I’m an economist. So of course I’m going to do some economics for you—complete with charts, graphs, and jargon. Get excited.

In actuality, I realize that “we’re going to do some economics” might be the least exciting six-word sequence you’ll hear today. Pure economic arguments tend to be logically sound, but dull and uninspiring—no one has ever marched for GDP growth, or rallied for equilibrium price.

But pure economics is important in helping us evaluate policies and programs aimed at reducing poverty. We economists need to be humble, because economics cannot tell you specifically what to do to become rich. Getting rich is typically based on hard work, of course, but it also involves a fair deal of guesswork, luck, and good timing. Economics can, however, tell you surefire ways to keep poor people poor.

Let me flip that around and say, “Here are the things government policy should NOT do if you’re looking to give people maximum opportunities to escape poverty.”

The Story Of A Criminal Dad Who Made His Kids Work

Before we get to the pure economics, let me try to motivate our thinking on this subject by telling a true, personal story. It’s about a friend of mine, a guy I grew up with and have known for a long time. He was from a tight-knit, loving family—I still know and admire them greatly—but his dad was a criminal.

Let me explain: the dad was not cruel or abusive or a thief or anything like that. But he did routinely violate federal laws and regulations. You see, the dad was an entrepreneur, and he put my friend to work starting at age 10. And I’m talking hard, physical labor. They had a construction company and their kids did the grunt work like digging, mucking concrete, working around loud, dirty loaders and backhoes. Strike one: this guy’s dad was violating child labor laws.

But it gets worse: the boy was paid a starting wage of one dollar an hour, at a time when the federal minimum wage was $4.25. Strike two: violation of federal minimum wage law. Oh, and he was a tax cheat—didn’t withhold Social Security taxes from the kid’s paycheck, either. That’s strike three.

So this kid’s dad, otherwise an apparently decent guy—he coached youth football and was a really friendly neighbor—was a three-fold violator of federal labor and tax law. Oh, and lest I forget to mention, I found out later the dad also was hiring “undocumented” immigrants, violating yet another branch of federal labor law.

Why Working Hard Made Me A ‘Privileged’ Kid

So, what do you think about this guy? Not the kid so much, but the dad—a multiple lawbreaker who “exploited” child and illegal immigrant labor?

Let me tell you what his kids think of him, because I still know them and occasionally we talk about their old man. He had two sons and a daughter. The sons both grew up working in the family business, and one of them is actually still working with his dad in construction. The daughter only worked a bit in the family business, but she’s still close to her dad. All three of the grown kids deeply love, admire, and respect their dad, and always have.

How do I know these intimate details about this family? Well, as you might have guessed by now, I am that kid! Forgive me if that seemed deceptive. I really do know him and his family, you know, and the story is entirely true.

But you might be wondering, what’s my point in telling you all of this? Why call out my own dear old dad as a criminal? Well, you see, what some would view as “criminal,” “exploitation,” and “cheating,” was in my view actually one of the greatest gifts adults can give to a child. My parents bestowed upon me a great privilege. It has nothing to do with race, class, or sex. In other words, it’s not white privilege, but work privilege.

I was richly blessed to grow up under loving, caring parents who taught me two essential things: first, they taught me Christianity. I grew up knowing I have life, forgiveness, and salvation in the shed blood of Jesus Christ, and thus I can live without fear of death or any other kind of malady the world might throw at me.

Second, my parents taught me how to work. I never need worry about my and my family’s daily bread because I gained both trade skills that have allowed me to do jobs and, more importantly, the economic skills that have allowed me to always get jobs.

Knowing How To Work Helps People Succeed

I have never been unemployed. Now I don’t say that to brag, and I beg your pardon if that comes across as egotistical. But it does point out a tremendous benefit of the work skills and work knowledge that my parents instilled in me from a very young age. Knowing how to work, and how to get work, has meant I’ve never wanted for a job and never lacked income. Just a few years into my work life, I had begun to develop skills. By age 15, I was pouring concrete and busting forms, driving excavators, putting up drywall, and putting down roofing—not to mention running my own lawn mowing business on the side.

Every summer I worked 50 to 60 hours a week, and occasional weekends while school was in session. By age 18, I was earning $12 an hour—more than double the minimum wage—doing semi-skilled construction work. I could do framing and trim carpentry, operate equipment like skid loaders, form, pour and finish concrete, hang and finish drywall, install roofing, and more.

