Taxes on companies are taxes on work. And when you tax something, you get less of it. That’s econ 101. It has nothing to do with politics, it’s just the way life is.

Another math fact from econ 101: You can’t lower taxes significantly on the people who contribute the least. You have to go where the money is. Doing that makes more money for all of us, because to stay competitive companies are highly likely to invest bigger profit margins back into their businesses, which means higher incomes and training for workers, and more and better equipment, all of which is healthy for the economy at large. This is precisely what we’re seeing out of the tax cuts (although I doubt it can last very long without major federal spending and economic policy reform, which are long-term, structural dampers on our economy).

Um, it’s simple math. Of course those in the high brackets will pay less in $$ than those at low rates. The rich were taxed 40% will get a bigger cut in$$—3% times $200k > 5% times $30k. Hope this helps

— Greg Hall (@UoMTigers) February 6, 2018

The worst thing about all this is not that Tur apparently doesn’t understand basic economics and the tradeoffs middle-class Americans face in allaying their most common large expenses. It’s that she assumes everyday Americans are too helpless to provide for their own needs and desires through optimism-fueled hard work, planning, and saving.

The United States is a heavily indebted welfare state in which most citizens are not contributing enough to pay for the benefits they demand. The only thing that will really make our fiscal crisis come out right is if many more of us start acting like the people she’s belittling, and see supporting ourselves as our own responsibility and within our own power to achieve. That requires praise for thinking ahead and paying our own way in life, rather than demeaning people for exhibiting character traits our nation desperately needs.