Looking back, I am convinced that the skills and mentality I had attained by age 18 set me on a path of success for the rest of my life. These skills carried me through college and graduate school: not only did they allow me to earn an income while in school and support a family, they also helped me pass my classes because I had a project-oriented mindset and had learned to work step-by-step with an end in mind.

Toward the end of my grad school training, I was married with two young kids, commuting 50 miles each way to work and school—and working 20 to 30 hours a week doing handyman jobs all around the D.C. area. We were probably near the official poverty line for our family size; I never bothered to check because the word “poor” just wasn’t in our vocabulary. We always had work, and therefore sufficient income to meet our needs, even though there were lean times along the way.

Again, my point is not to brag. It’s not really about me. I’m not special, just blessed—privileged. I think my story is not all that rare. It just happens to be the one I know best. The point is that there’s a simple cure to poverty: work. I happen to be really good at work because of my “work privilege,” and I have a rich stock of work privilege because my parents loved me enough to break barriers (including stupid laws) in order to teach me how to work and how to find work.

Government Policies Damage the Poor’s Ability To Work

Let me say that again so it really sinks in: My dad and mom loved me so much that they “exploited” my labor and violated federal laws in order to teach me about work.

Okay, now the economics: what should you not do if you want to give people the best chance of escaping poverty—not necessarily becoming rich, but at least not being poor?

Do not have government policies that impair or destroy people’s ability to work!

Don’t cut off young people’s work opportunities. Don’t cut off their access to those early jobs that build work privilege, and build productive, employed, non-poor lives.

What government policies might we be talking about here? Unfortunately, there are many. But let me address three big ones that, in my professional opinion, represent some of the biggest obstacles to work currently faced by the poor in America:

1. The Minimum Wage Hurts, Not Helps, The Poor

First, let’s tackle the minimum wage. Sadly, the people most supportive of minimum wage increases are those most apt to be harmed by its presence—the poor.

Pure economics teaches that there’s one thing that determines a person’s wage: his “marginal value product.” In simple terms, you’re paid the value of what you produce. I think business owners can attest to this from experience. They know that they will lose money if they over-pay their workers. People with lots of work experience can also understand this, because they’ve seen how their earnings go up over time as they acquire skills. If their current employer doesn’t recognize their growth and offer an appropriate raise, they gain the ability to jump ship and seek higher pay elsewhere.

Now, some people think entrepreneurs are hoarding piles of money Scrooge McDuck-style, and it’s only stinginess that prevents them from “sharing” more of their wealth with workers. If you think this kind of caricature represents normal entrepreneurs, I probably can’t help you. The fact is that businesses only hire people when doing so contributes to the bottom line—when it adds profits. This means they pay people roughly what they’re worth in terms of the value of their contribution.

If a person’s work value happens to be low, the minimum wage might wind up cutting off all legal work opportunities for that person. And why do workers lack skills that would make them productive enough to earn minimum wage or better? In most cases, it’s a simple matter of youth and inexperience. Remember, when starting work at age 10, I earned a fourth of the minimum wage—thanks, Dad!

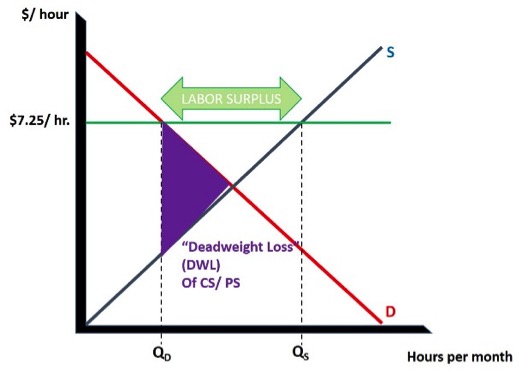

Here’s how we think about this result economically. The minimum wage is a price floor on unskilled labor. Note that the minimum wage is completely irrelevant to the typical college grad, whose first job will have starting pay north of $20 an hour. It was also irrelevant to me by the time I reached legal working age, due to all the skills and work privilege I had built up.

The people it really hurts are those who are not blessed with the ability or opportunity to complete college or start work early—often the poor, those the minimum wage professes to help. But here’s what this kind of price floor does in a market: it causes more sellers (workers) than buyers (employers), a result which we call a “surplus”—chronically unsold goods or services. In the case of labor markets, there’s a special term for “surplus labor.” It’s called unemployment.

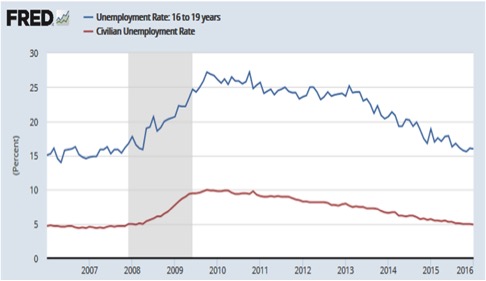

And here’s the proof: when you compare the teen unemployment rate to the overall unemployment rate, you’ll notice that teens are consistently unemployed at a rate three to four times higher than everyone else. So, you see, a government policy meant to help boost people’s incomes actually creates a situation in which some people have trouble finding those first jobs. Because of this, they fail to gain experience and any semblance of work privilege, and possibly wind up trapped in poverty.

So how not to alleviate poverty, item one? Do NOT enact a minimum wage.

2. Occupational Licensing Laws Impede the Poor

Next, let’s take on occupational licensing laws. I’m talking about license requirements for the sorts of jobs that ordinary, enterprising people—including the poor—can often do either with little to no training, or with training and skills acquirable without expensive formal schooling.

Simply put, governmental licensing requirements put up barriers—often very costly ones—to these people entering into jobs they can and should be able to do. This video segment by journalist John Stossel tells a depressingly common tale of how licensing laws seek to crush the entrepreneurial spirit:

So what not to do to alleviate poverty, item two: do NOT enact occupational licensing requirements on any jobs that the poor could otherwise do now.

3. The Payroll Tax Burdens Those With Lower Incomes

Finally, let’s tackle one of the most insidious anti-work, poverty-inducing government policies around: the payroll tax. Economists like to say, “If you tax something, you get less of it.” The payroll tax is, pure and simple, a “job tax.” It affects anyone who has a job, and there are no exemptions or deductions for people with low incomes, children, mortgage payments, etc.

Now, to be sure, the government needs revenue to fulfill its proper functions of delivering public goods, law and order, and the like. While economists generally favor the tax system to be as neutral as possible in terms of altering people’s incentives regarding work, saving, consuming, etc., the American people have consistently shown preferences for a progressive income tax system as the biggest tax collection vehicle for the federal government.

In public finance jargon, “progressive taxation” means that those with higher incomes pay a higher share of the total tax burden. The exact rate structure here is really a matter of politics and policy preferences, and pure economics can’t tell us what tax structure we should prefer. Economics can only tell us what kind of results to expect based on the tax structure we have or might want to impose. “You tax something, you get less of it.”

Guess what happens when you tax the first-dollar income of everyone, including the lowest-income people in society—the poor? Well, you get less jobs—less work—being done by them. Unlike the rest of the personal income tax system, the payroll tax—Social Security and Medicare taxes taken out of every worker’s paychecks—is steeply regressive. It poses a heavier burden on those with lower incomes.

Now, I’m personally opposed, as a matter of preference, to progressive taxation. I think a flat tax would be more just and would promote more economic growth. But I’m vehemently, angrily opposed to regressive taxation—because the poor can least afford taxes that quite possibly tax them out of the jobs that they desperately need.

The debate on the proper level of payroll taxes—or whether payroll taxes should be done away with—is complicated by the idea that the FICA tax (Social Security payroll levies) revenues are actually somehow earmarked to finance Social Security payouts. But myths about “lockboxes” and “trust funds” notwithstanding, a regressive, first-dollar tax on wage earners is bad for wage earners, especially those at the bottom of the wage distribution.

What not to do to alleviate poverty, item three? Do NOT regressively tax the very thing that we’ve identified as “the cure” for poverty: work and jobs.

We Can Fight Poverty By Promoting ‘Work Privilege’

I hope I’ve helped you think about the damage bad government policies can do in the effort to uplift the poor. Nothing works like work, and I would suggest again that my deep “work privilege” makes me a living example of that.

Can government promote work? I’m skeptical of that, because so many government policies—such as the minimum wage, occupational licensing, and payroll taxes—are clearly anti-work, especially for the poorest among us. Work privilege starts at home, and my experience convinces me that civic efforts to strengthen traditional family values are the best way to promote work amongst the people.

Government policies can, however, and do get in the way of poor people’s ability to either get work or benefit from work. Policies such as minimum wages, occupational licensing, and the payroll tax are the wrong things to do if we want to help the poor.

As a doctor of economics, my prescription is to drop these bad habits and restore healthy labor markets that people at all levels of society can take advantage of.